Concept explainers

Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2018. The accounting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions:

| May 3. | Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $4,500. |

| 5. | Received cash from clients on account, $2,450. |

| 9. | Paid cash for a newspaper advertisement, $225. |

| 13. | Paid Office Station Co. for part of the debt incurred on April 5, $640. |

| 15. | Recorded services provided on account for the period May 1–15, $9,180. |

| 16. | Paid part-time receptionist for two weeks’ salary including the amount owed on April 30, $750. |

| 17. | Recorded cash from cash clients for fees earned during the period May 1-16, $8,360. |

| Record the following transactions on Page 6 of the journal: | |

| 20. | Purchased supplies on account, $735. |

| 21. | Recorded services provided on account for the period May 16-20,$4,820. |

| 25. | Recorded cash from cash clients for fees earned for the period May 17- 23, $7,900. |

| 27. | Received cash from clients on account, $9,520. |

| 28. | Paid part-time receptionist for two weeks’ salary, $750. |

| 30. | Paid telephone bill for May, $260. |

| 31. | Paid electricity bill for May, $810. |

| 31. | Recorded cash from cash clients for fees earned for the period May 26-31, $3,300. |

| 31. | Recorded services provided on account for the remainder of May, $2,650. |

| 31. | Paid dividends, $10,500. |

Instructions

- 1. The cl1art of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing

trial balance as of April 30, 2018, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2018, and place a check mark (✓) in the Posting Reference column. Journalize each of the May transactions in a two-column journal starting on Page 5 of the journal and using Kelly Consulting’s chart of accounts. (Do not insert the account numbers in the journal at this time.) - 2. Post the journal to a ledger of four-column accounts.

- 3. Prepare an unadjusted trial balance.

- 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6).

- (A) Insurance expired during May is $275.

- (B) Supplies on hand on May 31 are $715.

- (C)

Depreciation of office equipment for May is $330. - (D) Accrued receptionist salary on May 31 is $325.

- (E) Rent expired during May is $1,600.

- (F) Unearned fees on May 31 are $3,210.

- 5. (Optional) Enter the unadjusted trial balance on an end-of-period spreadsheet and complete the spreadsheet.

- 6. Journalize and post the

adjusting entries . Record the adjusting entries on Page 7 of the journal. - 7. Prepare an adjusted trial balance.

- 8. Prepare an income statement, a

retained earnings statement, and abalance sheet . - 9. Prepare and

post the closing entries. Record the closing entries on Page 8 of d1e journal. (Income Summary is account #34 in d1e chart of accounts.) Indicate closed accounts by inserting a line in both the Balance columns opposite the closing entry. - 10. Prepare a post-closing trial balance.

(1)

Journal:

Journal is the book of original entry. Journal consists of the day-to-day financial transactions in a chronological order. The journal has two aspects; they are debit aspect and the credit aspect.

T-Accounts:

T-accounts are referred as T-account because its format represents the letter “T”. The T-accounts consists of the following:

- The title of accounts.

- The debit side (Dr) and,

- The credit side (Cr).

Adjusted trial balance:

end of the accounting period. This adjusting entry is essential for preparing the financial statements of the business.

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Adjusting entries:

An adjusting entry is prepared when the trial balance is not up-to-date, and complete, and they are usually prepared at the

Spreadsheet: A spreadsheet is a worksheet. It is used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Statement of owners’ equity:

This statement reports the beginning owner’s equity and all the changes, which led to ending owners’ equity. Additional capital, net income from income statement is added to and drawing is deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Income statement:

An income statement is one of the financial statements which shows the revenues, and expenses of the company. The income statement is prepared to ascertain the net income/loss of the company, by deducting the expenses from the revenues.

Balance sheet:

A balance sheet is a financial statement consists of the assets, liabilities, and the stockholder’s equity of the company. The balance of the assets account must be equal to that of the liabilities and the stockholder’s equity account.

Closing entries:

Closing entries are recorded in order to close the temporary accounts such as incomes and expenses by transferring them to the permanent accounts. It is passed at the end of the accounting period, to transfer the final balance.

Post-Closing Trial Balance:

After passing all the journal entries and the closing entries of the permanent accounts and then further posting them to each of the respective accounts, a post-closing trial balance is prepared which consists of a list of all the permanent accounts. A post-closing trial balance serves as an evidence to prove that the balance of the permanent accounts is equal.

To journalize: The transactions of May in a two column journal beginning on page 5.

Explanation of Solution

Journalize the transactions of May in a two column journal beginning on page 5.

| Journal Page 5 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2018 | 3 | Cash | 11 | 4,500 | |

| May | Unearned fees | 23 | 4,500 | ||

| (To record the cash received for the service yet to be provide) | |||||

| 5 | Cash | 11 | 2,450 | ||

| Accounts receivable | 12 | 2,450 | |||

| (To record the cash received from clients) | |||||

| 9 | Miscellaneousexpense | 59 | 225 | ||

| Cash | 11 | 225 | |||

| (To record the payment made for Miscellaneous expense) | |||||

| 13 | Accounts payable | 21 | 640 | ||

| Cash | 11 | 640 | |||

| (To record the payment made to creditors on account) | |||||

| 15 | Accounts receivable | 12 | 9,180 | ||

| Fees earned | 41 | 9,180 | |||

| (To record the revenue earned and billed) | |||||

| 14 | Salary Expense | 51 | 630 | ||

| Salaries payable | 22 | 120 | |||

| Cash | 11 | 750 | |||

| (To record the payment made for salary) | |||||

| Cash | 11 | 8,360 | |||

| 17 | Fees earned | 41 | 8,360 | ||

| (To record the receipt of cash) | |||||

Table (1)

| Journal Page 6 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| 2018 | 18 | Supplies | 14 | 735 | |

| May | Accounts payable | 21 | 735 | ||

| (To record the payment made for automobile expense) | |||||

| 21 | Accounts receivable | 12 | 4,820 | ||

| Fees earned | 41 | 4,820 | |||

| (To record the payment of advertising expense) | |||||

| 25 | Cash | 11 | 7,900 | ||

| Fees earned | 41 | 7,900 | |||

| (To record the cash received from client for fees earned) | |||||

| 27 | Cash | 11 | 9,520 | ||

| Accounts receivable | 12 | 9,520 | |||

| (To record the cash received from clients) | |||||

| 28 | Salary expense | 51 | 750 | ||

| Cash | 11 | 750 | |||

| (To record the payment of salary) | |||||

| 30 | Miscellaneous Expense | 59 | 260 | ||

| Cash | 11 | 260 | |||

| (To record the payment of telephone charges) | |||||

| 31 | Miscellaneous Expense | 59 | 810 | ||

| Cash | 11 | 810 | |||

| (To record the payment of electricity charges) | |||||

| 31 | Cash | 11 | 3,300 | ||

| Fees earned | 41 | 3,300 | |||

| (To record the cash received from client for fees earned) | |||||

| 31 | Accounts receivable | 12 | 2,650 | ||

| Fees earned | 41 | 2,650 | |||

| (To record the revenue earned and billed) | |||||

| 31 | Dividends | 33 | 10,500 | ||

| Cash | 11 | 10,500 | |||

| (To record the drawing made for personal use) | |||||

Table (2)

(2), (6) and (9)

To record: The balance of each accounts in the appropriate balance column of a four-column account and post them to the ledger.

Explanation of Solution

| Account: Cash Account no.11 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 1 | Balance | ✓ | 22,100 | |||

| 3 | 5 | 4,500 | 26,600 | ||||

| 5 | 5 | 2,450 | 29,050 | ||||

| 9 | 5 | 225 | 28,825 | ||||

| 13 | 5 | 640 | 28,185 | ||||

| 16 | 5 | 750 | 27,435 | ||||

| 17 | 5 | 8,360 | 35,795 | ||||

| 25 | 6 | 7,900 | 43,695 | ||||

| 27 | 6 | 9,520 | 53,215 | ||||

| 28 | 6 | 750 | 52,465 | ||||

| 30 | 6 | 260 | 52,205 | ||||

| 31 | 6 | 810 | 51,395 | ||||

| 31 | 6 | 3,300 | 54,695 | ||||

| 31 | 6 | 10,500 | 44,195 | ||||

Table (3)

| Account: Accounts ReceivableAccount no.12 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 1 | Balance | ✓ | 3,400 | |||

| 5 | 5 | 2,450 | 950 | ||||

| 15 | 5 | 9,180 | 10,130 | ||||

| 21 | 6 | 4,820 | 14,950 | ||||

| 27 | 6 | 9,520 | 5,430 | ||||

| 31 | 6 | 2,650 | 8,080 | ||||

Table (4)

| Account: SuppliesAccount no.14 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 1 | Balance | ✓ | 1,350 | |||

| 20 | 6 | 735 | 2,085 | ||||

| 30 | Adjusting | 7 | 1,350 | 715 | |||

Table (5)

| Account: Prepaid RentAccount no.15 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 1 | Balance | ✓ | 3,200 | |||

| 31 | Adjusting | 7 | 1,600 | 1,600 | |||

Table (6)

| Account: Prepaid InsuranceAccount no.16 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 1 | Balance | ✓ | 1,500 | |||

| 31 | Adjusting | 7 | 275 | 1,225 | |||

Table (7)

| Account: Office equipmentAccount no.18 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 1 | Balance | ✓ | 14,500 | |||

Table (8)

| Account: Accumulated Depreciation-Office equipmentAccount no.19 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 1 | Balance | ✓ | 330 | |||

| 31 | Adjusting | 7 | 330 | 660 | |||

Table (9)

| Account: Accounts Payable Account no.21 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 1 | Balance | ✓ | 800 | |||

| 13 | 5 | 640 | 160 | ||||

| 20 | 6 | 735 | 895 | ||||

Table (10)

| Account: Salaries Payable Account no.22 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 1 | Balance | ✓ | 120 | |||

| 16 | 5 | 120 | |||||

| 31 | Adjusting | 7 | 325 | 325 | |||

Table (11)

| Account: Unearned Fees Account no.23 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 1 | Balance | ✓ | 2,500 | |||

| 3 | 5 | 4,500 | 7,000 | ||||

| 31 | Adjusting | 7 | 3,790 | 3,210 | |||

Table (12)

| Account: Common StockAccount no.31 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 1 | Balance | ✓ | 30,000 | |||

Table (13)

| Account: Retained EarningsAccount no.32 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 1 | Balance | ✓ | 12,300 | |||

| 31 | Closing | 8 | 33,425 | 45,725 | |||

| 31 | Closing | 8 | 10,500 | 35,225 | |||

Table (14)

| Account: DividendsAccount no.33 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 31 | 6 | 10,500 | 10,500 | |||

| 31 | Closing | 8 | 10,500 | ||||

Table (15)

| Account: Income SummaryAccount no.34 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 31 | Closing | 8 | 40,000 | 40,000 | ||

| 31 | Closing | 8 | 6,575 | 33,425 | |||

| 31 | Closing | 8 | 33,425 | ||||

Table (16)

| Account: Fees earned Account no.41 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 15 | 5 | 9,180 | 9,180 | |||

| 17 | 5 | 8,360 | 17,540 | ||||

| 21 | 6 | 4,820 | 22,360 | ||||

| 25 | 6 | 7,900 | 30,260 | ||||

| 31 | 6 | 3,300 | 33,560 | ||||

| 31 | 6 | 2,650 | 36,210 | ||||

| 31 | Adjusting | 7 | 3,790 | 40,000 | |||

| 31 | Closing | 8 | 40,000 | ||||

Table (17)

| Account: Salary expense Account no.51 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 16 | 5 | 630 | 630 | |||

| 28 | 6 | 750 | 1,380 | ||||

| 31 | Adjusting | 7 | 325 | 1,705 | |||

| 31 | Closing | 8 | 1,705 | ||||

Table (18)

| Account: Rent expense Account no.52 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 31 | Adjusting | 7 | 1,600 | 1,600 | ||

| 31 | Closing | 8 | 1,600 | ||||

Table (19)

| Account: Supplies expense Account no.53 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 31 | Adjusting | 7 | 1,370 | 1,370 | ||

| 31 | Closing | 8 | 1,370 | ||||

Table (20)

| Account: Depreciation expense Account no.54 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 31 | Adjusting | 7 | 330 | 330 | ||

| 31 | Closing | 8 | 330 | ||||

Table (21)

| Account: Insurance expense Account no.54 | |||||||

| Date | Item | PostRef. |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 31 | Adjusting | 7 | 275 | 275 | ||

| 31 | Closing | 8 | 275 | ||||

Table (22)

| Account: Miscellaneous expense Account no.59 | |||||||

| Date | Item | Post. Ref |

Debit ($) |

Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2018 | |||||||

| May | 9 | 5 | 225 | 225 | |||

| 30 | 6 | 260 | 485 | ||||

| 31 | 6 | 810 | 1,295 | ||||

| 31 | Closing | 8 | 1,295 | ||||

Table (23)

(3)

To prepare: The unadjusted trial balance of Consulting Kat May, 31.

Explanation of Solution

Prepare an unadjusted trial balance of Consulting K for the month ended May, 31 as follows:

|

K Consulting Unadjusted Trial Balance May 31, 2018 |

|||

| Particulars |

Account No. |

Debit $ | Credit $ |

| Cash | 11 | 44,195 | |

| Accounts receivable | 12 | 8,080 | |

| Supplies | 14 | 2,085 | |

| Prepaid rent | 15 | 3,200 | |

| Prepaid insurance | 16 | 1,500 | |

| Office Equipment | 18 | 14,500 | |

| Accumulated depreciation-Office equipment | 19 | 330 | |

| Accounts payable | 21 | 895 | |

| Salaries payable | 22 | 0 | |

| Unearned fees | 23 | 7,000 | |

| Common stock | 31 | 30,000 | |

| Retained earnings | 32 | 12,300 | |

| Dividends | 33 | 10,500 | |

| Fees earned | 41 | 36,210 | |

| Salary expense | 51 | 1,380 | |

| Rent expense | 52 | 0 | |

| Supplies expense | 53 | 0 | |

| Depreciation expense | 54 | 0 | |

| Insurance expense | 55 | 0 | |

| Miscellaneous expense | 59 | 1,295 | |

| Total | 86,735 | 86,735 | |

Table (22)

The debit column and credit column of the unadjusted trial balance are agreed, both having balance of $86,735.

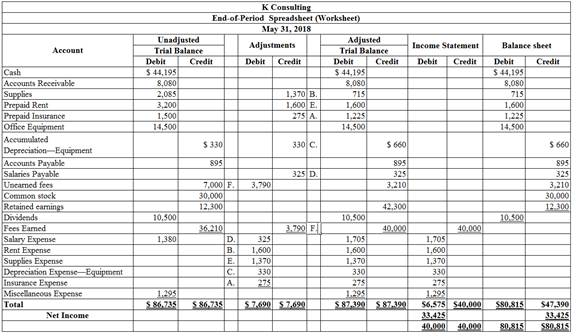

(5)

To enter: The unadjusted trial balance on an end-of-period spreadsheet.

Explanation of Solution

The unadjusted trial balance on an end-of-period spreadsheet is prepared as follows:

Table (23)

Hence, the unadjusted trial balance on an end-of-period spreadsheet is prepared and completed.

(6)

To Journalize: Theadjusting entries of Consulting K for May 31.

Explanation of Solution

The adjusting entries of ConsultingK for May 31, 2018are as follows:

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

|

| 2018 | Insurance expense | 55 | 275 | ||

| May | 31 | Prepaid insurance | 16 | 275 | |

| (To record the insurance expense for May ) | |||||

| 31 | Supplies expense(1) | 53 | 1,370 | ||

| Supplies | 14 | 1,370 | |||

| (To record the supplies expense) | |||||

| 31 | Depreciation expense | 54 | 330 | ||

| Accumulated Depreciation | 19 | 330 | |||

| (To record the depreciation and the accumulated depreciation) | |||||

| 31 | Salaries expense | 51 | 325 | ||

| Salaries payable | 22 | 325 | |||

| (To record the accrued salaries payable) | |||||

| 31 | Rent expense | 52 | 1,600 | ||

| Prepaid rent | 15 | 1,600 | |||

| (To record the rent expense for May ) | |||||

| 31 | Unearned fees(2) | 23 | 3,790 | ||

| Fees earned | 41 | 3,790 | |||

| (To record the receipt of unearned fees) | |||||

Table (24)

Working notes:

(7)

To prepare: An adjusted trial balance of Consulting K for May 31, 2018.

Explanation of Solution

An adjusted trial balanceof Consulting K for May 31, 2018 is prepared as follows:

|

K Consulting Adjusted Trial Balance May 31, 2018 |

|||

| Particulars |

Account No. |

Debit $ | Credit $ |

| Cash | 11 | 44,195 | |

| Accounts receivable | 12 | 8,080 | |

| Supplies | 14 | 715 | |

| Prepaid insurance | 16 | 1,600 | |

| Prepaid rent | 15 | 1,225 | |

| Office Equipment | 18 | 14,500 | |

| Accumulated Depreciation-Office equipment | 19 | 660 | |

| Accounts payable | 21 | 895 | |

| Salaries payable | 22 | 325 | |

| Unearned fees | 23 | 3,210 | |

| Common stock | 31 | 30,000 | |

| Retained earnings | 32 | 12,300 | |

| Dividends | 33 | 10,500 | |

| Fees earned | 41 | 40,000 | |

| Salary expense | 51 | 1,705 | |

| Rent expense | 52 | 1,600 | |

| Supplies Expense | 53 | 1,370 | |

| Depreciation expense | 54 | 330 | |

| Insurance expense | 55 | 275 | |

| Miscellaneous expense | 59 | 1,295 | |

| Total | 87,390 | 87,390 | |

Table (25)

The debit column and credit column of the adjusted trial balance are agreed, both having balance of $87,390.

(8)

To Prepare: An income statement for the year ended May 31, 2018.

Explanation of Solution

An income statement for the year ended May 31, 2018 is as follows:

| K Consulting | ||

| Income Statement | ||

| For the year ended May 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Fees Earned | 40,000 | |

| Expenses: | ||

| Salaries Expense | 1,705 | |

| Rent Expense | 1,600 | |

| Supplies Expense | 1,370 | |

| Depreciation Expense- Building | 330 | |

| Insurance Expense | 275 | |

| Miscellaneous Expense | 1,295 | |

| Total Expenses | 6,575 | |

| Net Income | $33,425 | |

Table (26)

Hence, the net income of K Consultingfor the year ended May 31, 2018is $33,425.

(9)

To Journalize: The closing entries for KConsulting.

Explanation of Solution

Closing entry for revenue and expense accounts:

| Date | Accounts title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| May 31, 2018 | Fees earned | 41 | 40,000 | |

| Income summary | 34 | 40,000 | ||

| (To close the balances of revenue account) | ||||

| May 31, 2018 | Income summary | 34 | 6,575 | |

| Salary expense | 51 | 1,705 | ||

| Rent Expense | 52 | 1,600 | ||

| Supplies Expense | 53 | 1,370 | ||

| Depreciation Expense | 54 | 330 | ||

| Insurance Expense | 55 | 275 | ||

| Miscellaneous Expense | 59 | 1,295 | ||

| (To close the balances of expense account) | ||||

| May 31, 2018 | Income summary | 34 | 33,425 | |

| Retained earnings | 32 | 33,425 | ||

| (To Close the excess of revenue to expenses) | ||||

| May 31, 2018 | Retained earnings | 32 | 10,500 | |

| Dividends | 33 | 10,500 | ||

| (To close the dividend account to retained earnings account) | ||||

Table (4)

- Fees earned are revenue account. Since the amount of revenue is closed and transferred to Income summary account. Here, FI Services earned an income of $40,000. Therefore, it is debited.

- Wages Expense, Rent Expense, Insurance Expense, Utilities Expense, supplies Expense, Depreciation Expense, and Miscellaneous Expense are expense accounts. Since the amount of expenses are closed to Income Summary account. Therefore, it is credited.

- Closing entries are also passed in order to close the excess of revenue over the expenses, and the dividend account.

(10)

To Journalize: The closing entries for KConsulting.

Explanation of Solution

Prepare apost–closing trial balance of KConsulting for the month ended May 31, 2018 as follows:

|

Consulting K Post-closing Trial Balance May, 31, 2018 |

|||

| Particulars | Account Number | Debit $ | Credit $ |

| Cash | 11 | 44,195 | |

| Accounts receivable | 12 | 8,080 | |

| Supplies | 14 | 715 | |

| Prepaid rent | 15 | 1,600 | |

| Prepaid insurance | 16 | 1,225 | |

| Office Equipment | 18 | 14,500 | |

| Accumulated depreciation –Office Equipment | 19 | 660 | |

| Accounts payable | 21 | 895 | |

| Salaries payable | 22 | 325 | |

| Unearned rent | 23 | 3,210 | |

| Common stock | 31 | 30,000 | |

| Retained earnings | 32 | 35,225 | |

| Total | 70,315 | 70,315 | |

Table (5)

The debit column and credit column of the post–closing trial balance are agreed, both having balance of $70,315

Want to see more full solutions like this?

Chapter 4 Solutions

Working Papers for Warren/Reeve/Duchac's Corporate Financial Accounting, 14th

- I am looking for help with this financial accounting question using proper accounting standards.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardI need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub