Concept explainers

1.

To prepare: Ledger account, according to balance column format.

1.

Explanation of Solution

Cash Acct. No. 101 Cash Acct. No. 101 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Office Supplies Acct. No. 124 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Prepaid Insurance Acct. No. 128 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Buildings Acct. No. 173 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Salaries Payable Acct. No. 209 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Common Stock Acct. No. 307 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Dividends Acct. No. 319 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Storage Fees Earned Acct. No. 406 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Depreciation ExpenseBuildings Acct. No. 606 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Salaries Expense Acct. No. 622 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Insurance Expense Acct. No. 637 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Rent Expense Acct. No. 640 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Office Supplies Expense Acct. No. 650 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Repairs Expense Acct. No. 684 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Telephone expense Acct. No. 688 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Income Summary Acct. No. 901 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

2.

To prepare: Journal

2.

Explanation of Solution

Prepare journal entries.

Common Stock issued in exchange for Cash and Computer Equipment.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| July 1 | Cash | 30,000 | ||

| Buildings | 150,000 | |||

| Common Stock | 180,000 | |||

| (Being common stock issued in exchange for cash and building ) |

Rent paid for one month worth $2,000.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| July 2 | Rent Expense | 2,000 | ||

| Cash | 2,000 | |||

| (Being rent paid for the first month)) |

Office Supplies Worth $2,400 purchased for cash.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| July 3 | Office Supplies | 2,400 | ||

| Cash | 2,400 | |||

| (Being Office supplies worth $2,400 purchased) |

Insurance purchased worth$7,200 for cash.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| July 10 | Prepaid Insurance | 7,200 | ||

| Cash | 7,200 | |||

| (Being Insurance purchased) |

Salary Expense worth $1,000 paid for two weeks of work.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| July 14 | Salary Expense | 1,000 | ||

| Cash | 1,000 | |||

| (Being Salary paid for two weeks of work) |

Storage fees worth of $9,800 is received from customers.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| July 24 | Cash | 9,800 | ||

| Storage fees earned | 9,800 | |||

| (Being storage fees received from customers) |

Salary Expense worth $1,000 paid for two weeks of work.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| July 28 | Salary Expense | 1,000 | ||

| Cash | 1,000 | |||

| (Being Salary paid for two weeks of work) |

Cash worth $950 used for repairs of company’ computer.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| July 29 | Repair Expense | 950 | ||

| Cash | 950 | |||

| (Being cash spend on repairs) |

Telephone expenses paid by company worth $400

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| July 30 | Telephone Expense | 400 | ||

| Cash | 400 | |||

| (Being telephone expenses paid) |

Dividend paid by company worth $2,000

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| July 31 | Dividends | 2,000 | ||

| Cash | 2,000 | |||

| (Being dividend paid by company) |

Posting of journal entries to ledger account:

| Cash Acct. No. 101 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 1 | Common Stock | 30,000 | 30,000 | ||

| July 2 | Rent Expenses | 2,000 | 28,000 | ||

| July 3 | Office supplies | 2,400 | 25,600 | ||

| July 10 | Prepaid Insurance | 7,200 | 18,400 | ||

| July 14 | Salary Expense | 1,000 | 17,400 | ||

| July 24 | Storage fees earned | 9,800 | 27,200 | ||

| July 28 | Salary Expense | 1,000 | 26,200 | ||

| July 29 | Repair Expense | 950 | 25,250 | ||

| July 30 | Telephone Expense | 400 | 24,850 | ||

| July 31 | Dividend | 2,000 | 22,850 |

The ending balance is $22,850.

| Accounts Receivable Acct. No. 106 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Office Supplies Acct. No. 124 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 3 | Cash | 2,400 | 2,400 |

The ending balance is $2,400.

| Prepaid Insurance Acct. No. 128 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 10 | Cash | 7,200 | 7,200 |

The ending balance is $7,200.

| Buildings Acct. No. 173 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 1 | Common stock | 150,000 | 150,000 |

The ending balance is $150,000.

| Accumulated | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Salaries Payable Acct. No. 209 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Common Stock Acct. No. 307 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 1 | Cash | 30,000 | 30,000 | ||

| July 1 | Buildings | 150,000 | 180,000 |

The ending balance is $180,000.

| Retained Earnings Acct. No. 318 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Dividends Acct. No. 319 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Cash | 2,000 | 2,000 |

The ending balance is $2,000.

| Storage Fees Earned Acct. No. 406 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 24 | Cash | 9,800 | 9,800 |

The ending balance is $9,800.

| Depreciation ExpenseBuildings Acct. No. 606 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Salaries Expense Acct. No. 622 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 14 | Cash | 1,000 | 1,000 | ||

| July 28 | Cash | 1,000 | 2,000 |

The ending balance is $2,000.

| Insurance Expense Acct. No. 637 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Rent Expense Acct. No. 640 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 2 | Cash | 2,000 | 2,000 |

The ending balance is $2,000.

| Office Supplies Expense Acct. No. 650 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Repairs Expense Acct. No. 684 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 29 | Cash | 950 | 950 |

The ending balance is $950.

| Telephone expense Acct. No. 688 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 30 | Cash | 400 | 400 |

The ending balance is $400.

| Income Summary Acct. No. 901 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

3.

To prepare: An unadjusted

3.

Explanation of Solution

| S.S. Company | ||

| Unadjusted Trial Balance | ||

| As on April 30, 2017 | ||

| Particulars | Debit($) | Credit($) |

| Cash | 22,850 | |

| Accounts Receivable | 0 | |

| Office Supplies | 2,400 | |

| Prepaid Insurance | 7,200 | |

| Building | 150,000 | |

| Accumulated Depreciation-Building | 0 | |

| Salaries Payable | 0 | |

| Common Stock | 180,000 | |

| Retained earnings | 0 | |

| Dividends | 2,000 | |

| Storage fees earned | 9,800 | |

| Depreciation Expense-Building | 0 | |

| Salaries Expenses | 2,000 | |

| Rent Expenses | 2,000 | |

| Office Supply Expense | 0 | |

| Repairs Expenses | 950 | |

| Telephone Expense | 400 | |

| Insurance Expense | 0 | |

| Income Summary | 0 | |

| Total | 189,800 | 189,800 |

Thus, the total of unadjusted trial balance on 31th July, 2017 is $189,800.

4.

To prepare: Adjusting entry.

4.

Explanation of Solution

a.

| Date | Particulars | Post ref | Debit($) | Credit($) |

| July 31 | Insurance Expense | 400 | ||

| Prepaid Insurance | 400 | |||

| (Being insurance coverage worth $400has expired) |

b.

| Date | Particulars | Post ref | Debit($) | Credit($) |

| July 31 | Office Supplies Expense | 875 | ||

| Office Supply | 875 | |||

| (Being $875 worth of office Supplies got exhausted) |

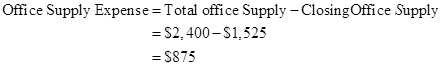

Working note:

Calculation of office supply expense,

c.

| Date | Particulars | Post ref | Debit($) | Credit($) |

| July 31 | Depreciation Expense | 1,500 | ||

| Accumulated Depreciation-Building | 1,500 | |||

| (Being depreciation is recorded) |

d.

| Date | Particulars | Post ref | Debit($) | Credit($) |

| July 31 | Salary Expense | 100 | ||

| Salary Payable | 100 | |||

| (Being salaries worth $100 due to be paid) |

e.

| Date | Particulars | Post ref | Debit($) | Credit($) |

| July 31 | Accounts Receivable | 1,150 | ||

| Storage fees earned | 1,150 | |||

| (Being storage fees earned but not received yet) |

Posting of

| Cash Acct. No. 101 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 1 | Common Stock | 30,000 | 30,000 | ||

| July 2 | Rent Expenses | 2,000 | 28,000 | ||

| July 3 | Office supplies | 2,400 | 25,600 | ||

| July 10 | Prepaid Insurance | 7,200 | 18,400 | ||

| July 14 | Salary Expense | 1,000 | 17,400 | ||

| July 24 | Storage fees earned | 9,800 | 27,200 | ||

| July 28 | Salary Expense | 1,000 | 26,200 | ||

| July 29 | Repair Expense | 950 | 25,250 | ||

| July 30 | Telephone Expense | 400 | 24,850 | ||

| July 31 | Dividend | 2,000 | 22,850 |

The ending balance is $22,850.

| Accounts Receivable Acct. No. 106 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Storage fees earned | 1,150 | 1,150 |

The ending balance is $1,150.

| Office Supplies Acct. No. 124 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 3 | Cash | 2,400 | 2,400 | ||

| July 31 | Office supplies expense | 875 | 1,525 |

The ending balance is $1,525.

| Prepaid Insurance Acct. No. 128 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 10 | Cash | 7,200 | 7,200 | ||

| July 31 | Insurance expense | 400 | 6,800 |

The ending balance is $6,800.

| Buildings Acct. No. 173 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 1 | Common stock | 150,000 | 150,000 |

The ending balance is $150,000.

| Accumulated depreciation Buildings Acct. No. 174 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Depreciation expense | 1,500 | 1,500 |

The ending balance is $1,500.

| Salaries Payable Acct. No. 209 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Salary expense | 100 | 100 |

The ending balance is $100.

| Common Stock Acct. No. 307 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 1 | Cash | 30,000 | 30,000 | ||

| July 1 | Buildings | 150,000 | 180,000 |

The ending balance is $180,000.

| Retained Earnings Acct. No. 318 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Dividends Acct. No. 319 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Cash | 2,000 | 2,000 |

The ending balance is $2,000.

| Storage Fees Earned Acct. No. 406 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 24 | Cash | 9,800 | 9,800 | ||

| July 31 | Accounts receivable | 1,150 | 10,950 |

The ending balance is $10,950.

| Depreciation ExpenseBuildings Acct. No. 606 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Accumulated depreciation-Buildings | 1,500 | 1,500 |

The ending balance is $1,500.

| Salaries Expense Acct. No. 622 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 14 | Cash | 1,000 | 1,000 | ||

| July 28 | Cash | 1,000 | 2,000 | ||

| July 31 | Salaries payable | 100 | 2,100 |

The ending balance is $2,100.

| Insurance Expense Acct. No. 637 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Prepaid insurance | 400 | 400 |

The ending balance is $400.

| Rent Expense Acct. No. 640 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 2 | Cash | 2,000 | 2,000 |

The ending balance is $2,000.

| Office Supplies Expense Acct. No. 650 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Office supplies | 875 | 875 |

The ending balance is $875.

| Repairs Expense Acct. No. 684 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 29 | Cash | 950 | 950 |

The ending balance is $950.

| Telephone expense Acct. No. 688 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 30 | Cash | 400 | 400 |

The ending balance is $400.

| Income Summary Acct. No. 901 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

5.

To prepare: An adjusted trial balance, income statement, statement of retained earnings and

5.

Explanation of Solution

| S.S. Company | ||

| Adjusted Trial Balance | ||

| For month ended July 31, 2017 | ||

| Particulars | Debit($) | Credit($) |

| Cash | 22,850 | |

| Accounts Receivable | 1,150 | |

| Office Supplies | 1,525 | |

| Prepaid Insurance | 6,800 | |

| Buildings | 150,000 | |

| Accumulated Depreciation-Buildings | 1,500 | |

| Salaries Payable | 100 | |

| Common Stock | 180,000 | |

| Retained earnings | 0 | |

| Dividends | 2,000 | |

| Storage fees Earned | 10,950 | |

| Depreciation Expense-Buildings | 1,500 | |

| Salaries Expenses | 2,100 | |

| Rent Expenses | 2,000 | |

| Office Supply Expense | 875 | |

| Repairs Expenses | 950 | |

| Telephone Expense | 400 | |

| Insurance Expense | 400 | |

| Income Summary | 0 | |

| Total | 192,550 | 192,550 |

Thus, the total of adjusted trial balance on 31thJuly, 2017 is $192,550.

Prepare Income Statement.

| S.S. Company | ||

| Income Statement | ||

| For month ended July 31, 2017 | ||

| Particulars | Amount($) | Amount($) |

| Revenue: | ||

| Service Revenue | 10,950 | |

| Total Revenue | 10,950 | |

| Expenses: | ||

| Depreciation Expense-Buildings | 1,500 | |

| Salaries Expenses | 2,100 | |

| Rent Expenses | 2,000 | |

| Office Supply Expense | 875 | |

| Repairs Expenses | 950 | |

| Telephone Expense | 400 | |

| Insurance Expense | 400 | |

| Total Expense | 8,225 | |

| Net income | 2,725 |

Thus, net income of S.S. Company is $2,725.

Prepare Retained Earnings Statement:

| S.S. Company | |

| Retained Earnings Statement | |

| For month ended July 31, 2017 | |

| Particulars | Amount($) |

| Opening balance | 0 |

| Net income | 2,725 |

| Dividends | (2,000) |

| Retained earnings | 725 |

Therefore, retained earnings of S.S. Company are $725.

Prepare balance sheet.

| S.S. Company | ||

| Balance sheet | ||

| As on July 31, 2017 | ||

| Particulars | Amount($) | |

| Assets | ||

| Cash | 22,850 | |

| Office Supplies | 1,525 | |

| Account Receivables | 1,150 | |

| Prepaid Insurance | 6,800 | |

| Buildings | 150,000 | |

| Less: Accumulated depreciation | (1,500) | 148,500 |

| Total Assets | 180,825 | |

| Liabilities and Stockholder’s Equity | ||

| Liabilities | ||

| Salaries Payable | 100 | |

| Stockholder’s Equity | ||

| Common Stock | 180,000 | |

| Retained earnings | 725 | |

| Total stockholders’ equity | 180,725 | |

| Total Liabilities and Stockholder’s equity | 180,825 |

Thus, the balance sheet total is $180,825.

6.

To prepare: Closing entries.

6.

Explanation of Solution

Service revenue transfer to income summary account for closing.

| Date | Particulars | Post ref | Debit($) | Credit($) |

| July 31 | Service Revenue | 10,950 | ||

| Income Summary | 10,950 | |||

| (Being service revenue transfer to income summary account) |

All expenses transfer to income summary account for closing.

| Date | Particulars | Post ref | Debit($) | Credit($) |

| July 31 | Income summary | 8,225 | ||

| Depreciation Expense-Buildings | 1,500 | |||

| Salaries Expenses | 2,100 | |||

| Rent Expenses | 2,000 | |||

| Office Supply Expense | 875 | |||

| Repairs Expenses | 950 | |||

| Telephone Expense | 400 | |||

| Insurance Expense | 400 | |||

| (Being all expenses transfer to income summary account) |

Income Summary transfer to income summary account for closing.

| Date | Particulars | Post ref | Debit($) | Credit($) |

| July 31 | Income Summary | 2,725 | ||

| Retained Earning | 2,725 | |||

| (Being net income transfer to retained earnings) |

Deduct dividend from retained earnings.

| Date | Particulars | Post ref | Debit($) | Credit($) |

| July 31 | Retained Earning | 2,000 | ||

| Dividend | 2,000 | |||

| (Being dividend distributed) |

Posting of closing entries into ledger account.

| Cash Acct. No. 101 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 1 | Common stock | 30,000 | 30,000 | ||

| July 2 | Rent expenses | 2,000 | 28,000 | ||

| July 3 | Office supplies | 2,400 | 25,600 | ||

| July 10 | Prepaid insurance | 7,200 | 18,400 | ||

| July 14 | Salary expense | 1,000 | 17,400 | ||

| July 24 | Storage fees earned | 9,800 | 27,200 | ||

| July 28 | Salary expense | 1,000 | 26,200 | ||

| July 29 | Repair expense | 950 | 25,250 | ||

| July 30 | Telephone expense | 400 | 24,850 | ||

| July 31 | Dividend | 2,000 | 22,850 |

The ending balance is $22,850.

| Accounts Receivable Acct. No. 106 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Storage fees earned | 1,150 | 1,150 |

The ending balance is $1,150.

| Office Supplies Acct. No. 124 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 3 | Cash | 2,400 | 2,400 | ||

| July 31 | Office supplies expense | 875 | 1525 |

The ending balance is $1,525.

| Prepaid Insurance Acct. No. 128 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 10 | Cash | 7,200 | 7,200 | ||

| July 31 | Insurance expense | 400 | 6,800 |

The ending balance is $6,800.

| Buildings Acct. No. 173 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 1 | Common stock | 150,000 | 150,000 |

The ending balance is $150,000.

| Accumulated depreciation Buildings Acct. No. 174 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Depreciation expense | 1,500 | 1,500 |

The ending balance is $1,500.

| Salaries Payable Acct. No. 209 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Salary expense | 100 | 100 |

The ending balance is $100.

| Common Stock Acct. No. 307 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 1 | Cash | 30,000 | 30,000 | ||

| July 1 | Buildings | 150,000 | 180,000 |

The ending balance is $180,000.

| Retained Earnings Acct. No. 318 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Income summary | 2,725 | |||

| July 31 | Dividend | 2,000 | 725 |

The ending balance is $0.

| Dividends Acct. No. 319 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Cash | 2,000 | 2,000 | ||

| July 31 | Retained earnings | 2,000 | 0 |

The ending balance is $0.

| Storage Fees Earned Acct. No. 406 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 24 | Cash | 9,800 | 9,800 | ||

| July 31 | Accounts receivable | 1,150 | 10,950 | ||

| July 31 | Income summary | 10,950 | 0 |

The ending balance is $0.

| Depreciation ExpenseBuildings Acct. No. 606 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Accumulated depreciation- Buildings | 1,500 | 1,500 | ||

| July 31 | Income summary | 1,500 | 0 |

The ending balance is $0.

| Salaries Expense Acct. No. 622 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 14 | Cash | 1,000 | 1,000 | ||

| July 28 | Cash | 1,000 | 2,000 | ||

| July 31 | Salaries payable | 100 | 2,100 | ||

| July 31 | Income summary | 2,100 | 0 |

The ending balance is $0.

| Insurance Expense Acct. No. 637 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Prepaid insurance | 400 | 400 | ||

| July 31 | Income summary | 400 | 0 |

The ending balance is $0.

| Rent Expense Acct. No. 640 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 2 | Cash | 2,000 | 2,000 | ||

| July 31 | Income summary | 2,000 | 0 |

The ending balance is $0.

| Office Supplies Expense Acct. No. 650 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Office supplies | 875 | 875 | ||

| July 31 | Income summary | 875 | 0 |

The ending balance is $0.

| Repairs Expense Acct. No. 684 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 29 | Cash | 950 | 950 | ||

| July 31 | Income summary | 950 | 0 |

The ending balance is $0.

| Telephone expense Acct. No. 688 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 30 | Cash | 400 | 400 | ||

| July 31 | Income summary | 400 | 0 |

The ending balance is $0.

| Income Summary Acct. No. 901 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| July 31 | Service Revenue | 10,950 | 10,950 | ||

| July 31 | Depreciation Expense-Buildings | 1,500 | 9,450 | ||

| July 31 | Salaries Expenses | 2,100 | 7,350 | ||

| July 31 | Rent Expenses | 2,000 | 5,350 | ||

| July 31 | Office Supply Expense | 875 | 4,475 | ||

| July 31 | Repairs Expenses | 950 | 3,525 | ||

| July 31 | Telephone Expense | 400 | 3,125 | ||

| July 31 | Insurance Expense | 400 | 2,725 | ||

| July 31 | Retained earnings | 2,725 | 0 |

The ending balance is $0.

7.

To prepare: A post closing trial balance.

7.

Explanation of Solution

| S.S. Company | ||

| Adjusted Trial Balance | ||

| For month ended July 31, 2017 | ||

| Particulars | Debit($) | Credit($) |

| Cash | 22,850 | |

| Accounts Receivable | 1,150 | |

| Office Supplies | 1,525 | |

| Prepaid Insurance | 6,800 | |

| Buildings | 150,000 | |

| Accumulated Depreciation-Buildings | 1,500 | |

| Salaries Payable | 100 | |

| Common Stock | 180,000 | |

| Retained earnings | 725 | |

| Dividends | 0 | |

| Storage fees Earned | 0 | |

| Depreciation Expense-Buildings | 0 | |

| Salaries Expenses | 0 | |

| Rent Expenses | 0 | |

| Office Supply Expense | 0 | |

| Repairs Expenses | 0 | |

| Telephone Expense | 0 | |

| Insurance Expense | 0 | |

| Income Summary | 0 | 0 |

| Total | 182,325 | 182,325 |

Thus, the total of post-closing trial balance on 31th July, 2017 is $182,325.

Want to see more full solutions like this?

Chapter 3 Solutions

GEN COMBO LOOSELEAF FINANCIAL AND MANAGERIAL ACCOUNTING; CONNECT ACCESS CARD

- Preserved belonging schedule for Sunland Company December 31, 2006 Number of DayPart De Nos Customer Ya Du Over 90 1-30 25-60 65-90 $21,900 $10,100 $11,000 24.500 554 500 55,300 15,000 6,000 354.000 Delon 820,100 96400 16,500 6,000 $900 $150,000 $20,000 $25,000 84000 829,700 Perceng Unco 1 Todd D December 1, 2006, the und)sed boloncellence for Doub Journal and using every for uncollecables December 1, 2016 Credit account titles are automatically indented when mount entered. Do not indent manually debit entry before credit entry) Date Dec. 31 Account Titles Debit Credit End Date Expense Date Explanation Rat. Debit Credit Balance Dec. 31 Adjusting Allowance for Doubtful Accounta Date Explanation Rat. Debit Credit Balance Dec. 31 Glance Dec. 31 Acting Textbook and Mediaarrow_forwardMCQarrow_forwardGeneral Accounting: Lian has $616,400 in sales. The profit margin is 8.75 percent and the firm has 14,000 shares of stock outstanding. The market price per share is$45.25. What is the price-earnings ratio?arrow_forward

- General accounting questionarrow_forwardStriveTech Co. uses the high-low method to analyze cost behavior. The company observed that at 18,000 machine hours of activity, total maintenance costs averaged $28.00 per hour. When activity increased to 22,000 machine hours (still within the relevant range), the average total cost per machine hour dropped to $25.00. Based on this information, the fixed cost was: a. $396,000 b. $297,000 c. $308,000 d. $220,000 e. $528,000arrow_forwardBright Tech Inc. sold one of its divisions at a loss of $80,000. The company's income tax rate is 30%. What is the after-tax loss that will be reported on the income statement?arrow_forward

- what is the value of equity? Financial Accountarrow_forwardCompute the cost to be allocatedarrow_forwardOn September 1, 2024, Baxter Inc. reported Retained Earnings of $432,000. During the month, Baxter generated revenues of $70,000, incurred expenses of $35,000, purchased equipment for $15,000, and paid dividends of $8,500. What is the balance in Retained Earnings on September 30, 2024? A. $24,000 credit B. $423,000 credit C. $458,500 credit D. $426,000 creditarrow_forward

- Financial accountingarrow_forwardWhy does capital adequacy determine accounting method selection? (a) Standard methods work for all situations (b) Methods remain constant regardless of resources (c) Available financial resources influence reporting choices (d) Capital levels never affect accountingarrow_forwardWhat is the price earning ratio??arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education