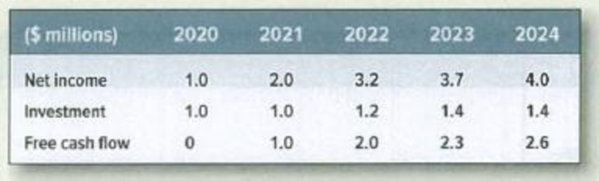

Valuing a business* Phoenix Corp. faltered in the recent recession but is recovering.

Phoenix’s recovery will be complete by 2024, and there will be no further growth in net income or free cash flow.

- a. Calculate the PV of free cash flow, assuming a

cost of equity of 9%. - b. Assume that Phoenix has 12 million shares outstanding. What is the price per share?

- c. Confirm that the expected

rate of return on Phoenix stock is exactly 9% in each of the years from 2020 to 2024.

a)

To determine: Present value of free cash flow

Explanation of Solution

Compute the present value of free cash flow:

Hence, the present value is $24.8 million.

b)

To determine: Price per share

Explanation of Solution

Note:

Assume no debt, the share price are as follows,

Hence, the price per share is $2.04.

c)

To confirm: The expected rate of return is 9%.

Explanation of Solution

Compute PV of the cash flows at various points in time:

Compute rate of return using the formula

Thus, the above calculation shows that the rate of return on Company P is exactly 9%.

Want to see more full solutions like this?

Chapter 4 Solutions

PRIN.OF CORP.FINANCE-CONNECT ACCESS

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Marketing: An Introduction (13th Edition)

Management (14th Edition)

Microeconomics

Horngren's Accounting (12th Edition)

Essentials of MIS (13th Edition)

- Need answer ! If the Net Present Value (NPV) of a project is positive, it indicates: A. The project is unprofitableB. The project is financially viableC. The project has no riskD. The project will increase costsarrow_forwardDon't use chatgpt! Which of the following refers to the rate at which one currency is exchanged for another? A. Interest rateB. Exchange rateC. Inflation rateD. Capitalization ratearrow_forwardi need help in this question. Which of the following refers to the rate at which one currency is exchanged for another? A. Interest rateB. Exchange rateC. Inflation rateD. Capitalization ratearrow_forward

- What is the formula of net persent values ? explain.arrow_forwardIf the Net Present Value (NPV) of a project is positive, it indicates: A. The project is unprofitableB. The project is financially viableC. The project has no riskD. The project will increase costsarrow_forwardWhich of the following refers to the rate at which one currency is exchanged for another? A. Interest rateB. Exchange rateC. Inflation rateD. Capitalization ratearrow_forward

- Which of the following refers to the rate at which one currency is exchanged for another? A. Interest rateB. Exchange rateC. Inflation rateD. Capitalization rate need help!arrow_forwardNo chatgpt! In financial terms, liquidity refers to: A. Profitability of an investmentB. Ability to meet short-term obligationsC. Long-term solvencyD. Market value of equityarrow_forwardIn financial terms, liquidity refers to: A. Profitability of an investmentB. Ability to meet short-term obligationsC. Long-term solvencyD. Market value of equityarrow_forward

- In financial terms, liquidity refers to: A. Profitability of an investmentB. Ability to meet short-term obligationsC. Long-term solvencyD. Market value of equity need help!arrow_forwardWhat does beta measure in finance? A. Systematic risk of a stock compared to the marketB. Profitability of a companyC. Interest rate sensitivity of a bondD. Company's operational efficiency need answer.arrow_forwardNo chatgpt!! What does beta measure in finance? A. Systematic risk of a stock compared to the marketB. Profitability of a companyC. Interest rate sensitivity of a bondD. Company's operational efficiencyarrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning