Principles Of Accounting

12th Edition

ISBN: 9781285637877

Author: NEEDLES

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 6P

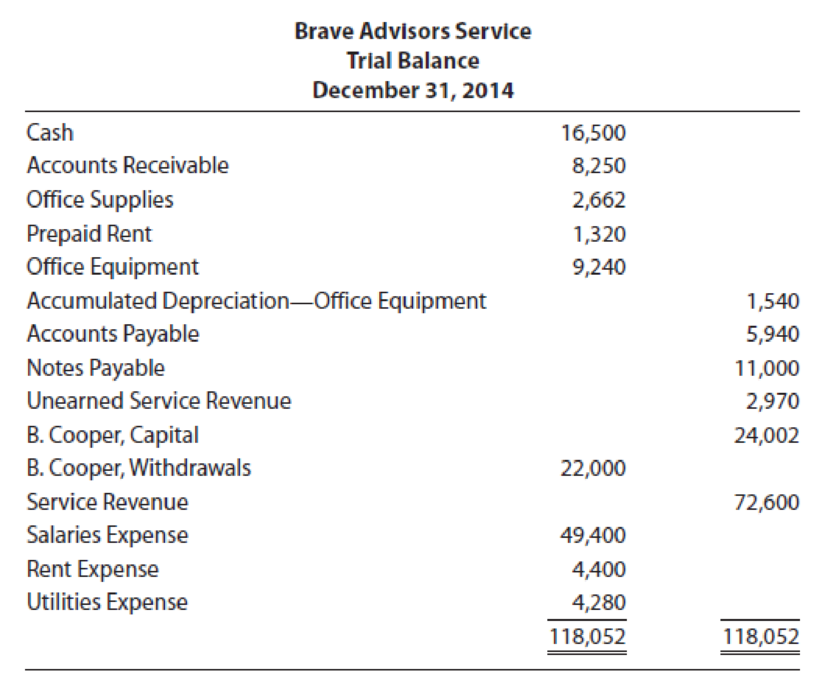

Brave Advisors Service’s

The following information is also available:

- a. Ending inventory of office supplies, $264

- b. Prepaid rent expired, $440

- c.

Depreciation of office equipment for the period, $660 - d. Accrued interest expense at the end of the period, $550

- e. Accrued salaries at the end of the period, $330

- f. Service revenue still unearned at the end of the period, $1,166

- g. Service revenue earned but unrecorded, $2,200

REQUIRED

- 1. Open T accounts for the accounts in the trial balance plus the following: Interest Payable; Salaries Payable; Office Supplies Expense; Depreciation Expense—Office Equipment; and Interest Expense. Enter the balances shown on the trial balance.

- 2. Determine the

adjusting entries and post them directly to the T accounts. - 3. Prepare an adjusted trial balance.

- 4. ACCOUNTING CONNECTION ▶ Which financial statements do each of the above adjustments affect? Which financial statement is not affected by the adjustments?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

General Accounting

Costs incurred during the year were as follows:

I need help finding the accurate solution to this general accounting problem with valid methods.

Chapter 3 Solutions

Principles Of Accounting

Ch. 3 - Prob. 1DQCh. 3 - Will the carrying value of a long-term asset...Ch. 3 - If, at the end of the accounting period, you were...Ch. 3 - Prob. 4DQCh. 3 - Prob. 5DQCh. 3 - Prob. 6DQCh. 3 - Match the concepts of accrual accounting that...Ch. 3 - The Prepaid Insurance account began the year with...Ch. 3 - The Supplies account began the year with a balance...Ch. 3 - Prob. 4SE

Ch. 3 - Prob. 5SECh. 3 - During the month of August, deposits in the amount...Ch. 3 - Prob. 7SECh. 3 - Malesherbes Companys adjusted trial balance on...Ch. 3 - Prob. 9SECh. 3 - Prob. 10SECh. 3 - Carlos Companys accountant makes the assumptions...Ch. 3 - Four conditions must be met before revenue should...Ch. 3 - Prob. 3EACh. 3 - Prob. 4EACh. 3 - Prob. 5EACh. 3 - Prob. 6EACh. 3 - Prob. 7EACh. 3 - Prob. 8EACh. 3 - Prepare year-end adjusting entries for each of the...Ch. 3 - Prob. 10EACh. 3 - Prob. 11EACh. 3 - Wipro Companys income statement included the...Ch. 3 - At the end of the first three months of operation,...Ch. 3 - On November 30, the end of the current fiscal...Ch. 3 - Kinokawa Consultants Companys trial balance on...Ch. 3 - Hertz Limo Service was organized to provide...Ch. 3 - At the end of its fiscal year, Berwyn Cleaners...Ch. 3 - Brave Advisors Services trial balance on December...Ch. 3 - Prob. 7PCh. 3 - Prob. 8PCh. 3 - Prob. 9APCh. 3 - On March 31, the end of the current fiscal year,...Ch. 3 - Lee Technology Corporations trial balance on...Ch. 3 - Prob. 12APCh. 3 - Prob. 13APCh. 3 - Scoop Consulting Services trial balance on...Ch. 3 - Prob. 15APCh. 3 - Prob. 16APCh. 3 - Never Flake Company provided a rust-prevention...Ch. 3 - Prob. 2CCh. 3 - Prob. 3CCh. 3 - Prob. 4CCh. 3 - Prob. 5CCh. 3 - Prob. 6C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the operating cycle?arrow_forwardIf Ryder Capital can give up one unit of future consumption and increase its current consumption by 0.94 units, what must be its real rate of interest?arrow_forwardI am searching for the most suitable approach to this financial accounting problem with valid standards.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License