1.

Prepare T-accounts and enter the beginning balance from the

1.

Explanation of Solution

T-account:

The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

The T-accounts of given item in trial balance are as follows:

| Cash | |||

| Jan. 1 | $41,500 | ||

| Bal. | $41,500 | ||

| Land | |||

| Jan. 1 | $110,800 | ||

| Bal. | $110,800 | ||

| Jan. 1 | $32,700 | ||

| Bal. | $32,700 | ||

|

Accounts receivables | |||

| Jan. 1 | $25,700 | ||

| Bal. | $25,700 | ||

| Accounts payable | |||

| Jan.1 | $15,300 | ||

| Bal. | $15,300 | ||

| Notes payable | |||

| Jan. 1 | $30,000 | ||

| Bal. | $30,000 | ||

| Common stock | |||

| Jan. 1 | $100,000 | ||

| Bal. | $100,000 | ||

Table (1)

2.

Record the journal entries for given transactions.

2.

Explanation of Solution

Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

The journal entries for given transactions of Company J are as follows:

| Date | Account Title and Explanation | Debit($) | Credit($) |

| January 12, 2021 | 62,400 | ||

| Service revenue | 62,400 | ||

| (To record the recognized service revenue on account ) | |||

| February 25,2021 | Cash | 75,300 | |

| Service revenue | 75,300 | ||

| (To record cash collection from customer) | |||

| April 30, 2021 | Cash | 30,000 | |

| Common stock | 30,000 | ||

| (To record the cash received from issuance of common stock) | |||

|

June 16, 2021 | Supplies | 12,100 | |

| Accounts payable | 12,100 | ||

| (To record the purchase of supplies on account) | |||

| July 7, 2021 | Accounts payable | 11,300 | |

| Cash | 11,300 | ||

| (To record the payment of cash on account) | |||

| September 30, 2021 | Salary expense | 64,200 | |

| Cash | 10,000 | ||

| (To record payment of salaries for work in the current period) | |||

| December 30,2021 | Dividends | 2,900 | |

| Cash | 2,900 | ||

| (To record the payment of dividends) |

Table (2)

3.

Post the transactions to T-accounts.

3.

Explanation of Solution

T-accounts of above transactions are as follows:

| Cash | |||

| Jan.1 | $41,500 | July.7 | $11,300 |

| Feb.25 | $75,300 | Sep.30 | $64,200 |

| Mar.19 | $45,700 | Nov.22 | $22,500 |

| Apr.30 | $30,000 | Dec.30 | $2,900 |

| Total | $192,500 | Total | 100,900 |

| Bal. | $91,600 | ||

| Land | |||

| Jan.1 | $110,800 | ||

| Bal. | $110,800 | ||

| Retained earnings | |||

| Jan.1 | $32,700 | ||

| Bal. | $32,700 | ||

| Salaries expenses | |||

| Jan.1 | $0 | ||

| Bal. | $64,200 | ||

| Accounts receivable | ||||

| Jan. 1 | $25,700 | |||

| Jan. 12 | $62,400 | Mar.19 | $45,700 | |

| Bal. | $42,400 | |||

|

Accounts payable | ||||

| Jan.1 | $15,300 | |||

| Jul. 7 | $11,300 | Jun.16 | $12,100 | |

| Bal. | $16,100 | |||

| Notes payable | |||

| Jan. 1 | $30,000 | ||

| Bal. | $30,000 | ||

| Dividends | |||

| Jan.1 | $0 | ||

| Dec.30 | $2,900 | ||

| Bal. | $2,900 | ||

| Advertising expense | |||

| Jan. 1 | $0 | ||

| Nov.22 | $22,500 | ||

| Bal. | $22,500 | ||

| Supplies | |||

| Jan.1 | $0 | ||

| Jun.16 | $12,100 | ||

| Bal. | $12,100 | ||

| Salaries payable | |||

| Jan. 1 | $0 | ||

| Dec.31 | $1,500 | ||

| Common stock | |||

| Jan. 1 | $100,000 | ||

| Apr.30 | $30,000 | ||

| Bal. | $130,000 | ||

|

Service revenue | |||

| Jan.1 | $0 | ||

| Jan.12 | $62,400 | ||

| Feb.25 | $75,300 | ||

| Bal. | 137,700 | ||

Table (3)

4.

Prepare the unadjusted trial balance of Company J.

4.

Explanation of Solution

| Company J | ||

| Unadjusted Trial Balance | ||

| December 31, 2021 | ||

| Accounts | Debit Amount($) |

Credit Amount($) |

| Cash | 91,600 | |

| Accounts Receivable | 42,400 | |

| Supplies | 12,100 | |

| Land | 110,800 | |

| Accounts payable | 16,100 | |

| Salaries payable | 0 | |

| Interest payable | 0 | |

| Notes payable | 30,000 | |

| Common stock | 130,000 | |

| Retained earnings | 32,700 | |

| Dividends | 2,900 | |

| Service revenue | 137,700 | |

| Salaries expense | 64,200 | |

| Advertising expense | 22,500 | |

| Interest expense | 0 | |

| Supplies expense | 0 | |

| Totals | $346,500 | $346,500 |

Table (4)

Therefore, the total of debit, and credit columns of unadjusted trial balance is $346,500.

5.

Record the given

5.

Explanation of Solution

Adjusting entries:

Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Adjusting entries of Company P are as follows:

| Date | Accounts title and explanation | Debit ($) | Credit ($) |

| December 31, 2021 | Interest Expense | 2,500 | |

| Interest payable | 2,500 | ||

| (To record the amount of accrue interest on notes payable) |

Table (5)

Following is the rule of debit and credit of above transaction:

- Interest expense is an expense, and it decreased the value of stockholder’s equity. Therefore, it is debited.

- Interest payable is a liability. There is a increase in the value of liability. Therefore it is credited.

Office supplies expense:

| Date | Accounts title and explanation | Debit ($) | Credit ($) |

| December 31, 2021 | Supplies expense | 9,800 | |

|

Supplies (1) | 9,800 | ||

| (To record the supplies expense incurred at the end of the accounting year) |

Table (6)

Following is the rule of debit and credit of above transaction:

- Supplies expense is an expense, and it decreased the value of stockholder’s equity. Therefore, it is debited.

- Supplies are an asset account. There is a decrease in assets, therefore it is credited.

Deferred revenue:

| Date | Accounts title and explanation | Debit ($) | Credit ($) |

| December 31, 2021 | Salaries expense | 1,500 | |

| Salaries payable | 1,500 | ||

| (To record the salary payable for the current period) |

Table (7)

Following is the rules of debit and credit of above transaction:

- Salaries expense is an expense. There is a decrease in the value of stockholder’s equity. Therefore, it is debited.

- Salaries payable is a liability. There is an increase in the value of liability. Therefore it is credited

Working note:

Calculate the supplies used during the year:

6.

Post the adjusting entries to appropriate T-accounts.

6.

Explanation of Solution

| Cash | |||

| Jan.1 | $41,500 | July.7 | $11,300 |

| Feb.25 | $75,300 | Sep.30 | $64,200 |

| Mar.19 | $45,700 | Nov.22 | $22,500 |

| Apr.30 | $30,000 | Dec.30 | $2,900 |

| Total | $192,500 | Total | 100,900 |

| Bal. | $91,600 | ||

| Land | |||

| Jan.1 | $110,800 | ||

| Bal. | $110,800 | ||

| Interest payable | |||

| Jan.1 | $0 | ||

| Dec.31 | $2,500 | ||

| Bal. | $2,500 | ||

| Retained earnings | |||

| Jan.1 | $32,700 | ||

| Bal. | $32,700 | ||

| Salaries Expense | |||

| Jan.1 | $0 | ||

| Sep.30 | $64,200 | ||

| Dec.30 | $1,500 | ||

| Bal. | $65,700 | ||

| Supplies Expense | |||

| Jan.1 | $0 | ||

| Dec.31 | $9,800 | ||

| Bal. | $9,800 | ||

| Accounts payable | |||

| Jan.1 | $15,300 | ||

| Jul. 7 | $11,300 | Jun.16 | $12,100 |

| Bal. | $16,100 | ||

| Notes payable | |||

| Jan. 1 | $30,000 | ||

| Bal. | $30,000 | ||

| Dividends | |||

| Jan.1 | $0 | ||

| Dec.30 | $2,900 | ||

| Bal. | $2,900 | ||

| Advertising expense | |||

| Jan. 1 | $0 | ||

| Nov.22 | $22,500 | ||

| Bal. | $22,500 | ||

| Supplies | |||

| Jan.1 | $0 | ||

| Jun.16 | $12,100 | Dec.31 | $9,800 |

| Bal. | $2,300 | ||

| Common stock | |||

| Jan. 1 | $100,000 | ||

| Apr.30 | $30,000 | ||

| Bal. | $130,000 | ||

|

Service revenue | |||

| Jan.1 | $0 | ||

| Jan.12 | $62,400 | ||

| Feb.25 | $75,300 | ||

| Bal. | $137,700 | ||

| Interest expense | |||

| Jan.1 | $0 | ||

| Dec.30 | $2,500 | ||

| Bal. | $2,500 | ||

Table (8)

7.

