1.

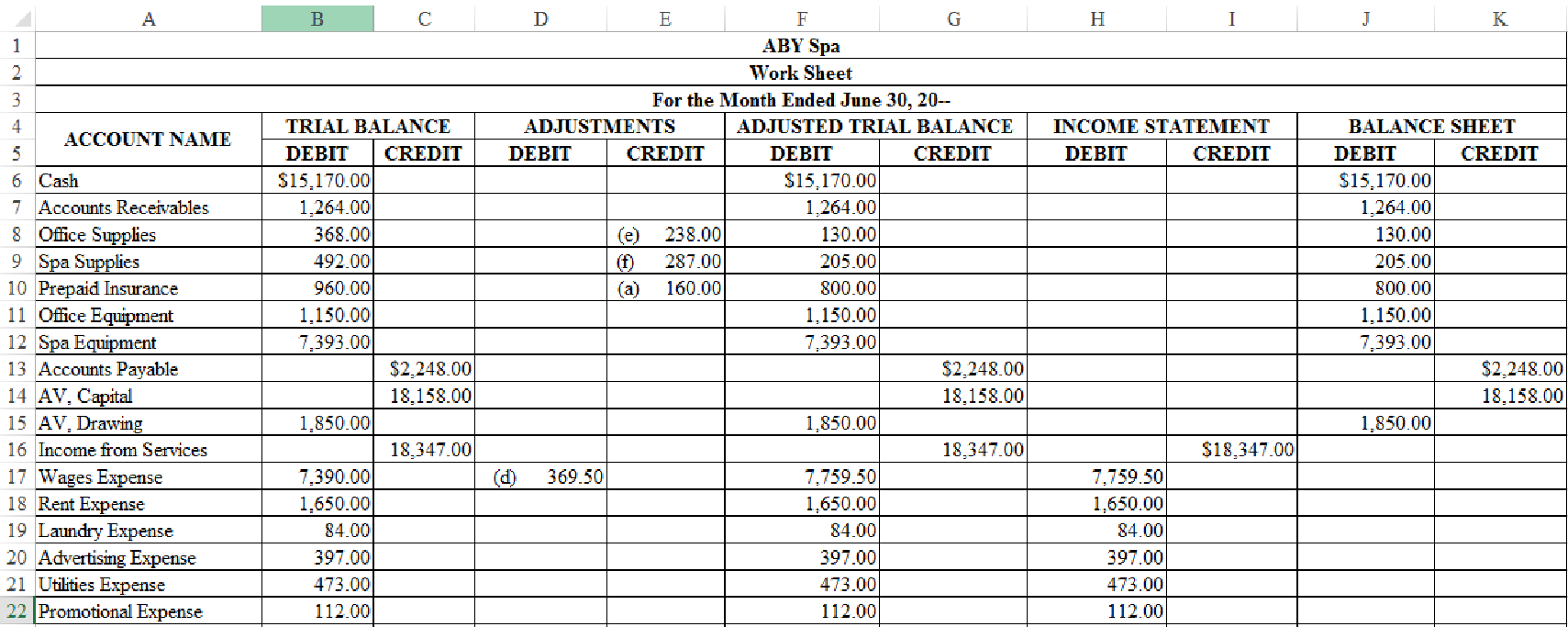

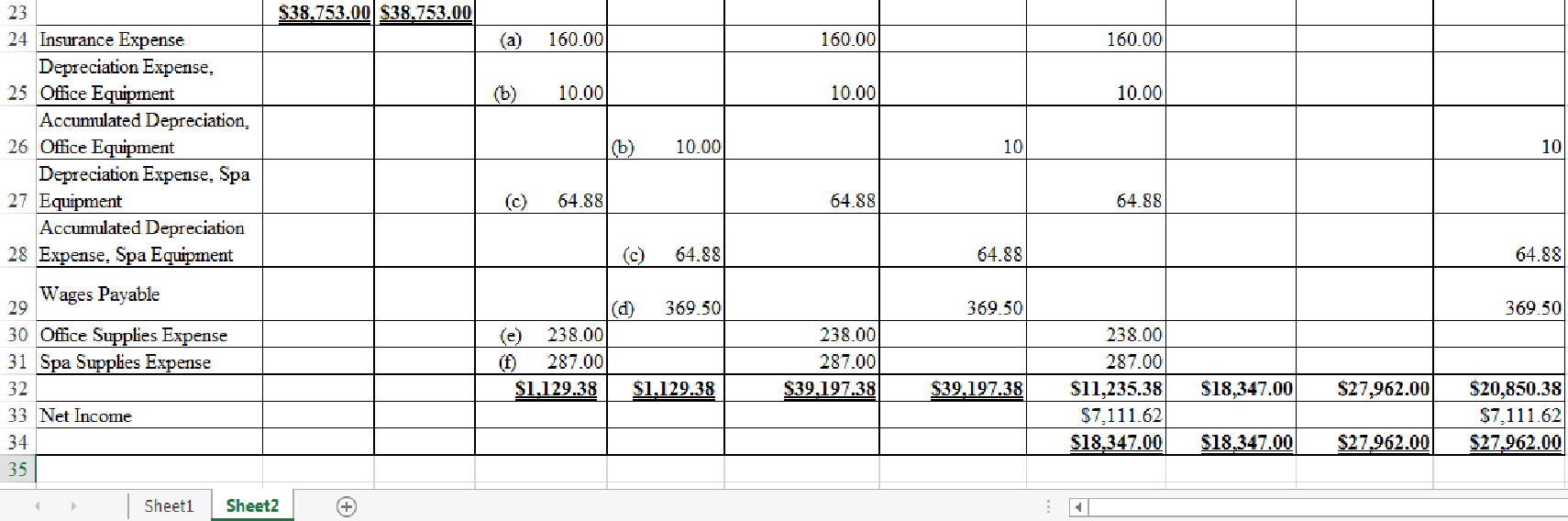

Indicate the given adjustments and complete the worksheet for ABY Spa for the month ended June 30, 20--.

1.

Explanation of Solution

Worksheet: Worksheet is an accounting tool that help accountants to record adjustments and up-date balances required to prepare financial statements. Worksheet is a central place where

Indicate the given adjustments and complete the worksheet for ABY Spa for the month ended June 30, 20--.

Figure-(1)

2.

Prepare adjusting journal entries for ABY Spa for the month ended June 30, 20--.

2.

Explanation of Solution

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare adjusting journal entries for ABY Spa for the month ended June 30, 20--.

Adjusting entry (a) for the prepaid insurance:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| June | 30 | Insurance Expense | 618 | 160 | ||

| Prepaid Insurance | 117 | 160 | ||||

| (Record part of prepaid insurance expired) | ||||||

Table (1)

Description:

- Insurance Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Prepaid Insurance is an asset account. Since amount of insurance is expired, asset account decreased, and a decrease in asset is credited.

Working Note 1:

Calculate the value of insurance expense for 1 month.

Adjusting entry (b) for the

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| June | 30 | Depreciation Expense, Office Equipment | 619 | 10.00 | ||

| 125 | 10.00 | |||||

| (Record depreciation expense) | ||||||

Table (2)

Description:

- Depreciation Expense, Office Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Office Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Working Note 2:

Compute monthly depreciation expense for the office equipment.

Adjusting entry (c) for the depreciation expense for spa equipment:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| June | 30 | Depreciation Expense, Spa Equipment | 620 | 64.88 | ||

| Accumulated Depreciation, Spa Equipment | 129 | 64.88 | ||||

| (Record depreciation expense) | ||||||

Table (3)

Description:

- Depreciation Expense, Spa Equipment is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Accumulated Depreciation, Spa Equipment is a contra-asset account, and contra-asset accounts would have a normal credit balance, hence, the account is credited.

Working Note 3:

Compute monthly depreciation expense for the spa equipment.

Adjusting entry (d) for the wages expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| June | 30 | Wages Expense | 611 | 369.50 | ||

| Wages Payable | 212 | 369.50 | ||||

| (Record accrued wages expenses) | ||||||

Table (4)

Description:

- Wages Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Wages Payable is a liability account. Since amount of payables has increased, liability decreased, and an increase in liability is credited.

Working Note 4:

Calculate the value of wages expense for 1 day.

Adjusting entry (e) for the office supplies expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| June | 30 | Office Supplies Expense | 613 | 238 | ||

| Office Supplies | 114 | 238 | ||||

| (Record part of supplies consumed) | ||||||

Table (5)

Description:

- Office Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Office Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

Working Note 5:

Calculate the value of office supplies expense for the month.

Adjusting entry (f) for the spa supplies expense:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| June | 30 | Spa Supplies Expense | 614 | 287 | ||

| Spa Supplies | 115 | 287 | ||||

| (Record part of supplies consumed) | ||||||

Table (6)

Description:

- Spa Supplies Expense is an expense account. Since expenses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Spa Supplies is an asset account. Since amount of supplies is used, asset account decreased, and a decrease in asset is credited.

Working Note 6:

Calculate the value of spa supplies expense for the month.

3.

3.

Explanation of Solution

Post the adjusting entries journalized in Part (2) in the ledger accounts of general ledger.

| ACCOUNT Cash ACCOUNT NO. 111 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | 1 | 15,000.00 | 15,000.00 | |||

| 3 | 1 | 960.00 | 14,040.00 | ||||

| 3 | 1 | 2,000.00 | 12,040.00 | ||||

| 3 | 1 | 1,650.00 | 10,390.00 | ||||

| 5 | 1 | 248.00 | 10,142.00 | ||||

| 5 | 1 | 112.00 | 10,030.00 | ||||

| 7 | 1 | 1,847.50 | 8,182.50 | ||||

| 7 | 1 | 2,630.00 | 10,812.50 | ||||

| 11 | 1 | 873.00 | 9,939.50 | ||||

| 14 | 1 | 3,703.00 | 13,642.50 | ||||

| 14 | 1 | 1,847.50 | 11,795.00 | ||||

| 18 | 1 | 1,200.00 | 10,595.00 | ||||

| 21 | 1 | 4,758.00 | 15,353.00 | ||||

| 21 | 1 | 1,847.50 | 13,505.50 | ||||

| 25 | 1 | 73.00 | 13,432.50 | ||||

| 28 | 1 | 1,847.50 | 11,585.00 | ||||

| 28 | 1 | 84.00 | 11,501.00 | ||||

| 30 | 1 | 5,992.00 | 17,493.00 | ||||

| 30 | 1 | 1,850.00 | 15,643.00 | ||||

| 30 | 1 | 225.00 | 15,418.00 | ||||

| 30 | 1 | 248.00 | 15,170.00 | ||||

Table (7)

| ACCOUNT Accounts Receivable ACCOUNT NO. 113 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 7 | 1 | 325.00 | 325.00 | |||

| 14 | 1 | 486.00 | 811.00 | ||||

| 21 | 1 | 344.00 | 1,155.00 | ||||

| 30 | 1 | 109.00 | 1,264.00 | ||||

Table (8)

| ACCOUNT Office Supplies ACCOUNT NO. 114 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 5 | 1 | 248 | 248 | |||

| 5 | 1 | 120 | 368 | ||||

| 30 | Adjusting | 4 | 238 | 130 | |||

Table (9)

| ACCOUNT Spa Supplies ACCOUNT NO. 115 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 492 | 492 | |||

| 30 | Adjusting | 4 | 287 | 205 | |||

Table (10)

| ACCOUNT Prepaid Insurance ACCOUNT NO. 117 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 960 | 960 | |||

| 30 | Adjusting | 4 | 160 | 800 | |||

Table (11)

| ACCOUNT Office Equipment ACCOUNT NO. 124 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 5 | 1 | 318 | 318 | |||

| 5 | 1 | 832 | 1,150 | ||||

Table (12)

| ACCOUNT Accumulated Depreciation, Office Equipment ACCOUNT NO. 125 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 10.00 | 10.00 | ||

Table (13)

| ACCOUNT Spa Equipment ACCOUNT NO. 128 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | 1 | 3,158 | 3,158 | |||

| 3 | 1 | 4,235 | 7,393 | ||||

Table (14)

| ACCOUNT Accumulated Depreciation, Spa Equipment ACCOUNT NO. 129 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 64.88 | 64.88 | ||

Table (15)

| ACCOUNT Accounts Payable ACCOUNT NO. 211 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 2,235 | 2,235 | |||

| 3 | 1 | 492 | 2,727 | ||||

| 5 | 1 | 318 | 3,045 | ||||

| 5 | 1 | 397 | 3,442 | ||||

| 5 | 1 | 832 | 4,274 | ||||

| 5 | 1 | 120 | 4,394 | ||||

| 11 | 1 | 873 | 3,521 | ||||

| 18 | 1 | 1,200 | 2,321 | ||||

| 25 | 1 | 73 | 2,248 | ||||

Table (16)

| ACCOUNT Wages Payable ACCOUNT NO. 212 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 369.50 | 369.50 | ||

Table (17)

| ACCOUNT AV, Capital ACCOUNT NO. 311 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 1 | 1 | 15,000 | 15,000 | |||

| 1 | 1 | 3,158 | 18,158 | ||||

Table (18)

| ACCOUNT AV, Drawing ACCOUNT NO. 312 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | 1 | 1,850 | 1,850 | |||

Table (19)

| ACCOUNT Income from Services ACCOUNT NO. 411 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 7 | 1 | 2,630 | 2,630 | |||

| 7 | 1 | 325 | 2,955 | ||||

| 14 | 1 | 3,703 | 6,658 | ||||

| 14 | 1 | 486 | 7,144 | ||||

| 21 | 1 | 4,758 | 11,902 | ||||

| 21 | 1 | 344 | 12,246 | ||||

| 30 | 1 | 5,992 | 18,238 | ||||

| 30 | 1 | 109 | 18,347 | ||||

Table (20)

| ACCOUNT Wages Expense ACCOUNT NO. 611 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 7 | 1 | 1,847.50 | 1,847.50 | |||

| 14 | 1 | 1,847.50 | 3,695.00 | ||||

| 21 | 1 | 1,847.50 | 5,542.50 | ||||

| 28 | 1 | 1,847.50 | 7,390.00 | ||||

| 30 | Adjusting | 4 | 369.50 | 7,759.50 | |||

Table (21)

| ACCOUNT Rent Expense ACCOUNT NO. 612 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 3 | 1 | 1,650 | 1,650 | |||

Table (22)

| ACCOUNT Office Supplies Expense ACCOUNT NO. 613 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 238 | 238 | ||

Table (23)

| ACCOUNT Spa Supplies Expense ACCOUNT NO. 614 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 287 | 287 | ||

Table (24)

| ACCOUNT Laundry Expense ACCOUNT NO. 615 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 28 | 1 | 84 | 84 | |||

Table (25)

| ACCOUNT Advertising Expense ACCOUNT NO. 616 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 5 | 1 | 397 | 397 | |||

Table (26)

| ACCOUNT Utilities Expense ACCOUNT NO. 617 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | 1 | 225 | 225 | |||

| 30 | 1 | 248 | 473 | ||||

Table (27)

| ACCOUNT Insurance Expense ACCOUNT NO. 618 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 160 | 160 | ||

Table (28)

| ACCOUNT Depreciation Expense, Office Equipment ACCOUNT NO. 619 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 10 | 10 | ||

Table (29)

| ACCOUNT Depreciation Expense, Spa Equipment ACCOUNT NO. 620 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 30 | Adjusting | 1 | 64.88 | 64.88 | ||

Table (30)

| ACCOUNT Promotional Expense ACCOUNT NO. 630 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| June | 5 | 1 | 112 | 112 | |||

Table (31)

4.

Prepare an adjusted trial balance for ABY Spa as at June 30, 20--, based on the account balances derived in Part (3).

4.

Explanation of Solution

Adjusted trial balance: The trial balance which reflects the adjusting entries and incorporates the effect of all adjustments in the ledger accounts, is referred to as adjusted trial balance.

Prepare an adjusted trial balance for ABY Spa as at June 30, 20--, based on the account balances derived in Part (3).

| ABY Spa | ||

| Adjusted Trial Balance | ||

| June 30, 20-- | ||

| Account Title | Debit ($) | Credit ($) |

| Cash | $15,170.00 | |

| Accounts Receivable | 1,264.00 | |

| Office Supplies | 130.00 | |

| Spa Supplies | 205.00 | |

| Prepaid Insurance | 800.00 | |

| Office Equipment | 1,150.00 | |

| Accumulated Depreciation, Office Equipment | $10.00 | |

| Spa Equipment | 7,393.00 | |

| Accumulated Depreciation, Spa Equipment | 64.88 | |

| Accounts Payable | 2,248.00 | |

| Wages Payable | 369.50 | |

| AV, Capital | 18,158.00 | |

| AV, Drawing | 1,850.00 | |

| Income from Services | 18,347.00 | |

| Wages Expense | 7,759.50 | |

| Rent Expense | 1,650.00 | |

| Office Supplies Expense | 238.00 | |

| Laundry Expense | 84.00 | |

| Advertising Expense | 397.00 | |

| Utilities Expense | 473.00 | |

| Promotional Expense | 112.00 | |

| Depreciation Expense, Office Equipment | 10.00 | |

| Depreciation Expense, Spa Equipment | 64.88 | |

| Spa Supplies Expense | 287.00 | |

| Insurance Expense | 160.00 | |

| Total | $39,197.38 | $39,197.38 |

Table (32)

Hence, the debit and credit total of adjusted trial balance of ABY Spa at June 30, 20-- is $39,197.38.

5.

Prepare an income statement of ABY Spa for the month ended June 30, 20--, based on the account balances derived in Part (3).

5.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations, and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement of ABY Spa for the month ended June 30, 20--.

| ABY Spa | ||

| Income Statement | ||

| For the Month Ended June 30, 20-- | ||

| Revenues: | ||

| Income from Services | $18,347.00 | |

| Expenses: | ||

| Wages Expense | $7,759.50 | |

| Rent Expense | 1,650.00 | |

| Office Supplies Expense | 238.00 | |

| Laundry Expense | 84.00 | |

| Advertising Expense | 397.00 | |

| Utilities Expense | 473.00 | |

| Promotional Expense | 112.00 | |

| Depreciation Expense, Office Equipment | 10.00 | |

| Depreciation Expense, Spa Equipment | 64.88 | |

| Spa Supplies Expense | 287.00 | |

| Insurance Expense | 160.00 | |

| Total expenses | 11,235.38 | |

| Net income | $7,111.62 | |

Table (33)

6.

Prepare a statement of owners’ equity of ABY Spa, based on the account balances derived in Part (3), and net income computed in Part (5).

6.

Explanation of Solution

Statement of owners’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owners’ equity. Additional capital, net income from income statement is added to, and drawings is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement of owners’ equity for ABY Spa for the month ended June 30, 20--.

| ABY Spa | ||

| Statement of Owners’ Equity | ||

| For the Month Ended June 30, 20-- | ||

| AV, Capital, June 1, 20-- | $0 | |

| Investments during June | $18,158.00 | |

| Net income for June | 7,111.62 | |

| 25,269.62 | ||

| Less: Withdrawals for June | 1,850.00 | |

| Increase in capital | 23,419.62 | |

| AV, Capital, June 30, 20-- | $23,419.62 | |

Table (34)

7.

Prepare a balance sheet for ABY Spa, based on the account balances derived in Part (3), and capital of the owner from the statement of owners’ equity prepared in Part (6).

7.

Explanation of Solution

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and owners (owners’ equity) over those resources. The resources of the company are assets which include money contributed by owners and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and owners’ equity.

Prepare the balance sheet for ABY Spa as at June 30, 20--.

| ABY Spa | ||

| Balance Sheet | ||

| June 30, 20-- | ||

| Assets | ||

| Cash | $15,170.00 | |

| Accounts Receivable | 1,264.00 | |

| Office Supplies | 130.00 | |

| Spa Supplies | 205.00 | |

| Prepaid Insurance | 800.00 | |

| Office Equipment | $1,150.00 | |

| Less: Accumulated Depreciation, Office Equipment | 10.00 | 1,140.00 |

| Spa Equipment | 7,393.00 | |

| Less: Accumulated Depreciation, Spa Equipment | 64.88 | 7,328.12 |

| Total assets | $26,037.12 | |

| Liabilities | ||

| Accounts Payable | $2,248.00 | |

| Wages Payable | 369.50 | |

| Total Liabilities | $2,617.50 | |

| Owners’ Equity | ||

| AV, Capital | 23,419.62 | |

| Total Liabilities and Owners’ Equity | $26,037.12 | |

Table (35)

Want to see more full solutions like this?

Chapter 4 Solutions

College Accounting: A Career Approach (with Quickbooks Accountant 2015 Cd-rom)

- Gross profit would be_.arrow_forwardWhat is Bobby's 2019 net income using accrual accounting?arrow_forwardJob 786 was one of the many jobs started and completed during the year. The job required $8,400 in direct materials and 35 hours of direct labor time at a total direct labor cost of $9,300. If the job contained five units and the company billed at 70% above the unit product cost on the job cost sheet, what price per unit would have been charged to the customer?arrow_forward

- What is the company's gross profit?arrow_forwardMOH Cost: Top Dog Company has a budget with sales of 7,500 units and $3,400,000. Variable costs are budgeted at $1,850,000, and fixed overhead is budgeted at $970,000. What is the budgeted manufacturing cost per unit?arrow_forwardWhat was Ghana's cost of goods sold for 2023?arrow_forward

- Need Answerarrow_forwardSameer has $9,800 of net long-term capital gain and $5,200 of net short-term capital loss. This nets out to a: (a) $4,700 net long-term loss (b) $4,600 net long-term gain (c) $4,700 net short-term gain (d) $4,700 short-term loss helparrow_forwardWhat is the adjusted cost of goods sold for the year?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub