FUND. OF FINANCIAL ACCT. (LL) W/CONNECT

6th Edition

ISBN: 9781260725254

Author: PHILLIPS

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 4, Problem 12E

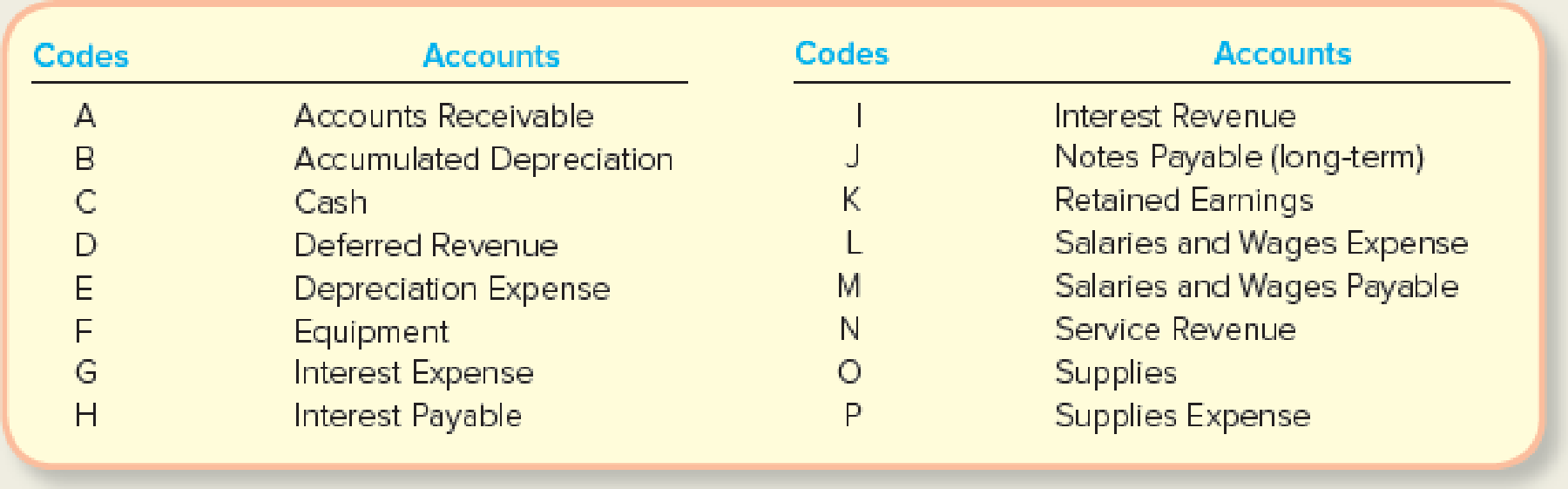

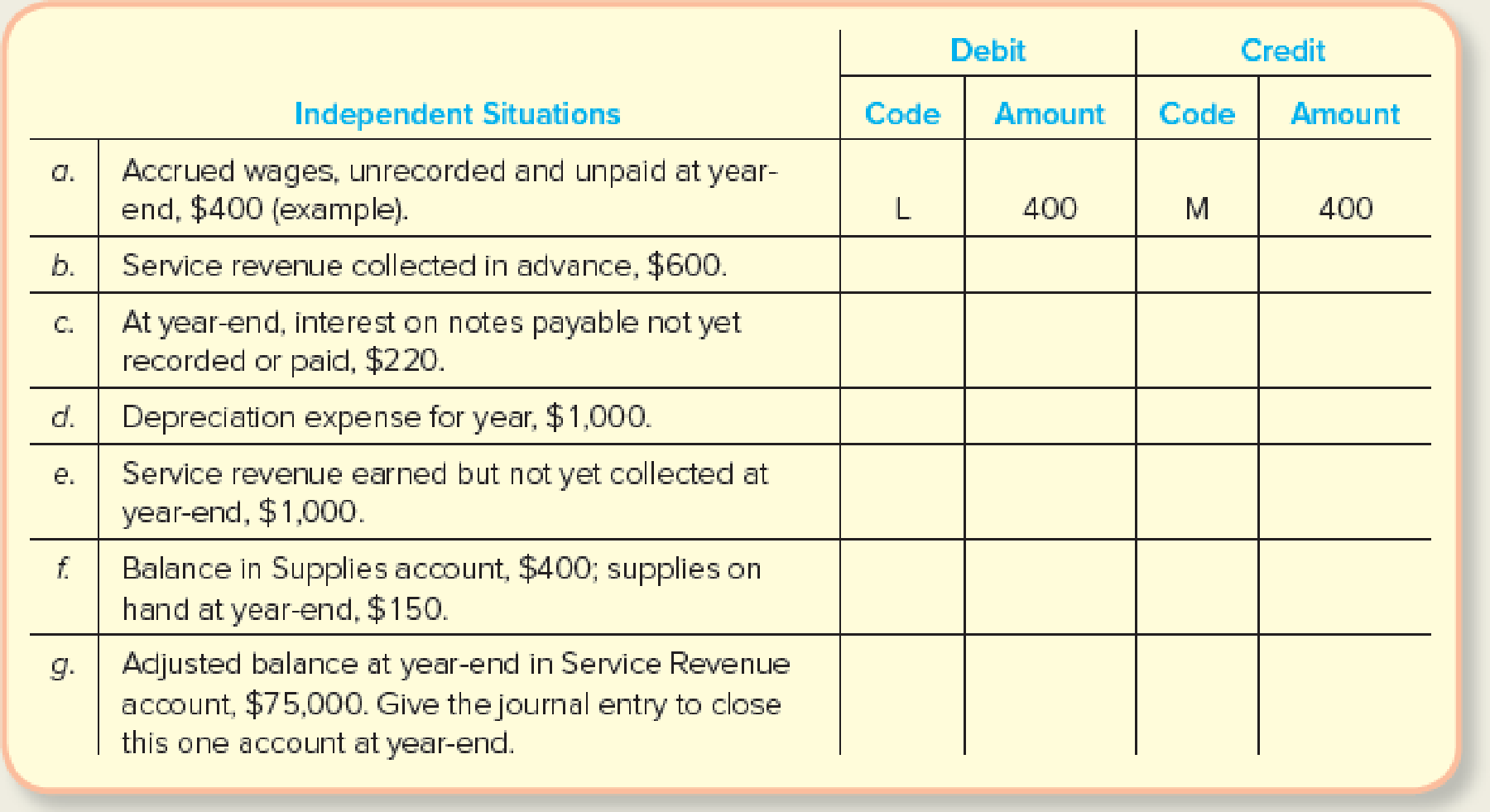

Recording Transactions Including Adjusting and Closing Journal Entries

The following accounts are used by Mouse Potato, Inc., a computer game maker.

Required:

For each of the following independent situations, give the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The following errors took place in journalizing and posting transactions:a. The payment of $3,125 from a customer on account was recorded as a debit to Cash and a credit toAccounts Payable.b. Advertising expense of $1,500 paid for the current month was recorded as a debit to MiscellaneousExpense and a credit to Advertising Expense.c. The purchase of supplies of $2,690 on the account was recorded as a debit to Office Equipment anda credit to Supplies.d. The receipt of $3,750 for services rendered was recorded as a debit to Accounts Receivable and acredit to Fees Earned.Required:Prepare journal entries to correct the errors.Each error correction carries equal marks.

Required:a) Journalize the following transactions using the direct write-off method of accounting foruncollectible receivables:Aug. 7. Received $175 from Roosevelt McLair and wrote off the remainder owed of $400 asuncollectible.Nov. 23. Reinstated the account of Roosevelt McLair and received $400 cash in full payment.b) Journalize the following transactions using the allowance method of accounting for uncollectiblereceivables:Feb. 12. Received $750 from Manning Wingard and wrote off the remainder owed of $2,000 asuncollectible.June 30. Reinstated the account of Manning Wingard and received $2,000 cash in full payment.Each journal carries equal marks

If someone tracks, tallys and totals a current liabilities for an accounting period, and then seeks to apply this value in a calculation to assess our liquidity, what’s the difference between the current ratio and the “acid-test” (or “quick”) ratio? Does the difference between these two metrics even matter?

Chapter 4 Solutions

FUND. OF FINANCIAL ACCT. (LL) W/CONNECT

Ch. 4 - Prob. 1QCh. 4 - Explain the relationships between adjustments and...Ch. 4 - Prob. 3QCh. 4 - Prob. 4QCh. 4 - What is a contra-asset? Give an example of one.Ch. 4 - Explain the differences between depreciation...Ch. 4 - What is an adjusted trial balance? What is its...Ch. 4 - On December 31, a company makes a 59,000 payment...Ch. 4 - Using the information in question 8, determine the...Ch. 4 - Using the information in question 8, prepare the...

Ch. 4 - What is the equation for each of the following...Ch. 4 - Prob. 12QCh. 4 - What is the purpose of closing journal entries?Ch. 4 - Prob. 14QCh. 4 - Prob. 15QCh. 4 - What is a post-closing trial balance? Is it a...Ch. 4 - The owner of a local business complains that the...Ch. 4 - Which of the following accounts would not appear...Ch. 4 - Which account is least likely to appear in an...Ch. 4 - When a concert promotions company collects cash...Ch. 4 - On December 31, an adjustments made to reduce...Ch. 4 - An adjusting journal entry to recognize accrued...Ch. 4 - Prob. 6MCCh. 4 - Company A has owned a building for several years....Ch. 4 - Which of the following trial balances is used as a...Ch. 4 - Assume the balance in Prepaid Insurance is 2,500...Ch. 4 - Assume a company receives a bill for 10,000 for...Ch. 4 - Prob. 1MECh. 4 - Understanding Concepts Related to Adjustments...Ch. 4 - Matching Transactions with Type of Adjustment...Ch. 4 - Recording Adjusting Journal Entries Using the...Ch. 4 - Determine Accounting Equation Effects of Deferral...Ch. 4 - Prob. 6MECh. 4 - Determining Accounting Equation Effects of Accrual...Ch. 4 - Recording Adjusting Journal Entries Using be...Ch. 4 - Preparing Journal Entries for Deferral...Ch. 4 - Preparing Journal Entries for Deferral...Ch. 4 - Preparing Journal Entries for Deferral and Accrual...Ch. 4 - Reporting Adjusted Account Balances Indicate...Ch. 4 - Preparing an Adjusted Trial Balance Macro Company...Ch. 4 - Reporting an Income Statement The Sky Blue...Ch. 4 - Reporting a Statement of Retained Earnings Refer...Ch. 4 - Prob. 16MECh. 4 - Recording Closing Journal Entries Refer to the...Ch. 4 - Preparing and Posting Adjusting Journal Entries At...Ch. 4 - Preparing and Posting Adjusting Journal Entries At...Ch. 4 - Prob. 20MECh. 4 - Prob. 21MECh. 4 - Prob. 22MECh. 4 - Prob. 23MECh. 4 - Prob. 24MECh. 4 - Prob. 25MECh. 4 - Prob. 26MECh. 4 - Prob. 1ECh. 4 - Identifying Adjustments and Preparing Financial...Ch. 4 - Prob. 3ECh. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Determining Adjustments and Accounting Equation...Ch. 4 - Recording Adjusting Journal Entries Refer to E4-6....Ch. 4 - Recording Typical Adjusting Journal Entries...Ch. 4 - Determining Accounting Equation Effects of Typical...Ch. 4 - Determining Adjusted Income Statement Account...Ch. 4 - Reporting Depreciation The adjusted trial balance...Ch. 4 - Recording Transactions Including Adjusting and...Ch. 4 - Analyzing the Effects of Adjusting Journal Entries...Ch. 4 - Reporting an Adjusted Income Statement Dyer, Inc.,...Ch. 4 - Recording Adjusting Entries and Preparing an...Ch. 4 - Recording Four Adjusting Journal Entries and...Ch. 4 - Recording Four Adjusting Journal Entries and...Ch. 4 - Prob. 18ECh. 4 - Analyzing, Recording, and Summarizing Business...Ch. 4 - Preparing Adjusting Entries, an Adjusted Trial...Ch. 4 - Preparing an Adjusted Trial Balance, Closing...Ch. 4 - Analyzing and Recording Adjusting Journal Entries...Ch. 4 - Prob. 3CPCh. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - Preparing a Trial Balance, Closing Journal Entry,...Ch. 4 - Analyzing and Recording Adjusting Journal Entries...Ch. 4 - Prob. 3PACh. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - Preparing a Trial Balance, Closing Journal Entry,...Ch. 4 - Recording Adjusting Journal Entries Cactus...Ch. 4 - Determining Accounting Equation Effects of...Ch. 4 - Identifying and Preparing Adjusting Journal...Ch. 4 - From Recording Transactions to Preparing Accrual...Ch. 4 - Prob. 2COPCh. 4 - Recording Transactions (Including Adjusting...Ch. 4 - From Recording Transactions (Including Adjusting...Ch. 4 - From Recording Transactions to Preparing Accrual...Ch. 4 - Prob. 6COPCh. 4 - Finding Financial Information Refer to the...Ch. 4 - Prob. 2SDCCh. 4 - Ethical Decision Making: A Mini-Case Assume you...Ch. 4 - Adjusting the Accounting Records Assume it is now...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dear tutor. I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardno aiWhich of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forwardDon't use chatgpt Which of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understated i need help in this question quiarrow_forwardI need correct answer 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardNo chatgpt 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedneed anarrow_forwardNo ai 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardDevelopment costs in preparing the mine $ 3,400,000 Mining equipment 159,600 Construction of various structures on site 77,900 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $12,000. The structures will be torn down. Geologists estimate that 820,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow Probability $ 620,000 40% 720,000 30% 820,000 30% Hecala’s credit-adjusted risk-free interest rate is 7%. During 2024, Hecala extracted 122,000 tons of ore from the mine. The company’s fiscal year ends on December 31. Required: Determine the amount at which Hecala will record the mine. Calculate the…arrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,  Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License