Prepare the adjusted trial balance of Company J.

7.

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is that statement which contains complete list of accounts with their adjusted balances, after all relevant adjustments have been made. This statement is prepared at the end of every financial period.

Adjusted trial balance of Company J is as follows:

| Company J | ||

| Adjusted Trial Balance | ||

| December 31, 2021 | ||

| Accounts | Debit Amount($) |

Credit Amount($) |

| Cash | 91,600 | |

| Accounts Receivable | 42,400 | |

| Supplies | 12,100 | |

| Land | 110,800 | |

| Accounts payable | 16,100 | |

| Salaries payable | 1,500 | |

| Interest payable | 2,200 | |

| Notes payable | 30,000 | |

| Common stock | 130,000 | |

| Retained earnings | 32,700 | |

| Dividends | 2,900 | |

| Service revenue | 137,700 | |

| Salaries expense | 64,200 | |

| Advertising expense | 22,500 | |

| Interest expense | 2,500 | |

| Supplies expense | 9,800 | |

| Totals | $350,500 | $350,500 |

Table (9)

Therefore, the total of debit, and credit columns of adjusted trial balance is $350,500.

8.

Prepare an income statement for 2021 and classified balance sheet as on December 31, 2021.

8.

Explanation of Solution

Income statement of Company J is as follows:

| Company J | ||

| Income statement | ||

| For the year ended December 31, 2021 | ||

| Particulars | Amount in $ | Amount in $ |

| Service revenue (A) | 137,700 | |

| Expenses: | ||

| Salaries expense | 65,700 | |

| Utilities expense | 22,500 | |

| Depreciation expense | 2,500 | |

| Supplies expense | 9,800 | |

| Total expense (B) | 100,500 | |

| Net income | 37,200 | |

Table (10)

Therefore, the net income of Company J is $37,200.

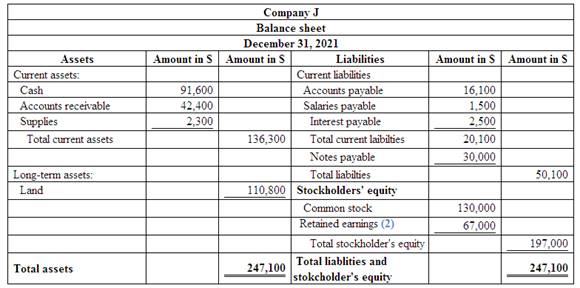

Classified balance sheet of Company J is as follows:

Figure (1)

Therefore, the total assets of Company P are $247,100, and the total liabilities and stockholders’ equity are $247,100.

Working note:

Calculation of ending balance retained earnings

9.

Record the necessary closing entries of Company J.

9.

Explanation of Solution

Closing entries of Company J is as follows:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2021 | Service revenue | 137,700 | ||

| Retained earnings | 137,700 | |||

| (To close all revenue account) | ||||

| December 31, 2021 | Retained earnings | 100,500 | ||

| Salaries expense | 65,700 | |||

| Advertising expense | 22,500 | |||

| Interest expense | 2,500 | |||

| Supplies expense | 9,800 | |||

| (To close all the expenses account) | ||||

| December 31,2021 | Retained earnings | 2,900 | ||

| Dividends | 2,900 | |||

| (To close the dividends account) | ||||

Table (11)

10.

Post the closing entries to the T-accounts.

10.

Explanation of Solution

Post the closing entries to the T-accounts.

| Cash | |||

| Jan.1 | $41,500 | July.7 | $11,300 |

| Feb.25 | $75,300 | Sep.30 | $64,200 |

| Mar.19 | $45,700 | Nov.22 | $22,500 |

| Apr.30 | $30,000 | Dec.30 | $2,900 |

| Total | $192,500 | Total | 100,900 |

| Bal. | $91,600 | ||

| Land | |||

| Jan.1 | $110,800 | ||

| Bal. | $110,800 | ||

| Interest payable | |||

| Jan.1 | $0 | ||

| Dec.31 | $2,500 | ||

| Bal. | $2,500 | ||

| Retained earnings | |||

| Jan.1 | $32,700 | ||

| Dec.31 | 100,500 | Dec.31 | 137,700 |

| Dec.31 | 2,900 | ||

| Bal. | $32,700 | ||

| Salaries Expense | |||

| Jan.1 | $0 | ||

| Sep.30 | $64,200 | ||

| Dec.30 | $1,500 | ||

| Bal. | $65,700 | ||

| Supplies Expense | |||

| Jan.1 | $0 | ||

| Dec.31 | $9,800 | Dec.31 | $9,800 |

| Bal. | $0 | ||

| Accounts receivable | |||

| Jan.1 | $25,700 | ||

| Jan.12 | $62,400 | Mar.19 | $45,700 |

| Bal. | 42,400 | ||

| Accounts payable | |||

| Jan.1 | $15,300 | ||

| Jul.7 | $11,300 | Jun.16 | $12,100 |

| Bal. |

$16,100 | ||

|

Notes payable | |||

| Jan. 1 | $30,000 | ||

| Bal. | $30,000 | ||

| Dividends | |||

| Jan.1 | $0 | ||

| Dec.30 | $2,900 | Dec.31 | $2,900 |

| Bal. | $2,900 | ||

| Advertising expense | |||

| Jan. 1 | $0 | ||

| Nov.22 | $22,500 | Dec.31 | $22,500 |

| Bal. | $0 | ||

| Supplies | |||

| Jan.1 | $0 | ||

| Jun.16 | $12,100 | ||

| Bal. | $9,800 | ||

| Total | $2,300 | ||

| Salaries payable | |||

| Jan. 1 | $0 | ||

| Dec.31 | $1,500 | ||

| Common stock | |||

| Jan. 1 | $100,000 | ||

| Apr.30 | $30,000 | ||

| Bal. | $130,000 | ||

|

Service revenue | |||

| Jan.1 | $0 | ||

| Jan.12 | $62,400 | ||

| Dec.31 | 137,700 | Feb.25 | $75,300 |

| Bal. | $0 | ||

| Interest expense | |||

| Jan.1 | $0 | ||

| Dec.30 | $2,500 | Dec.31 | $2,500 |

| Bal. | $0 | ||

Table (12)

11.

Prepare a post-closing trial balance of Company J.

11.

Explanation of Solution

Post-closing trial balance of Company J is as follows:

| Company J | ||

| Adjusted Trial Balance | ||

| December 31, 2021 | ||

| Accounts | Debit Amount($) | Credit Amount($) |

| Cash | 91,600 | |

| Accounts Receivable | 42,400 | |

| Supplies | 2,300 | |

| Land | 110,800 | |

| Account payable | 16,000 | |

| Salaries payable | 1,500 | |

| Interest payable | 2,500 | |

| Notes payable | 30,000 | |

| Common stock | 130,000 | |

| Retained earnings | 67,000 | |

| Total | $247,100 | $247,100 |

Table (13)

Therefore, the total of debit, and credit columns of post-closing trial balance is $247,100.

Want to see more full solutions like this?

Chapter 3 Solutions

FIN ACC W/ CONNECT & PROCTORIO >BI<

- In 2022, North Shore Community College had a total student body that was 5% more than in 2021, which was 5% more than in 2020. The enrollment in 2022 was 4,200. How many students attended the college in 2021? How many students attended the college in 2020?arrow_forwardWhen iam uploading it getting blurr comment i will write values. Don't answer with incorrect dataarrow_forwardSolve correctly if image is blurry comment..arrow_forward

- If data is not clear please commentarrow_forwardPlease don't use AI And give correct answer .arrow_forwardLouisa Pharmaceutical Company is a maker of drugs for high blood pressure and uses a process costing system. The following information pertains to the final department of Goodheart's blockbuster drug called Mintia. Beginning work-in-process (40% completed) 1,025 units Transferred-in 4,900 units Normal spoilage 445 units Abnormal spoilage 245 units Good units transferred out 4,500 units Ending work-in-process (1/3 completed) 735 units Conversion costs in beginning inventory $ 3,250 Current conversion costs $ 7,800 Louisa calculates separate costs of spoilage by computing both normal and abnormal spoiled units. Normal spoilage costs are reallocated to good units and abnormal spoilage costs are charged as a loss. The units of Mintia that are spoiled are the result of defects not discovered before inspection of finished units. Materials are added at the beginning of the process. Using the weighted-average method, answer the following question: What are the…arrow_forward

- General accountingarrow_forwardFinancial accounting questionarrow_forwardOn November 30, Sullivan Enterprises had Accounts Receivable of $145,600. During the month of December, the company received total payments of $175,000 from credit customers. The Accounts Receivable on December 31 was $98,200. What was the number of credit sales during December?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education