17E MANAGERIAL ACCOUNTING CUSTOM

17th Edition

ISBN: 9781266776328

Author: Garrison

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 16P

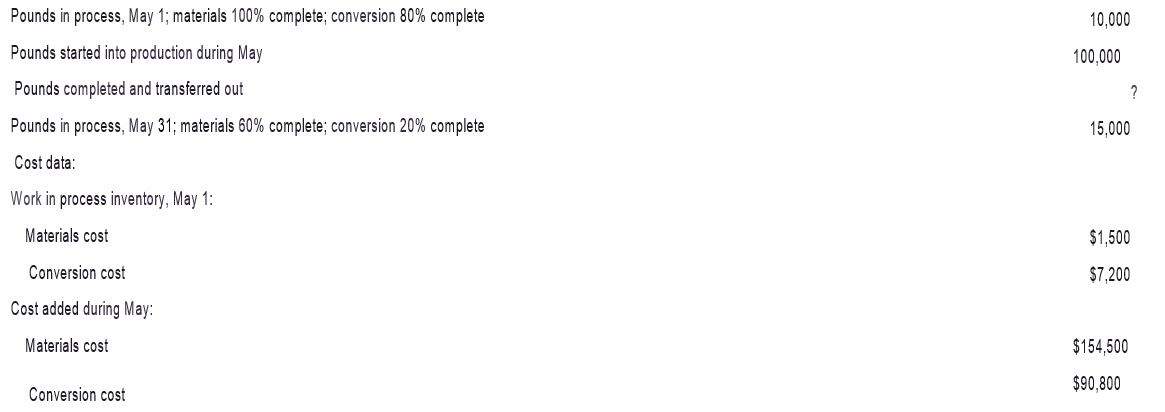

PROBLEM 4-16 Comprehensive Problem-Weighted-Average Method LO4-2, LO4-3, LO4-4, LO4-5

Builder Products, Inc., uses the weighted-average method in its

Production data:

Required:

- Compute the equivalent units of production for materials and conversion for May.

- Compute the cost per equivalent unit for materials and conversion for May.

- Compute the cost of ending work in process inventory’ for materials, conversion, and in total for May.

- Compute the cost of units transferred out to the nest department for materials, conversion, and in total for May.

- Prepare a cost reconciliation report for May

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Can you solve this general accounting question with the appropriate accounting analysis techniques?

HELP

Can you help me solve this accounting problem with the correct methodology?

Chapter 4 Solutions

17E MANAGERIAL ACCOUNTING CUSTOM

Ch. 4.A - EXERCISE 4A-1 Computation of Equivalent Units of...Ch. 4.A - EXERCISE 4A-2 Cost per Equivalent Unit-FIFO Method...Ch. 4.A - EXERCISE 4A-3 Assigning Costs to Units-FIFO Method...Ch. 4.A - EXERCISE 4A-4 Cost Reconciliation Report-EIFO...Ch. 4.A - EXERCISE 4A-5 Computation of Equivalent Units of...Ch. 4.A - EXERCISE 4A-6 Equivalent Units of Production-FIFO...Ch. 4.A - EXERCISE 4A-7 Equivalent Units of Production and...Ch. 4.A -

EXERCISE 4A-8 Equivalent Units of Production—FIFO...Ch. 4.A - EXERCISE 4A-9 Equivalent Units; Equivalent Units...Ch. 4.A - PROBLEM 4A-10 Equivalent Units of Production;...

Ch. 4.A - Prob. 11PCh. 4.A - Prob. 12CCh. 4.B - Prob. 1ECh. 4.B - EXERCISE 4B-2 Step-Down Method LO4-11 Madison Park...Ch. 4.B - Prob. 3ECh. 4.B - EXERCISE 4B-4 Direct Method LO4-10 Refer to the...Ch. 4.B - PROBLEM 4B-5 Step-Down Method L04-11 Woodbury...Ch. 4.B - Prob. 6CCh. 4 - Prob. 1QCh. 4 - In what ways are job-order and process costing...Ch. 4 - Why is cost accumulation simpler in a process...Ch. 4 - How many Work in Process accounts are maintained...Ch. 4 - Prob. 5QCh. 4 - Prob. 6QCh. 4 - Prob. 7QCh. 4 - Prob. 8QCh. 4 - Prob. 1AECh. 4 - This exercise relates to the Double Diamond Skis’...Ch. 4 - This exercise relates to the Double Diamond Skis’...Ch. 4 - Clopack Company manufactures one product that goes...Ch. 4 - Clopack Company manufactures one product that goes...Ch. 4 - Clopack Company manufactures one product that goes...Ch. 4 - Clopack Company manufactures one product that goes...Ch. 4 - Clopack Company manufactures one product that goes...Ch. 4 -

Clopack Company manufactures one product that...Ch. 4 -

Clopack Company manufactures one product that...Ch. 4 -

Clopack Company manufactures one product that...Ch. 4 - Clopack Company manufactures one product that goes...Ch. 4 - Prob. 10F15Ch. 4 - Prob. 11F15Ch. 4 - Prob. 12F15Ch. 4 -

Clopack Company manufactures one product that...Ch. 4 - Prob. 14F15Ch. 4 - Prob. 15F15Ch. 4 - Prob. 1ECh. 4 - Prob. 2ECh. 4 - Prob. 3ECh. 4 - EXERCISE 4-4 Assigning Costs to...Ch. 4 - EXERCISE 4-5 Cost Reconciliation...Ch. 4 - Prob. 6ECh. 4 - Prob. 7ECh. 4 - Prob. 8ECh. 4 -

EXERCISE 4-9 Equivalent Units and Cost per...Ch. 4 - Prob. 10ECh. 4 - Prob. 11ECh. 4 - Prob. 12ECh. 4 - Prob. 13PCh. 4 - Prob. 14PCh. 4 - Prob. 15PCh. 4 - PROBLEM 4-16 Comprehensive...Ch. 4 - Prob. 17PCh. 4 - Prob. 18PCh. 4 - Prob. 19CCh. 4 - (

CASE 4-20 Ethics and the Manager, Understanding...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Echo Industries uses a single raw material in its production process. The standard price for a unit of material is $2.25. During the month, the company purchased and used 820 units of this material at a price of $2.10 per unit. The standard quantity required per finished product is 4 units, and during the month, the company produced 205 finished units. How much was the material price variance?arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardGeneral accounting questionsarrow_forward

- Accounting?arrow_forwardFaith Industries purchased a crane for $78,000 on January 1, 2021. The crane has an expected salvage value of $6,000 and is expected to be used for 120,000 hours over its estimated useful life of 8 years. Actual usage was 13,800 hours in 2021 and 15,400 hours in 2022. Calculate depreciation expense per hour under the units-of-activity method. (Round the answer to 2 decimal places.)arrow_forwardAccurate Answerarrow_forward

- Kellogg Corporation uses a single raw material in its production process. The standard price for a unit of material is $3.25. During the month, the company purchased and used 680 units of this material at a price of $3.40 per unit. The standard quantity required per finished product is 2 units, and during the month, the company produced 325 finished units. How much was the material quantity variance?arrow_forwardI am searching for the accurate solution to this financial accounting problem with the right approach.arrow_forwardgeneral accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY