MANAGERIAL ACCOUNTING(LL)-W/CONNECT >C<

19th Edition

ISBN: 9781264189816

Author: Noreen

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3A, Problem 3A.4P

Activity-Based Absorption Costing as an Alternative to Traditional Product Costing LO3-5

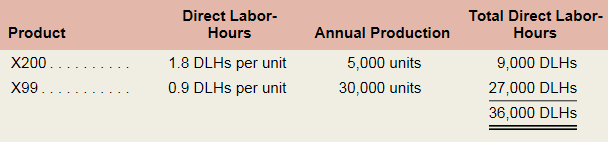

Elix Company manufactures two models of ultra-high fidelity speakers—the X200 model and the X99 model. Data regarding the two products follow:

Additional information about the company follows:

- Model X200 requires S72 in direct materials per unit, and model X99 requires $50.

- The direct labor workers are paid S20 per hour.

- The company has always used direct labor-hours as the base for applying

manufacturing overhead cost to products. - Model X200 is more complex to manufacture than model X99 and requires the use of special equipment.

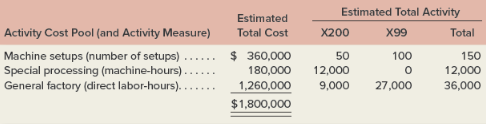

- Because of the special work required in (d) above, the company is considering the use of activity-based absorption costing to apply manufacturing overhead cost to products. Three activity cost pools have been identified as follows:

Required:

- Assume that the company continues to use direct labor-hours as the base for applying overhead cost to products.

- Compute the plantwide predetermined overhead rate.

- Compute the unit product cost of each model.

- Assume that the company decides to use activity-based absorption costing to apply overhead cost to products.

- Compute the activity rate for each activity cost pool and determine the amount of overhead cost that would be applied to each model using the activity-based approach.

- Compute the unit product cost of each model.

- Explain why overhead cost shifted from the high-volume model to the low-volume model under the activity-based approach.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Based on potential sales of 800 units per year, a new product at Waverly Manufacturing has estimated traceable costs of $1,600,000. What is the target price to obtain a 25% profit margin on sales? A. $2,500.68 B. $2,400.21 C. $2,666.67 D. $1,950.55

Hi expert please given correct answer with accounting

Can you explain this financial accounting question using accurate calculation methods?

Chapter 3A Solutions

MANAGERIAL ACCOUNTING(LL)-W/CONNECT >C<

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Assuming that all sales were made on accountarrow_forwardThe amount of cash collected from customers during 2019 was?arrow_forwardDanbury Processing combines corn husks and methanol. After joint manufacturing costs of $4,200 have been incurred, the mixture separates into two products, cellulose fiber and methyl esters. At the split-off point, cellulose fiber can be sold for $8,300, and the methyl esters can be sold for $12,700. The cellulose fiber can be further processed at a cost of $9,100 to make biodegradable packaging, which could be sold for $21,500. The methyl esters can be further processed at a cost of $7,800 to make biodiesel, which could be sold for $18,900. What is the net increase (decrease) in operating income from biodegradable packaging? helparrow_forward

- I need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardDanbury Processing combines corn husks and methanol. After joint manufacturing costs of $4,200 have been incurred, the mixture separates into two products, cellulose fiber and methyl esters. At the split-off point, cellulose fiber can be sold for $8,300, and the methyl esters can be sold for $12,700. The cellulose fiber can be further processed at a cost of $9,100 to make biodegradable packaging, which could be sold for $21,500. The methyl esters can be further processed at a cost of $7,800 to make biodiesel, which could be sold for $18,900. What is the net increase (decrease) in operating income from biodegradable packaging?arrow_forwardCan you explain the process for solving this financial accounting question accurately?arrow_forward

- Financial accountingarrow_forwardGolden Star Cafe had a 12% return on a $60,000 investment in new dining furniture. The investment resulted in increased sales and an increase in income that was 3% of the increase in sales. What was the increase in sales? Accurate answerarrow_forwardI am looking for help with this financial accounting question using proper accounting standards.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY