Concept explainers

Prepare journal entries to record each of the given December transaction:

Introduction:

A

To calculate:

Journal Entries:

Explanation of Solution

| DATE | PARTICULARS | DR AMOUNT | CR AMOUNT |

| Dec 2 | Advertising expense A/c DrTo Cash A/c | $1,025 | $1,025 |

| Dec 3 | Repair Expense- Computer A/c DrTo Cash A/c | $500 | $500 |

| Dec 4 | Cash A/c DrTo Accounts Receivable A/c | $3950 | $3950 |

| Dec 10 | Wages A/c DrTo Cash A/c | $750 | $750 |

| Dec 14 | Cash A/c DrTo Unearned Computer Service Revenue | $1500 | $1500 |

| Dec 15 | Computer Supplies A/c DrTo Accounts Payable A/c | $1100 | $1100 |

| Dec 20 | Cash A/c DrTo Computer Services Revenue A/c | $5625 | $5625 |

| Dec 28 | Cash A/c DrTo Accounts Receivable A/c | $3000 | $3000 |

| Dec 29 | Mileage Expense A/c DrTo cash A/c | $192 | $192 |

| Dec 31 | S. Rey Withdrawal A/c DrTo cash A/c | $1500 | $1500 |

Conclusion:

The above mentioned entries would be reflected in the books of Business Solution for the month of December.

Prepare

Introduction:

Adjusting entries are journal entries made at the end of an accounting period to allocate income or expenditure to the period in which they actually occurred.

To calculate:

Adjusting Entries for month end December.

Explanation of Solution

| Particulars | Debit Amount | Credit Amount |

| Computer Supplies Expenses A/c Dr To Computer Supplies A/c | $3065 | $3065 |

| Insurance Expense A/c Dr To Prepaid Insurance | $555 | $555 |

| Wages Expenses A/c Dr To Wages Payable | $500 | $500 |

To Office Equipment A/c | $400 | $400 |

| Depreciation expenses- Computer Equipment A/c Dr To Computer Equipment A/c | $1250 | $1250 |

| Rent Expense A/c Dr To Prepaid Rent A/c | $2475 | $2475 |

These adjusting entries would be recorded as above

Conclusion:

The above mentioned adjusting entries would be reflected in the books of Business Solution for the month of December.

Prepare Adjusted

Introduction:

An adjusted trial balance is a list of all the account balances contained in the general ledger after

the adjusting entries for a period have been posted in the accounts

To calculate:

Adjust Trial Balance as on December 31, 2019

Explanation of Solution

| Account Title | Debit | Credit |

| Cash | 48372 | |

| Accounts Receivable | 5668 | |

| Computer supplies | 580 | |

| Prepaid Insurance | 1665 | |

| Prepaid Rent | 825 | |

| Office equipment | 8000 | |

| 400 | ||

| Computer Equipment | 20000 | |

| Accumulated Depreciation-Computer Equipment | 1250 | |

| Accounts Payable | 1100 | |

| Wages Payable | 500 | |

| Unearned Computer Services Revenue | 1500 | |

| S.Rey Capital | 73000 | |

| S.Rey Withdrawal | 7100 | |

| Computer Services Revenue | 31284 | |

| Depreciation expenses-Office Equipment | 400 | |

| Depreciation expenses- Computer Equipment | 1250 | |

| Wages Expenses | 3875 | |

| Insurance Expenses | 555 | |

| Rent Expenses | 2475 | |

| Computer Supplies Expenses | 3065 | |

| Advertising Expenses | 2753 | |

| Mileage Expenses | 896 | |

| Miscellaneous Expense | 250 | |

| Repair Expenses- Computer | 1305 | |

| TOTALS | 109034 | 109034 |

The Adjusted Trial Balance would reflect balances as above

Conclusion:

The aforesaid adjusted trial balance would be reflected in the books of Business Solution for the month of December.

Prepare Income Statement for three months ended as of December 31, 2019

Introduction:

An Income statement is the summary of all the income and expenses of a company over a period

To calculate:

Income Statement as on December 31, 2019

Explanation of Solution

| Revenue | 31284 |

| Unearned Computer Services Revenue | 1500 |

| Expenses: | |

| Depreciation expenses-Office Equipment | 400 |

| Depreciation expenses- Computer Equipment | 1250 |

| Wages Expenses | 3875 |

| Insurance Expenses | 555 |

| Rent Expenses | 2475 |

| Computer Supplies Expenses | 3065 |

| Advertising Expenses | 2753 |

| Mileage Expenses | 896 |

| Miscellaneous Expense | 250 |

| Repair Expenses- Computer | 1305 |

| Operating Income | 15960 |

The Income statement would show the above given income and expenses.

Conclusion:

The aforesaid income and expenditure would be reflected in the books of Business Solution for the month of December.

Prepare statement of owners equity for three months ended as of December 31, 2019

Introduction:

A statement of owner's equity summarizes changes in the capital balance of a business over a defined period

To calculate:

Owners Equity as on December 31, 2019

Explanation of Solution

| Opening Capital | 73,000 |

| (+) Income earned | 15,960 |

| (-) Losses incurred | |

| (+) Owners Contribution during the period | |

| (-) Owners draw during the period | (7,100) |

| Closing Capital | 81,860 |

The owners equity would be shown as above with a closing balance of $ 81,860

Conclusion:

The aforesaid Owners Equity would be reflected in the books of Business Solution for the month of December.

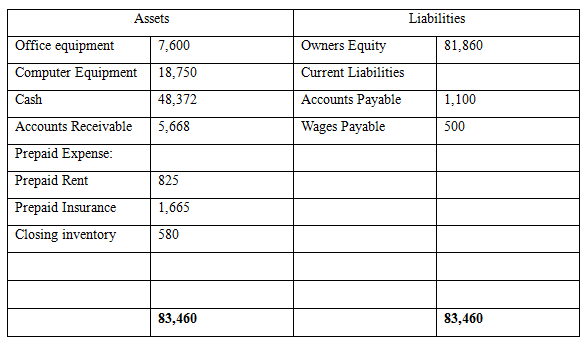

Prepare

Introduction:

Balance sheet is a statement of assets and liabilities and capital of a business at a particular point of time

To calculate:

Balance Sheet as on December 31, 2019

Explanation of Solution

The balance sheet would be shown as above with a closing balance

Conclusion:

The aforesaid Balance sheet would be reflected in the books of Business Solution for the month of December.

Want to see more full solutions like this?

Chapter 3 Solutions

FUND.ACCT.PRIN.(LOOSELEAF)-W/ACCESS

- I need the correct answer to this financial accounting problem using the standard accounting approach.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardThe installment method of revenue recognition is primarily used for_. (a) Service contracts (b) Sales with extended payment terms (c) Construction projects (d) Consignment sales MCQarrow_forward

- Please explain the correct approach for solving this general accounting question.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardSullivan Manufacturing estimates that overhead costs for the next year will be $3,200,000 for indirect labor and $480,000 for factory utilities. The company uses machine hours as its overhead allocation base. If 160,000 machine hours are planned for the next year, what is the company's plantwide overhead rate?arrow_forward

- Could you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardCan you demonstrate the accurate method for solving this financial accounting question?arrow_forward

- Can you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardGabbana Manufacturing estimated that machine hours for the year would be 30,000 hours and overhead (all fixed) would be $150,000. Gabbana applies its overhead on the basis of machine hours. During the year, all overhead costs were exactly as planned ($150,000). There was $12,000 in over-applied overhead. How many machine-hours were worked during the period? Helparrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education