MANAGERIAL ACCT(LL)+CONNECT+PROCTORIO PL

17th Edition

ISBN: 9781265574826

Author: Garrison

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 6E

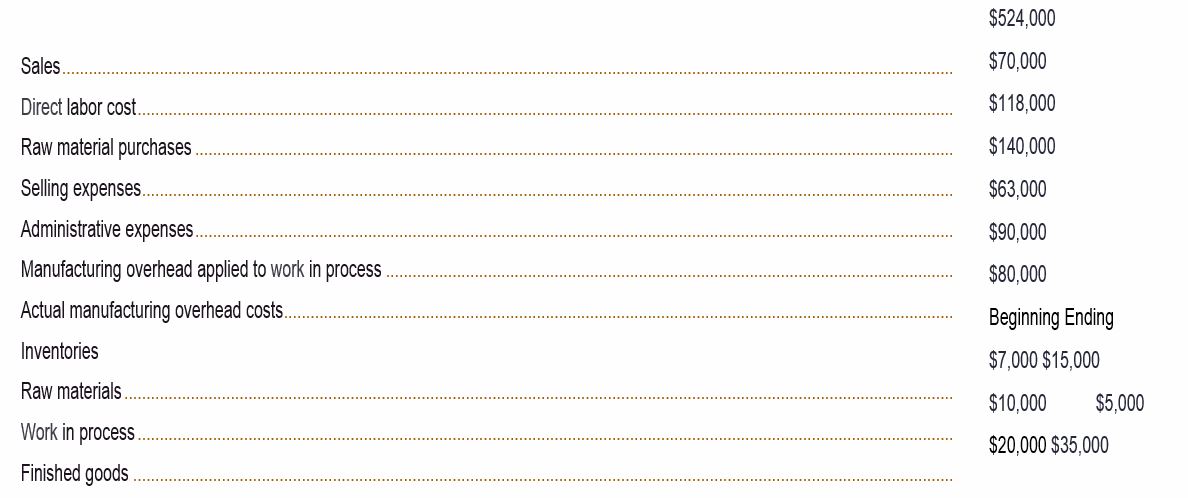

EXERCISE 3-6 Schedules of Cost of Goods Manufactured and Cost of Goods Sold; Income Statement LO3-3

The following data from the just completed year are taken from the accounting records of Mason Company:

Required;

- Prepare a schedule of cost of goods manufactured. Assume all raw materials used in production were direct materials.

- Prepare a schedule of cost of goods sold. Assume that the company's underapplied or overapplied

overhead is closed to Cost of Goods Sold. - Prepare an income statement.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

During the current year, Diego Corporation sells equipment for $325,000. The equipment originally cost $290,000 when purchased and placed in service four years ago, and $65,000 of depreciation deductions were allowed. The result of the sale is: a. Ordinary income of $100,000 b. Sec. 1231 gain of $100,000 c. Ordinary income of $65,000 and a long-term capital gain of $35,000 d. Ordinary income of $65,000 and Sec. 1231 gain of $35,000

Can you explain this general accounting question using accurate calculation methods?

Can you solve this financial accounting problem with appropriate steps and explanations?

Chapter 3 Solutions

MANAGERIAL ACCT(LL)+CONNECT+PROCTORIO PL

Ch. 3.A - EXERCISE 3A-1 Transaction Analysis LO3-5 Carmen...Ch. 3.A - EXERCISE 3A-2 Transaction Analysis LO3-5 Adams...Ch. 3.A - EXERCISE 3A-3 Transaction Analysis LO3-5 Dixon...Ch. 3.A - PROBLEM 3A-4 Transaction Analysis LO3-5 Morrison...Ch. 3.A - PROBLEM 3A-5 Transaction Analysis LO3-5 Star...Ch. 3.A -

PROBLEM 3A-6 Transaction Analysis LO3-5

Brooks...Ch. 3 - Prob. 1QCh. 3 - Prob. 2QCh. 3 - What is underapplied overhead Overapplied...Ch. 3 - 3-4 Provide two reasons why overhead might be...

Ch. 3 - Prob. 5QCh. 3 - How do you compute the raw materials used in...Ch. 3 - Prob. 7QCh. 3 - How do you compute the cost of goods manufactured?Ch. 3 - Prob. 9QCh. 3 - Prob. 10QCh. 3 - Prob. 1AECh. 3 - Prob. 2AECh. 3 - Prob. 3AECh. 3 - Prob. 4AECh. 3 - Prob. 1F15Ch. 3 - Prob. 2F15Ch. 3 - Bunnell Corporation is a manufacturer that uses...Ch. 3 - Prob. 4F15Ch. 3 - Prob. 5F15Ch. 3 - Bunnell Corporation is a manufacturer that uses...Ch. 3 - Prob. 7F15Ch. 3 - Prob. 8F15Ch. 3 - Prob. 9F15Ch. 3 - Prob. 10F15Ch. 3 - Bunnell Corporation is a manufacturer that uses...Ch. 3 - Prob. 12F15Ch. 3 - Prob. 13F15Ch. 3 - Prob. 14F15Ch. 3 - Prob. 15F15Ch. 3 - EXERCISE 3-1 Prepare Journal Entries LO3-1 Lamed...Ch. 3 - Prob. 2ECh. 3 - EXERCISE 3-3 Schedules of Cost of Goods...Ch. 3 - EXERCISE 3-4 Underapplied and Overapplied Overhead...Ch. 3 - Prob. 5ECh. 3 - EXERCISE 3-6 Schedules of Cost of Goods...Ch. 3 - (

$

15,000...Ch. 3 - EXERCISE 3-8 Applying Overhead: Journal Entries;...Ch. 3 - Prob. 9ECh. 3 - Prob. 10ECh. 3 -

PROBLEM 3-11: T-Account Analysis of Cost Flows...Ch. 3 - Prob. 12PCh. 3 - PROBLEM 3-13 Schedules of Cost of Goods...Ch. 3 - Prob. 14PCh. 3 -

PROBLEM 3-15 Journal Entries; T-Accounts;...Ch. 3 - Prob. 16PCh. 3 - Prob. 17PCh. 3 - Prob. 18C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License