(a)

Calculate the

(a)

Explanation of Solution

The consumer surplus can be calculated using the general formula as given below:

Substitute the respective values in Equation (1).

Thus, the consumer surplus is $45,000.

Consumer surplus: It is the difference between the highest willing

(b)

Calculate

(b)

Explanation of Solution

The producer surplus when the

Substitute the values in Equation (2).

Thus, the producer surplus is $27,000.

Producer surplus: It is the difference between the lowest willing to accept price by the producer and the actual price received by the producer.

(c)

The new consumer surplus when the government imposes

(c)

Explanation of Solution

The new consumer surplus can be calculated using Equation (3) as given below:

Thus, the new consumer surplus is 20,000.

Price floor: A price floor is defined as the minimum price usually fixed by the Government below which the products are not sold in the market.

Consumer surplus: It is the difference between the highest willing price of the consumer and the actual price that the consumer pays.

(d)

Calculate the new producer surplus when the price floor imposed by the government.

(d)

Explanation of Solution

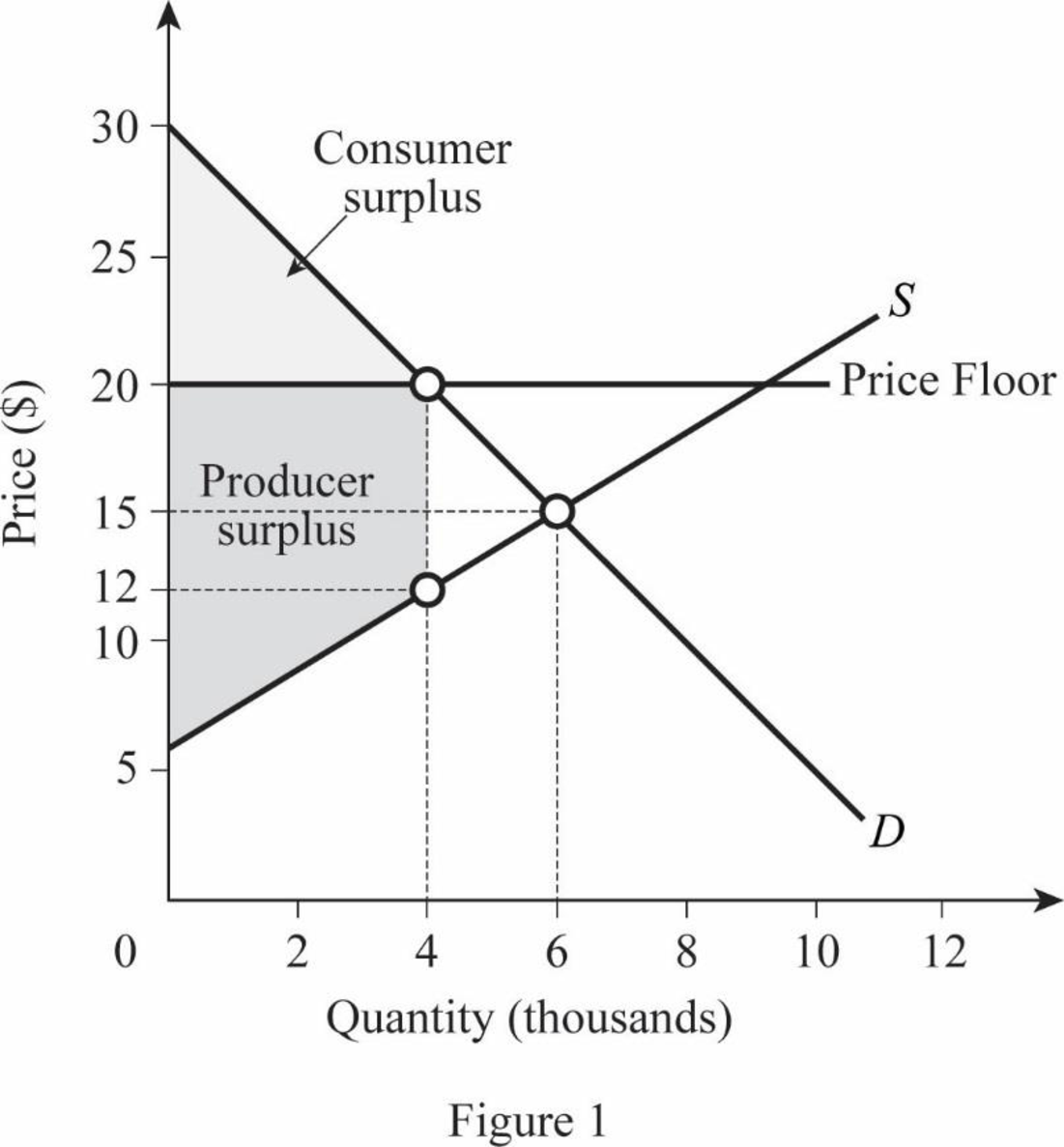

The new producer surplus when the government imposes price floor can be depicted as the shaded area given in Figure 1. It is the area below the floor price and above the supply curve minus dead weight loss.

New producer surplus can be calculated with the help of the new equilibrium price and minimum willing price along with the new

Thus, the new producer surplus is $44,000.

Price floor: A price floor is defined as the minimum price usually fixed by the government below which the products are not sold in the market.

Producer surplus: It is the difference between the lowest willing to accept price by the producer and the actual price received by the producer.

(e)

Price floor is supported mostly by the consumers or producers.

(e)

Explanation of Solution

Price floor is the minimum support price imposed by the government for the benefits of producers. Price floor is generally imposed on agricultural products, which ensures a minimum price for their product. Moreover, the price floor guarantees the minimum wage law, for better living.

Price floor: A price floor is defined as the minimum price usually fixed by the government and below this, the products are not sold in the market.

Want to see more full solutions like this?

Chapter 4 Solutions

Economics: Principles for a Changing World

- How Command Economics Relate to Principle Of Economics?arrow_forwardhow commond economies relate to principle Of Economics ?arrow_forwardCritically analyse the five (5) characteristics of Ubuntu and provide examples of how they apply to the National Health Insurance (NHI) in South Africa.arrow_forward

- Critically analyse the five (5) characteristics of Ubuntu and provide examples of how they apply to the National Health Insurance (NHI) in South Africa.arrow_forwardOutline the nine (9) consumer rights as specified in the Consumer Rights Act in South Africa.arrow_forwardIn what ways could you show the attractiveness of Philippines in the form of videos/campaigns to foreign investors? Cite 10 examples.arrow_forward

- Explain the following terms and provide an example for each term: • Corruption • Fraud • Briberyarrow_forwardIn what ways could you show the attractiveness of a country in the form of videos/campaigns?arrow_forwardWith the VBS scenario in mind, debate with your own words the view that stakeholders are the primary reason why business ethics must be implemented.arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education