Concept explainers

Integration of financial statements; Chapters 3 and 4

• LO4–8

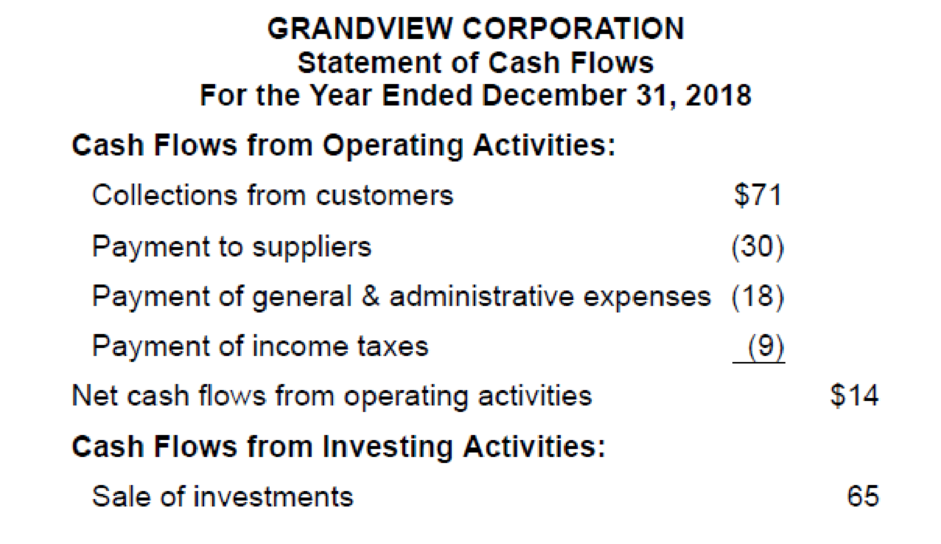

The chief accountant for Grandview Corporation provides you with the company’s 2018 statement of

Required:

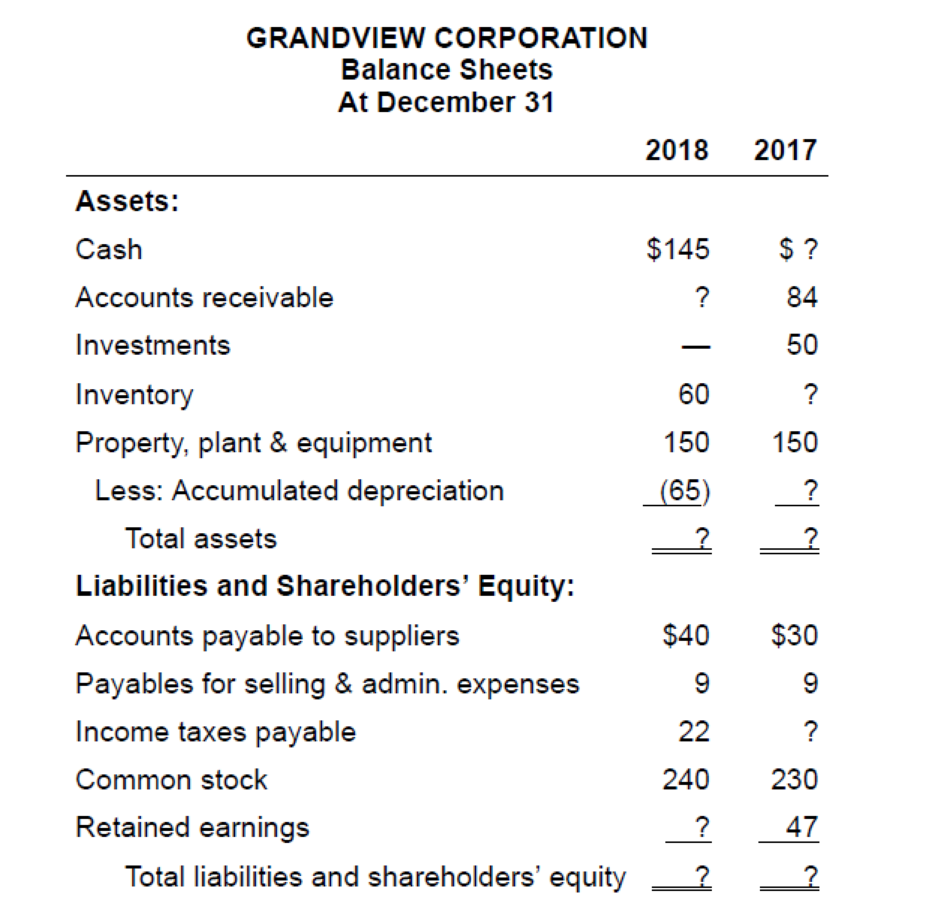

1. Calculate the missing amounts.

2. Prepare the operating activities section of Grandview’s 2018 statement of cash flows using the indirect method.

(1)

Financial statement:

A financial statement is the complete record of financial transactions that take place in a company at a particular point of time. It provides important financial information regardingthe assets, liabilities, revenues and expenses of the company to its internal and external users. It helps them to know the exact financial position of the company.

To calculate: the missing amounts.

Explanation of Solution

Calculate the missing amounts.

Cash Balance – 2017:

Accounts receivable-2018:

Inventory – 2018:

Calculate the purchase:

Calculate Inventory – 2017:

Accumulated Depreciation – 2017:

Calculate total assets:

| Total Assets | 2018($) | 2017($) |

| Cash | 145 | 59 |

| Accounts Receivable | 93 | 84 |

| Investments | - | 50 |

| Inventory | 60 | 52 |

| Property, plant, and equipment | 150 | 150 |

| Less: Accumulated Depreciation | (65) | (55) |

| Total Assets | $383 | $340 |

Table (1)

Calculate Income tax payable – 2017

Calculate retained earnings -2018:

Calculate total liabilities and shareholders’ equity:

| Total Liabilities and Stockholder’s Equity | 2018($) | 2017($) |

| Accounts payable to suppliers | 40 | 30 |

| Payables for selling and administrative expenses | 9 | 9 |

| Income taxes payable | 22 | 24 |

| Common stock | 240 | 230 |

| Retained earnings | 72 | 47 |

| Total Assets | $383 | $340 |

Table (2)

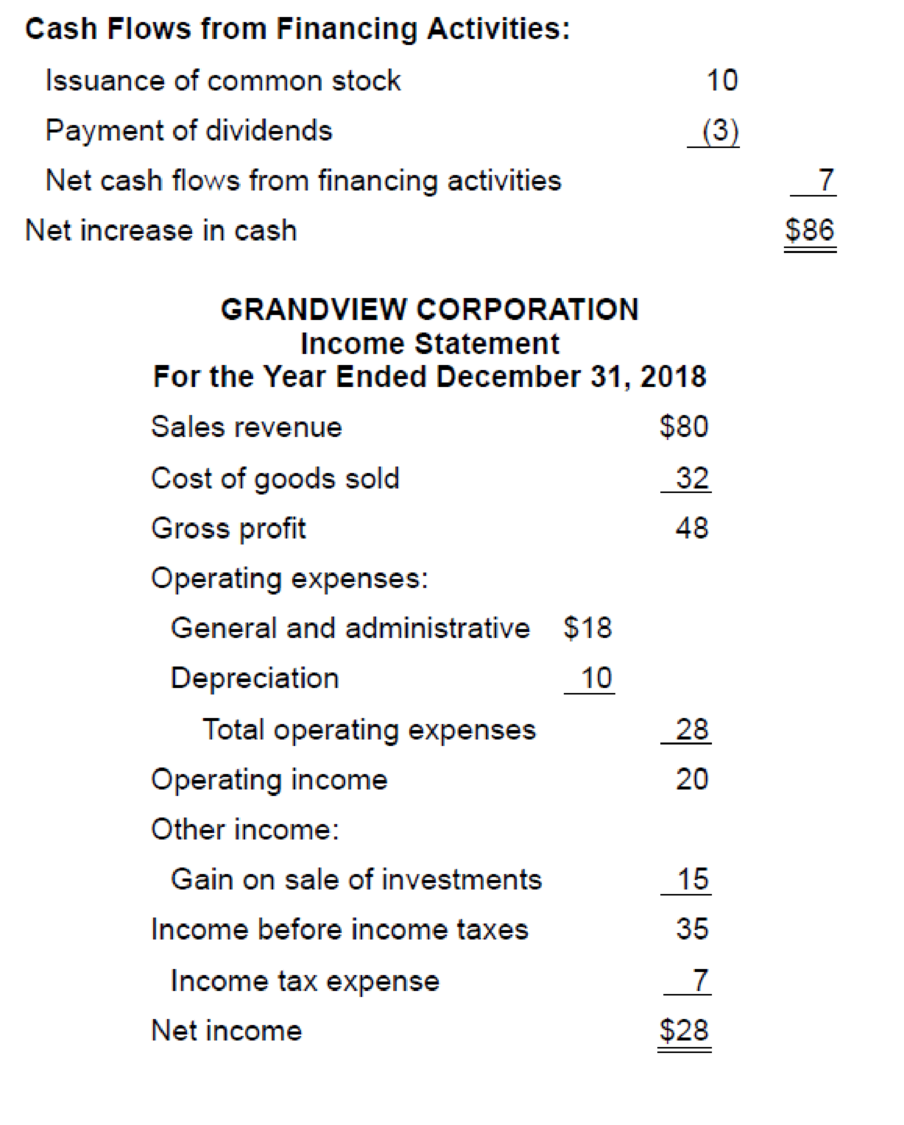

(2)

To prepare: Operating activities section of Corporation G’s cash flow statement using indirect method.

Explanation of Solution

Prepare the operating activities of Corporation G for 2018 statement of cash flows using indirect method.

| Corporation G | ||

| Statement of Cash Flows - Indirect Method (Partial) | ||

| For the Year 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flows from Operating activities: | ||

| Net income | 28 | |

| Adjustments for noncash effects: | ||

| Depreciation expense | 10 | |

| Gain on sale of investments | (15) | |

| Changes in operating assets and liabilities | ||

| Increase in accounts receivable(1) | (9) | |

| Increase in inventory(2) | (8) | |

| Increase in accounts payable(3) | 10 | |

| Decrease in income taxes payable(4) | (2) | (14) |

| Net cash flows from operating activities | $14 | |

Table (3)

Working notes:

Determine changes of assets and liabilities:

Want to see more full solutions like this?

Chapter 4 Solutions

Loose Leaf Intermediate Accounting

- Please Solve This Financial Accounting Question with Correct Methodarrow_forwardGeneral Accountingarrow_forwardNeed help ! Which of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forward

- Financial Accounting 3.1arrow_forwardWhich of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditneed helparrow_forwardGeneral Accounting Question 2.5arrow_forward

- I will report your answer to Coursehero using chatgpt they block your account and will not give your payment!!! so don't answer with chatgpt. The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forwardWhich of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forwardI need help The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forward

- Hi This Question is Simple I want Answer step by step of this Financial Accountingarrow_forwardNeed help The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forwardNo AI The accounting cycle begins with:A. Posting to the ledgerB. Journalizing transactionsC. Preparing the financial statementsD. Adjusting entriesarrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning