Concept explainers

Adjusting entries are made at the end of the year to adjust the financial position of the enterprise according to accrual basis of accounting.

Accounting rules regarding journal entries:

Journal Entries:

It is a book of original entry. It records and summarizes financial transaction of an entity in chronological manner, generally according to dual aspect of accounting.

Adjusted

It is a statement which contains balances of all account after all the adjusting entries has been made.

Income Statement:

It is a financial statement which shows the

It is a financial statement which shows the amount of profit retained by the company for their future unforeseen events.

Closing Entries:

These entries is made for those item whose balance need to be zero for next accounting period otherwise data of two accounting periods will get mix with each other.

Balance Sheet:

Balance sheet shows the financial position of a firm. It consists of asset, liabilities and the

1.

To prepare: Ledger account, according to balance column format.

Explanation of Solution

| Cash Acct. No. 101 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Accounts Receivable Acct. No. 106 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Office Supplies Acct. No. 124 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Prepaid Insurance Acct. No. 128 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Computer Equipment Acct. No. 167 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Salaries Payable Acct. No. 209 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Common Stock Acct. No. 307 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Retained Earnings Acct. No. 318 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Dividends Acct. No. 319 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Commission Earned Acct. No. 406 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Depreciation ExpenseComputer Equipment Acct. No. 612 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Salaries Expense Acct. No. 622 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Insurance Expense Acct. No. 637 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Rent Expense Acct. No. 640 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Office Supplies Expense Acct. No. 650 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Repairs Expense Acct. No. 684 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Telephone expense Acct. No. 688 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| Income Summary Acct. No. 901 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

2.

To prepare: Journal

2.

Explanation of Solution

Common Stock worth $50,000 issued in exchange for Cash and Computer Equipment.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| April 1 | Cash | 30,000 | ||

| Computer Equipment | 20,000 | |||

| Common Stock | 50,000 | |||

| (Being N brings in cash and Computer Equipment for Common Stock ) |

Rent paid for one month worth $1,800.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| April 2 | Rent Expense | 1,800 | ||

| Cash | 1,800 | |||

| (Being rent paid for the first month)) |

Office Supplies Worth $1,000 purchased for cash.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| April 3 | Office Supplies | 1,000 | ||

| Cash | 1,000 | |||

| (Being Office supplies worth $1,000 purchased) |

Insurance purchased worth$2,400 for cash.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| April 10 | Prepaid Insurance | 2,400 | ||

| Cash | 2,400 | |||

| (Being Insurance purchased) |

Salary Expense worth $1,600 paid for two weeks of work.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| April 14 | Salary Expense | 1,600 | ||

| Cash | 1,600 | |||

| (Being Salary paid for two weeks of work) |

Commission Earned from airlines worth $8,000.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| April 24 | Cash | 8,000 | ||

| Commission Earned | 8,000 | |||

| (Being commission earned from airlines) |

Salaries paid $1,600.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| April 28 | Salary Expense | 1,600 | ||

| Cash | 1,600 | |||

| (Being Salary paid for two weeks of work) |

Cash worth $350 used for repairs of company’ computer.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| April 29 | Repair Expense | 350 | ||

| Cash | 350 | |||

| (Being cash spend on repairs) |

Telephone expenses paid by company worth $750.

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| April 30 | Telephone Expense | 750 | ||

| Cash | 750 | |||

| (Being telephone expenses paid) |

Dividend paid by company worth $1,500

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) |

| April 30 | Dividends | 1,500 | ||

| Cash | 1,500 | |||

| (Being dividend paid by company) |

Posting of journal entries to ledger account.

| Cash Acct. No. 101 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 1 | Common Stock | 30,000 | 30,000 | ||

| April 2 | Rent Expenses | 1,800 | 28,200 | ||

| April 3 | Office supplies | 1,000 | 27,200 | ||

| April 10 | Prepaid Insurance | 2,400 | 24,800 | ||

| April 14 | Salary Expense | 1,600 | 23,200 | ||

| April 24 | Commission earned | 8,000 | 31,200 | ||

| April 28 | Salary Expense | 1,600 | 29,600 | ||

| April 29 | Repair Expense | 350 | 29,250 | ||

| April 30 | Telephone Expense | 750 | 28,500 | ||

| April 30 | Dividend | 1,500 | 27,000 |

The ending balance is $27,000.

| Accounts Receivable Acct. No. 106 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Office Supplies Acct. No. 124 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 3 | Cash | 1,000 | 1,000 |

The ending balance is $1,000.

| Prepaid Insurance Acct. No. 128 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 10 | Prepaid Insurance | 2,400 | 2,400 |

The ending balance is $2,400.

| Computer Equipment Acct. No. 167 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 1 | Common Stock | 20,000 | 20,000 |

The ending balance is $20,000.

| Accumulated | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Salaries Payable Acct. No. 209 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Common Stock Acct. No. 307 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 1 | Cash | 30,000 | 30,000 | ||

| April 1 | Computer Equipment | 20,000 | 50,000 |

The ending balance is $50,000.

| Retained Earnings Acct. No. 318 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Dividends Acct. No. 319 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Cash | 1,500 | 1,500 |

The ending balance is $1,500.

| Commission Earned Acct. No. 406 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 24 | Cash | 8,000 | 8,000 |

The ending balance is $8,000.

| Depreciation ExpenseComputer Equipment Acct. No. 612 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Salaries Expense Acct. No. 622 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 14 | cash | 1,600 | 1,600 | ||

| April 28 | cash | 1,600 | 3,200 |

The ending balance is $3,200.

| Insurance Expense Acct. No. 637 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Rent Expense Acct. No. 640 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 2 | Cash | 1,800 | 1,800 |

The ending balance is $1,800.

| Office Supplies Expense Acct. No. 650 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Repairs Expense Acct. No. 684 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 29 | Cash | 350 | 350 |

The ending balance is $350.

| Telephone expense Acct. No. 688 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Cash | 750 | 750 |

The ending balance is $750.

| Income Summary Acct. No. 901 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

3.

To prepare: An unadjusted trial balance.

3.

Explanation of Solution

| J.N | ||

| Unadjusted Trial Balance | ||

| As on April 30, 2017 | ||

| Particulars | Debit($) | Credit($) |

| Cash | 27,000 | |

| Accounts Receivable | 0 | |

| Office Supplies | 1,000 | |

| Prepaid Insurance | 2,400 | |

| Computer Equipment | 20,000 | |

| Accumulated Depreciation-Computer Equipment | 0 | |

| Salaries Payable | 0 | |

| Common Stock | 50,000 | |

| Retained earnings | 0 | |

| Dividends | 1,500 | |

| Commission Earned | 8,000 | |

| Depreciation Expense-Computer Equipment | 0 | |

| Salaries Expenses | 3,200 | |

| Rent Expenses | 1,800 | |

| Office Supply Expense | 0 | |

| Repairs Expenses | 350 | |

| Telephone Expense | 750 | |

| Insurance Expense | 0 | |

| Income Summary | 0 | |

| Total | 58,000 | 58,000 |

The total of Unadjusted Trial Balance on 30th April, 2017 is $58,000.

4.

a.

To prepare: Adjusting entry.

4.

a.

Explanation of Solution

| Date | Particulars | Post ref | Debit($) | Credit($) |

| April 30 | Insurance Expense | 133 | ||

| Prepaid Insurance | 133 | |||

| (Being insurance coverage worth $133has expired) |

b.

To prepare: Adjusting entry.

b.

Explanation of Solution

| Date | Particulars | Post ref | Debit($) | Credit($) |

| April 30 | Office Supplies Expense | 400 | ||

| Office Supply | 400 | |||

| (Being $400 worth of office Supplies got exhausted) |

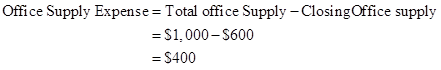

Working note:

Calculation of office supply expense,

c.

To prepare: Adjusting entry.

c.

Explanation of Solution

| Date | Particulars | Post ref | Debit($) | Credit($) |

| April 30 | Depreciation Expense | 500 | ||

| Accumulated Depreciation-Computer equipment | 500 | |||

| (Being depreciation is recorded) |

d.

To prepare: Adjusting entry.

d.

Explanation of Solution

| Date | Particulars | Post ref | Debit($) | Credit($) |

| April 30 | Salary Expense | 420 | ||

| Salary Payable | 420 | |||

| (Being salaries worth $420 due to be paid) |

e.

To prepare: Adjusting entry.

e.

Explanation of Solution

| Date | Particulars | Post ref | Debit($) | Credit($) |

| April 30 | Accounts Receivable | 1,750 | ||

| Commission earned | 1,750 | |||

| (Being commission earned but not received yet) |

Posting of adjusting entries.

| Cash Acct. No. 101 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 1 | Common Stock | 30,000 | 30,000 | ||

| April 2 | Rent Expenses | 1,800 | 28,200 | ||

| April 3 | Office supplies | 1,000 | 27,200 | ||

| April 10 | Prepaid Insurance | 2,400 | 24,800 | ||

| April 14 | Salary Expense | 1,600 | 23,200 | ||

| April 24 | Commission earned | 8,000 | 31,200 | ||

| April 28 | Salary Expense | 1,600 | 29,600 | ||

| 29 April | Repair Expense | 350 | 29,250 | ||

| April 30 | Telephone Expense | 750 | 28,500 | ||

| April 30 | Dividend | 1,500 | 27,000 |

The ending balance is $27,000.

| Accounts Receivable Acct. No. 106 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Commission Earned | 1,750 | 1,750 |

The ending balance is $1,750.

| Office Supplies Acct. No. 124 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 3 | Cash | 1,000 | 1,000 | ||

| April 30 | Office Supply Expense | 400 | 600 |

The ending balance is $600.

| Prepaid Insurance Acct. No. 128 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 10 | Prepaid Insurance | 2,400 | 2,400 | ||

| April 30 | Insurance Expense | 133 | 2,267 |

The ending balance is $2,267.

| Computer Equipment Acct. No. 167 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 1 | Common Stock | 20,000 | 20,000 |

The ending balance is $20,000.

| Accumulated depreciation Computer Equipment Acct. No. 168 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Depreciation-computer equipment | 500 | 500 |

The ending balance is $500.

| Salaries Payable Acct. No. 209 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Salary Expense | 420 | 420 |

The ending balance is $420.

| Common Stock Acct. No. 307 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 1 | Cash | 30,000 | 30,000 | ||

| April 1 | Computer Equipment | 20,000 | 50,000 |

The ending balance is $50,000.

| Retained Earnings Acct. No. 318 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

| Dividends Acct. No. 319 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Cash | 1,500 | 1,500 |

The ending balance is $1,500.

| Commission Earned Acct. No. 406 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 24 | Cash | 8,000 | 8,000 | ||

| April 30 | Accounts Receivable | 1,750 | 9,750 |

The ending balance is $9,750.

| Depreciation ExpenseComputer Equipment Acct. No. 612 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Accumulated depreciation Computer Equipment | 500 | 500 |

The ending balance is $500.

| Salaries Expense Acct. No. 622 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 14 | cash | 1,600 | 1,600 | ||

| April 28 | cash | 1,600 | 3,200 | ||

| April 30 | Salary Payable | 420 | 3,620 |

The ending balance is $3,620.

| Insurance Expense Acct. No. 637 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Prepaid Insurance | 133 | 133 |

The ending balance is $133.

| Rent Expense Acct. No. 640 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 2 | Cash | 1,800 | 1,800 |

The ending balance is $1,800.

| Office Supplies Expense Acct. No. 650 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Office Supply | 400 | 400 |

The ending balance is $400.

| Repairs Expense Acct. No. 684 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 29 | Cash | 350 | 350 |

The ending balance is $350.

| Telephone expense Acct. No. 688 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Cash | 750 | 750 |

The ending balance is $750.

| Income Summary Acct. No. 901 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

The ending balance is $0.

5.

To prepare: An adjusted trial balance, income statement, statement of retained earnings and balance sheet.

5.

Explanation of Solution

| J.N. Company | ||

| Adjusted Trial Balance | ||

| As on April 30, 2017 | ||

| Particulars | Debit($) | Credit($) |

| Cash | 27,000 | |

| Accounts Receivable | 1,750 | |

| Office Supplies | 600 | |

| Prepaid Insurance | 2,267 | |

| Computer Equipment | 20,000 | |

| Accumulated Depreciation-Computer Equipment | 500 | |

| Salaries Payable | 420 | |

| Common Stock | 50,000 | |

| Retained earnings | 0 | |

| Dividends | 1,500 | |

| Commission Earned | 9,750 | |

| Depreciation Expense-Computer Equipment | 500 | |

| Salaries Expenses | 3,620 | |

| Rent Expenses | 1,800 | |

| Office Supply Expense | 400 | |

| Repairs Expenses | 350 | |

| Telephone Expense | 750 | |

| Insurance Expense | 133 | |

| Income Summary | 0 | |

| Total | 58,920 | 58,920 |

The total of Adjusted Trial Balance on 30th April, 2017 is $58,920.

Prepare Income Statement:

| J.N. Company | ||

| Income Statement | ||

| For month ended April 30, 2017 | ||

| Particulars | Amount($) | Amount($) |

| Revenue: | ||

| Service Revenue | 9,750 | |

| Total Revenue | 9,750 | |

| Expenses: | ||

| Insurance Expense | 133 | |

| Salaries Expense | 3,620 | |

| Office Supplies Expense | 400 | |

| Rent expenses | 1,800 | |

| Repairs Expense | 350 | |

| Telephone Expense | 750 | |

| Depreciation Expense-Computer Equipment | 500 | |

| Total Expense | 7,553 | |

| Net income | 2,197 |

Net income of J.N is $2,197.

Prepare Retained Earnings Statement:

| J.N. Company | |

| Retained Earnings Statement | |

| For month ended September 30, 2017 | |

| Particulars | Amount($) |

| Opening balance | 0 |

| Net income | 2,197 |

| Dividends | (1,500) |

| Retained earnings | 697 |

Therefore, Retained earnings of J.N. Company are $697.

Prepare Balance Sheet:

| J.N. Company | ||

| Balance sheet | ||

| As on April 30, 2017 | ||

| Particulars | Amount($) | |

| Assets | ||

| Cash | 27,000 | |

| Office Supplies | 600 | |

| Account Receivables | 1,750 | |

| Prepaid Insurance | 2,267 | |

| Computer Equipment | 20,000 | |

| Less: Accumulated depreciation | (500) | 19,500 |

| Total Assets | 51,117 | |

| Liabilities and Stockholder’s Equity | ||

| Liabilities | ||

| Salaries Payable | 420 | |

| Stockholder’s Equity | ||

| Common Stock | 50,000 | |

| Retained earnings | 697 | |

| Total stockholders’ equity | 50,697 | |

| Total Liabilities and Stockholder’s equity | 51,117 |

Balance sheet total is $51,117.

6.

To prepare: Closing entries.

6.

Explanation of Solution

Service Revenue transfer to income summary account for closing.

| Date | Particulars | Post ref | Debit($) | Credit($) |

| April 30 | Service Revenue | 9,750 | ||

| Income Summary | 9,750 | |||

| (Being service revenue transfer to income summary account) |

All expenses transfer to income summary account for closing.

| Date | Particulars | Post ref | Debit($) | Credit($) |

| April 30 | Income summary | 7,553 | ||

| Insurance Expense | 133 | |||

| Salaries Expense | 3,620 | |||

| Office Supplies Expense | 400 | |||

| Rent expenses | 1,800 | |||

| Repairs Expense | 350 | |||

| Telephone Expense | 750 | |||

| Depreciation Expense-Computer Equipment | 500 | |||

| (Being all expenses transfer to income summary account) |

Income Summary transfer to income summary account for closing.

| Date | Particulars | Post ref | Debit($) | Credit($) |

| April 30 | Income Summary | 2,197 | ||

| Retained Earning | 2,197 | |||

| (Being net income transfer to retained earnings) |

Deduct dividend from retained earnings.

| Date | Particulars | Post ref | Debit($) | Credit($) |

| April 30 | Retained Earning | 1,500 | ||

| Dividend | 1,500 | |||

| (Being dividend distributed) |

To prepare ledger account for posting closing journal entries.

| Cash Acct. No. 101 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 1 | Common Stock | 30,000 | 30,000 | ||

| April 2 | Rent Expenses | 1,800 | 28,200 | ||

| April 3 | Office supplies | 1,000 | 27,200 | ||

| April 10 | Prepaid Insurance | 2,400 | 24,800 | ||

| April 14 | Salary Expense | 1,600 | 23,200 | ||

| April 24 | Commission earned | 8,000 | 31,200 | ||

| April 28 | Salary Expense | 1,600 | 29,600 | ||

| 29 April | Repair Expense | 350 | 29,250 | ||

| April 30 | Telephone Expense | 750 | 28,500 | ||

| April 30 | Dividend | 1,500 | 27,000 |

The ending balance is $27,000.

| Accounts Receivable Acct. No. 106 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Commission Earned | 1,750 | 1,750 |

The ending balance is $1,750.

| Office Supplies Acct. No. 124 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 3 | Cash | 1,000 | 1,000 | ||

| April 30 | Office Supply Expense | 400 | 600 |

The ending balance is $600.

| Prepaid Insurance Acct. No. 128 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 10 | Prepaid Insurance | 2,400 | 2,400 | ||

| April 30 | Insurance Expense | 133 | 2,267 |

The ending balance is $2,267.

| Computer Equipment Acct. No. 167 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 1 | Common Stock | 20,000 | 20,000 |

The ending balance is $20,000.

| Accumulated depreciation Computer Equipment Acct. No. 168 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Depreciation-computer equipment | 500 | 500 |

The ending balance is $500.

| Salaries Payable Acct. No. 209 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Salary Expense | 420 | 420 |

The ending balance is $420.

| Common Stock Acct. No. 307 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 1 | Cash | 30,000 | 30,000 | ||

| April 1 | Computer Equipment | 20,000 | 50,000 |

The ending balance is $50,000.

| Retained Earnings Acct. No. 318 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Income Summary | 2,197 | 2,197 | ||

| April 30 | Dividends | 1,500 | 697 |

The ending balance is $697.

| Dividends Acct. No. 319 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Cash | 1,500 | 1,500 | ||

| April 30 | Retained Earning | 1500 | 0 |

The ending balance is $0.

| Commission Earned Acct. No. 406 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 24 | Cash | 8,000 | 8,000 | ||

| April 30 | Accounts Receivable | 1,750 | 9,750 | ||

| April 30 | Income Summary | 9,750 | 0 |

The ending balance is $0.

| Depreciation ExpenseComputer Equipment Acct. No. 612 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Accumulated depreciation Computer Equipment | 500 | 500 | ||

| April 30 | Income Summary | 500 | 0 |

The ending balance is $0.

| Salaries Expense Acct. No. 622 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 14 | cash | 1,600 | 1,600 | ||

| April 28 | cash | 1,600 | 3,200 | ||

| April 30 | Salary Payable | 420 | 3,620 | ||

| April 30 | Income Summary | 3,620 | 0 |

The ending balance is $0.

| Insurance Expense Acct. No. 637 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Prepaid Insurance | 133 | 133 | ||

| April 30 | Income Summary | 133 | 0 |

The ending balance is $0.

| Rent Expense Acct. No. 640 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 2 | Cash | 1,800 | 1,800 | ||

| April 30 | Income Summary | 1,800 | 0 |

The ending balance is $0.

| Office Supplies Expense Acct. No. 650 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Office Supply | 400 | 400 | ||

| April 30 | Income Summary | 400 | 0 |

The ending balance is $0.

| Repairs Expense Acct. No. 684 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 29 | Cash | 350 | 350 | ||

| April 30 | Income Summary | 350 | 0 |

The ending balance is $0.

| Telephone expense Acct. No. 688 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Cash | 750 | 750 | ||

| April 30 | Income Summary | 750 | 0 |

The ending balance is $0.

| Income Summary Acct. No. 901 | |||||

| Date | Account Title and Explanation | Post ref | Debit($) | Credit($) | Balance($) |

| April 30 | Service Revenue | 9,750 | |||

| April 30 | Insurance Expense | 133 | 9,617 | ||

| April 30 | Salaries Expense | 3,620 | 5997 | ||

| April 30 | Office Supplies Expense | 400 | 5597 | ||

| April 30 | Rent expenses | 1,800 | 3797 | ||

| April 30 | Repairs Expense | 350 | 3447 | ||

| April 30 | Telephone Expense | 750 | 2697 | ||

| April 30 | Depreciation Expense-Computer Equipment | 500 | 2197 | ||

| April 30 | Retained Earnings | 2197 | 0 |

The ending balance is $0.

7.

To prepare: A post closing trial balance.

7.

Explanation of Solution

| J.N | ||

| Post-Closing Trial Balance | ||

| As on April 30, 2017 | ||

| Particulars | Debit($) | Credit($) |

| Cash | 27,000 | |

| Accounts Receivable | 1,750 | |

| Office Supplies | 600 | |

| Prepaid Insurance | 2,267 | |

| Computer Equipment | 20,000 | |

| Accumulated Depreciation-Computer Equipment | 500 | |

| Salaries Payable | 420 | |

| Common Stock | 50,000 | |

| Retained earnings | 697 | |

| Dividends | 0 | |

| Commission Earned | 0 | |

| Depreciation Expense-Computer Equipment | 0 | |

| Salaries Expenses | 0 | |

| Rent Expenses | 0 | |

| Office Supply Expense | 0 | |

| Repairs Expenses | 0 | |

| Telephone Expense | 0 | |

| Insurance Expense | 0 | |

| Income Summary | 0 | |

| Total | 51,617 | 51,617 |

The total of Post- Closing Trial Balance on 30th April, 2017 is $51,617.

Want to see more full solutions like this?

Chapter 3 Solutions

GEN COMBO FINANCIAL AND MANAGERIAL ACCOUNTING; CONNECT ACCESS CARD

- I need help finding the accurate solution to this financial accounting problem with valid methods.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forwardCarinal Ltd. specializes in the development of electronic components within quite acompetitive environment causing concerns for marketing and pricing. Its non-current assetsprimarily include IT software, property, and investments, and there have been additions tothese during the year.As audit manager, you are conducting a preliminary analytical review and associated riskanalysis for this client for the year ended June 30 2023. You have been presented with thefollowing draft financial information about Carinal with incomplete ratios and percentagescalculation. Using the information in the pic, complete the calculation of accounting ratios andpercentages and comment briefly on the performance of the company for the twoyears. 2. By reference to requirement 1, identify the areas that are subject to increased auditrisk and describe the further audit work you would perform in response to those risks.arrow_forward

- I am looking for help with this financial accounting question using proper accounting standards.arrow_forwardBergo Bay's accounting system generated the following account balances on December 31. The company's manager knows something is wrong with this list of balances because it does not show any balance for Work in Process Inventory and the accrued factory payroll (Factory Wages Payable) has not been recorded. Debit Credit Notes payable Cash Accounts receivable Raw materials inventory Work in process inventory Finished goods inventory Prepaid rent Accounts payable Common stock Retained earnings (prior year) Sales Cost of goods sold $ 75,000 44,000 27,000 0 12,000 4,000 $ 9,800 12,800 40,000 76,000 221,400 Factory overhead General and administrative expenses Totals 118,000 27,000 53,000 $ 360,000 $ 360,000 These six documents must be processed to bring the accounting records up to date. Materials requisition 10: Materials requisition 11: Materials requisition 12: Labor time ticket 52: Labor time ticket 53: $ 4,500 direct materials to Job 402 $ 7,000 direct materials to Job 404 $ 2,100…arrow_forwardAccurate Answerarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education