Subpart (a):

The production possibility frontier .

Subpart (a):

Explanation of Solution

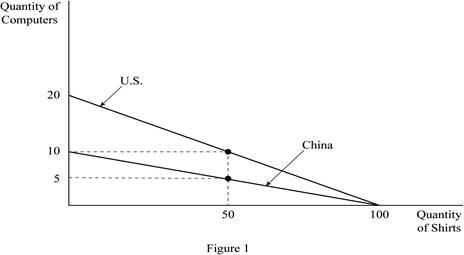

Figure -1 illustrates production possibility frontier.

Figure 1 shows the production possibilities frontiers for the two countries; U.S. and China. In Figure 1, the horizontal axis measures the quantity of shirts produced by both the countries and the vertical axis measures the quantity of computers produced. If either worker of the two countries, that is an American or a Chinese worker devotes all his labor hours in producing shirts, each worker can produce 100 shirts in a year. Then, it is the vertical intercept of the PPF for both the American and the Chinese worker. If they devote all of their time to the production of computers, then the U.S. worker can produce 20 computers in a year, while the Chinese worker can produce only 10 computers per year. These are the horizontal intercepts of the PPF for the U.S. and the Chinese worker, respectively. Since the

Concept introduction:

Production possibility frontier (PPF): PPF is a curve depicting all maximum output possibilities for two goods, given a set of inputs consisting of resources and other factors.

Subpart (b):

Opportunity cost and price of the good.

Subpart (b):

Explanation of Solution

To determine the export pattern of shirts, the

Opportunity cost of shirts in the U.S. is calculated as,

Thus, the price of 1 shirt in the U.S. is 0.2 computers.

Opportunity cost of shirts in China is calculated as,

Thus, the price of 1 shirt in China is 0.1 computers.

Since China has a lower opportunity cost of shirts, China has a comparative advantage in its production. So, China will produce and export shirts to the U.S. in exchange for computers from the U.S. since the latter has a comparative advantage in the production of computers (5 shirts

The range of prices of shirts at which trade can occur is between 0.1 and 0.2 computers, per computer.

An example would be a price of 0.15 computers. Suppose China produced only shirts (100 shirts) and exported 50 shirts in exchange for 7.5

The United States is also benefited from this trade. Suppose American workers produced only computers (20 computers) and traded 7.5 of computers to China for 50 shirts. The U.S. would have 12.5 (20-7.5) computers and 50 shirts. Thus, the U.S. would be better off than before trade (10 computers and 50 shirts).

Concept introduction:

Production possibility frontier (PPF): PPF is a curve depicting all maximum output possibilities for two goods, given a set of inputs consisting of resources and other factors.

Opportunity cost: Opportunity cost is the cost of foregone alternative, that is, loss of an alternative when another alternative is chosen.

Comparative advantage: It refers to the ability to produce a good at a lower opportunity cost than another producer.

Subpart (c):

Opportunity cost and price of the good.

Subpart (c):

Explanation of Solution

For the calculation of price, the calculation of opportunity cost is required.

Opportunity cost of a computer in the U.S. is calculated as,

Thus, the price of 1 computer in the U.S. is 5 shirts.

Opportunity cost of a computer in China is calculated as,

Thus, the price of 1 computer in China is 10 shirts.

The range of prices of computers at which trade can occur is between 5 and 10 shirts per computer. This is because, at a price lower than 5 shirts, the U.S. will choose to produce its own shirts and will be unwilling to export computers, as the opportunity cost of a shirt for the U.S. is 0.2

Concept introduction:

Production possibility frontier (PPF): PPF is a curve depicting all maximum output possibilities for two goods, given a set of inputs consisting of resources and other factors.

Opportunity cost: Opportunity cost is the cost of foregone alternative, that is, loss of an alternative when another alternative is chosen.

Comparative advantage: It refers to the ability to produce a good at a lower opportunity cost than another producer.

Subpart (d):

Gains from the trade.

Subpart (d):

Explanation of Solution

Concept introduction:

Specialization: Specialization refers to allocate the work according to their efficiency. If an individual, company or country has produced a good at lower opportunity cost, then that particular individual, company or country should produce those goods.

Trade: The trade refers to the exchange of capital, goods, and services across different countries.

Want to see more full solutions like this?

Chapter 3 Solutions

Bundle: Principles of Microeconomics, 7th + LMS Integrated Aplia, 1 term Printed Access Card

- 17. Given that C=$700+0.8Y, I=$300, G=$600, what is Y if Y=C+I+G?arrow_forwardUse the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all. Write explanation in paragraphs and if you use currency use USD currency: 10. What is the mechanism or process that allows the expenditure multiplier to “work” in theKeynesian Cross Model? Explain and show both mathematically and graphically. What isthe underpinning assumption for the process to transpire?arrow_forwardUse the Feynman technique throughout. Assume that you’reexplaining the answer to someone who doesn’t know the topic at all. Write it all in paragraphs: 2. Give an overview of the equation of exchange (EoE) as used by Classical Theory. Now,carefully explain each variable in the EoE. What is meant by the “quantity theory of money”and how is it different from or the same as the equation of exchange?arrow_forward

- Zbsbwhjw8272:shbwhahwh Zbsbwhjw8272:shbwhahwh Zbsbwhjw8272:shbwhahwhZbsbwhjw8272:shbwhahwhZbsbwhjw8272:shbwhahwharrow_forwardUse the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all:arrow_forwardUse the Feynman technique throughout. Assume that you’reexplaining the answer to someone who doesn’t know the topic at all: 4. Draw a Keynesian AD curve in P – Y space and list the shift factors that will shift theKeynesian AD curve upward and to the right. Draw a separate Classical AD curve in P – Yspace and list the shift factors that will shift the Classical AD curve upward and to the right.arrow_forward

- Use the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all: 10. What is the mechanism or process that allows the expenditure multiplier to “work” in theKeynesian Cross Model? Explain and show both mathematically and graphically. What isthe underpinning assumption for the process to transpire?arrow_forwardUse the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all: 15. How is the Keynesian expenditure multiplier implicit in the Keynesian version of the AD/ASmodel? Explain and show mathematically. (note: this is a tough one)arrow_forwardUse the Feynman technique throughout. Assume that you’re explaining the answer to someone who doesn’t know the topic at all: 13. What would happen to the net exports function in Europe and the US respectively if thedemand for dollars rises worldwide? Explain why.arrow_forward

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co

Economics Today and Tomorrow, Student EditionEconomicsISBN:9780078747663Author:McGraw-HillPublisher:Glencoe/McGraw-Hill School Pub Co Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax