Concept explainers

Production run size and activity improvement

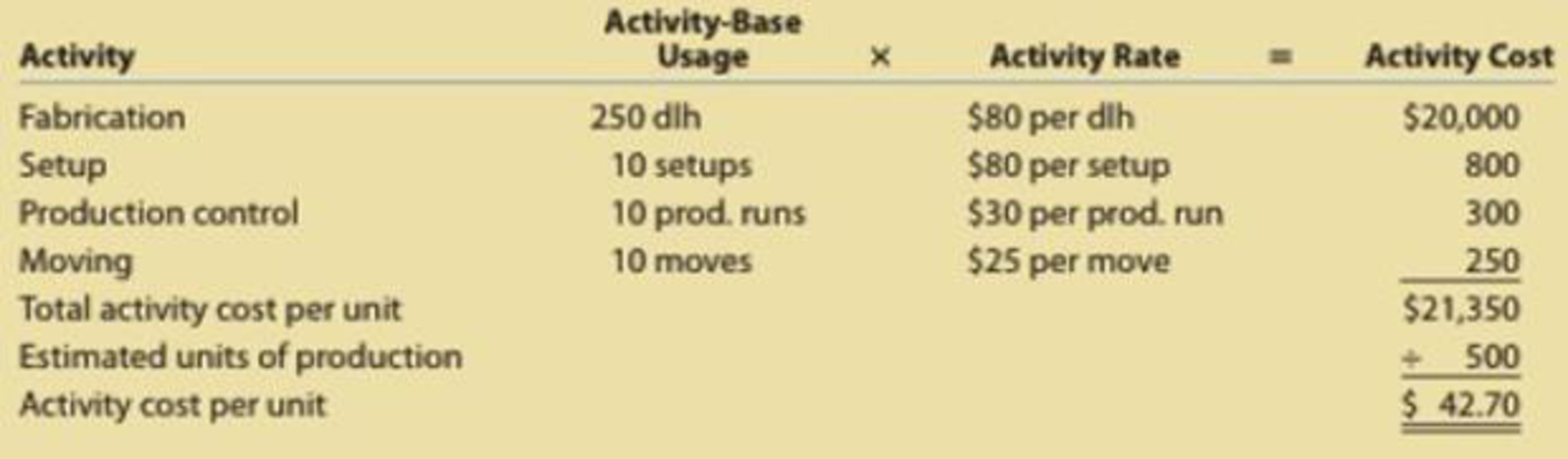

Littlejohn, Inc., manufactures machined parts for the automotive industry. The activity cost associated with Part XX-10 is as follows:

Each unit requires 30 minutes of fabrication direct labor. Moreover, Part XX-10 is manufactured in production run sizes of 50 units. Each production run is set up, scheduled (production control), and moved as a batch of 50 units. Management is considering improvements in the setup, production control, and moving activities in order to cut the production run sizes by half. As a result, the number of setups, production runs, and moves will double from 10 to 20. Such improvements are expected to speed the company’s ability to respond to customer orders.

- Setup is reengineered so that it takes 60% of the original cost per setup.

- Production control software will allow production control effort and cost per production run to decline by 60%.

- Moving distance was reduced by 40%, thus reducing the cost per move by the same amount.

- A. Determine the revised activity cost per unit under the proposed changes.

- B. Did these improvements reduce the activity cost per unit?

- C. What cost per unit for setup would be required for the solution in (a) to equal the base solution?

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

Managerial Accounting

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning