a.

Assuming the perpetual inventory system, indicate the effect of events on the financial statements by placing a ‘+’ for increase and ‘–’ for decrease, and indicate the events as AS (asset source), or AU (asset use), or AE (asset exchange), or CE (claims exchange).

a.

Explanation of Solution

Perpetual inventory system: The method or system of maintaining, recording, and adjusting the inventory perpetually throughout the year, is referred to as perpetual inventory system.

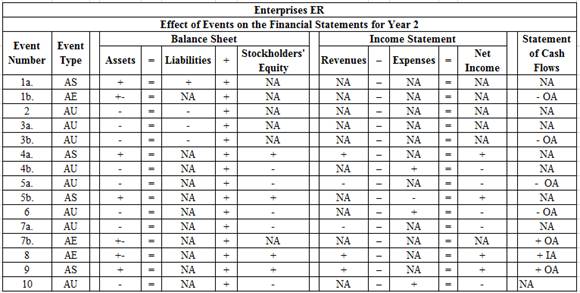

Effect of events on the financial statements for Enterprises ER:

Table (1)

Description:

- Asset source: All the transactions which increase assets either by borrowing from creditors (increase liabilities), or by earning operating revenues (increase in

stockholders’ equity ) are referred to as asset source transactions. - Asset use: All the transactions which decrease assets either by paying off liabilities (decrease in liabilities), or by paying operating expenses (decrease in stockholders’ equity) are referred to as asset use transactions.

- Asset exchange: All the transactions which increase assets and decrease assets simultaneously, with no effect on the total assets value are referred to as asset exchange transactions.

- Claims exchange: All the transactions which include exchange of liabilities for equity are referred to as claims exchange transactions.

b.

Journalize the inventory transactions in the books of Enterprises ER, assuming the perpetual inventory system.

b.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Journalize the inventory transactions in the books of Enterprises ER.

Transaction 1a:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Merchandise Inventory | 11,200 | |||||

| Accounts Payable | 11,200 | |||||

| (Record purchase of merchandise on account) | ||||||

Table (2)

Description:

- Merchandise Inventory is an asset account. Since merchandise is purchased, asset value increased, and an increase in asset is debited.

- Accounts Payable is a liability account. Since amount owed increased, liability increased, and an increase in liability is credited.

Transaction 1b:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Merchandise Inventory | 800 | |||||

| Cash | 800 | |||||

| (Record purchase of merchandise for cash) | ||||||

Table (3)

Description:

- Merchandise Inventory is an asset account. Since merchandise is purchased, asset value increased, and an increase in asset is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction 2:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Accounts Payable | 600 | |||||

| Merchandise Inventory | 600 | |||||

| (Record merchandise purchased on account returned) | ||||||

Table (4)

Description:

- Accounts Payable is a liability account. Since amount owed decreased, liability decreased, and a decrease in liability is debited.

- Merchandise Inventory is an asset account. Since merchandise purchased is returned, asset value decreased, and a decrease in asset is credited.

Transaction 3a:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Accounts Payable | 212 | |||||

| Merchandise Inventory | 212 | |||||

| (Record purchase discount received for merchandise purchased on account) | ||||||

Table (5)

Description:

- Accounts Payable is a liability account. Since sales discount is received, amount owed decreased, liability decreased, and a decrease in liability is debited.

- Merchandise Inventory is an asset account. Since cost of merchandise purchased is reduced by receiving discount, asset value decreased, and a decrease in asset is credited.

Working Notes:

Compute purchase discount.

Transaction 3b:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Accounts Payable | 10,388 | |||||

| Cash | 10,388 | |||||

| (Record cash paid for merchandise purchased on account) | ||||||

Table (6)

Description:

- Accounts Payable is a liability account. Since amount owed is paid, liability decreased, and a decrease in liability is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Working Notes:

Compute cash paid.

Note: Refer to Equation (1) for computation of purchase discount.

Transaction 4a:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| 13,500 | ||||||

| Sales Revenue | 13,500 | |||||

| (Record merchandise sold on account) | ||||||

Table (7)

Description:

- Accounts Receivable is an asset account. The amount is increased because amount to be received increased, and an increase in asset is debited.

- Sales Revenue is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Sales Revenue account is credited.

Transaction 4b:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Cost of Goods Sold | 8,000 | |||||

| Merchandise Inventory | 8,000 | |||||

| (Record cost incurred for goods sold) | ||||||

Table (8)

Description:

- Cost of Goods Sold is an expense account. Since losses and expenses decrease equity and a decrease in equity is debited, Cost of Goods Sold account is debited.

- Merchandise Inventory is an asset account. Since merchandise is sold, asset value decreased, and a decrease in asset is credited.

Transaction 5a:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Sales Revenue | 2,100 | |||||

| Accounts Receivable | 2,100 | |||||

| (Record merchandise sold on account returned) | ||||||

Table (9)

Description:

- Sales Revenue is a revenue account. Since goods sold were returned, revenues decreased, and a decrease in revenues (equity) is debited.

- Accounts Receivable is an asset account. The goods sold were returned, and amount to be received decreased, and a decrease in asset is credited.

Transaction 5b:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Merchandise Inventory | 1,200 | |||||

| Cost of Goods Sold | 1,200 | |||||

| (Record cost incurred on merchandise sold being reduced for the goods returned) | ||||||

Table (10)

Description:

- Merchandise Inventory is an asset account. Since merchandise sold is returned, asset value increased, and an increase in asset is debited.

- Cost of Goods Sold is an expense account. Since goods sold were returned, expenses decreased, and a decrease in expenses (equity) is credited.

Transaction 6:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Transportation-out | 800 | |||||

| Cash | 800 | |||||

| (Record freight charges on goods sold) | ||||||

Table (11)

Description:

- Transportation-out is an expense account. Since losses and expenses decrease equity and a decrease in equity is debited, Transportation-out account is debited.

- Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction 7a:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Sales Revenue | 270 | |||||

| Accounts Receivable | 270 | |||||

| (Record allowance granted on damaged merchandise sold on account) | ||||||

Table (12)

Description:

- Sales Revenue is a revenue account. Since sale allowance is granted on goods sold, revenues decreased, and a decrease in revenues (equity) is debited.

- Accounts Receivable is an asset account. The sale allowance is granted on goods sold, and amount to be received decreased, and a decrease in asset is credited.

Working Notes:

Compute sales discount.

Transaction 7b:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Cash | 13,230 | |||||

| Accounts Receivable | 13,230 | |||||

| (Record cash collected in part, on merchandise sold on account) | ||||||

Table (13)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable is an asset account. The sale allowance is granted on goods sold, and amount to be received decreased, and a decrease in asset is credited.

Working Notes:

Compute cash received.

Note: Refer to Equation (2) for computation of sales discount.

Transaction 8:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Cash | 3,500 | |||||

| Land | 2,000 | |||||

| Gain on Sale of Land | 1,500 | |||||

| (Record sale of land) | ||||||

Table (14)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Land is an asset account. Since land is sold, asset account decreased, and a decrease in asset is credited.

- Gain on Sale of Land is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Gain on Sale of Land account is credited.

Transaction 9:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Interest Receivable | 500 | |||||

| Interest Revenue | 500 | |||||

| (Record accrued interest income) | ||||||

Table (15)

Description:

- Interest Receivable is an asset account. Since interest to be received has increased, asset value increased, and an increase in asset is debited.

- Interest Revenue is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Interest Revenue account is credited.

Transaction 10:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Cost of Goods Sold | 1,888 | |||||

| Merchandise Inventory | 1,888 | |||||

| (Record inventory loss or shrinkage) | ||||||

Table (16)

Description:

- Cost of Goods Sold is an expense account. Loss of inventory is identified after evaluating the physical count and the recorded inventory. Since losses and expenses decrease equity and a decrease in equity is debited, Cost of Goods Sold account is debited.

- Merchandise Inventory is an asset account. Since merchandise is lost, asset value decreased, and a decrease in asset is credited.

Working Notes:

Calculate loss of inventory.

Step 1: Compute value of inventory as per records.

| Merchandise Inventory | |||

| Beginning balance | $4,000 | Accounts payable | $600 |

| Accounts payable | 11,200 | Accounts payable | 212 |

| Cash | 800 | Cost of goods sold | 8,000 |

| Cost of goods sold | 1,200 | ||

| Total | 17,200 | Total | 8,812 |

| Balance | $8,388 | ||

Table (17)

Step 2: Compute inventory loss or shrinkage.

Note: Refer to Table (17) for computation of balance in Merchandise Inventory account.

b.

Post the beginning balances into T-accounts, and post the journal entries prepared in Part (b) into T-accounts.

b.

Explanation of Solution

Post the journal entries prepared in Part (a) into T-accounts.

| Cash | |||

| Beginning balance | $16,800 | Merchandise inventory | $800 |

| Accounts receivable | 13,230 | Accounts payable | 10,388 |

| Land | 2,000 | Sales revenue | 2,100 |

| Gain on sale of land | 1,500 | Transportation-out | 800 |

| Total | 33,530 | Total | 14,088 |

| Balance | $19,442 | ||

Table (18)

| Accounts Receivable | |||

| Sales revenue | $13,500 | Sales revenue | $270 |

| Cash | 13,230 | ||

| Total | 13,500 | Total | 13,500 |

| Balance | $0 | ||

Table (19)

| Interest Receivable | |||

| Interest revenue | $500 | ||

| Total | 500 | Total | $0 |

| Balance | $500 | ||

Table (20)

| Merchandise Inventory | |||

| Beginning balance | $4,000 | Accounts payable | $600 |

| Accounts payable | 11,200 | Accounts payable | 212 |

| Cash | 800 | Cost of goods sold | 8,000 |

| Cost of goods sold | 1,200 | ||

| Total | 17,200 | Total | 8,812 |

| Balance | $8,388 | ||

| Cost of goods sold | 1,888 | ||

| Total | 8,388 | Total | 1,888 |

| Balance | $6,500 | ||

Table (21)

| Land | |||

| Beginning balance | $2,000 | Cash | $2,000 |

| Total | 2,000 | Total | 2,000 |

| Balance | $0 | ||

Table (22)

| Accounts Payable | |||

| Merchandise inventory | $600 | Merchandise inventory | $11,200 |

| Merchandise inventory | 212 | ||

| Cash | 10,388 | ||

| Total | 11,200 | Total | 11,200 |

| Balance | $0 | ||

Table (23)

| Common Stock | |||

| Beginning balance | $12,000 | ||

| Total | $0 | Total | 12,000 |

| Balance | $12,000 | ||

Table (24)

| Beginning balance | $10,800 | ||

| Total | $0 | Total | 10,800 |

| Balance | $10,800 | ||

Table (25)

| Sales Revenue | |||

| Cash | $2,100 | Accounts receivable | $13,500 |

| Accounts receivable | 270 | ||

| Total | $2,370 | Total | 13,500 |

| Balance | $11,130 | ||

Table (26)

| Cost of Goods Sold | |||

| Merchandise inventory | $8,000 | Merchandise inventory | $1,200 |

| Merchandise inventory | 1,888 | ||

| Total | 9,888 | Total | 1,200 |

| Balance | $8,688 | ||

Table (27)

| Transportation-out | |||

| Cash | $800 | ||

| Total | 800 | Total | $0 |

| Balance | $800 | ||

Table (28)

| Interest Revenue | |||

| Interest receivable | $500 | ||

| Total | $0 | Total | 500 |

| Balance | $500 | ||

Table (29)

| Gain on Sale of Land | |||

| Cash | $1,500 | ||

| Total | $0 | Total | 1,500 |

| Balance | $1,500 | ||

Table (30)

d.

Prepare a multistep income statement, statement of stockholders’ equity,

d.

Explanation of Solution

Multi-step income statement: The income statement represented in multi-steps with several subtotals, to report the income from principal operations, and separate the other expenses and revenues which affect net income, is referred to as multi-step income statement.

Prepare a multistep income statement for Enterprises ER for the year ended December 31, Year 2.

| Enterprises ER | ||

| Income Statement | ||

| For the Year Ended December 31, Year 2 | ||

| Sales | $13,500 | |

| Sales returns | (2,100) | |

| Sales discounts | (270) | |

| Net sales | $11,130 | |

| Cost of goods sold | (8,688) | |

| Gross margin | 2,442 | |

| Operating expenses: | ||

| Transportation-out | (800) | |

| Operating income | 1,642 | |

| Non-operating items: | ||

| Interest revenue | 500 | |

| Gain on sale of land | 1,500 | 2,000 |

| Net income | $3,642 | |

Table (31)

Statement of stockholders’ equity: The statement which reports the changes in stock, paid-in capital, retained earnings, and

Prepare a statement of stockholders’ equity for Enterprises ER for the year ended December 31, Year 2.

| Enterprises ER | ||

| Statement of Stockholders’ Equity | ||

| For the Year Ended December 31, Year 2 | ||

| Beginning common stock | $12,000 | |

| Stock issued | 0 | |

| Ending common stock | $12,000 | |

| Beginning retained earnings | $10,800 | |

| Net income | 3,642 | |

| Ending retained earnings | 14,442 | |

| Total stockholders’ equity | $26,442 | |

Table (32)

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet for Enterprises ER as at December 31, Year 2.

| Enterprises ER | ||

| Balance Sheet | ||

| December 31, Year 2 | ||

| Assets | ||

| Cash | $19,442 | |

| Accounts receivable | 6,500 | |

| Merchandise inventory | 500 | |

| Total assets | $26,442 | |

| Liabilities | $0 | |

| Stockholders’ equity | ||

| Common stock | 12,000 | |

| Retained earnings | 14,442 | |

| Total stockholders’ equity | 26,442 | |

| Total liabilities and stockholders’ equity | $26,442 | |

Table (33)

Statement of cash flows: Statement of cash flows reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period. Statement of cash flows includes the changes in cash balance due to operating, investing, and financing activities. Ending cash balance computed in balance sheet is required in statement of cash flows. Operating activities include cash inflows and outflows from business operations. Investing activities includes cash inflows and cash outflows from purchase and sale of land or equipment, or investments. Financing activities includes cash inflows and outflows from issuance of common stock and debt, payment of debt and dividends.

Prepare the statement of cash flows for Enterprises ER for the year ended December 31, Year 2.

| Enterprises ER | ||

| Statement of Cash Flows | ||

| For the Year Ended December 31, Year 2 | ||

| Cash flows from operating activities: | ||

| Cash inflow from customers | $11,130 | |

| |

(11,188) | |

| Cash outflow for expenses | (800) | |

| Net cash flow from operating activities | $(858) | |

| Cash flows from investing activities: | ||

| Cash inflow from sale of land | 3,500 | |

| Cash flows from financing activities | 0 | |

| Net change in cash | 2,642 | |

| Add: Beginning cash balance | 16,800 | |

| Ending cash balance | $19,442 | |

Table (34)

e.

Prepare closing entries at the end of Year 2, post the closing entries into T-accounts, and prepare post-closing trial balance of Enterprises ER as on December 31, Year 2.

e.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare closing entries at the end of Year 1 for Enterprises ER.

Closing revenues:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Sales Revenue | 11,130 | |||||

| Interest Revenue | 500 | |||||

| Gain from Sale of Land | 1,500 | |||||

| Retained Earnings | 13,130 | |||||

| (Record revenues being closed to Retained Earnings account) | ||||||

Table (35)

Description:

- Sales Revenue, Interest Revenue, and Gain from Sale of Land are revenue accounts. Since revenues are closed to Retained Earnings account, the accounts are cancelled by debiting to reverse its effect.

- Retained Earnings is a stockholders’ equity account. Since revenues are transferred to the account, the value increased, and an increase in equity is credited.

Closing expenses:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Year 2 | ||||||

| Retained Earnings | 9,488 | |||||

| Cost of Goods Sold | 8,688 | |||||

| Transportation-out | 800 | |||||

| (Record expenses being closed to Retained Earnings account) | ||||||

Table (36)

Description:

- Retained Earnings is a stockholders’ equity account. Since expenses are transferred to the account, the value decreased, and a decrease in equity is debited.

- Cost of Goods Sold and Transportation-out are expenses accounts. Since expenses are closed to Retained Earnings account, the accounts are cancelled by crediting to reverse the effect.

Post the entries into T-accounts.

| Cash | |||

| Balance | $19,442 | ||

Table (37)

| Interest Receivable | |||

| Balance | $500 | ||

Table (38)

| Merchandise Inventory | |||

| Balance | $6,500 | ||

Table (39)

| Common Stock | |||

| Balance | $12,000 | ||

Table (40)

| Retained Earnings | |||

| Beginning balance | $10,800 | ||

| Total | $0 | Total | 10,800 |

| Balance | $10,800 | ||

| Cost of goods sold | 8,688 | Sales revenue | 11,130 |

| Transportation-out | 800 | Interest revenue | 500 |

| Gain from sale of land | 1,500 | ||

| Total | 9,488 | Total | 23,930 |

| Balance | $14,442 | ||

Table (41)

| Sales Revenue | |||

| Cash | $2,100 | Accounts receivable | $13,500 |

| Accounts receivable | 270 | ||

| Total | $2,370 | Total | 13,500 |

| Balance | $11,130 | ||

| Retained earnings | 11,130 | ||

| Total | 11,130 | Total | 11,130 |

| Balance | $0 | ||

Table (41)

| Cost of Goods Sold | |||

| Merchandise inventory | $8,000 | Merchandise inventory | $1,200 |

| Merchandise inventory | 1,888 | ||

| Total | 9,888 | Total | 1,200 |

| Balance | $8,688 | ||

| Retained earnings | 8,688 | ||

| Total | 8,688 | Total | 8,688 |

| Balance | $0 | ||

Table (42)

| Transportation-out | |||

| Cash | $800 | ||

| Total | 800 | Total | $0 |

| Balance | $800 | ||

| Retained earnings | 800 | ||

| Total | 800 | Total | 800 |

| Balance | $0 | ||

Table (43)

| Interest Revenue | |||

| Interest receivable | $500 | ||

| Total | $0 | Total | 500 |

| Balance | $500 | ||

| Retained earnings | 500 | ||

| Total | 500 | Total | 500 |

| Balance | $0 | ||

Table (44)

| Gain on Sale of Land | |||

| Cash | $1,500 | ||

| Total | $0 | Total | 1,500 |

| Balance | $1,500 | ||

| Retained earnings | 1,500 | ||

| Total | 1,500 | Total | 1,500 |

| Balance | $0 | ||

Table (45)

Post-closing trial balance: Post-closing trial balance is a summary of all the asset, liability, and equity accounts and their balances, after the closing entries are prepared. So, post-closing trial balance reports the balances of permanent accounts only.

Prepare post-closing trial balance for Enterprises ER as of December 31, Year 2.

| Enterprises ER | ||

| Post-Closing Trial Balance | ||

| December 31, Year 2 | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | $19,442 | |

| Merchandise Inventory | 6,500 | |

| Interest receivable | 500 | |

| Common Stock | $12,000 | |

| Retained earnings | 14,442 | |

| Total | $26,442 | $26,442 |

Table (46)

Want to see more full solutions like this?

Chapter 4 Solutions

Loose-Leaf Fundamental Financial Accounting Concepts

- A machine costing $77,500 with a 5-year life and $4,700 residual value was purchased January 2. Compute depreciation for each of the 5 years, using the double-declining-balance method. Year1 Y2 Y3 Y4 Y5arrow_forwardSolare Company acquired mineral rights for $536,800,000. The diamond deposit is estimated at 48,800,000 tons. During the current year, 3,390,000 tons were mined and sold. Required: 1.Determine the depletion rate. 2. Determine the amount of depletion expense for the current year. 3.Journalize the adjusting entry to recognize the depletion expense. Refer to the Chart of Accounts for exact wording of account titles. _____________ Debit / Credit _____________ Debit / Crditarrow_forwardExercise 1-24 (Algo) Linking the statement of owner's equity and balance sheet LO P2 Mahomes Company reported the following data at the end of its first year of operations on December 31. Cash Accounts receivable Equipment Land Accounts payable Owner investments Mahomes, Withdrawals Net income $ 15,500 16,500 18,500 62,500 12,500 62,500 31,500 69,500 (a) Prepare its year-end statement of owner's equity. Hint. Mahomes, Capital on January 1 was $0. (b) Prepare its year-end balance sheet, using owner's capital calculated in part a. Complete this question by entering your answers in the tabs below. Required A Required B Prepare its year-end statement of owner's equity. Hint: Mahomes, Capital on January 1 was $0. Cash MAHOMES COMPANY Statement of Owner's Equity For Year Ended December 31arrow_forward

