Financial Modeling

Three entrepreneurs were looking to start a new brewpub near Sacramento, California, called Roseville Brewing Company (RBC). Brewpubs provide two products to customers—food from the restaurant segment and freshly brewed beer from the beer production segment. Both segments are typically in the same building, which allows customers to see the beer-brewing process.

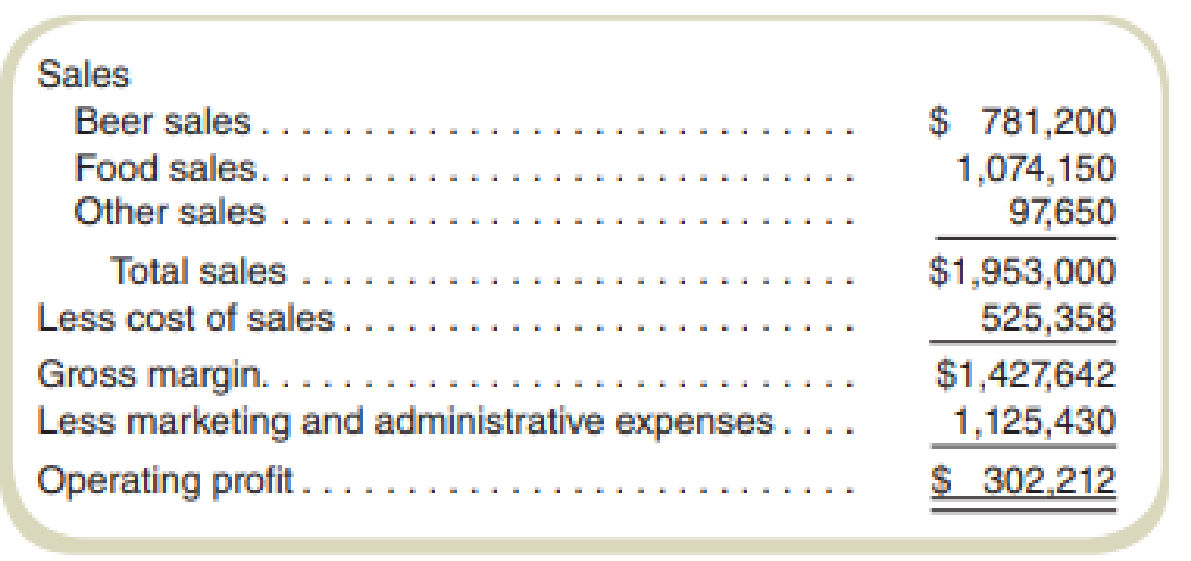

After months of research, the owners created a financial model that showed the following projections for the first year of operations:

In the process of pursuing capital through private investors and financial institutions, RBC was approached with several questions. The following represents a sample of the more common questions asked:

- What is the break-even point?

- What sales dollars will be required to make $200,000? To make $500,000?

- Is the product mix reasonable? (Beer tends to have a higher contribution margin ratio than food, and therefore product mix assumptions are critical to profit projections.)

- What happens to operating profit if the product mix shifts?

- How will changes in price affect operating profit?

- How much does a pint of beer cost to produce?

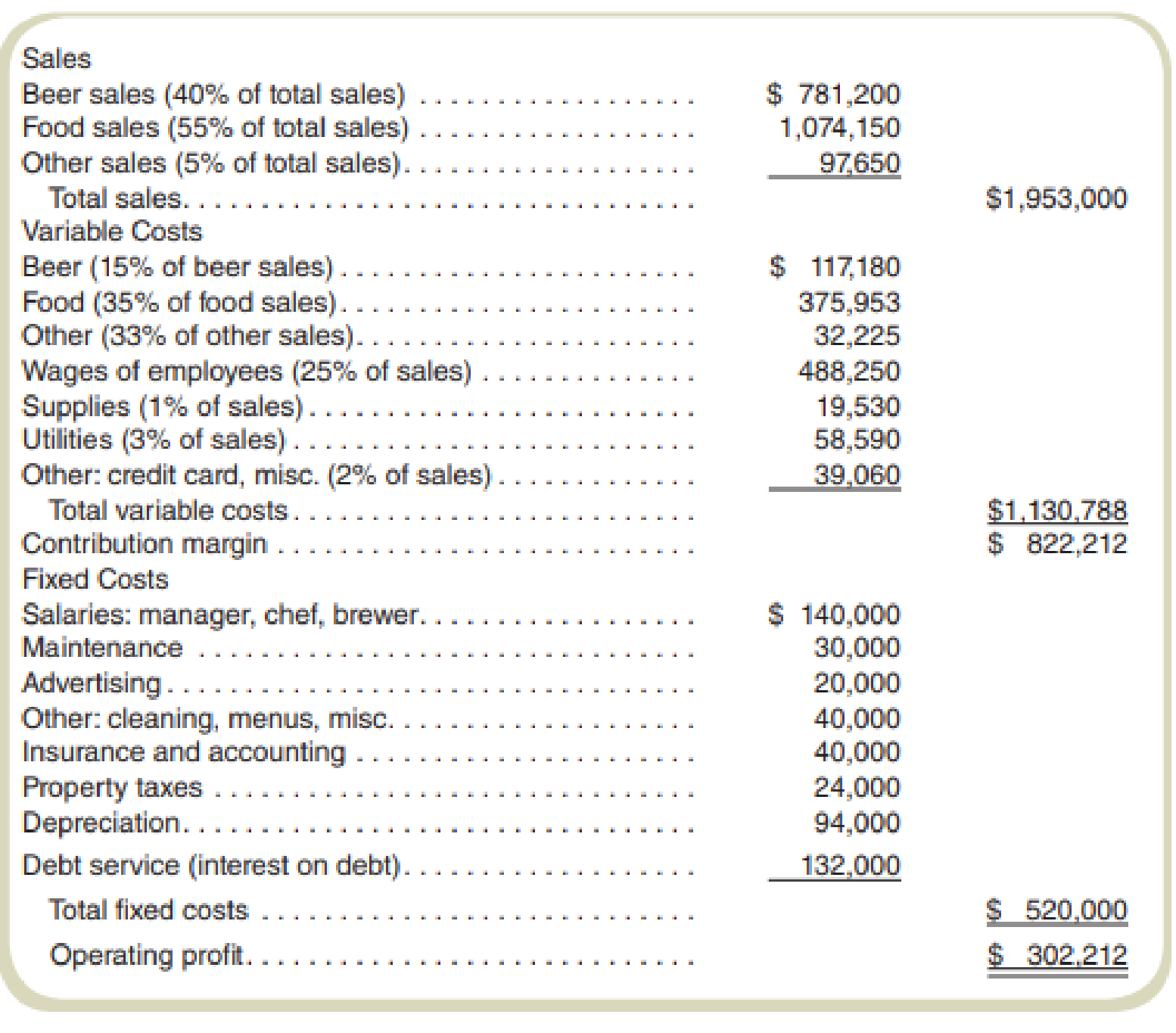

It became clear to the owners of RBC that the initial financial model was not adequate for answering these types of questions. After further research, RBC created another financial model that provided the following information for the first year of operations:

Required

- a. What were potential investors and financial institutions concerned with when asking the questions listed in the case?

- b. Why was the first financial model prepared by RBC inappropriate for answering most of the questions asked by investors and bankers? Be specific.

- c. If you were deciding whether to invest in RBC, how would you quickly check the reasonableness of RBC’s projected operating profit?

- d. Why is the question “How much does a pint of beer cost to produce?” difficult to answer?

- e. Perform a sensitivity analysis by answering the following questions:

- 1. What is the break-even point in sales dollars for RBC?

- 2. What is the margin of safety for RBC?

- 3. Why can’t RBC find the break-even point in units?

- 4. What sales dollars would be required to achieve an operating profit of $200,000? $500,000? What assumptions are made in this calculation?

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

- Zebrix Ltd. has an inventory period of 55 days, an accounts receivable period of 10 days, and an accounts payable period of 6 days. The company's annual sales are $208,400. How many times per year does the company turn over its accounts receivable?arrow_forwardLika company issues 2,000 shares of $10 par value common stock for $25 per share. What amount should be credited to the Common Stock account and to the Additional Paid-in Capital account?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardPlease provide the answer to this financial accounting question using the right approach.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

- Can you solve this financial accounting problem using accurate calculation methods?arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardI am looking for a reliable way to solve this financial accounting problem using accurate principles.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning