(a)

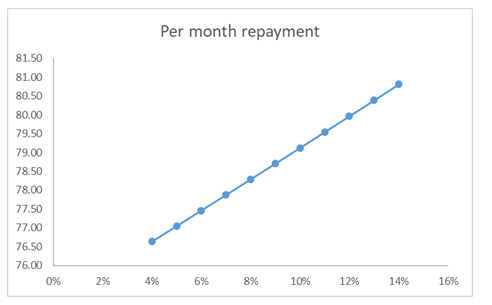

Graphical representation of monthly payment as a function of interest rate.

Answer to Problem 106P

Graphical representation of monthly payment as a function of interest rate.

Explanation of Solution

Given information:

- Loan Amount - $900

- Time period − 1 years

- Rate of Interest − 4-14% per annum

- Capital Recovery Factor:

The capital recovery factor is used to find the uniform annual amount A of a uniform series from a known present worth at the given interest rate i. It is calculated as:

Calculation:

The loan amount is $900. The monthly payments are to be made, therefore, the rate of interest will be divided by 12, while the time period will be multiplied by 12.

Based on the above information, the following table can be created:

| Time Period (in years) | Time Period (in months) | Rate of Interest (compounded annually) | Rate of Interest (compounded monthly) | Loan Amount to be paid | Per month repayment |

| 1 | 12 | 4% | 0.003 | 900 | 76.63 |

| 1 | 12 | 5% | 0.004 | 900 | 77.05 |

| 1 | 12 | 6% | 0.005 | 900 | 77.46 |

| 1 | 12 | 7% | 0.006 | 900 | 77.87 |

| 1 | 12 | 8% | 0.007 | 900 | 78.29 |

| 1 | 12 | 9% | 0.008 | 900 | 78.71 |

| 1 | 12 | 10% | 0.008 | 900 | 79.12 |

| 1 | 12 | 11% | 0.009 | 900 | 79.54 |

| 1 | 12 | 12% | 0.010 | 900 | 79.96 |

| 1 | 12 | 13% | 0.011 | 900 | 80.39 |

| 1 | 12 | 14% | 0.012 | 900 | 80.81 |

Now, the graph will be plotted between the rate of interest compounded annually and per month repayment. The graph will look as:

(b)

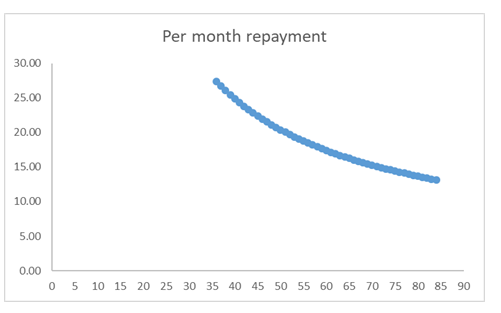

Graphical representation of monthly payment as a function of time period.

Answer to Problem 106P

Graphical representation of monthly payment as a function of interest rate.

Explanation of Solution

Given information:

- Loan Amount - $900

- Rate of Interest − 6% per annum.

- Time period − 36-84 months

- Capital Recovery Factor:

The capital recovery factor is used to find the uniform annual amount A of a uniform series from a known present worth at the given interest rate i. It is calculated as:

Calculation:

The loan amount is $900. The monthly payments are to be made, therefore, the rate of interest will be divided by 12, while the time period will be multiplied by 12.

Based on this information, following table can be created:

| Time Period (in months) | Rate of Interest (compounded annually) | Rate of Interest (compounded monthly) | Loan Amount to be paid | Per month repayment |

| 36 | 6% | 0.005 | 900 | 27.38 |

| 37 | 6% | 0.005 | 900 | 26.70 |

| 38 | 6% | 0.005 | 900 | 26.06 |

| 39 | 6% | 0.005 | 900 | 25.46 |

| 40 | 6% | 0.005 | 900 | 24.88 |

| 41 | 6% | 0.005 | 900 | 24.33 |

| 42 | 6% | 0.005 | 900 | 23.81 |

| 43 | 6% | 0.005 | 900 | 23.31 |

| 44 | 6% | 0.005 | 900 | 22.84 |

| 45 | 6% | 0.005 | 900 | 22.38 |

| 46 | 6% | 0.005 | 900 | 21.95 |

| 47 | 6% | 0.005 | 900 | 21.53 |

| 48 | 6% | 0.005 | 900 | 21.14 |

| 49 | 6% | 0.005 | 900 | 20.75 |

| 50 | 6% | 0.005 | 900 | 20.39 |

| 51 | 6% | 0.005 | 900 | 20.04 |

| 52 | 6% | 0.005 | 900 | 19.70 |

| 53 | 6% | 0.005 | 900 | 19.37 |

| 54 | 6% | 0.005 | 900 | 19.06 |

| 55 | 6% | 0.005 | 900 | 18.76 |

| 56 | 6% | 0.005 | 900 | 18.47 |

| 57 | 6% | 0.005 | 900 | 18.19 |

| 58 | 6% | 0.005 | 900 | 17.91 |

| 59 | 6% | 0.005 | 900 | 17.65 |

| 60 | 6% | 0.005 | 900 | 17.40 |

| 61 | 6% | 0.005 | 900 | 17.15 |

| 62 | 6% | 0.005 | 900 | 16.92 |

| 63 | 6% | 0.005 | 900 | 16.69 |

| 64 | 6% | 0.005 | 900 | 16.47 |

| 65 | 6% | 0.005 | 900 | 16.25 |

| 66 | 6% | 0.005 | 900 | 16.04 |

| 67 | 6% | 0.005 | 900 | 15.84 |

| 68 | 6% | 0.005 | 900 | 15.65 |

| 69 | 6% | 0.005 | 900 | 15.45 |

| 70 | 6% | 0.005 | 900 | 15.27 |

| 71 | 6% | 0.005 | 900 | 15.09 |

| 72 | 6% | 0.005 | 900 | 14.92 |

| 73 | 6% | 0.005 | 900 | 14.75 |

| 74 | 6% | 0.005 | 900 | 14.58 |

| 75 | 6% | 0.005 | 900 | 14.42 |

| 76 | 6% | 0.005 | 900 | 14.26 |

| 77 | 6% | 0.005 | 900 | 14.11 |

| 78 | 6% | 0.005 | 900 | 13.96 |

| 79 | 6% | 0.005 | 900 | 13.82 |

| 80 | 6% | 0.005 | 900 | 13.68 |

| 81 | 6% | 0.005 | 900 | 13.54 |

| 82 | 6% | 0.005 | 900 | 13.41 |

| 83 | 6% | 0.005 | 900 | 13.28 |

| 84 | 6% | 0.005 | 900 | 13.15 |

Now, the graph will be plotted between the time period and per month repayment. The graph will look as:

Want to see more full solutions like this?

Chapter 4 Solutions

ENGINEERING ECONOMIC ENHANCED EBOOK

- PART II: Multipart Problems wood or solem of triflussd aidi 1. Assume that a society has a polluting industry comprising two firms, where the industry-level marginal abatement cost curve is given by: MAC = 24 - ()E and the marginal damage function is given by: MDF = 2E. What is the efficient level of emissions? b. What constant per-unit emissions tax could achieve the efficient emissions level? points) c. What is the net benefit to society of moving from the unregulated emissions level to the efficient level? In response to industry complaints about the costs of the tax, a cap-and-trade program is proposed. The marginal abatement cost curves for the two firms are given by: MAC=24-E and MAC2 = 24-2E2. d. How could a cap-and-trade program that achieves the same level of emissions as the tax be designed to reduce the costs of regulation to the two firms?arrow_forwardOnly #4 please, Use a graph please if needed to help provearrow_forwarda-carrow_forward

- For these questions, you must state "true," "false," or "uncertain" and argue your case (roughly 3 to 5 sentences). When appropriate, the use of graphs will make for stronger answers. Credit will depend entirely on the quality of your explanation. 1. If the industry facing regulation for its pollutant emissions has a lot of political capital, direct regulatory intervention will be more viable than an emissions tax to address this market failure. 2. A stated-preference method will provide a measure of the value of Komodo dragons that is more accurate than the value estimated through application of the travel cost model to visitation data for Komodo National Park in Indonesia. 3. A correlation between community demographics and the present location of polluting facilities is sufficient to claim a violation of distributive justice. olsvrc Q 4. When the damages from pollution are uncertain, a price-based mechanism is best equipped to manage the costs of the regulator's imperfect…arrow_forwardFor environmental economics, question number 2 only please-- thank you!arrow_forwardFor these questions, you must state "true," "false," or "uncertain" and argue your case (roughly 3 to 5 sentences). When appropriate, the use of graphs will make for stronger answers. Credit will depend entirely on the quality of your explanation. 1. If the industry facing regulation for its pollutant emissions has a lot of political capital, direct regulatory intervention will be more viable than an emissions tax to address this market failure. cullog iba linevoz ve bubivorearrow_forward

- Exercise 3 The production function of a firm is described by the following equation Q=10,000-3L2 where L stands for the units of labour. a) Draw a graph for this equation. Use the quantity produced in the y-axis, and the units of labour in the x-axis. b) What is the maximum production level? c) How many units of labour are needed at that point? d) Provide one reference with you answer.arrow_forwardExercise 1 Consider the market supply curve which passes through the intercept and from which the market equilibrium data is known, this is, the price and quantity of equilibrium PE=50 and QE=2000. Considering those two points, find the equation of the supply. Draw a graph of this line. Provide one reference with your answer. Exercise 2 Considering the previous supply line, determine if the following demand function corresponds to the market demand equilibrium stated above. QD=3000-2p.arrow_forwardConsider the market supply curve which passes through the intercept and from which the marketequilibrium data is known, this is, the price and quantity of equilibrium PE=50 and QE=2000.a. Considering those two points, find the equation of the supply. b. Draw a graph of this line.arrow_forward

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education