Concept explainers

1. and 2.

Prepare the T-accounts.

1. and 2.

Explanation of Solution

T-account: An account is referred to as a T-account, because the alignment of the components of the account resembles the capital letter ‘T’. An account consists of the three main components which are as follows:

- The title of the account

- The left or debit side

- The right or credit side

Post the unadjusted balances and the

Cash account:

| Cash | |||

| 76,000 | |||

| Balance | 76,000 | ||

| Accounts Receivable | |||

| 15,000 | |||

| Balance | 15,000 | ||

Supplies account:

| Supplies | |||

| 27,000 | |||

| 22,000 | |||

| Balance | 5,000 | ||

Prepaid insurance account:

| Prepaid insurance | |||

| 24,000 | |||

| 20,000 | |||

| Balance | 4,000 | ||

Equipment account:

| Equipment | |||

| 95,000 | |||

| Balance | 95,000 | ||

| Accumulated depreciation | |||

| 37,000 | |||

| 10,000 | |||

| Balance | 47,000 | ||

Accounts Payable account:

| Accounts Payable | |||

| 12,000 | |||

| Balance | 12,000 | ||

Salaries Payable account:

| Salaries Payable | |||

| 0 | |||

| 4,000 | |||

| Balance | 4,000 | ||

Interest Payable account:

| Interest Payable | |||

| 0 | |||

| 1,000 | |||

| Balance | 1,000 | ||

Notes Payable account:

| Notes Payable | |||

| 35,000 | |||

| Balance | 35,000 | ||

Deferred revenue account:

| Deferred revenue | |||

| 15,000 | 60,000 | ||

| Balance | 45,000 | ||

Common Stock account:

| Common Stock | |||

| 35,000 | |||

| Balance | 35,000 | ||

| Retained Earnings | |||

| 10,000 | |||

| Balance | 10,000 | ||

Dividends account:

| Dividends | |||

| 3,000 | |||

| Balance | 3,000 | ||

Service Revenue account:

| Service Revenue | |||

| 227,000 | |||

| 15,000 | |||

| Balance | 242,000 | ||

Insurance Expense account:

| Insurance Expense | |||

| 0 | |||

| 20,000 | |||

| Balance | 20,000 | ||

Depreciation Expense account:

| Depreciation Expense | |||

| 0 | |||

| 10,000 | |||

| Balance | 10,000 | ||

Salaries Expense account:

| Salaries Expense | |||

| 164,000 | |||

| 4,000 | |||

| Balance | 168,000 | ||

Utilities Expense account:

| Utilities Expense | |||

| 12,000 | |||

| 0 | |||

| Balance | 12,000 | ||

Interest Expense account:

| Interest Expense | |||

| 0 | |||

| 1,000 | |||

| Balance | 1,000 | ||

Supplies Expense account:

| Supplies Expense | |||

| 0 | |||

| 22,000 | |||

| Balance | 22,000 | ||

3.

Prepare an adjusted

3.

Explanation of Solution

Trial balance: Trial balance is a summary of all the ledger accounts balances presented in a tabular form with two column, debit and credit. It checks the mathematical accuracy of the

Prepare an adjusted trial balance for the year ending December 31, 2021:

| Company JA | ||

| Adjusted Trial Balance | ||

| For the Year Ending December 31, 2021 | ||

| Accounts | Debit ($) | Credit ($) |

| Cash | 76,000 | |

| Accounts Receivable | 15,000 | |

| Supplies | 5,000 | |

| Prepaid Insurance | 4,000 | |

| Equipment | 95,000 | |

| Accumulated | 47,000 | |

| Accounts Payable | 12,000 | |

| Salaries Payable | 4,000 | |

| Deferred Revenue | 45,000 | |

| Interest Payable | 1,000 | |

| Notes Payable | 35,000 | |

| Common Stock | 35,000 | |

| Retained Earnings | 10,000 | |

| Dividends | 3,000 | |

| Service Revenue | 242,000 | |

| Salaries Expense | 168,000 | |

| Depreciation Expense | 10,000 | |

| Insurance Expense | 20,000 | |

| Supplies Expense | 22,000 | |

| Utilities Expense | 12,000 | |

| Interest Expense | 1,000 | |

| Total | $431,000 | $431,000 |

Table (1)

4.

Prepare an income statement, statement of shareholders’ equity, and a classified balance sheet for the year ended December 31, 2021.

4.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare an income statement for the year ended December 31, 2021:

| Company JA | ||

| Income statement | ||

| For the Year Ending December 31, 2021 | ||

| Details | Amount ($) | Amount ($) |

| Revenues: | ||

| Service Revenue | 242,000 | |

| Total Revenue | 242,000 | |

| Less: Expenses | ||

| Salaries expense | 168,000 | |

| Depreciation expense | 10,000 | |

| Insurance expense | 20,000 | |

| Supplies expense | 22,000 | |

| Utilities expense | 12,000 | |

| Interest expense | 1,000 | |

| Total Expenses | (233,000) | |

| Net Income | $9,000 | |

Table (2)

Statement of Stockholders’ Equity: Stockholders’ equity statement shows the changes made in the stockholders’ equity account and in the total stockholders’ equity during the accounting period. It is otherwise known as statements of shareholder’s investment.

Prepare statement of stockholders’ equity the year ended December 31, 2021.

| Company JA | |||

| Statement of Stockholders’ Equity | |||

| For the Year Ended December 31, 2021 | |||

| Particulars | Common Stock | Retained Earnings | Total Stockholders’ Equity |

| Beginning balance | $35,000 | $10,000 | $45,000 |

| Issuance of common stock | $0 | $0 | $0 |

| Less: Net income for 2021 | $0 | $9,000 | $9,000 |

| Less: Dividends | $0 | ($3,000) | ($3,000) |

| Ending balance | $35,000 | $16,000 | $51,000 |

Table (3)

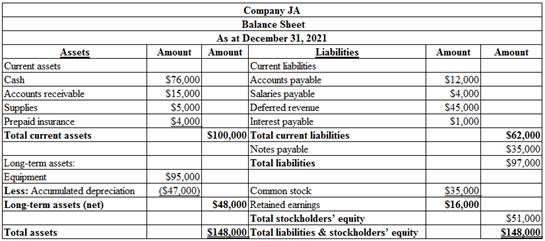

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and claims of stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet as of December 31, 2021.

Table (4)

5.

Prepare the closing entries.

5.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare the closing entry for revenue account.

| Date | Accounts title and explanation | Debit ($) |

Credit ($) |

| December 31, 2021 | Service Revenues | 242,000 | |

| Retained Earnings | 242,000 | ||

| (To close the revenues account) |

Table (5)

In this closing entry, service revenue account is closed by transferring the amount of service revenue to the retained earnings account in order to bring the revenue account balance to zero. Hence, debit the service revenue account and credit retained earnings account.

Prepare the closing entry for expense account:

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| December 31, 2021 | Retained Earnings | 233,000 | ||

| Salaries expense | 168,000 | |||

| Depreciation expense | 10,000 | |||

| Insurance expense | 20,000 | |||

| Supplies expense | 22,000 | |||

| Utilities expense | 12,000 | |||

| Interest expense | 1,000 | |||

| (To close the expenses account) |

Table (6)

In this closing entry, all the expenses account is closed by transferring the amount of expenses to the retained earnings in order to bring the expenses account balance to zero. Hence, debit the retained earnings account and credit all expenses account.

Prepare the closing entry for dividend account:

| Date | Accounts title and explanation | Debit ($) |

Credit ($) |

| December 31, 2021 | Retained Earnings | 3,000 | |

| Dividends | 3,000 | ||

| (To close the dividends account) |

Table (7)

In this closing entry, the dividends account is closed by transferring the amount of dividends to the retained earnings in order to bring the dividends account balance to zero. Hence, debit the retained earnings account and credit dividends account.

6.

Prepare the T-Accounts to post the closing entries.

6.

Explanation of Solution

Retained Earnings account:

| Retained Earnings | |||

| 10,000 | |||

| 233,000 | 242,000 | ||

| 3,000 | |||

| Balance | 16,000 | ||

Service Revenue account:

| Service Revenue | |||

| 242,000 | |||

| 242,000 | |||

| Balance | 0 | ||

Dividends account:

| Dividends | |||

| 3,000 | |||

| 3,000 | |||

| Balance | 0 | ||

Salaries Expense account:

| Salaries Expense | |||

| 164,000 | |||

| 4,000 | 168,000 | ||

| Balance | 0 | ||

Depreciation expense account:

| Depreciation expense | |||

| 0 | |||

| 10,000 | 10,000 | ||

| Balance | 0 | ||

Insurance Expense account:

| Insurance Expense | |||

| 0 | |||

| 20,000 | 20,000 | ||

| Balance | 0 | ||

Supplies Expense account:

| Supplies Expense | |||

| 0 | |||

| 22,000 | 22,000 | ||

| Balance | 0 | ||

Utilities Expense account:

| Utilities Expense | |||

| 12,000 | |||

| 12,000 | |||

| Balance | 0 | ||

Interest Expense account:

| Interest Expense | |||

| 0 | |||

| 1,000 | 1,000 | ||

| Balance | 0 | ||

7.

Prepare the post-closing trial balance.

7.

Explanation of Solution

Post-closing trial balance: It is a trial balance that is prepared after the closing entries are recorded. It includes only the balance sheet accounts as the income statement accounts are closed to the income summary.=

Prepare a post-closing trial balance.

| Company JA | ||

| Post-Closing Trial Balance | ||

| For the Year Ended December 31, 2021 | ||

| Accounts |

Debit ($) |

Credit ($) |

| Cash | 76,000 | |

| Accounts Receivable | 15,000 | |

| Supplies | 5,000 | |

| Prepaid Insurance | 4,000 | |

| Equipment | 95,000 | |

| Accumulated Depreciation | 47,000 | |

| Accounts Payable | 12,000 | |

| Salaries Payable | 4,000 | |

| Deferred Revenue | 45,000 | |

| Interest Payable | 1,000 | |

| Notes Payable | 35,000 | |

| Common Stock | 35,000 | |

| Retained Earnings | 16,000 | |

| Total | $195,000 | $195,000 |

Table (8)

Want to see more full solutions like this?

Chapter 3 Solutions

FINANCIAL ACCOUNTING

- Financial Accountingarrow_forwardHayden Manufacturing computes its predetermined overhead rate annually on the basis of direct labor hours. At the beginning of the year, it was estimated that 40,000 direct labor hours would be required for the period's estimated level of production. The company also estimated $520,000 of fixed manufacturing overhead expenses for the coming period and variable manufacturing overhead of $4 per direct labor hour. Hayden's actual manufacturing overhead for the year was $684,000, and its actual total direct labor was 41,200 hours. Required: Compute the company's predetermined overhead rate for the year.arrow_forwardGeneral accounting question and right solutionarrow_forward

- I need help with this solution and general accountingarrow_forwardSuppose the required reserve ratio is 0.20 and individuals hold no cash. Total bank deposits are $150 million, and the banks hold $40 million in reserves. How much more money can the bank create if it does not hold excess reserves?arrow_forwardElena gives stock to Jake that has a tax basis of $4,500. At the time of the gift, the stock is worth only $3,800. Jake later sells the stock for $5,000. What amount of gain must Jake report on the sale?arrow_forward

- No ai if image is blurr or value is not showing properly. please comment below i will write values. if you answer with incorrect values i will give unhelpful confirm.arrow_forwardCould you explain the steps for solving this financial accounting question accurately?arrow_forwardChang Company uses a standard costing system. In August, 7,960 actual labor hours were worked at a rate of $17.55 per hour. The standard number of hours is 6,350 and the standard wage rate is $15.45 per hour. Determine the Labor Rate and Variance Labor Efficiency Variance.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education