Concept explainers

Adjustment data on an end-of-period spreadsheet

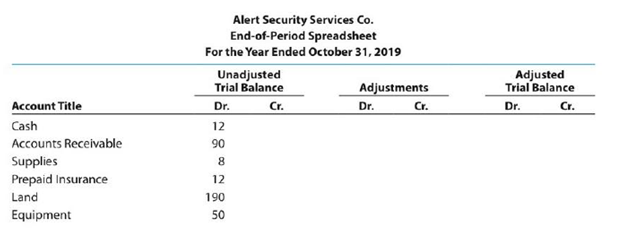

Alert Security Services Co. offers security services to business clients. The

| Accum. Depr.—Equipment | 4 | |

| Accounts Payable | 36 | |

| Wages Payable | 0 | |

| Brenda Schultz, Capital | 260 | |

| Brenda Schultz, Drawing | 8 | |

| Fees Earned | 200 | |

| Wages Expense | 110 | |

| Rent Expense | 12 | |

| Insurance Expense | 0 | |

| Utilities Expense | 6 | |

| Supplies Expense | 0 | |

| Depreciation Expense | 0 | |

| Miscellaneous Expense | 2 | |

| 500 | 500 |

The data for year-end adjustments are as follows:

a. Fees earned but not yet billed, $13

b. Supplies on hand, $4.

c. Insurance premiums expired, $10.

d. Depreciation expense, $3.

e. Wages accrued but not paid, $1.

Enter the adjustment data and place the balances in the Adjusted Trial Balance columns.

Trending nowThis is a popular solution!

Chapter 4 Solutions

Bundle: Accounting, Loose-Leaf Version, 27th + CengageNOWv2, 1 term Printed Access Card for Warren/Reeve/Duchac?s Financial Accounting, 15th

- Can you help me solve this general accounting problem with the correct methodology?arrow_forwardPlease explain the solution to this financial accounting problem with accurate explanations.arrow_forwardJuno Manufacturing used$42,000 of direct materials and incurred $55,000 of direct labor costs during the month of August. The company applied $28,000 of overhead to its products.If the cost of goods manufactured was $135,000 and the ending work in process inventory was $18,000, the beginning work in process must have been equal to_.arrow_forward

- What was cost of goods manufactured?arrow_forwardPugh Sporting Goods manufactures two types of kayaks: River Explorers and Lake Cruisers. The company incurred manufacturing overhead costs of $320,000 in May. They have decided to allocate these costs based on units produced. During May, the company used 10,500 direct labor hours for River Explorers and 12,000 direct labor hours for Lake Cruisers. In total, the company produced 8,000 River Explorers and 6,000 Lake Cruisers. The amount of overhead allocated to each product, respectively, would be: a) $182,880 and $137,160 b) $140,000 and $180,000 c) $160,000 and $160,000 d) $175,000 and $145,000 e) $168,000 and $152,000 Don't use AIarrow_forwardCalculate the firm's predetermined overhead rate.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College