Compare traditional and ABC allocations at a pharmacy (Learning Objective 2)

Dover Pharmacy, part of a large chain of pharmacies, fills a variety of prescriptions for customers. The complexity of prescriptions filled by Dover varies widely; pharmacists can spend between five minutes and six hours on a prescription order. Traditionally, the pharmacy has allocated its

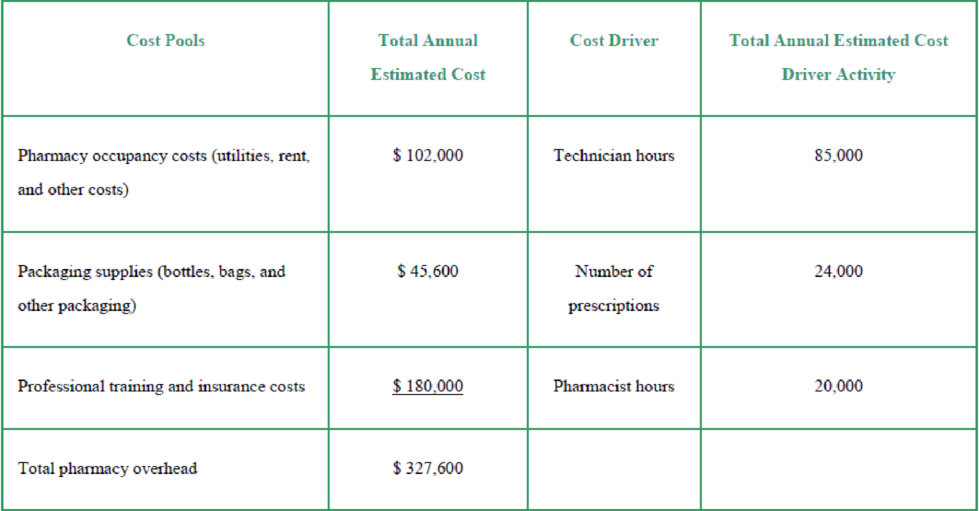

The pharmacy chain’s controller is exploring whether activity-based costing (ABC) may better allocate the pharmacy overhead costs to pharmacy orders. The controller has gathered the following information:

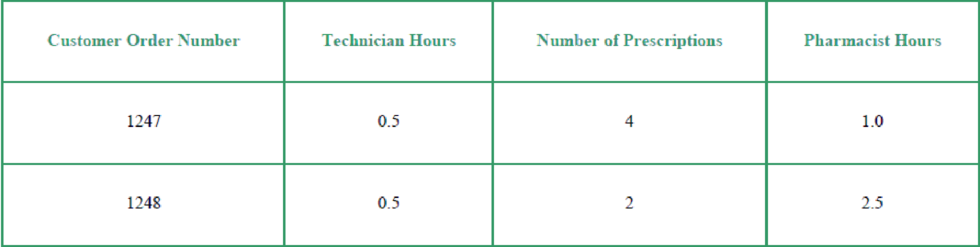

The clerk for Dover has gathered the following information regarding two recent pharmacy orders:

Requirements

- 1. What is the traditional overhead rate based on the number of prescriptions?

- 2. How much pharmacy overhead would be allocated to customer order number 1247 if traditional overhead allocation based on the number of prescriptions is used?

- 3. How much pharmacy overhead would be allocated to customer order number 1248 if traditional overhead allocation based on the number of prescriptions is used?

- 4. What are the following cost pool allocation rates?

- a. Pharmacy occupancy costs

- b. Packaging supplies

- c. Professional training and insurance costs

- 5. How much would be allocated to customer order number 1247 if activity-based costing (ABC) is used to allocate the pharmacy overhead costs?

- 6. How much would be allocated to customer order number 1248 if activity-based costing (ABC) is used to allocate the pharmacy overhead costs?

- 7. Which allocation method (traditional or activity-based costing) would produce a more accurate product cost? Explain your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting, Student Value Edition Plus MyLab Accounting with Pearson eText -- Access Card Package (5th Edition)

- General accounting questionarrow_forwardTimberline Tools has annual sales of $745,800, total debt of $204,000, total equity of $396,000, and a profit margin of 5.6 percent. What is the return on assets (ROA)?arrow_forwardVista Motors has a total asset turnover of 2.9, a net profit margin of 6.25 percent, and an equity multiplier of 3.6. Calculate Vista's return on equity (ROE) using the DuPont equation. (Financial accounting)arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning