The effect of tax on economic efficiency.

Explanation of Solution

Tax is a unilateral payment made to the government from the public for various purposes. There are many types of taxes, such as income tax, wealth tax, and so forth, which constitute a major portion of the revenue of the government that can be used for making public expenditures. Economic efficiency is a situation where no one can be in a better position without hurting the other. In the case, economic efficiency is the situation where the marginal benefit (of the consumer) from the last unit produced is equal to the marginal cost of the production of the unit. This means that both of them will be the same and neither the consumer nor the producer can be in a better position. The sum of the

Here, the tax imposed on the ride is 20%, which is equal to 6 pounds. This is because the

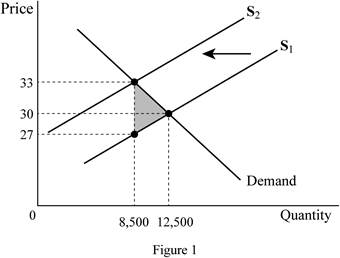

Thus, the supply vertically shifts by the tax amount of 6 pounds, and as a result, the quantity demanded decreases to 8,500 rides. The owner of the vehicles receives only 27 pounds, which is the reason for the decrease in the supply of the rides in the market. Thus, the consumer has to pay 33 pounds more than the equilibrium price, whereas the owner receives 3 pounds less than the equilibrium price received by him before the tax. Thus, the tax is equally shared among the consumer and the owner (by 3 pounds each). The economic efficiency is reduced by the tax because there will be

The new quantity demanded after the introduction of the tax is 8,500 rides and the new price after the introduction of the tax is 33 pounds. The price actually received by the owner of the vehicle also reduces to 27 pounds; this means that both the owner and the consumer are paying 3 pounds each as tax. This shows that the tax burden is evenly distributed between the seller and the buyer. There is deadweight loss in the economy because of the tax and it can be denoted by the area shaded in grey colour on the graph.

Concept introduction:

Tax: It is the unilateral payment made by the public towards the government. There are many different types of taxes in the economy, which includes income tax, property tax, professional tax, and so forth.

Economic efficiency: It is the situation where the economy is efficient. This means that the marginal benefit from the last unit produced is equal to the marginal cost of production and the economic surplus will be at is maximum.

Want to see more full solutions like this?

Chapter 4 Solutions

MyLab Economics with Pearson eText -- Access Card -- for Economics

- Answerarrow_forwardM” method Given the following model, solve by the method of “M”. (see image)arrow_forwardAs indicated in the attached image, U.S. earnings for high- and low-skill workers as measured by educational attainment began diverging in the 1980s. The remaining questions in this problem set use the model for the labor market developed in class to walk through potential explanations for this trend. 1. Assume that there are just two types of workers, low- and high-skill. As a result, there are two labor markets: supply and demand for low-skill workers and supply and demand for high-skill workers. Using two carefully drawn labor-market figures, show that an increase in the demand for high skill workers can explain an increase in the relative wage of high-skill workers. 2. Using the same assumptions as in the previous question, use two carefully drawn labor-market figures to show that an increase in the supply of low-skill workers can explain an increase in the relative wage of high-skill workers.arrow_forward

- Published in 1980, the book Free to Choose discusses how economists Milton Friedman and Rose Friedman proposed a one-sided view of the benefits of a voucher system. However, there are other economists who disagree about the potential effects of a voucher system.arrow_forwardThe following diagram illustrates the demand and marginal revenue curves facing a monopoly in an industry with no economies or diseconomies of scale. In the short and long run, MC = ATC. a. Calculate the values of profit, consumer surplus, and deadweight loss, and illustrate these on the graph. b. Repeat the calculations in part a, but now assume the monopoly is able to practice perfect price discrimination.arrow_forwardThe projects under the 'Build, Build, Build' program: how these projects improve connectivity and ease of doing business in the Philippines?arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education