- ht = ences X On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,920 in assets to launch the business. On December 31, the company's records show the following items and amounts. Cash withdrawals by owner Consulting revenue Salaries expense Cash $ 8,450 Accounts receivable 16,950 Office supplies 4,080 Rent expense Land 46,020 Office equipment 18,860 Telephone expense Accounts payable 9,280 Owner investments 84,920 Miscellaneous expenses $ 2,930 16,950 4,420 7,900 860 680 Exercise 1-18 (Algo) Preparing an income statement LO P2 Using the above information prepare a December income statement for the business. ERNST CONSULTING Income Statement Revenues Rent expense Salaries expense Telephone expense Total revenues $ 4,420 7,900 860 $ SA Assets Cash 8,450 Accounts receivable 16,950 Office supplies 4,080 Land 46,020 Office equipment 18,860 navable 9,280 13,180 5 11 of 14 Next >arrow_forwardEquipment was acquired at the beginning of the year at a cost of $77,220. The equipment was depreciated using the straight-line method based upon an estimated useful life of 6 years and an estimated residual value of $7,560. P1 What was the depreciation expense for the first year? _______ P2 Assuming the equipment was sold at the end of the second year for $58,320, determine the gain or loss on sale of the equipment. $_______________ P3 Journalize the entry to record the sale. Refer to the Chart of Accounts for exact wording of account titles. 1. ____ Debit / Credit 2.____ Debit / Credit 3.____ Debit / Credit 4.____ Debit / Creditarrow_forwardUse the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,920 in assets to launch the business. On December 31, the company's records show the following items and amounts. Cash Accounts receivable Office supplies Land Office equipment Accounts payable Owner investments $ 8,450 Cash withdrawals by owner 16,950 4,080 Rent expense Consulting revenue Salaries expense 18,860 Telephone expense Miscellaneous expenses 46,020 9,280 84,920 $ 2,930 16,950 4,420 7,900 860 680 Check my work Exercise 1-21 (Algo) Preparing a statement of cash flows LO P2 Also assume the following: a. The owner's initial investment consists of $38,900 cash and $46,020 in land. b. The company's $18,860 equipment purchase is paid in cash. c. Cash paid to employees is $2,700. The accounts payable balance of $9,280 consists of the $4,080 office supplies…arrow_forward

- ht = ences X On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $84,920 in assets to launch the business. On December 31, the company's records show the following items and amounts. Cash withdrawals by owner Consulting revenue Salaries expense Cash $ 8,450 Accounts receivable 16,950 Office supplies 4,080 Rent expense Land 46,020 Office equipment 18,860 Telephone expense Accounts payable 9,280 Owner investments 84,920 Miscellaneous expenses $ 2,930 16,950 4,420 7,900 860 680 Exercise 1-18 (Algo) Preparing an income statement LO P2 Using the above information prepare a December income statement for the business. ERNST CONSULTING Income Statement Revenues Rent expense Salaries expense Telephone expense Total revenues $ 4,420 7,900 860 $ SA Assets Cash 8,450 Accounts receivable 16,950 Office supplies 4,080 Land 46,020 Office equipment 18,860 navable 9,280 13,180 5 11 of 14 Next >arrow_forwardAssets Current Assets Cash Credit card receivables Accounts receivable Marketable securities Food Inventories Prepaid expenses Total Current Assets Golden Bay Balance Sheet as at December 31 Year 2018 Year 2019 $ 18,500 9,807 $ 29,400 11,208 5,983 6,882 15,400 2,000 12,880 14,700 10 800 14 900 73370 79 090 Property Plant & Equipment Land Building Equipment Furnishings $ 60,500 828,400 114,900 75,730 (330,100) 16 600 766 030 839 400 $ 60,500 884,400 157,900 81,110 (422,000) 18 300 7 80 210 859 300 Net: Accumulated depreciation China, glass, silver, & linen Total Assets Liabilities & Stockholders' Equity Current Liabilities Accounts payable Accrued expenses payable Taxes payable Current mortgage payable Total Current assets $ 19,200 4,200 12,400 26 900 62 700 $16,500 5,000 20,900 26 000 68 400 Long-term liabilities Mortgage payable Total Liabilities $ $512 800 $486 400 575 500 $555 200 Stockholders' Equity Common stock ($5 par. 40,000 shares issued & OS) $200,000 Retained earnings…arrow_forwardMat lives in Barbados and is desirous of starting his own business from inheritances that his parents left him. He approached you for advice on the best type of business to register. Mr. Mat said he would love to gain benefits from any tax relief that is available that the government has to offer. Give advice to Mr. Mat whether it would be more beneficial to start a Company or an Individual Trading Business. outline for Mr. Mat why setting up either a company, or a trading as business is more advantageous over the other. cover matters like: Tax rates, Available tax reliefs and or tax credits Ease of operations of a company, as well as ease of operations of an individual trading business.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education