EBK PRINCIPLES OF CORPORATE FINANCE

12th Edition

ISBN: 9781259358487

Author: BREALEY

Publisher: MCGRAW HILL BOOK COMPANY

expand_more

expand_more

format_list_bulleted

Question

Chapter 31, Problem 1PS

Summary Introduction

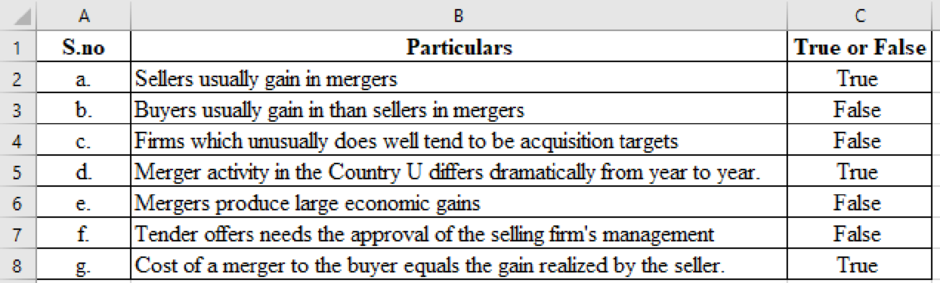

To indicate: Whether the transactions are true or false.

Expert Solution & Answer

Explanation of Solution

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Don't use AI

The formula for calculating the net present value (NPV) of a project is:

If $1,000 is invested at 8% compounded annually, what will be the value after 2 years?

A) $1,160B) $1,081.60C) $1,080D) $1,100

Which of the following is NOT a type of bond?

A) Government Bonds

B) Corporate Bonds

C) Convertible Bonds

D) Credit Bonds

Chapter 31 Solutions

EBK PRINCIPLES OF CORPORATE FINANCE

Knowledge Booster

Similar questions

- What is the formula for calculating compound interest?arrow_forwardA house is worth $250,000 and the property taxes are 1.25% of the value per year. How much are the annual property taxes? no ai..??arrow_forwardThe concept of present value relates to the idea that* The discount rate is always higher when you invest now than in the future The discount rate is always higher when you invest in the future than now The money you have now is worth less today than an identical amount you would receive in the future The money you have now is worth more today than an identical amount you would receive in the futurehelp..??arrow_forward

- A person wants to accumulate $10,000 in 4 years. How much should they invest annually if the interest rate is 6% compounded annually? A) $2,500B) $2,352.34C) $2,275.49D) $2,100step by step!!arrow_forwardNo ai will unhelpful What is the future value of an ordinary annuity that pays $200 per year for 5 years at an interest rate of 5% compounded annually? A) $1,000B) $1,052.63C) $1,105.13D) $1,215.51 step by step sopevarrow_forwardNo Ai will give unhelp What is the future value of an ordinary annuity that pays $200 per year for 5 years at an interest rate of 5% compounded annually? A) $1,000B) $1,052.63C) $1,105.13D) $1,215.51arrow_forward

- no ai ..,???10. *Calculating Expected Return*: A stock has a 50% chance of returning 15% and a 50% chance of returning 5%. What is the expected return on investment?arrow_forwardWhat is the future value of an ordinary annuity that pays $200 per year for 5 years at an interest rate of 5% compounded annually? A) $1,000B) $1,052.63C) $1,105.13D) $1,215.51arrow_forwardA person wants to accumulate $10,000 in 4 years. How much should they invest annually if the interest rate is 6% compounded annually? A) $2,500B) $2,352.34C) $2,275.49D) $2,100arrow_forward

- What is the present value of $2,000 to be received after 3 years, discounted at 10% per annum? A) $1,500.25B) $1,502.63C) $1,450D) $1,800 step by steparrow_forwardNo Ai ..??? 10. A company offers a 10% discount on all purchases over $100. If you buy something for $120, how much will you pay after the discount?arrow_forwardWhat is the present value of $2,000 to be received after 3 years, discounted at 10% per annum? A) $1,500.25B) $1,502.63C) $1,450D) $1,800explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you