Activity-Based Absorption Costing and Pricing LO3—5

Java Source, Inc., (JSI) buys coffee beans from around the world and roasts, blends, and packages them for resale. Some of JSI’s coffees are very popular and sell in large volumes, while a few of the newer blends sell in very low volumes. JSI prices its coffees at

For the coming year, JSI’s budget includes estimated manufacturing

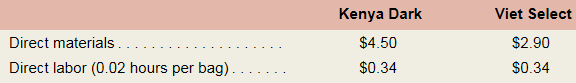

The expected costs for direct materials and direct labor for one-pound bags of two of the company’ s coffee products appear below.

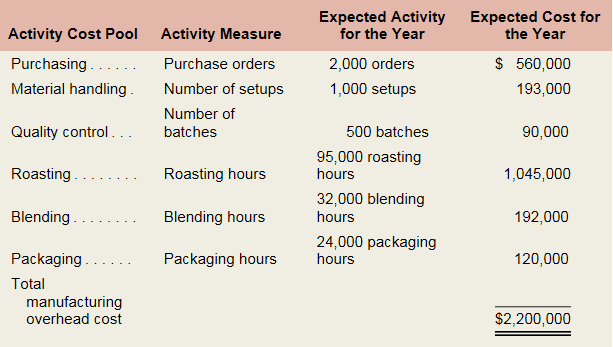

JSI’s controller believes that the company s traditional costing system may be providing misleading cost information. To determine whether or not this is correct, the controller has prepared an analysis of the year’s expected manufacturing overhead costs, as shown in the following table:

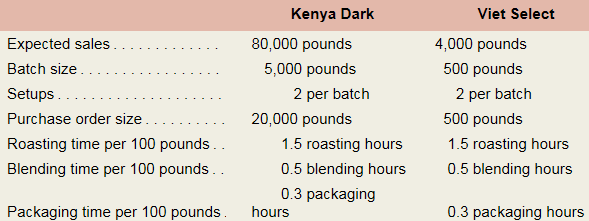

Data regarding the expected production of Kenya Dark and Viet Select coffee are presented below.

Required:

- Using direct labor-hours as the manufacturing overhead cost allocation base, do the following:

- Determine the plantwide predetermined overhead rate that will be used during the year.

- Determine the unit product cost of one pound of Kenya Dark coffee and one pound of Viet Select coffee.

- Using the activity-based absorption costing approach, do the following:

- Determine the total amount of manufacturing overhead cost assigned to Kenya Dark coffee and to Viet Select coffee for the year.

- Using the data developed in (2a) above, compute the amount of manufacturing overhead cost per pound of Kenya Dark coffee and Viet Select coffee.

- Determine the unit product cost of one pound of Kenya Dark coffee and one pound of Viet Select coffee.

- Write a brief memo to the president of ISI that explains what you found in (1) and (2) above and that discusses the implications of using direct labor-hours as the only manufacturing overhead cost allocation base.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3A Solutions

MANAGERIAL ACCOUNTING F/..(LL)-W/ACCESS

- Accurate Answerarrow_forwardHarrison Company reports the following updated cost information for August: • Cost of goods manufactured: $150,000 • Direct materials used: $30,000 • • Work in process inventory, Aug. 1: $25,000 Work in process inventory, Aug. 31: $20,000 Direct labor incurred: $70,000 What is the amount of manufacturing overhead incurred by Harrison Company in August?arrow_forwardA firm has a degree of operating leverage (DOL) of 4.2. If its profits increase by 3%, what is the percentage change in sales?arrow_forward

- New Visions, Inc. is looking to achieve a net income of 18% of sales. Here's the firm's updated profile: Unit sales price: $12 Variable cost per unit: $7 Total fixed costs: $50,000 What is the level of sales in units required to achieve a net income of 18% of sales? A. 12,500 units B. 15,000 units C. 17,606 units D. 20,000 unitsarrow_forwardSolve this questionsarrow_forwardDetermine the amount of overhead Hamilton manufacturing should record in the current period of this financial accounting questionarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning