FUND.ACCT.PRIN.-CONNECT ACCESS

25th Edition

ISBN: 9781260780185

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

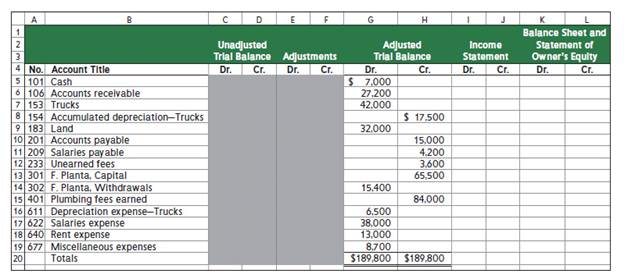

Chapter 4, Problem 2E

Exercise 4-2

Extending accounts in a work sheet Pl

The Adjusted

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

what chapter/page number is this quote found on in the book the plain truth? “The English judged a person so that they'd be justified in casting her out. The Amish judged a person so that they'd be justified in welcoming her back. Where I'm from, if someone is accused of sinning, it's not so that others can place blame. It's so that the person can make amends and move on." ― Jodi Picoult, quote from Plain Truth

What is meant by compensated absences for employees of a company, and what does this even have to do with reporting of current liabilities? Also, what is vested rights of an employee?

A company paid $12,000 for a one-year insurance policy on October 1. What amount should be reported as Prepaid Insurance on the December 31 balance sheet?

A. $3,000B. $9,000C. $12,000D. $0need help

Chapter 4 Solutions

FUND.ACCT.PRIN.-CONNECT ACCESS

Ch. 4 - Prob. 1QSCh. 4 - Prob. 2QSCh. 4 - Computing ending capital balance using work sheet...Ch. 4 - Preparing a partial work sheet P1 The ledger of...Ch. 4 - Explaining temporary and permanent accounts Choose...Ch. 4 - Preparing closing entries from the ledger P2 The...Ch. 4 - Prob. 7QSCh. 4 - Prob. 8QSCh. 4 - Prob. 9QSCh. 4 - Prob. 10QS

Ch. 4 - Prob. 11QSCh. 4 - Prob. 12QSCh. 4 - Prob. 13QSCh. 4 - Prob. 14QSCh. 4 - Prob. 15QSCh. 4 - Prob. 16QSCh. 4 - Prob. 17QSCh. 4 - Prob. 18QSCh. 4 - Prob. 19QSCh. 4 - Prob. 20QSCh. 4 - Exercise 4-1 Extending adjusted account balances...Ch. 4 - Exercise 4-2 Extending accounts in a work sheet Pl...Ch. 4 - Exercise 4-3 Preparing adjusting entries from a...Ch. 4 - Exercise 4-4 Preparing unadjusted and adjusted...Ch. 4 - Exercise 4-5 Determining effects of closing...Ch. 4 - Exercise 4-6 Completing the income statement...Ch. 4 - Exercise 4-7 Preparing a work sheet and recording...Ch. 4 - Exercise 4-8

Preparing and posting closing...Ch. 4 - Exercise 4-9 Preparing closing entries and a...Ch. 4 - Exercise 4-10 Preparing closing entries and a...Ch. 4 - Prob. 11ECh. 4 - Exercise 4-12 Preparing a classified balance sheet...Ch. 4 - Exercise 4-13 Computing the current ratio A1 Use...Ch. 4 - Exercise 4-14 Preparing closing entries P2...Ch. 4 - Exercise 4-15 Computing and analysing the current...Ch. 4 - Exercise 4.16A Preparing reversing entries P4 Hawk...Ch. 4 - Exercise 4-17APreparing reversing entries P4 The...Ch. 4 - Problem 4-1A Applying the accounting cycle C2 P2...Ch. 4 - Problem 4-2A Preparing a work sheet, adjusting and...Ch. 4 - Problem 4-3A Determining balance sheet...Ch. 4 - Problem 4-4A Preparing closing entries, financial...Ch. 4 - Problem 4-5A Preparing trial balances, closing...Ch. 4 - Problem 4-6AA Preparing adjusting, reversing, and...Ch. 4 - Problem 4-1B Applying the accounting cycle C2 P2...Ch. 4 - Prob. 2PSBCh. 4 - Problem 4-3B Determining balance sheet...Ch. 4 - Prob. 4PSBCh. 4 - Problem 4-5B Preparing trial balances, closing...Ch. 4 - Problem 4-6BAPreparing adjusting, reversing, and...Ch. 4 - The December 31. 2019= adjusted trial balance of...Ch. 4 - Transactions from the Fast Forward illustration in...Ch. 4 - Prob. 2GLPCh. 4 - Prob. 3GLPCh. 4 - Based on Problem 4-6ACh. 4 - Prob. 5GLPCh. 4 - Refer to Apple' s financial statements in Appendix...Ch. 4 - Prob. 2AACh. 4 - Prob. 3AACh. 4 - Prob. 1DQCh. 4 - That accounts are affected by closing entries?...Ch. 4 - Prob. 3DQCh. 4 - What is the purpose of the Income Summary account?Ch. 4 - Prob. 5DQCh. 4 - Prob. 6DQCh. 4 - Why are the debit and credit entries in the...Ch. 4 - Prob. 8DQCh. 4 - Prob. 9DQCh. 4 - How is unearned revenue classified on the balance...Ch. 4 - Prob. 11DQCh. 4 - Prob. 12DQCh. 4 - Prob. 13DQCh. 4 - Prob. 1BTNCh. 4 - Prob. 2BTNCh. 4 - Prob. 3BTNCh. 4 - The unadjusted trial balance and information for...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial Accounting Question please answerarrow_forwardA company paid $12,000 for a one-year insurance policy on October 1. What amount should be reported as Prepaid Insurance on the December 31 balance sheet? A. $3,000B. $9,000C. $12,000D. $0arrow_forwardNo chatgpt 9. In a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recordedAnswer: Barrow_forward

- 9. In a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recordedneed helparrow_forwardCan you demonstrate the accurate method for solving this financial accounting question?arrow_forwardWhat effect does recording depreciation expense have on the accounting equation?A. Increases assets and increases equityB. Decreases assets and decreases equityC. Increases liabilities and decreases equityD. No effect on assets or equity No AIarrow_forward

- No ai 9. In a perpetual inventory system, what happens when goods are sold?A. Only sales revenue is recordedB. Inventory and cost of goods sold are updated immediatelyC. Inventory is updated at the end of the accounting periodD. Only cost of goods sold is recordedAnswer: Barrow_forwardSolve this question with accounting questionarrow_forwardHello tutor solve this situation with accounting questionarrow_forward

- What effect does recording depreciation expense have on the accounting equation?A. Increases assets and increases equityB. Decreases assets and decreases equityC. Increases liabilities and decreases equityD. No effect on assets or equity helparrow_forwardWhat effect does recording depreciation expense have on the accounting equation?A. Increases assets and increases equityB. Decreases assets and decreases equityC. Increases liabilities and decreases equityD. No effect on assets or equityarrow_forwardFinancial accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY