FOUNDATIONS OF FINANCE-MYFINANCELAB

10th Edition

ISBN: 9780135160619

Author: KEOWN

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 10SP

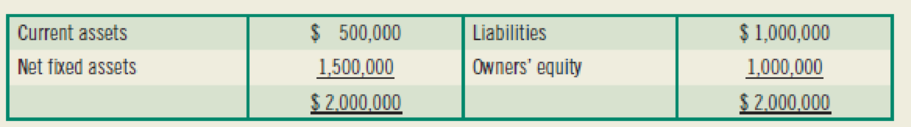

(Evaluating current and proforma profitability) (Financial ratios—investment analysis) The annual sales for Salco Inc. were $4.5 million last year. All sales are on credit. The firm’s end-of-year

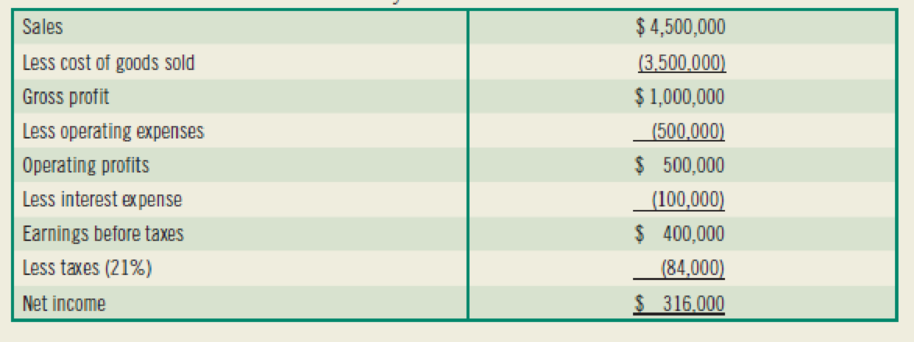

The firm’s income statement for the year was as follows:

- a. Calculate Salco’s total asset turnover, operating profit margin, and operating

return on assets . - b. Salco plans to renovate one of its plants, which will require an added investment in plant and equipment of $1 million. The firm will maintain its present debt ratio of 0.5 when financing the new investment and expects sales to remain constant. The operating profit margin will rise to 13 percent. What will be the new operating return on assets for Salco after the plant’s renovation?

- c. Given that the plant renovation in part (b) occurs and Salco’s interest expense rises by $50,000 per year, what will be the return earned on the common stockholders’ investment? Compare this

rate of return with that earned before the renovation.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the difference between operating leverage and financial leverage in finance?

How does the weighted average cost of capital (WACC) impact investment decisions?need help.

How does the weighted average cost of capital (WACC) impact investment decisions?

Chapter 4 Solutions

FOUNDATIONS OF FINANCE-MYFINANCELAB

Ch. 4 - Describe the five-question approach to using...Ch. 4 - What are the limitations of industry average...Ch. 4 - What is the difference between a firms gross...Ch. 4 - Prob. 9RQCh. 4 - Prob. 1SPCh. 4 - Prob. 2SPCh. 4 - Prob. 3SPCh. 4 - (Price/ book) Chang, Inc.s balance sheet shows a...Ch. 4 - Prob. 5SPCh. 4 - (Ratio analysis) The balance sheet and income...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Consider the sales data for Computer Success given in Problem 7. Use a 3-month weighted moving average to forec...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

1.10 Brown’s, a local bakery, is worried about increased costs—particularly energy. Last year’s records can pro...

Operations Management

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

13. Indicate how each of these accounts should be classified in the stockholders’ equity section of the balance...

Financial Accounting: Tools for Business Decision Making, 8th Edition

4. JC Manufacturing purchase d inventory for $ 5,300 and al so paid a $260 freight bill. JC Manufacturing retur...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

E8-16 Understanding internal control, components, procedures, and laws

Learning Objectives 1, 2, 3

Match ...

Horngren's Accounting (12th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Dont use ai How do interest rates impact the valuation of financial assets, like bonds and stocks?arrow_forwardHow do interest rates impact the valuation of financial assets, like bonds and stocks? dont use chatgpt.arrow_forwardHow do interest rates impact the valuation of financial assets, like bonds and stocks? need helparrow_forward

- How do interest rates impact the valuation of financial assets, like bonds and stocks in finance?arrow_forwardWhat are the key differences between stocks and bonds as investment options? i need correct solution without aiarrow_forwardWhat are the key differences between stocks and bonds as investment options? i need answer properly.arrow_forward

- What are the key differences between stocks and bonds as investment options?need helparrow_forwardWhat are the key differences between stocks and bonds as investment options?arrow_forwardWhat is diversification, and how can it reduce risk in a portfolio? i need correct answer for this question.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License