1.

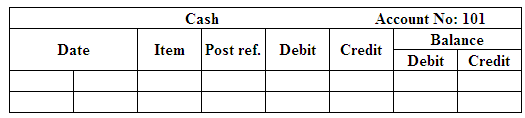

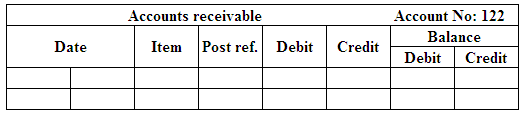

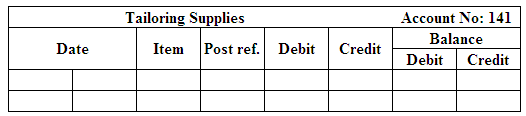

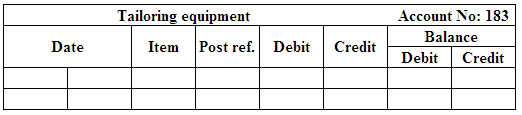

Set up general ledger accounts by entering the balances as of November 1.

1.

Explanation of Solution

General ledger:

General ledger is a record of all accounts of assets, liabilities, and

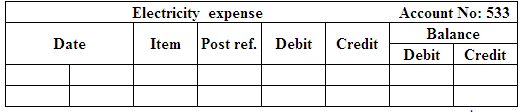

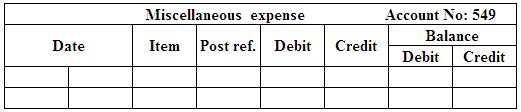

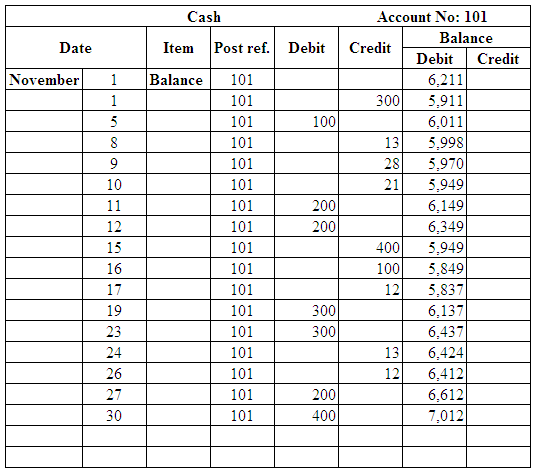

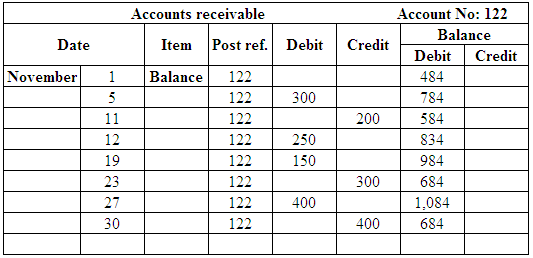

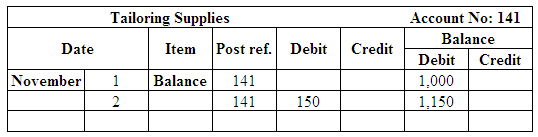

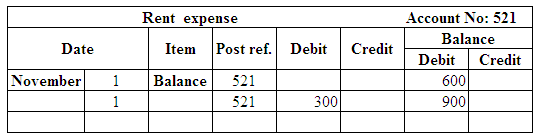

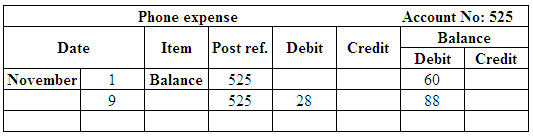

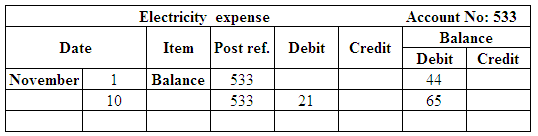

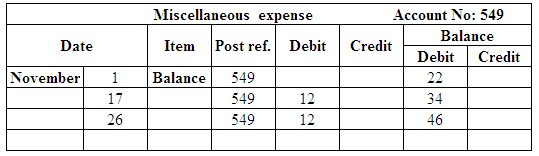

(Figure 1)

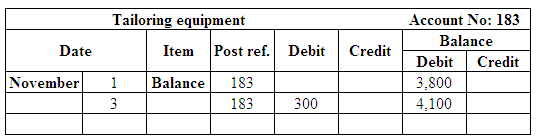

(Figure 2)

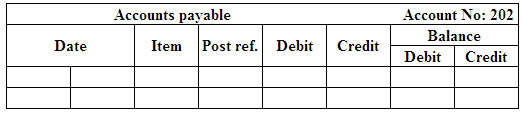

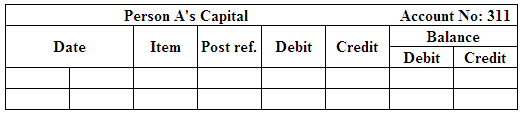

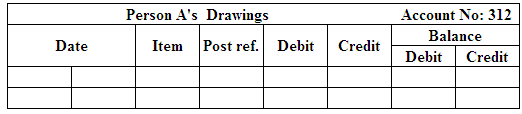

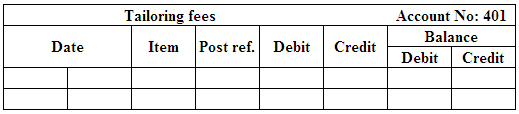

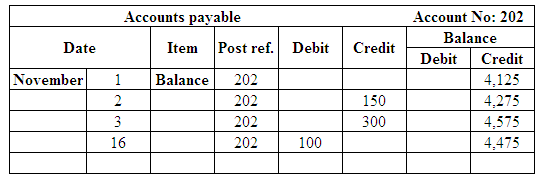

(Figure 3)

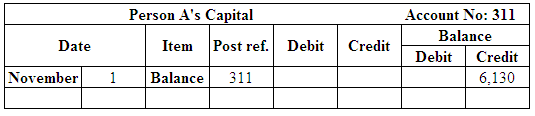

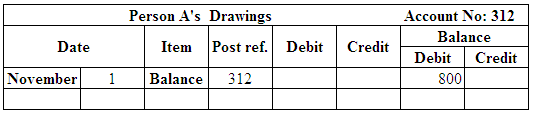

(Figure 4)

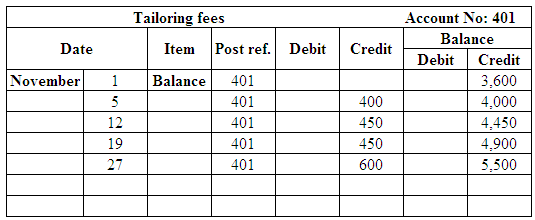

(Figure 5)

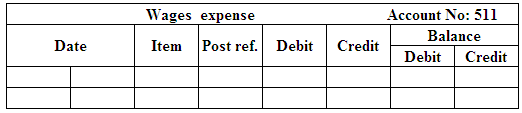

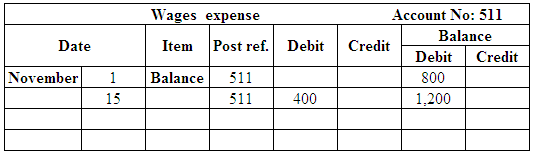

(Figure 6)

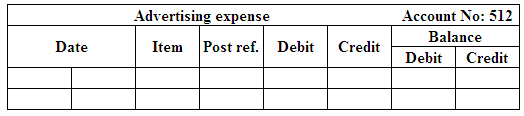

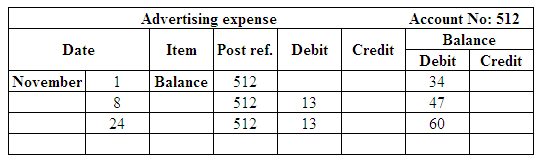

(Figure 7)

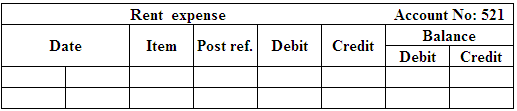

(Figure 8)

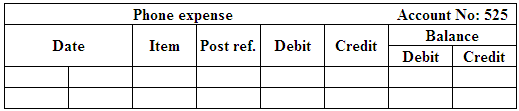

(Figure 9)

(Figure 10)

(Figure 11)

(Figure 12)

(Figure 13)

(Figure 14)

2.

Prepare

2.

Explanation of Solution

Prepare journal entry to record the given transactions.

| Date | Accounts title and explanation |

Post. Ref. |

Debit ($) |

Credit ($) |

| November 1 | Rent Expense | 521 | 300 | |

| Cash | 101 | 300 | ||

| (To record the payment on November ) | ||||

| November 2 | Tailoring supplies | 141 | 150 | |

| Accounts payable | 202 | 150 | ||

| (To record the purchase of tailoring supplies on account) | ||||

| November 3 | Tailoring Equipment | 183 | 300 | |

| Accounts payable | 202 | 300 | ||

| (To record the purchase machine on account) | ||||

| November 5 | Cash | 101 | 100 | |

| | 122 | 300 | ||

| Tailoring fees | 401 | 400 | ||

| (To record the amount earned on tailoring fees) | ||||

| November 8 | Advertising expense | 512 | 13 | |

| Cash | 101 | 13 | ||

| (To record the payment made on the newspaper ad) | ||||

| November 9 | Phone Expense | 525 | 28 | |

| Cash | 101 | 28 | ||

| (To record the payment of phone bill) | ||||

| November 10 | Electricity Expense | 533 | 21 | |

| Cash | 101 | 21 | ||

| (To record the payment of electricity bill) | ||||

| November 11 | Cash | 101 | 200 | |

| Accounts Receivable | 122 | 200 | ||

| (To record the cash to be received on account) | ||||

| November 12 | Cash | 101 | 200 | |

| Accounts receivable | 122 | 250 | ||

| Tailoring Fees | 401 | 450 | ||

| (To record the cash on tailoring fees) | ||||

| November 15 | Wages Expense | 511 | 400 | |

| Cash | 101 | 400 | ||

| (To record the payment made to the employee) | ||||

| November 16 | Accounts Payable | 202 | 100 | |

| Cash | 101 | 100 | ||

| (To record the payment of cash on account) | ||||

| November 17 | Miscellaneous Expense | 549 | 12 | |

| Cash | 101 | 12 | ||

| (To record the payment made for magazine subscription) | ||||

| November 19 | Cash | 101 | 300 | |

| Accounts receivable | 122 | 150 | ||

| Tailoring Fees | 401 | 450 | ||

| (To record the cash on tailoring fees) | ||||

| November 23 | Cash | 101 | 300 | |

| Accounts Receivable | 122 | 300 | ||

| (To record the amount of cash received on account) | ||||

| November 24 | Advertising expense | 512 | 13 | |

| Cash | 101 | 13 | ||

| (To record the payment made on the newspaper ad) | ||||

| November 26 | Miscellaneous Expense | 549 | 12 | |

| Cash | 101 | 12 | ||

| (To record the payment made for magazine subscription) | ||||

| November 27 | Cash | 101 | 200 | |

| Accounts receivable | 122 | 400 | ||

| Tailoring Fees | 401 | 600 | ||

| (To record the cash on tailoring fees) | ||||

| November 30 | Cash | 101 | 400 | |

| Accounts Receivable | 122 | 400 | ||

| (To record the cash received on account) |

(Table 1)

3.

3.

Explanation of Solution

Post the entries to the general ledger.

(Figure 18)

(Figure 19)

(Figure 20)

(Figure 21)

(Figure 22)

(Figure 23)

(Figure 24)

(Figure 25)

(Figure 26)

(Figure 27)

(Figure 28)

(Figure 29)

(Figure 30)

(Figure 31)

4.

Prepare a

4.

Explanation of Solution

Prepare a trial balance.

| Company T | |||

| Trial balance | |||

| November 31, 20.. | |||

| Accounts | Account No. | Debit ($) | Credit ($) |

| Cash | 101 | 7,012 | |

| Accounts Receivable | 122 | 684 | |

| Tailoring Supplies | 141 | 1,150 | |

| Tailoring Equipment | 183 | 4,100 | |

| Accounts Payable | 202 | 4,475 | |

| Person A’s, Capital | 311 | 6,130 | |

| Person A’s, Drawing | 312 | 800 | |

| Tailoring Fees | 401 | 5,500 | |

| Wages Expense | 511 | 1,200 | |

| Advertising Expense | 512 | 60 | |

| Rent Expense | 521 | 900 | |

| Phone Expense | 525 | 88 | |

| Electricity Expense | 533 | 65 | |

| Miscellaneous Expense | 549 | 46 | |

| Total | 16,105 | 16,105 | |

(Table 2)

Therefore, the total of the debit and credit column of the trial balance reported an amount of $16,105.

Want to see more full solutions like this?

Chapter 4 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-Leaf Version, 22nd + CengageNOWv2, 2 terms Printed Access Card

- Ten years ago, a corporation created a new brand name that is now considered to be its most valuable asset. On which financial statement and at what amount will you see the brand name reported? Balance Sheet At Its Present Value Statement Of Comprehensive Income With No Value Not Reported On A Financial Statementarrow_forwardneed answer of this question for financial accountingarrow_forwardWhat is the company Roe?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning