Managerial Accounting

17th Edition

ISBN: 9781260247787

Author: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 8E

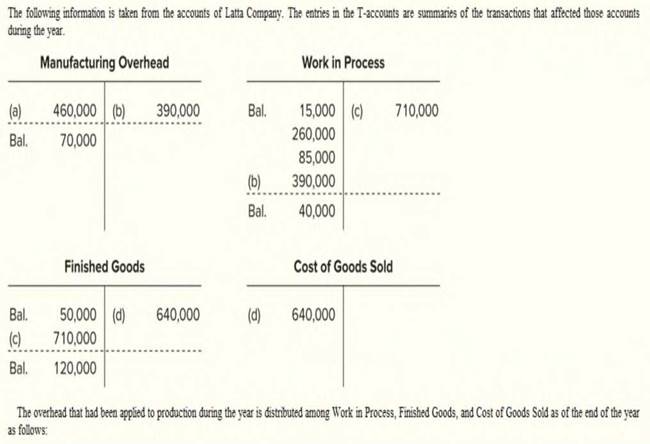

EXERCISE 3-8 Applying

Work in Process, ending....................$19.500

Finished Goods, ending....................58,500

Cost of Goods Sold....................312.000

Overhead applied....................$390.0::

For example, of the $40,000 ending balance in Work in Process, $19,500 was overhead that had been applied during the year.

Required:

- Identify' reasons for entries (a) through (d).

- Assume that the underapplied or overapplied overhead is closed to Cost of Goods Sold. Prepare the necessary

journal entry . - Assume that the underapplied or overapplied overhead is closed proportionally' to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the necessary journal entry. Provide supporting computations.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need help finding the accurate solution to this financial accounting problem with valid methods.

I am looking for help with this general accounting question using proper accounting standards.

Can you explain this financial accounting question using accurate calculation methods?

Chapter 3 Solutions

Managerial Accounting

Ch. 3.A - EXERCISE 3A-1 Transaction Analysis LO3-5 Carmen...Ch. 3.A - EXERCISE 3A-2 Transaction Analysis LO3-5 Adams...Ch. 3.A - EXERCISE 3A-3 Transaction Analysis LO3-5 Dixon...Ch. 3.A - PROBLEM 3A-4 Transaction Analysis LO3-5 Morrison...Ch. 3.A - PROBLEM 3A-5 Transaction Analysis LO3-5 Star...Ch. 3.A -

PROBLEM 3A-6 Transaction Analysis LO3-5

Brooks...Ch. 3 - Prob. 1QCh. 3 - Prob. 2QCh. 3 - What is underapplied overhead Overapplied...Ch. 3 - 3-4 Provide two reasons why overhead might be...

Ch. 3 - Prob. 5QCh. 3 - How do you compute the raw materials used in...Ch. 3 - Prob. 7QCh. 3 - How do you compute the cost of goods manufactured?Ch. 3 - Prob. 9QCh. 3 - Prob. 10QCh. 3 - Prob. 1AECh. 3 - Prob. 2AECh. 3 - Prob. 3AECh. 3 - Prob. 4AECh. 3 - Prob. 1F15Ch. 3 - Prob. 2F15Ch. 3 - Bunnell Corporation is a manufacturer that uses...Ch. 3 - Prob. 4F15Ch. 3 - Prob. 5F15Ch. 3 - Bunnell Corporation is a manufacturer that uses...Ch. 3 - Prob. 7F15Ch. 3 - Prob. 8F15Ch. 3 - Prob. 9F15Ch. 3 - Prob. 10F15Ch. 3 - Bunnell Corporation is a manufacturer that uses...Ch. 3 - Prob. 12F15Ch. 3 - Prob. 13F15Ch. 3 - Prob. 14F15Ch. 3 - Prob. 15F15Ch. 3 - EXERCISE 3-1 Prepare Journal Entries LO3-1 Lamed...Ch. 3 - Prob. 2ECh. 3 - EXERCISE 3-3 Schedules of Cost of Goods...Ch. 3 - EXERCISE 3-4 Underapplied and Overapplied Overhead...Ch. 3 - Prob. 5ECh. 3 - EXERCISE 3-6 Schedules of Cost of Goods...Ch. 3 - (

$

15,000...Ch. 3 - EXERCISE 3-8 Applying Overhead: Journal Entries;...Ch. 3 - Prob. 9ECh. 3 - Prob. 10ECh. 3 -

PROBLEM 3-11: T-Account Analysis of Cost Flows...Ch. 3 - Prob. 12PCh. 3 - PROBLEM 3-13 Schedules of Cost of Goods...Ch. 3 - Prob. 14PCh. 3 -

PROBLEM 3-15 Journal Entries; T-Accounts;...Ch. 3 - Prob. 16PCh. 3 - Prob. 17PCh. 3 - Prob. 18C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain the correct approach for solving this financial accounting question.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forward

- I need assistance with this general accounting question using appropriate principles.arrow_forwardCan you explain this financial accounting question using accurate calculation methods?arrow_forwardCan you help me solve this financial accounting question using valid financial accounting techniques?arrow_forward

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Cost Classifications - Managerial Accounting- Fixed Costs Variable Costs Direct & Indirect Costs; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=QQd1_gEF1yM;License: Standard Youtube License