Foundations of Financial Management

16th Edition

ISBN: 9781259277160

Author: Stanley B. Block, Geoffrey A. Hirt, Bartley Danielsen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 28P

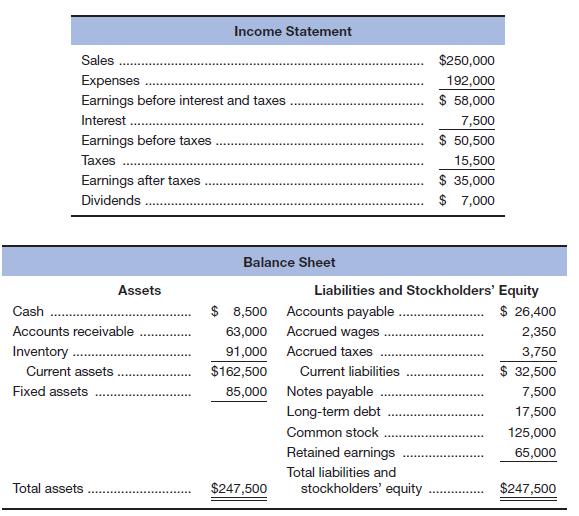

The Manning Company has financial statements as shown next, which are representative of the company’s historical average.

The firm is expecting a 35 percent increase in sales next year, and management is concerned about the company’s need for external funds. The increase in sales is expected to be carried out without any expansion of fixed assets, but rather through more efficient asset utilization in the existing store. Among liabilities, only current liabilities vary directly with sales.

Using the percent-of-sales method, determine whether the company has external financing needs, or a surplus of funds.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Solve this question with financial accounting question

I need help with this situation and financial accounting question

Remaining Time: 50 minutes, 26 seconds.

* Question Completion Status:

A Moving to the next question prevents changes to this answer.

Question 9

Question 9 of 20

5 points

Save Answer

A currency speculator wants to speculate on the future movements of the €. The speculator expects the € to appreciate in the near future and decides to concentrate on the nearby contract. The broker requires a 2%

Initial Margin (IM) and the Maintenance Margin (MM) is 75% of IM. Following € Futures quotes are currently available from the Chicago Mercantile Exchange (CME).

Euro (CME)- €125,000; $/€

Open

High

Low

Settle Change Open Interest

June

1.2216

1.2276

1.2175 1.2259

-0.0018

Sept

1.2229

1.2288

1.2189 1.2269 0.0018

255,420

19,335

In addition to the information provided above, consider the following CME quotes that are available at the end of day one's trading:

Euro (CME) - €125,000; $/€

Open

High

Low

June

1.2216

Sept

1.2229

1.2276

1.2288

Settle Change Open Interest

1.2175 1.2176 -0.0083 255,420

1.2189…

Chapter 4 Solutions

Foundations of Financial Management

Ch. 4 - What are the basic benefits and purposes of...Ch. 4 - Explain how the collections and purchases...Ch. 4 - With inflation, what are the implications of using...Ch. 4 - Explain the relationship between inventory...Ch. 4 - Prob. 5DQCh. 4 - Discuss the advantage and disadvantage of level...Ch. 4 - What conditions would help make a percent-of-sales...Ch. 4 - Prob. 1PCh. 4 - Philip Morris expects the sales for his clothing...Ch. 4 - Galehouse Gas Stations Inc. expects sales to...

Ch. 4 - The Alliance Corp. expects to sell the following...Ch. 4 - Prob. 5PCh. 4 - Cyber Security Systems had sales of 3,500 units at...Ch. 4 - Dodge Ball Bearings had sales of 15,000 units at...Ch. 4 - Sales for Ross Pro’s Sports Equipment are expected...Ch. 4 - Vitale Hair Spray had sales of 13,000 units in...Ch. 4 - Delsing Plumbing Company has beginning inventory...Ch. 4 - On December 31 of last year, Wolfson Corporation...Ch. 4 - At the end of January, Higgins Data Systems had an...Ch. 4 - At the end of January, Mineral Labs had an...Ch. 4 - Convex Mechanical Supplies produces a product with...Ch. 4 - The Bradley Corporation produces a product with...Ch. 4 - Sprint Shoes Inc. had a beginning inventory of...Ch. 4 - J. Lo’s Clothiers has forecast credit sales for...Ch. 4 - Simpson Glove Company has made the following sales...Ch. 4 - Watt’s Lighting Stores made the following sales...Ch. 4 - Ultravision Inc. anticipates sales of $290,000...Ch. 4 - The Denver Corporation has forecast the following...Ch. 4 - Wright Lighting Fixtures forecasts its sales in...Ch. 4 - The Volt Battery Company has forecast its sales in...Ch. 4 - Graham Potato Company has projected sales of...Ch. 4 - Harry’s Carryout Stores has eight locations. The...Ch. 4 - Archer Electronics Company’s actual sales and...Ch. 4 - Prob. 27PCh. 4 - The Manning Company has financial statements as...Ch. 4 - Conn Man’s Shops, a national clothing chain, had...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License