Contrasting ABC and Conventional Product cost L04−2, L04−3, L04−4

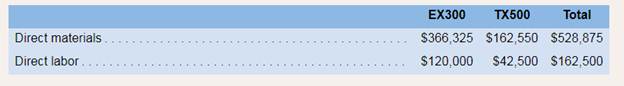

Precision Manufacturing Inc. (PMI) makes two types of industrial component parts−the EX300 and the

TX500. It annually produces 60,000 units of EX300 and l2500 units of TXSOO. The company’sconventional cost system allocates manufacturing

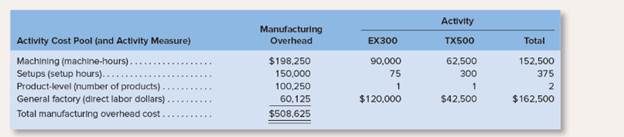

The company is considering implementing an activity-based costing system that distributes all of its

manufacturing overhead to four activities as shown below:

Required:

1. Compute the plant wide overhead rate that would be used in the company’s conventional cost system.

Using the plant wide rate. Compute the unit product cost for each product.

2. Compute the activity rate for each activity cost pool. Using the activity rates, compute the unit productcost for each product.

3. Why do the conventional and activity-based cost assignments differ from one another?

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

INTRO MGRL ACCT LL W CONNECT

- Xander Industries has a balanced day of 31 December. On 1 January 2XX5, it had an opening inventory balance of $32,500. Xander Industries purchased $48,700 worth of goods for resale. On 31 December 2XX5, the closing inventory balance was $19,200. During the year, Xander Industries had sales of $74,000. What is the Cost of Goods Sold for Xander Industries for the period ending 31 December 2XX5?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardProvide solutionarrow_forward

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardFinancial accountingarrow_forwardMoonlight Ltd. had 25,000 units of ending inventory recorded at $8.20 per unit using the FIFO method. The current replacement cost is $6.10 per unit. Which amount should be reported as Ending Merchandise Inventory on the balance sheet using the lower-of-cost-or-market rule?arrow_forward

- What was its charge for depreciation and amortization?arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardKFC Industries estimates direct labor costs and manufacturing overhead costs for the upcoming year to be $920,000 and $740,000, respectively. KFC allocates overhead costs based on machine hours. The estimated total labor hours and machine hours for the coming year are 23,000 hours and 9,250 hours, respectively. What is the predetermined overhead allocation rate? (Round your answer to the nearest cent.)arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,