Analyzing the Effects of

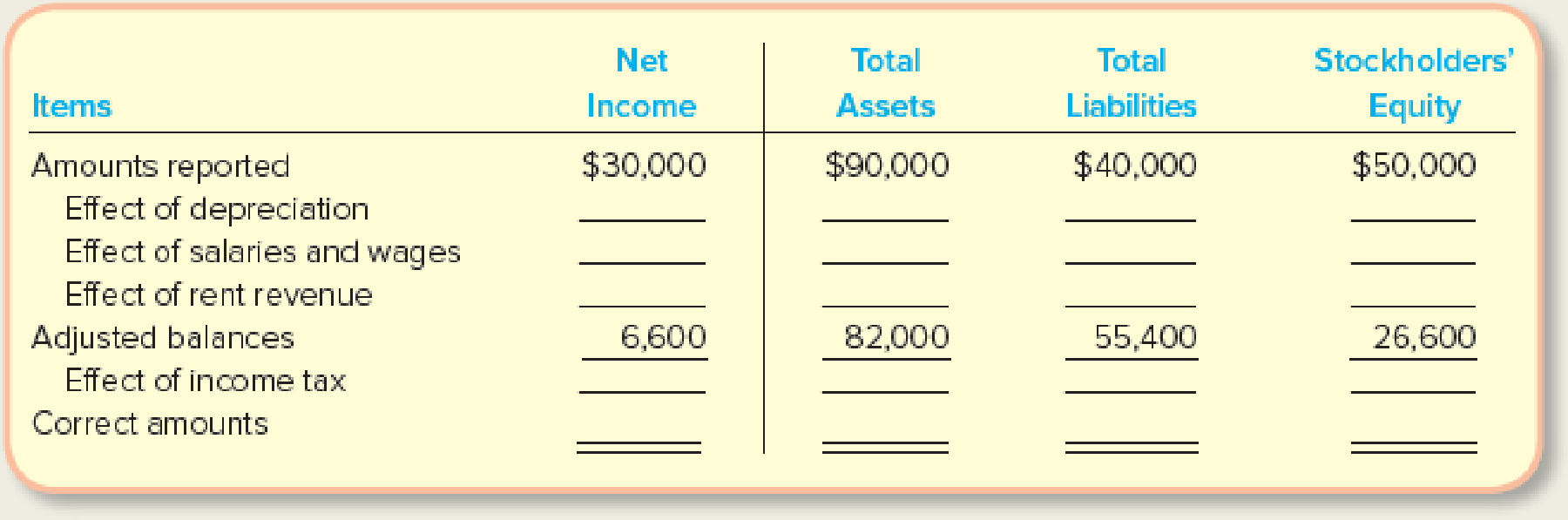

On December 31, 2018, Alan and Company prepared an income statement and balance sheet but failed to take into account four adjusting journal entries. The income statement, prepared on this incorrect basis, reported income before income tax of $30,000. The balance sheet (before the effect of income taxes) reflected total assets, $90,000; total liabilities, $40,000; and stockholders’ equity, $50,000. The data for the four adjusting journal entries follow:

- a. Amortization of $8,000 for the year on software was not recorded.

- b. Salaries and wages amounting to $17,000 for the last three days of December 2018 were not paid and not recorded (the next payroll will be on January 10, 2019).

- c. Rent revenue of $4,800 was collected on December 1, 2018, for office space for the three-month period December 1, 2018, to February 28, 2019. The $4,800 was credited in full to Deferred Revenue when collected.

- d. Income taxes were not recorded and not paid. The income tax rate for the company is 30%.

Required:

Complete the following table to show the effects of the four adjusting journal entries (indicate deductions with parentheses):

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

GEN COMBO LL FUNDAMENTALS OF FINANCIAL ACCOUNTING; CONNECT ACCESS CARD

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- Can you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub