Financial Modeling

Three entrepreneurs were looking to start a new brewpub near Sacramento, California, called Roseville Brewing Company (RBC). Brewpubs provide two products to customers—food from the restaurant segment and freshly brewed beer from the beer production segment. Both segments are typically in the same building, which allows customers to see the beer-brewing process.

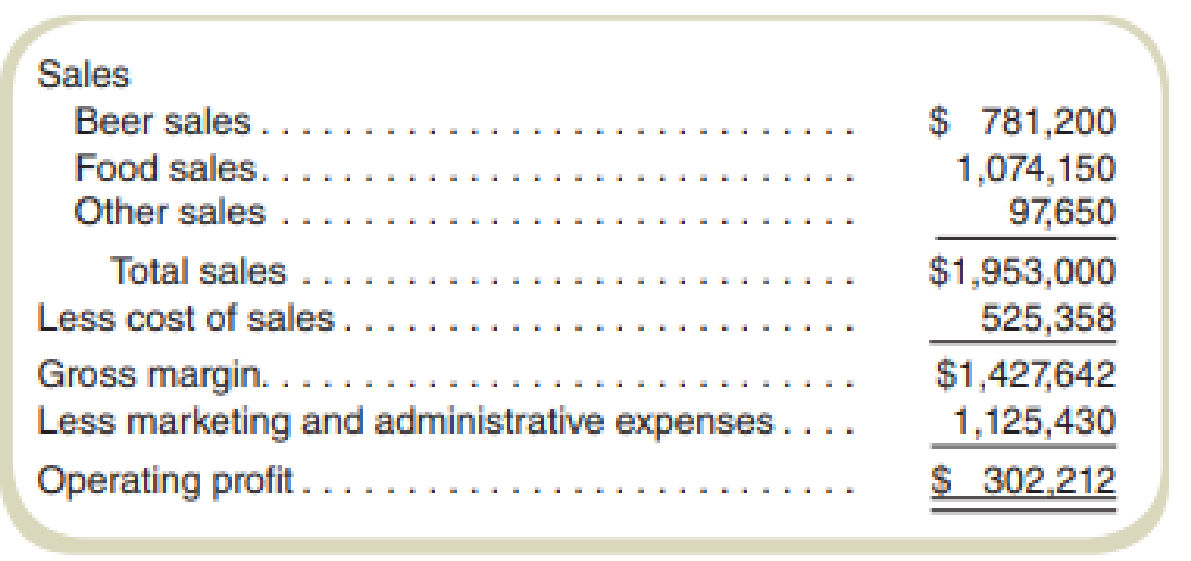

After months of research, the owners created a financial model that showed the following projections for the first year of operations:

In the process of pursuing capital through private investors and financial institutions, RBC was approached with several questions. The following represents a sample of the more common questions asked:

- What is the break-even point?

- What sales dollars will be required to make $200,000? To make $500,000?

- Is the product mix reasonable? (Beer tends to have a higher contribution margin ratio than food, and therefore product mix assumptions are critical to profit projections.)

- What happens to operating profit if the product mix shifts?

- How will changes in price affect operating profit?

- How much does a pint of beer cost to produce?

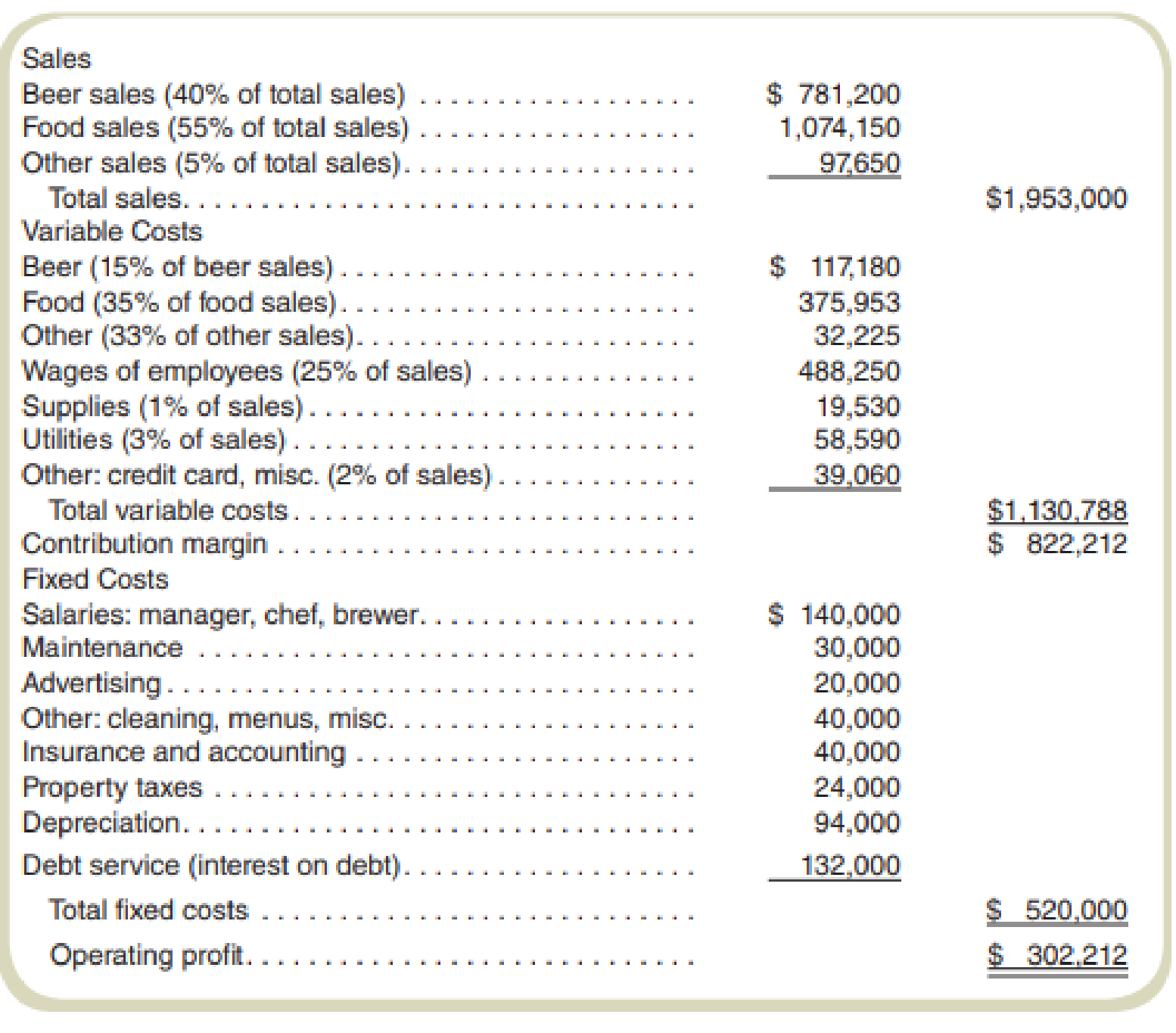

It became clear to the owners of RBC that the initial financial model was not adequate for answering these types of questions. After further research, RBC created another financial model that provided the following information for the first year of operations:

Required

- a. What were potential investors and financial institutions concerned with when asking the questions listed in the case?

- b. Why was the first financial model prepared by RBC inappropriate for answering most of the questions asked by investors and bankers? Be specific.

- c. If you were deciding whether to invest in RBC, how would you quickly check the reasonableness of RBC’s projected operating profit?

- d. Why is the question “How much does a pint of beer cost to produce?” difficult to answer?

- e. Perform a sensitivity analysis by answering the following questions:

- 1. What is the break-even point in sales dollars for RBC?

- 2. What is the margin of safety for RBC?

- 3. Why can’t RBC find the break-even point in units?

- 4. What sales dollars would be required to achieve an operating profit of $200,000? $500,000? What assumptions are made in this calculation?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

FUNDAMENTALS OF COST ACCOUNTING

- Dear tutor. I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardno aiWhich of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forwardDon't use chatgpt Which of the following errors will not be detected by a trial balance?A. Debiting cash instead of accounts receivableB. Recording revenue twiceC. Failing to record a transactionD. A $100 debit matched with a $100 creditarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understated i need help in this question quiarrow_forwardI need correct answer 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forwardNo chatgpt 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedneed anarrow_forwardNo ai 7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward7. If inventory is overstated at year-end, which of the following is true?A. Net income is understatedB. Expenses are overstatedC. Net income is overstatedD. Assets are understatedarrow_forward

- I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forwardDevelopment costs in preparing the mine $ 3,400,000 Mining equipment 159,600 Construction of various structures on site 77,900 After the minerals are removed from the mine, the equipment will be sold for an estimated residual value of $12,000. The structures will be torn down. Geologists estimate that 820,000 tons of ore can be extracted from the mine. After the ore is removed, the land will revert back to the state of New Mexico. The contract with the state requires Hecala to restore the land to its original condition after mining operations are completed in approximately four years. Management has provided the following possible outflows for the restoration costs: Cash Outflow Probability $ 620,000 40% 720,000 30% 820,000 30% Hecala’s credit-adjusted risk-free interest rate is 7%. During 2024, Hecala extracted 122,000 tons of ore from the mine. The company’s fiscal year ends on December 31. Required: Determine the amount at which Hecala will record the mine. Calculate the…arrow_forwardI mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning