Concept explainers

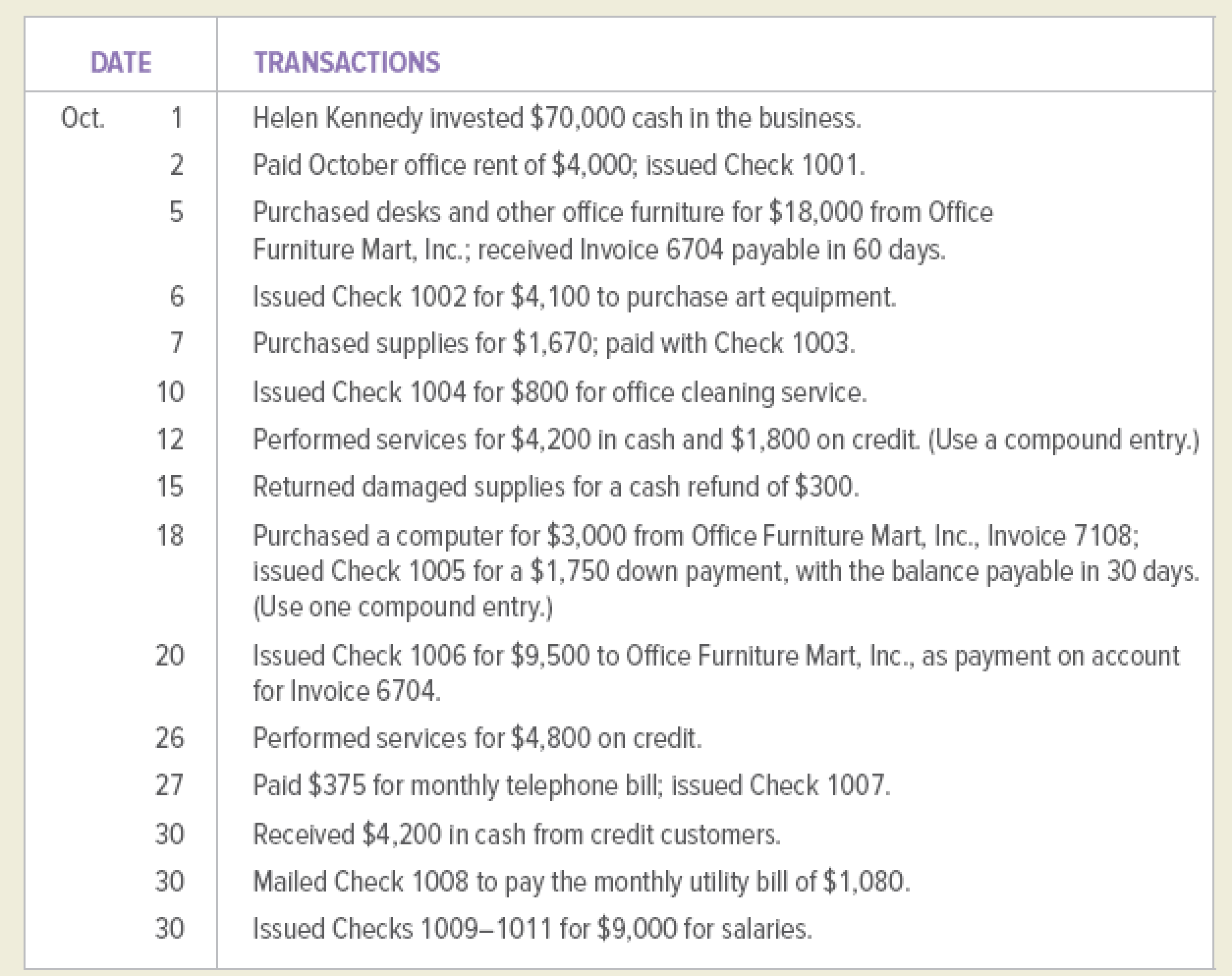

On October 1, 2019, Helen Kennedy opened an advertising agency. She plans to use the chart of accounts listed below.

INSTRUCTIONS

1. Journalize the transactions. Number the journal page 1, write the year at the top of the Date column, and include a description for each entry.

2. Post to the ledger accounts. Before you start the posting process, open accounts by entering account names and numbers in the headings. Follow the order of the accounts in the chart of accounts.

ASSETS

101 Cash

111

121 Supplies

141 Office Equipment

151 Art Equipment

LIABILITIES

202 Accounts Payable

OWNER’S EQUITY

301 Helen Kennedy, Capital

302 Helen Kennedy, Drawing

REVENUE

401 Fees Income

EXPENSES

511 Office Cleaning Expense

514 Rent Expense

517 Salaries Expense

520 Telephone Expense

523 Utilities Expense

Analyze: What is the balance of account 202 in the general ledger?

1.

Journalize the given transaction.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit: A debit, is an accounting term that refers to the left side of an account. The term debit is be denoted by (Dr). The recording amount on the left side of the account is known as debiting.

Credit: A credit, is an accounting term that refers to the right side of an account. The term credit is denoted as (Cr). The recording amount on the right side of the account is known as crediting.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all the increase in the assets, the expenses and the dividends, all the decrease in liabilities, revenues and the stockholders’ equities.

- Credit, all the increase in the liabilities, the revenues, and the stockholders’ equities, and all decreases in the assets, and the expenses.

Pass the journal entries for the given transactions:

| General Journal | Page - 1 | |||

| Date | Description | Post | Debit | Credit |

| 2019 | ||||

| October 1 | Cash | 101 | $70,000 | |

| HK Capital | 301 | $70,000 | ||

| (To record the receipt of capital) | ||||

| October 2 | Rent expense | 514 | $4,000 | |

| Cash | 101 | $4,000 | ||

| (To record the payment of rent, Check 1001) |

Table (1)

| General Journal | Page - 2 | |||

| Date | Description | Post | Debit | Credit |

| 2019 | ||||

| October 5 | Office Equipment | 141 | $18,000 | |

| Accounts payable | 202 | $18,000 | ||

| (To record the purchase of office equipment on account Invoice 6704) | ||||

| October 6 | Art Equipment | 151 | $4,100 | |

| Cash | 101 | $4,100 | ||

| (To record the purchase of art equipment for cash, Check 1002) | ||||

| October 7 | Supplies | 121 | $1,670 | |

| Cash | 101 | $1,670 | ||

| (To record the purchase of supplies for cash, Check 1003) | ||||

| October 10 | Office Cleaning Expense | 511 | $8,00 | |

| Cash | 101 | $8,00 | ||

| (To record the payment of office cleaning expense, Check 1004) | ||||

| October 12 | Cash | 101 | $4,200 | |

| Accounts receivable | 111 | $1,800 | ||

| Fees Income | 401 | $6,000 | ||

| (To record the services provided for cash and on account) | ||||

| October 15 | Cash | 101 | $300 | |

| Supplies | 121 | $300 | ||

| (To record the return of damaged supplies for cash refund) | ||||

| October 18 | Office Equipment | 141 | $3,000 | |

| Cash | 101 | $1,750 | ||

| Accounts payable | 202 | $1,250 | ||

| (To record the services provided for cash and on account) |

Table (2)

| General Journal | Page - 3 | |||

| Date | Description | Post | Debit | Credit |

| 2019 | ||||

| October 20 | Accounts payable | 202 | $9,500 | |

| Cash | 101 | $9,500 | ||

| (To record the payment for office supplies, Invoice 5103 by Check 206) | ||||

| October 26 | Accounts receivable | 111 | $4,800 | |

| Fees income | 401 | $4,800 | ||

| (To record the service provided on account) | ||||

| October 27 | Telephone expense | 520 | $375 | |

| Cash | 101 | $375 | ||

| (To record the payment of telephone bill, Check 1007) | ||||

| October 30 | Cash | 101 | $4,200 | |

| Accounts receivable | 111 | $4,200 | ||

| (To record the receipt of fees) | ||||

| Utilities expense | 523 | $1,080 | ||

| Cash | 101 | $1,080 | ||

| (To record the payment of utility bill, Check 1008) | ||||

| Salaries expense | 517 | $9,000 | ||

| Cash | 101 | $9,000 | ||

| (To record the payment of salaries, Checks 1009-1011) |

Table (3)

2.

Post the journal entries in the General Ledger and identify the balance in the Account 202.

Explanation of Solution

General ledger:

General ledger is a record of all accounts of assets, liabilities, and stockholders’ equity, necessary to prepare financial statements. In the ledger all the entries are recorded in the account order, for which the transactions actually take place.

Post the journal entries in the General Ledger:

| GENERAL LEDGER | ||||||

| ACCOUNT: Cash | Account No.: 101 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | J1 | $ 70,000 | $ 70,000 | |||

| October 2 | J1 | $ 4,000 | $ 66,000 | |||

| October 6 | J2 | $ 4,100 | $ 61,900 | |||

| October 7 | J2 | $ 1,670 | $ 60,230 | |||

| October 10 | J2 | $ 800 | $ 59,430 | |||

| October 12 | J2 | $ 4,200 | $ 63,630 | |||

| October 15 | J2 | $ 300 | $ 63,930 | |||

| October 18 | J2 | $ 1,750 | $ 62,180 | |||

| October 20 | J2 | $ 9,500 | $ 52,680 | |||

| October 27 | J3 | $ 375 | $ 52,305 | |||

| October 30 | J3 | $ 4,200 | $ 56,505 | |||

| October 30 | J3 | $ 1,080 | $ 55,425 | |||

| October 30 | J3 | $ 9,000 | $ 46,425 | |||

| ACCOUNT: Accounts receivable | Account No.: 111 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 12 | J1 | $ 1,800 | $ 1,800 | |||

| October 26 | J3 | $ 4,800 | $ 6,600 | |||

| October 30 | J3 | $ 4,200 | $ 2,400 | |||

Table (4)

| GENERAL LEDGER | ||||||

| ACCOUNT: Supplies | Account No.: 121 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 7 | J2 | $ 1,670 | $ 1,670 | |||

| October 15 | J2 | $ 300 | $1,370 | |||

| ACCOUNT: Office Equipment | Account No.: 141 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 5 | J2 | $ 18,000 | $ 18,000 | |||

| October 18 | J2 | $ 3,000 | $ 21,000 | |||

| ACCOUNT: Art Equipment | Account No.: 151 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 6 | J2 | $ 4,100 | $ 4,100 | |||

| ACCOUNT: Accounts payable | Account No.: 202 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 5 | J2 | $ 18,000 | $ 18,000 | |||

| October 18 | J2 | $ 1,250 | $ 19,250 | |||

| October 20 | J3 | $ 9,500 | $ 9,750 | |||

| ACCOUNT: HK Capital | Account No.: 301 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 1 | J1 | $ 70,000 | $ 70,000 | |||

| ACCOUNT: HK Drawings | Account No.: 302 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

Table (5)

| GENERAL LEDGER | ||||||

| ACCOUNT: Fees Income | Account No.: 401 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 18 | J2 | $ 6,000 | $ 6,000 | |||

| October 20 | J3 | $ 4,800 | $ 10,800 | |||

| ACCOUNT: Office Cleaning Expense | Account No.: 511 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 10 | J2 | $ 800 | $ 800 | |||

| ACCOUNT: Rent Expense | Account No.: 514 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 2 | J1 | $ 4,000 | $ 4,000 | |||

| ACCOUNT: Salaries Expense | Account No.: 517 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 30 | J3 | $ 9,000 | $ 9,000 | |||

| ACCOUNT: Telephone Expense | Account No.: 520 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 27 | J3 | $ 375 | $ 375 | |||

| ACCOUNT: Utilities Expense | Account No.: 523 | |||||

| Date | Description | Post. Ref. | Debit | Credit | Balance | |

| Debit | Credit | |||||

| 2019 | ||||||

| October 30 | J3 | $ 1,080 | $ 1,080 | |||

Table (6)

The Account 202 shows a credit balance of $9,750 at the end of the month.

Want to see more full solutions like this?

Chapter 4 Solutions

COLLEGE ACCOUNTING ETEXT+CONNECT ACCESS

- No chatgpt! Which financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings StatementNo Aiarrow_forwardWhich financial statement lists revenues and expenses?A. Balance SheetB. Cash Flow StatementC. Income StatementD. Retained Earnings Statementarrow_forward

- Which account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentcorrectarrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentcorrect solutuarrow_forwardWhich account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentneedarrow_forward

- Which account is a contra-asset?A. Accounts PayableB. Accumulated DepreciationC. Notes ReceivableD. Prepaid Rentarrow_forwardChoose the items of income or expense that belong in the described areas of Form 1120, Schedule M-1 (Sections: Income subject to tax not recorded on books, Expenses recorded on books this year not deducted on this return, Income recorded on books this year not included on this return, and Deductions on this return not charged against book income.) Note the appropriate amount for the item selected under each section. If the amount decreases taxable income relative to book income, provide the amount as a negative number. If the amount increases taxable income relative to book income, provide the amount as a positive number. The following adjusted revenue and expense accounts appeared in the accounting records of Pashi, Inc., an accrual basis taxpayer, for the year ended December 31, Year 2. Revenues Net sales $3,000,000 Interest 18,000 Gains on sales of stock 5,000 Key-man life insurance proceeds 100,000 Subtotal $3,123,000 Costs and Expenses Cost of…arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning