Concept explainers

2.

Prepare the journal entries to record the each of the transactions and events for Corporation SS.

2.

Explanation of Solution

Prepare the journal entries.

| Date | Account titles and Explanation | Post Ref. | Debit ($) | Credit ($) |

| April 1 | Cash | 101 | 30,000 | |

| Buildings | 173 | 20,000 | ||

| Common stock | 307 | 50,000 | ||

| (To record the common stock in exchange for cash and building) | ||||

| April 2 | Rent expense | 640 | 1,800 | |

| Cash | 101 | 1,800 | ||

| (To record the rent expense) | ||||

| April 3 | Office supplies | 124 | 1,000 | |

| Cash | 101 | 1,000 | ||

| (To record the office supplies) | ||||

| April 10 | Prepaid insurance | 128 | 2,400 | |

| Cash | 101 | 2,400 | ||

| (To record the prepaid insurance) | ||||

| April 14 | Salaries expense | 622 | 1,600 | |

| Cash | 101 | 1,600 | ||

| (To record the salaries expense) | ||||

| April 24 | Cash | 101 | 8,000 | |

| Commission earned | 401 | 8,000 | ||

| (To record the commission earned) | ||||

| April 28 | Salaries expense | 622 | 1,600 | |

| Cash | 101 | 1,600 | ||

| (To record the salaries expense) | ||||

| April 29 | Repairs expense | 684 | 350 | |

| Cash | 101 | 350 | ||

| (To record the repairs expense) | ||||

| April 30 | Telephone expense | 688 | 750 | |

| Cash | 101 | 750 | ||

| (To record the telephone expense) | ||||

| April 30 | Dividends | 319 | 1,500 | |

| Cash | 101 | 1,500 | ||

| (To record the payment of dividends) |

Table (1)

3.

Prepare the unadjusted

3.

Explanation of Solution

Unadjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts that appears on the ledger accounts before making adjusting journal entries.

Prepare the unadjusted trial balance as on April 30, 2015.

| Corporation AT | ||

| Unadjusted trial balance | ||

| For the year ended April 30, 2015 | ||

| Particulars | Debit($) | Credit ($) |

| Cash | 27,000 | |

| Accounts receivable | 0 | |

| Office supplies | 1,000 | |

| Prepaid insurance | 2,400 | |

| Building | 20,000 | |

| 0 | ||

| Salaries payable | 0 | |

| Common stock | 50,000 | |

| 0 | ||

| Dividends | 1,500 | |

| Commission earned | 8,000 | |

| Depreciation expense, Computer | 0 | |

| Salaries expense | 3,200 | |

| Insurance expense | 0 | |

| Rent expense | 1,800 | |

| Office supplies expense | 0 | |

| Repairs expense | 350 | |

| Telephone expense | 750 | |

| Totals | $58,000 | $58,000 |

Table (2)

4.

Prepare the

4.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and

Prepare the adjusting entries as on 31st April 2015.

| Date | Account titles and Explanation | Post Ref. | Debit ($) | Credit ($) |

| April 30 | Insurance expense | 637 | 133 | |

| Prepaid insurance | 128 | 133 | ||

| (To record the adjusting entry for insurance expense) | ||||

| April 30 | Office supplies expense | 650 | 400 | |

| Office supplies | 124 | 400 | ||

| (To record the adjusting entry for office supplies expense) | ||||

| April 30 | 612 | 500 | ||

| Accumulated depreciation-Equipment | 168 | 500 | ||

| (To record the adjusting entry for depreciation expense, Buildings) | ||||

| April 30 | Salaries expense | 622 | 420 | |

| Salaries payable | 209 | 420 | ||

| (To record the adjusting entry for salaries expense) | ||||

| April 30 | Accounts receivable | 106 | 1,750 | |

| Storage fees earned | 401 | 1,750 | ||

| (To record the adjusting entry for storage fees earned) |

Table (3)

5.

Prepare the adjusted trial balance as of 31st April 2015.

5.

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Prepare the adjusted trial balance as of 31st April 2015.

| Corporation AT | ||

| Adjusted trial balance | ||

| For the year ended April 31, 2015 | ||

| Particulars | Debit($) | Credit ($) |

| Cash | 27,000 | |

| Accounts receivable | 1,750 | |

| Office supplies | 600 | |

| Prepaid insurance | 2,267 | |

| Building | 20,000 | |

| Accumulated depreciation, Building | 500 | |

| Salaries payable | 420 | |

| Common stock | 50,000 | |

| Retained earnings | 0 | |

| Dividends | 1,500 | |

| Commission earned | 9,750 | |

| Depreciation expense, Building | 500 | |

| Salaries expense | 3,620 | |

| Insurance expense | 133 | |

| Rent expense | 1,800 | |

| Office supplies expense | 400 | |

| Repairs expense | 350 | |

| Telephone expense | 750 | |

| Totals | $60,670 | $60,670 |

Table (4)

Income statement:

Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues and vice versa.

Prepare the income statement for the year ended 31st April 2015.

| Corporation AT | ||

| Income statement | ||

| For the three months ended April 31, 2015 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | ||

| Commission earned | 9,750 | |

| Total revenue | 9,750 | |

| Expenses | ||

| Depreciation expense, Buildings | 500 | |

| Salaries expense | 3,620 | |

| Insurance expense | 133 | |

| Rent expense | 1,800 | |

| Office supplies expense | 400 | |

| Repairs expense | 350 | |

| Telephone expense | 750 | |

| Total Expenses | 7,553 | |

| Net income | $2,197 | |

Table (5)

Statement of Retained Earnings:

Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare the statement of retained earnings for the year ended 31st April 2015.

| Corporation AT | ||

| Statement of Retained Earnings | ||

| For the three months ended 31st April 2015 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, Beginning | 0 | |

| Add: Net income | 2,197 | |

| Subtotal | 2,197 | |

| Less: Dividends | 1,500 | |

| Retained earnings, Ending | $697 | |

Table (6)

Balance sheet:

This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Prepare the balance sheet as on 31st April 2015.

| Corporation AT | ||

| Balance Sheet | ||

| As an April 31, 2015 | ||

| Particulars | Amount($) | Amount($) |

| ASSETS | ||

| Current Assets: | ||

| Cash | 27,000 | |

| Accounts receivable | 1,750 | |

| Office Supplies | 600 | |

| Prepaid insurance | 2,267 | |

| Total Current Assets | 31,617 | |

| Computer equipment | 20,000 | |

| Less: Accumulated depreciation, Buildings | 500 | 19,500 |

| Total assets | $51,117 | |

| LIABILITIES | ||

| Current Liabilities: | ||

| Salaries payable | 420 | |

| Total current liabilities | 420 | |

| Long-liabilities: | 0 | |

| Total liabilities | 420 | |

| Stockholders’ equity | ||

| Paid-in capital | ||

| Common stock | 50,000 | |

| Retained earnings | 697 | |

| Total Stockholders’ Equity | 50,697 | |

| Total liabilities and Stockholders’ Equity | $51,117 | |

Table (7)

6.

Record and post the necessary closing entries as of 30th April 2015.

6.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to Retained Earnings account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare the closing entry for revenue accounts.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| April 30 | Commission earned | 405 | 9,750 | |

| Income summary | 901 | 9,750 | ||

| (To close the revenues account) |

Table (8)

In this closing entry, revenue accounts are closed by transferring the amount of revenue accounts to the income summary account in order to bring the revenue account balance to zero. Hence, debit the revenue accounts and credit income summary account.

Prepare the closing entry for expenses account.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| April 31 | Income summary | 901 | 7,553 | |

| Depreciation expense-Equipment | 612 | 500 | ||

| Salaries expense | 622 | 3,620 | ||

| Insurance expense | 637 | 133 | ||

| Rent expense | 640 | 1,800 | ||

| Office supplies expense | 650 | 400 | ||

| Repairs expense | 684 | 350 | ||

| Telephone expense | 688 | 750 | ||

| (To close the expenses account) |

Table (9)

In this closing entry, expenses account is closed by transferring the amount of expenses to the income summary in order to bring the expenses account balance to zero. Hence, debit the income summary account and credit all expenses account.

Prepare closing entry for income summary account.

| Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| April 31 | Income Summary | 901 | 2,197 | |

| Retained Earnings | 308 | 2,197 | ||

| (To close the income summary account) |

Table (10)

Closing entry of income summary account:

In this closing entry, income summary account is closed by transferring the amount of income summary (profit) to the retained earnings in order to bring the income summary account balance to zero. Hence, debit the income summary account and credit retained earnings account.

Prepare closing entry for dividend account.

Date | Accounts title and explanation | Post Ref. |

Debit ($) |

Credit ($) |

| April 31 | Retained Earnings | 318 | 1,500 | |

| Dividends | 319 | 1,500 | ||

| (To close the dividends account) |

Table (11)

In this closing entry, dividend account is closed by transferring the amount of dividend to the retained earnings in order to bring the dividend account balance to zero. Hence, debit the retained earnings account and credit dividend account.

7.

Prepare the post-closing trial balance as on 31st April 2015.

7.

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Prepare the post-closing trial balance as on 30th April 2015.

| Corporation SS | ||

| Adjusted trial balance | ||

| For the year ended April 30, 2015 | ||

| Particulars | Debit($) | Credit ($) |

| Cash | 27,000 | |

| Accounts receivable | 1,750 | |

| Office supplies | 600 | |

| Prepaid insurance | 2,267 | |

| Computer equipment | 20,000 | |

| Accumulated depreciation, Computer Equipment | 500 | |

| Salaries payable | 420 | |

| Common stock | 50,000 | |

| Retained earnings | 697 | |

| Totals | $51,617 | $51,617 |

Table (11)

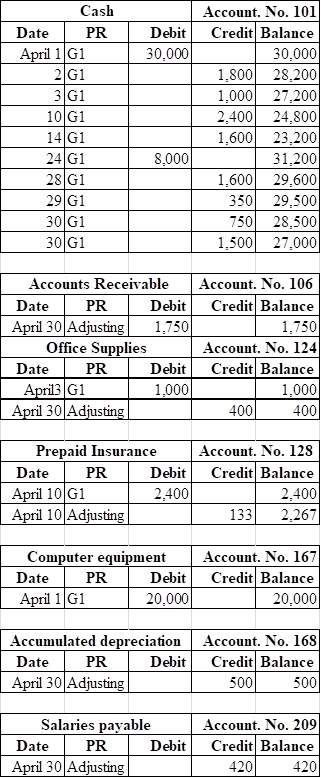

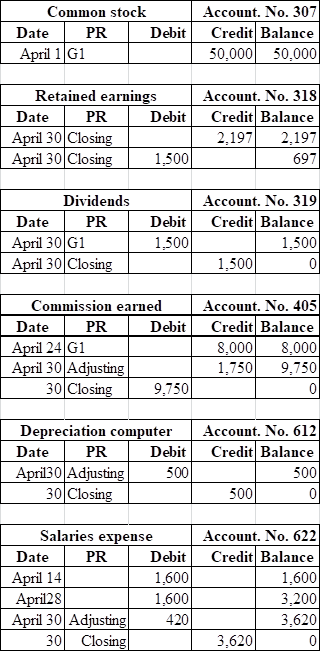

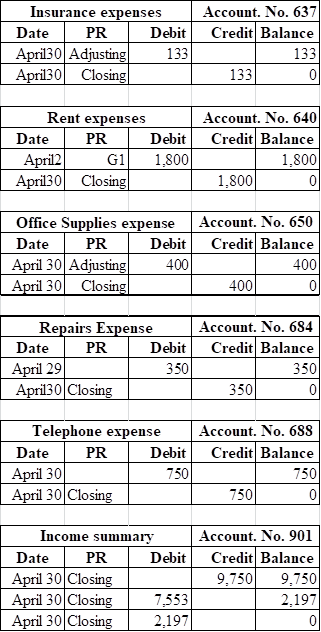

1, 2, 4, and 6

Post the transactions to the general ledger.

1, 2, 4, and 6

Explanation of Solution

Post the transactions to the general ledger.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting Fundamentals:

- Kindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forwardCan you explain the process for solving this financial accounting question accurately?arrow_forwardPlease given correct answer for General accounting question I need step by step explanationarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education