Contrasting Activity-Based Costing and Conventional Product CostingL04-2, L04-3, L04-4

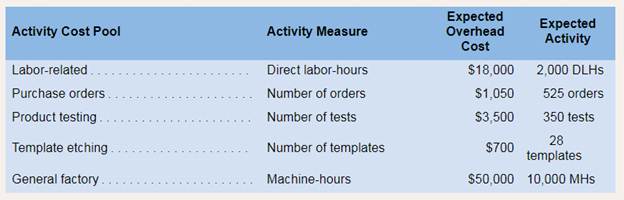

Rusties Company recently implemented an activity-based costing system. At the beginning of the year, management made the following estimates of cost and activity in the company’s five activity cost pools:

Required:

1. Compute the activity rate for each of the activity cost pools.

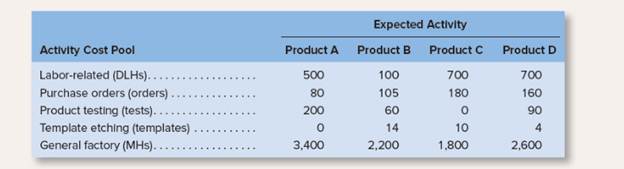

2. The expected activity for the year was distributed among the company’s four products as follows:

Using the ABC data, determine the total amount of

3. Assume that prior to implementing ABC, Rusties used a conventional cost system thatapplied all manufacturing overhead to products based on direct labor-hours. Explain how theconventional overhead cost assignments would differ from the activity-based cost assignments withrespect to Product B.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

BREWER ND LL INTRO MGRL ACTG CON+ AC

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- I am looking for help with this general accounting question using proper accounting standards.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardChapter Six Mini Practice Set Saved Help 30 1 points eBook Print 이 References ALLOUMILITY WUIN UI LIIS CUSUTY SERVICES FOR MEN January 2002. Assume that you are the chief accountant for Eli's Consulting Services. During January, the business will use the same types of records and procedures that you learned about in Chapters 1 through 6. The chart of accounts for Eli's Consulting Services has been expanded to include a few new accounts. Follow the instructions on the Requirements tab to complete the accounting records for the month of January. DATE TRANSACTIONS January 2 Purchased supplies for $14,000; issued Check 1015. January 2 Purchased a one-year insurance policy for $16,800. January 7 Sold services for $30,000 in cash and $20,000 on credit during the first week of January. January 12 Collected a total of $8,000 on account from credit customers during the first week of January. January 12 Issued Check 1017 for $7,200 to pay for special promotional advertising to new businesses on…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning