Determinants of demand and it relevance to the equilibrium position.

Explanation of Solution

Transaction demand for money is the need for money to meet the day-to-day expenditures. It varies directly with nominal

Asset demand for money refers to the desire of public to hold money in the form of financial assets, such as stocks, bonds and so forth. If the interest rate is greater, then people would be interested to save more thereby the asset demand for money would be lower and vice versa. Thus interest rate is the major determinant of the asset demand for money.

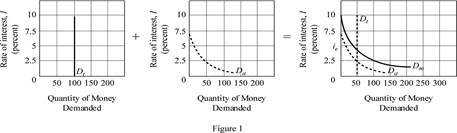

In figure -1, the horizontal axis measures quantity demanded and vertical axis measures the interest rate. The transaction demand for money, represented as Dt, is dependent only on the nominal GDP and has little effect by interest rate, so graphically it is depicted by a vertical line.

The asset demand for money, represented as Da in the figure has an inverse relation with the interest rate since it involves in the

The Total Money demand is the sum of Transaction demand and Asset demand for money

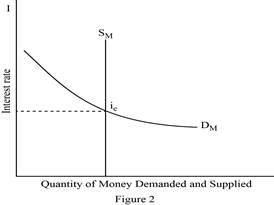

Figure- 2 depicts the equilibrium market, with quantity demanded and supplied measured in the horizontal axis and interest rate in the vertical axis.

The Monetary Authority (usually, the Central Bank of a country) decides on the Money Supply which is unaffected by the decisions that holds money for transaction or as financial asset. The Money Supply (Sm) is depicted by a vertical straight line which is independent of the rate of interest.

The Total Money demand (Dm) depends on the level of income and interest rate. It can be depicted as a linear function of income and interest rate. Demand for money varies directly with levels of income and inversely with the interest rate and slopes downward.

Dm = aY – bi

A

Dm = Sm

The interest rate at which equilibrium is made is the equilibrium interest rate (ie). Thus ie is determined at the point where Dm =Sm.

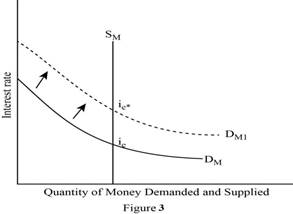

Let’s now illustrate the effect on equilibrium interest rate due to an increase in the total demand for money.

In Figure -3, the horizontal axis measures the quantity of money demanded and supplied and vertical axis represents the interest rate. When the Total money demand increases (shifts to right from DM to DM1) with money supply (SM) remaining constant, the equilibrium interest rate goes up from ie to ie*.

As the money demand increases, the previous interest rate is no longer sustainable because when the demand for money increases it exceeds the supply of money at the previous interest rate. This limits the money available to borrowers or creditors. Also there would be an upward pressure on the interest rate. Thus previous interest rate is no longer maintainable.

Concept Introduction:

Transaction demand for money: It refers to that amount of money required by individuals or firms to finance their current transaction or forthcoming expenditure.

Asset demand for money: It is the extent to which, people hold money in the form of asset.

Total Money demand: It refers to the desire of individuals or firms to hold money in the form of both financial assets and for transactions at each possible interest rate.

Equilibrium Interest rate: It is the point in which demand for money equals with the supply of money.

Want to see more full solutions like this?

Chapter 34 Solutions

Micro Economics / Macro Economics Spokane Falls Commnity College SFCC Econ 201/202

- Some people say that since inflation can be reduced in the long run without an increase in unemployment, we should reduce inflation to zero. Others believe that a steady rate of inflation at, say, 3 percent, should be our goal. What are the pros and cons of these two arguments? What, in your opinion, are good long-run goals for reducing inflation and unemployment?arrow_forwardExplain in words how investment multiplier and the interest sensitivity of aggregate demand affect the slope of the IS curve. Explain in words how and why the income and interest sensitivities of the demand for real balances affect the slope of the LM curve. According to the IS–LM model, what happens to the interest rate, income, consumption, and investment under the following circumstances?a. The central bank increases the money supply.b. The government increases government purchases.c. The government increases taxes.arrow_forwardSuppose that a person’s wealth is $50,000 and that her yearlyincome is $60,000. Also suppose that her money demand functionis given by Md = $Y10.35 - i2Derive the demand for bonds. Suppose the interest rate increases by 10 percentage points. What is the effect on her demand for bonds?b. What are the effects of an increase in income on her demand for money and her demand for bonds? Explain in wordsarrow_forward

- Imagine you are a world leader and you just viewed this presentation as part of the United Nations Sustainable Development Goal Meeting. Summarize your findings https://www.youtube.com/watch?v=v7WUpgPZzpIarrow_forwardPlease draw a standard Commercial Bank Balance Sheet and briefly explain each of the main components.arrow_forwardPlease draw the Federal Reserve System’s Balance Sheet and briefly explain each of the main components.arrow_forward

- 19. In a paragraph, no bullet, points please answer the question and follow the instructions. Give only the solution: Use the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all. How does the Federal Reserve currently get the federal funds rate where they want it to be?arrow_forward18. In a paragraph, no bullet, points please answer the question and follow the instructions. Give only the solution: Use the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all. Carefully compare and contrast fiscal policy and monetary policy.arrow_forward15. In a paragraph, no bullet, points please answer the question and follow the instructions. Give only the solution: Use the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all. What are the common arguments for and against high levels of federal debt?arrow_forward

- 17. In a paragraph, no bullet, points please answer the question and follow the instructions. Give only the solution: Use the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all. Explain the difference between present value and future value. Be sure to use and explain the mathematical formulas for both. How does one interpret these formulas?arrow_forward12. Give the solution: Use the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all. Show and carefully explain the Taylor rule and all of its components, used as a monetary policy guide.arrow_forward20. In a paragraph, no bullet, points please answer the question and follow the instructions. Give only the solution: Use the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all. What is meant by the Federal Reserve’s new term “ample reserves”? What may be hidden in this new formulation by the Fed?arrow_forward

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning