1.

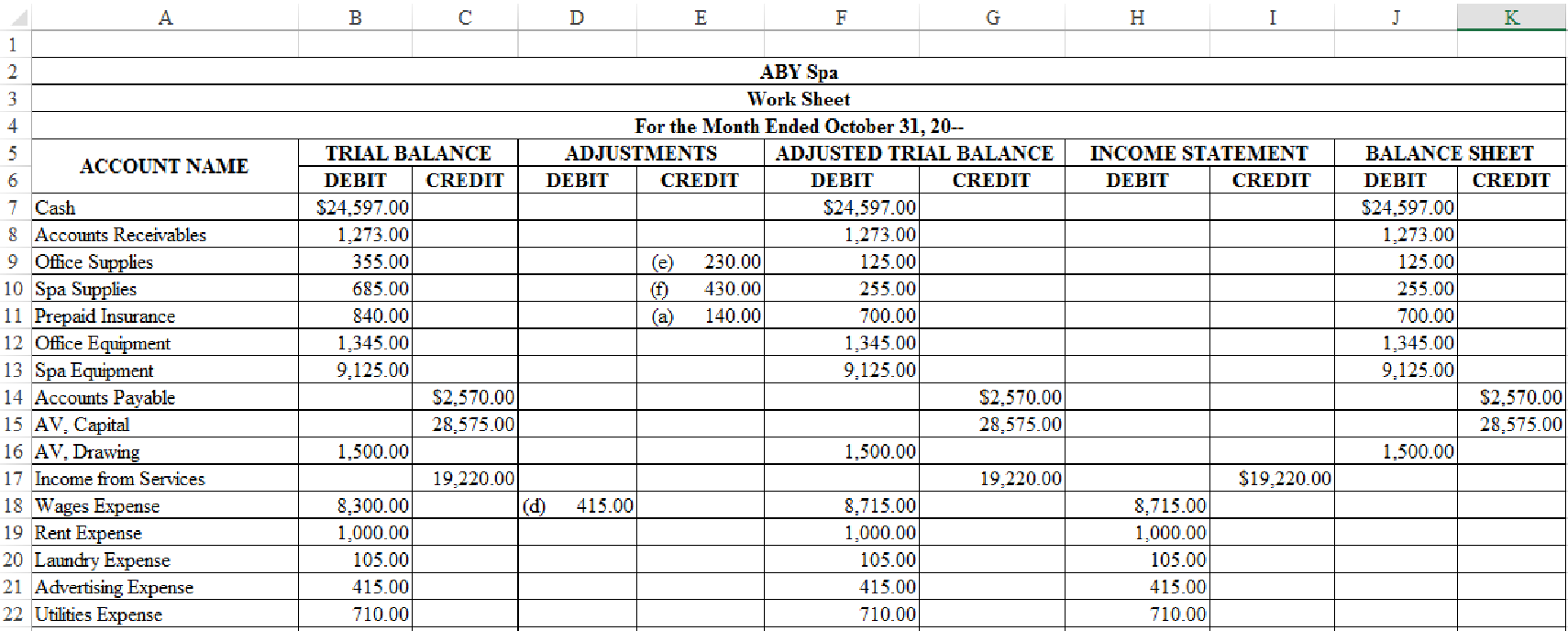

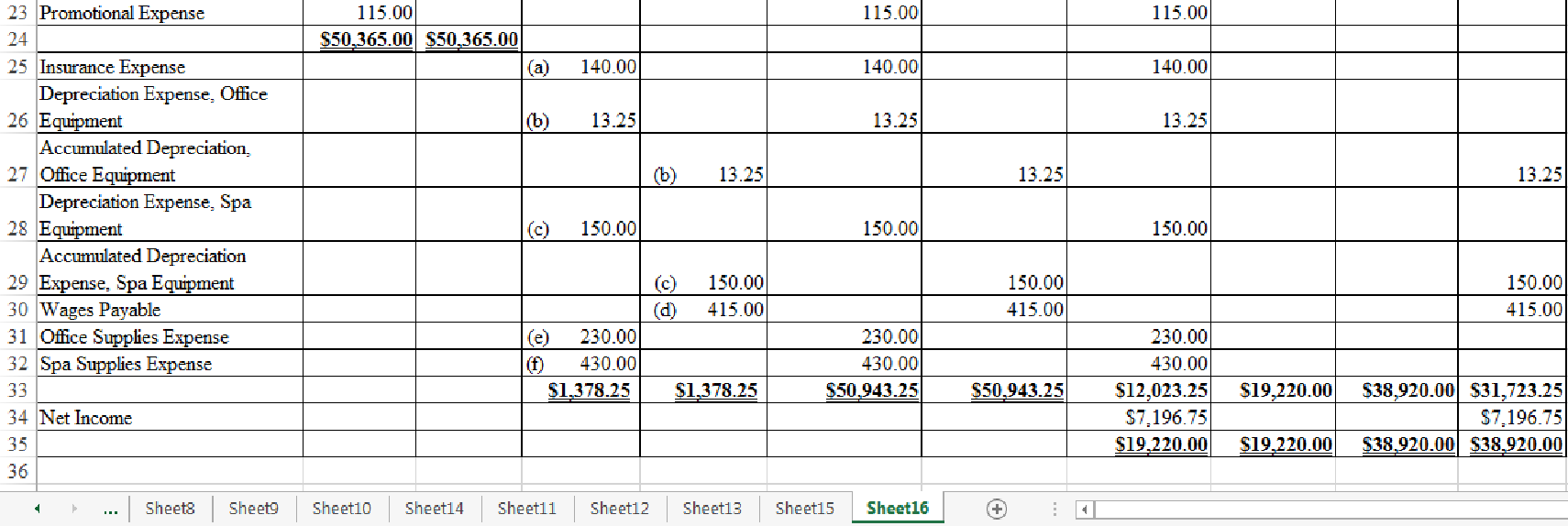

Indicate the given adjustments and complete the worksheet for ABY Spa for the month ended October 31, 20--.

1.

Explanation of Solution

Worksheet: Worksheet is an accounting tool that help accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where

Indicate the given adjustments and complete the worksheet for ABY Spa for the month ended October 31, 20--.

Figure-(1)

2.

Prepare adjusting journal entries for ABY Spa for the month ended October 31, 20--.

2.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare adjusting journal entries for ABY Spa for the month ended October 31, 20--.

Adjusting entry (a) for the prepaid insurance:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 31 | Insurance Expense | 618 | 140 | ||

| Prepaid Insurance | 117 | 140 | ||||

| (Record part of prepaid insurance expired) | ||||||

Table (1)

Description:

- Insurance Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Insurance is an asset account. Since amount of insurance is expired, asset account decreased, and a decrease in asset is credited.

Working Note 1:

Calculate the value of insurance expense for 1 month.

Adjusting entry (b) for the

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 31 | Depreciation Expense, Office Equipment | 619 | 13.25 | ||

| 125 | 13.25 | |||||

| (Record depreciation expense) | ||||||

Table (2)

Description:

- Depreciation Expense, Office Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Office Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Working Note 2:

Compute monthly depreciation expense for the office equipment.

Adjusting entry (c) for the depreciation expense for spa equipment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 31 | Depreciation Expense, Spa Equipment | 620 | 150 | ||

| Accumulated Depreciation, Spa Equipment | 129 | 150 | ||||

| (Record depreciation expense) | ||||||

Table (3)

Description:

- Depreciation Expense, Spa Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Spa Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Working Note 3:

Compute monthly depreciation expense for the spa equipment.

Adjusting entry (d) for the wages expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 31 | Wages Expense | 611 | 415 | ||

| Wages Payable | 212 | 415 | ||||

| (Record accrued wages expenses) | ||||||

Table (4)

Description:

- Wages Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Wages Payable is a liability account. Since amount of payables has increased, liability decreased, and an increase in liability is credited.

Working Note 4:

Calculate the value of wages expense for 1 day.

Adjusting entry (e) for the office supplies expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 31 | Office Supplies Expense | 613 | 230 | ||

| Office Supplies | 114 | 230 | ||||

| (Record part of supplies consumed) | ||||||

Table (5)

Description:

- Office Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Office Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

Working Note 5:

Calculate the value of office supplies expense for the month.

Adjusting entry (f) for the spa supplies expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| October | 31 | Spa Supplies Expense | 614 | 430 | ||

| Spa Supplies | 115 | 430 | ||||

| (Record part of supplies consumed) | ||||||

Table (6)

Description:

- Spa Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Spa Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

Working Note 6:

Calculate the value of spa supplies expense for the month.

3.

3.

Explanation of Solution

Post the adjusting entries journalized in Part (2) in the ledger accounts of general ledger.

| ACCOUNT Cash ACCOUNT NO. 111 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 1 | 1 | 25,000 | 25,000 | |||

| 3 | 1 | 840 | 24,160 | ||||

| 3 | 1 | 3,000 | 21,160 | ||||

| 3 | 1 | 1,000 | 20,160 | ||||

| 5 | 1 | 230 | 19,930 | ||||

| 5 | 1 | 115 | 19,815 | ||||

| 7 | 1 | 2,075 | 17,740 | ||||

| 7 | 1 | 3,465 | 21,205 | ||||

| 11 | 1 | 1,000 | 20,205 | ||||

| 14 | 1 | 3,307 | 23,512 | ||||

| 14 | 1 | 2,075 | 21,437 | ||||

| 18 | 1 | 1,200 | 20,237 | ||||

| 21 | 1 | 4,587 | 24,824 | ||||

| 21 | 1 | 2,075 | 22,749 | ||||

| 25 | 1 | 350 | 22,399 | ||||

| 28 | 1 | 2,075 | 20,324 | ||||

| 28 | 1 | 105 | 20,219 | ||||

| 31 | 1 | 6,588 | 26,807 | ||||

| 31 | 1 | 1,500 | 25,307 | ||||

| 31 | 1 | 325 | 24,982 | ||||

| 31 | 1 | 385 | 24,597 | ||||

Table (7)

| ACCOUNT Accounts Receivable ACCOUNT NO. 113 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 7 | 1 | 350 | 350 | |||

| 14 | 1 | 468 | 818 | ||||

| 21 | 1 | 345 | 1,163 | ||||

| 31 | 1 | 110 | 1,273 | ||||

Table (8)

| ACCOUNT Office Supplies ACCOUNT NO. 114 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 5 | 1 | 230 | 230 | |||

| 5 | 1 | 125 | 355 | ||||

| 31 | Adjusting | 230 | 125 | ||||

Table (9)

| ACCOUNT Spa Supplies ACCOUNT NO. 115 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 3 | 1 | 685 | 685 | |||

| 31 | Adjusting | 430 | 255 | ||||

Table (10)

| ACCOUNT Prepaid Insurance ACCOUNT NO. 117 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 3 | 1 | 840 | 840 | |||

| 31 | Adjusting | 140 | 700 | ||||

Table (11)

| ACCOUNT Office Equipment ACCOUNT NO. 124 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 5 | 1 | 520 | 520 | |||

| 5 | 1 | 825 | 1,345 | ||||

Table (12)

| ACCOUNT Accumulated Depreciation, Office Equipment ACCOUNT NO. 125 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 13.25 | 13.25 | ||

Table (13)

| ACCOUNT Spa Equipment ACCOUNT NO. 128 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 1 | 1 | 3,575 | 3,575 | |||

| 3 | 1 | 5,550 | 9,125 | ||||

Table (14)

| ACCOUNT Accumulated Depreciation, Spa Equipment ACCOUNT NO. 129 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 150 | 150 | ||

Table (15)

| ACCOUNT Accounts Payable ACCOUNT NO. 211 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 3 | 1 | 2,550 | 2,550 | |||

| 3 | 1 | 685 | 3,235 | ||||

| 5 | 1 | 520 | 3,755 | ||||

| 5 | 1 | 415 | 4,170 | ||||

| 5 | 1 | 825 | 4,995 | ||||

| 5 | 1 | 125 | 5,120 | ||||

| 11 | 1 | 1,000 | 4,120 | ||||

| 18 | 1 | 1,200 | 2,920 | ||||

| 25 | 1 | 350 | 2,570 | ||||

Table (16)

| ACCOUNT Wages Payable ACCOUNT NO. 212 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 415 | 415 | ||

Table (17)

| ACCOUNT AV, Capital ACCOUNT NO. 311 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 1 | 1 | 25,000 | 25,000 | |||

| 1 | 1 | 3,575 | 28,575 | ||||

Table (18)

| ACCOUNT AV, Drawing ACCOUNT NO. 312 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | 1 | 1,500 | 1,500 | |||

Table (19)

| ACCOUNT Income from Services ACCOUNT NO. 411 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 7 | 1 | 3,465 | 3,465 | |||

| 7 | 1 | 350 | 3,815 | ||||

| 14 | 1 | 3,307 | 7,122 | ||||

| 14 | 1 | 468 | 7,590 | ||||

| 21 | 1 | 4,587 | 12,177 | ||||

| 21 | 1 | 345 | 12,522 | ||||

| 31 | 1 | 6,588 | 19,110 | ||||

| 31 | 1 | 110 | 19,220 | ||||

Table (20)

| ACCOUNT Wages Expense ACCOUNT NO. 611 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 7 | 1 | 2,075 | 2,075 | |||

| 14 | 1 | 2,075 | 4,150 | ||||

| 21 | 1 | 2,075 | 6,225 | ||||

| 28 | 1 | 2,075 | 8,300 | ||||

| 31 | Adjusting | 415 | 8,715 | ||||

Table (21)

| ACCOUNT Rent Expense ACCOUNT NO. 612 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 3 | 1 | 1,000 | 1,000 | |||

Table (22)

| ACCOUNT Office Supplies Expense ACCOUNT NO. 613 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 230 | 230 | ||

Table (23)

| ACCOUNT Spa Supplies Expense ACCOUNT NO. 614 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 430 | 430 | ||

Table (24)

| ACCOUNT Laundry Expense ACCOUNT NO. 615 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 28 | 1 | 105 | 105 | |||

Table (25)

| ACCOUNT Advertising Expense ACCOUNT NO. 616 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 5 | 1 | 415 | 415 | |||

Table (26)

| ACCOUNT Utilities Expense ACCOUNT NO. 617 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | 1 | 325 | 325 | |||

| 31 | 1 | 385 | 710430 | ||||

Table (27)

| ACCOUNT Insurance Expense ACCOUNT NO. 618 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 140 | 140 | ||

Table (28)

| ACCOUNT Depreciation Expense, Office Equipment ACCOUNT NO. 619 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 13.25 | 13.25 | ||

Table (29)

| ACCOUNT Depreciation Expense, Spa Equipment ACCOUNT NO. 620 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 31 | Adjusting | 1 | 150 | 150 | ||

Table (30)

| ACCOUNT Promotional Expense ACCOUNT NO. 630 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| October | 5 | 1 | 115 | 115 | |||

Table (31)

4.

Prepare an adjusted trial balance for ABY Spa as at October 31, 20--, based on the account balances derived in Part (3).

4.

Explanation of Solution

Adjusted trial balance: The trial balance which reflects the adjusting entries and incorporates the effect of all adjustments in the ledger accounts, is referred to as adjusted trial balance.

Prepare an adjusted trial balance for ABY Spa as at October 31, 20--, based on the account balances derived in Part (3).

| ABY Spa | ||

| Adjusted Trial Balance | ||

| October 31, 20-- | ||

| Account Title | Debit ($) | Credit ($) |

| Cash | $24,597 | |

| Accounts Receivable | 1,273 | |

| Office Supplies | 125 | |

| Spa Supplies | 255 | |

| Prepaid Insurance | 700 | |

| Office Equipment | 1,345 | |

| Accumulated Depreciation, Office Equipment | $13.25 | |

| Spa Equipment | 9,125 | |

| Accumulated Depreciation, Spa Equipment | 150 | |

| Accounts Payable | 2,570 | |

| Wages Payable | 415 | |

| AV, Capital | 28,575 | |

| AV, Drawing | 1,500 | |

| Income from Services | 19,220 | |

| Wages Expense | 8,715 | |

| Rent Expense | 1,000 | |

| Office Supplies Expense | 230 | |

| Laundry Expense | 105 | |

| Advertising Expense | 415 | |

| Utilities Expense | 710 | |

| Promotional Expense | 115 | |

| Depreciation Expense, Office Equipment | 13.25 | |

| Depreciation Expense, Spa Equipment | 150 | |

| Spa Supplies Expense | 430 | |

| Insurance Expense | 140 | |

| Total | $50,943.25 | $50,943.25 |

Table (32)

Hence, the debit and credit total of adjusted trial balance of ABY Spa at October 31, 20-- is $50,943.25.

5.

Prepare an income statement of ABY Spa for the month ended October 31, 20--, based on the account balances derived in Part (3).

5.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations, and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement of ABY Spa for the month ended October 31, 20--.

| ABY Spa | ||

| Income Statement | ||

| For the Month Ended October 31, 20-- | ||

| Revenues: | ||

| Income from Services | $19,220.00 | |

| Expenses: | ||

| Wages Expense | $8,715.00 | |

| Rent Expense | 1,000.00 | |

| Office Supplies Expense | 230.00 | |

| Laundry Expense | 105.00 | |

| Advertising Expense | 415.00 | |

| Utilities Expense | 710.00 | |

| Promotional Expense | 115.00 | |

| Depreciation Expense, Office Equipment | 13.25 | |

| Depreciation Expense, Spa Equipment | 150.00 | |

| Spa Supplies Expense | 430.00 | |

| Insurance Expense | 140.00 | |

| Total expenses | 12,023.25 | |

| Net income | $7,196.75 | |

Table (33)

6.

Prepare a statement of owners’ equity of ABY Spa, based on the account balances derived in Part (3), and net income computed in Part (5).

6.

Explanation of Solution

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owners’ equity. Additional capital, net income from income statement is added to, and drawings is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement of owners’ equity for ABY Spa for the month ended October 31, 20--.

| ABY Spa | ||

| Statement of Owners’ Equity | ||

| For the Month Ended October 31, 20-- | ||

| AV, Capital, October 1, 20-- | $0 | |

| Investments during October | $28,575.00 | |

| Net income for October | 7,196.75 | |

| 35,771.75 | ||

| Less: Withdrawals for October | 1,500.00 | |

| Increase in capital | 34,271.75 | |

| AV, Capital, October 31, 20-- | $34,271.75 | |

Table (34)

7.

Prepare a balance sheet for ABY Spa, based on the account balances derived in Part (3), and capital of the owner from the statement of owners’ equity prepared in Part (6).

7.

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and owners (owners’ equity) over those resources. The resources of the company are assets which include money contributed by owners and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and owners’ equity.

Prepare the balance sheet for ABY Spa as at October 31, 20--.

| ABY Spa | ||

| Balance Sheet | ||

| October 31, 20-- | ||

| Assets | ||

| Cash | $24,597.00 | |

| Accounts Receivable | 1,273.00 | |

| Office Supplies | 125.00 | |

| Spa Supplies | 255.00 | |

| Prepaid Insurance | 700.00 | |

| Office Equipment | $1,345.00 | |

| Less: Accumulated Depreciation, Office Equipment | 13.25 | 1,331.75 |

| Spa Equipment | 9,125.00 | |

| Less: Accumulated Depreciation, Spa Equipment | 150.00 | 8,975.00 |

| Total assets | $37,256.75 | |

| Liabilities | ||

| Accounts Payable | $2,570.00 | |

| Wages Payable | 415.00 | |

| Total Liabilities | $2,985.00 | |

| Owners’ Equity | ||

| AV, Capital | 34,271.75 | |

| Total Liabilities and Owners’ Equity | $37,256.75 | |

Table (35)

Want to see more full solutions like this?

Chapter 4 Solutions

COLLEGE ACCOUNTING W/ ACCESS >BI<

- Andrea Company had beginning raw materials inventory of $34,500. During the period, the company purchased $127,000 of raw materials on account. If the ending balance in raw materials was $22,800, the amount of raw materials transferred to work in process inventory is?arrow_forwardI need help this financial accounting questionsarrow_forwardElegant Furnishings earned net sales revenue of $42,375,000 in 2023. The cost of goods sold was $29,662,500, and net income reached $7,800,000, the company's highest ever. Compute the company's gross profit percentage for 2023.arrow_forward

- Can you explain the process for solving this financial accounting problem using valid standards?arrow_forwardI am looking for a reliable way to solve this financial accounting problem using accurate principles.arrow_forwardTroy (single) purchased a home in Hopkinton, Massachusetts, on January 1, 2007, for $300,000. He sold the home on January 1, 2024, for $320,000. How much gain must Troy recognize on his home sale in each of the following alternative situations? Note: Leave no answer blank. Enter zero if applicable. d. Troy rented out the home from January 1, 2007, through December 31, 2019. He lived in the home as his principal residence from January 1, 2020, through December 31, 2020. He rented out the home from January 1, 2021, through December 31, 2021, and lived in the home as his principal residence from January 1, 2022, through the date of the sale. Assume accumulated depreciation on the home at the time of sale was $0. Note: Do not round intermediate calculations.arrow_forward

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardCan you demonstrate the accurate steps for solving this financial accounting problem with valid procedures?arrow_forwardTom Hale was an entertainment executive who had a fatal accident on a film set. Tom's will directed his executor to distribute his cash and stock to his spouse and his real estate to a church (an “A” charity). The remainder of Tom’s assets were to be placed in trust for three children. Tom’s estate consisted of the following: Assets: Personal assets $ 1,340,000 Cash and stock 26,400,000 Intangible assets (film rights) 83,500,000 Real estate 17,400,000 $ 128,640,000 Liabilities: Mortgage $ 5,600,000 Other liabilities 6,500,000 $ 12,100,000 a. Tom made a taxable gift of $7.50 million in 2011. Compute the estate tax for Tom's estate. (Refer to Exhibit 25-1 and Exhibit 25-2.) Note: Enter your answers in dollars, not millions of dollars. EXHIBIT 25-2 The Exemption Equivalent / Applicable Exclusion Amount Year of Transfer Gift Tax Estate Tax 1986 $500,000 $500,000 1987 1997 600,000 600,000 1998 625,000 625,000 1999 650,000 650,000…arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub