FUNDAMENTALS OF COST ACCOUNTING BUNDLE

6th Edition

ISBN: 9781260858525

Author: LANEN

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 56P

Extensions of the CVP Model—Semifixed (Step) Costs

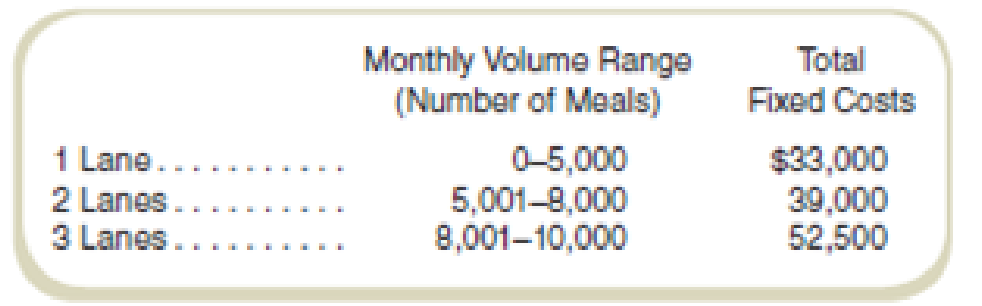

Sam’s Sushi serves only a fixed-price lunch. The price of $10 and the variable cost of $4 per meal remain constant regardless of volume. Sam can increase lunch volume by opening and staffing additional check-out lanes. Sam has three choices:

Required

- a. Calculate the break-even point(s).

- b. If Sam can sell all the meals he can serve, should he operate at one, two, or three lanes? Support your answer.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the purpose of depreciation?A. Track the market value of assetsB. Match the cost of an asset to the periods it benefitsC. Allocate cash flowsD. Record the decrease in asset liquidity

Dear tutor.

I mistakenly submitted blurr image please comment i will write values.

please dont Solve with incorrect values otherwise unhelpful.

Please Get the Correct answer to this General Accounting Question without any problem

Chapter 3 Solutions

FUNDAMENTALS OF COST ACCOUNTING BUNDLE

Ch. 3 - Write out the profit equation and describe each...Ch. 3 - What are the components of total costs in the...Ch. 3 - How does the total contribution margin differ from...Ch. 3 - Compare cost-volume-profit (CVP) analysis with...Ch. 3 - Fixed costs are often defined as fixed over the...Ch. 3 - Prob. 6RQCh. 3 - What is the margin of safety? Why is this...Ch. 3 - Prob. 8RQCh. 3 - Write out the equation for the target volume (in...Ch. 3 - How do income taxes affect the break-even...

Ch. 3 - Why is it common to assume a fixed sales mix...Ch. 3 - What are some important assumptions commonly made...Ch. 3 - Prob. 13CADQCh. 3 - Prob. 14CADQCh. 3 - The typical cost-volume-profit graph assumes that...Ch. 3 - The assumptions of CVP analysis are so simplistic...Ch. 3 - Prob. 17CADQCh. 3 - Consider a class in a business school where volume...Ch. 3 - Prob. 19CADQCh. 3 - Prob. 20CADQCh. 3 - Consider the Business Application,...Ch. 3 - Consider the Business Application,...Ch. 3 - Prob. 23CADQCh. 3 - Profit Equation Components Identify each of the...Ch. 3 - Profit Equation Components Identify the letter of...Ch. 3 - Basic Decision Analysis Using CVP Anus Amusement...Ch. 3 - Basic CVP Analysis The manager of Dukeys Shoe...Ch. 3 - CVP AnalysisEthical Issues Mark Ting desperately...Ch. 3 - Basic Decision Analysis Using CVP Derby Phones is...Ch. 3 - Prob. 30ECh. 3 - Basic Decision Analysis Using CVP Warner Clothing...Ch. 3 - Basic Decision Analysis Using CVP Refer to the...Ch. 3 - Prob. 33ECh. 3 - Prob. 34ECh. 3 - Analysis of Cost Structure Spring Companys cost...Ch. 3 - CVP and Margin of Safety Bristol Car Service...Ch. 3 - CVP and Margin of Safety Caseys Cases sells cell...Ch. 3 - Prob. 38ECh. 3 - Prob. 39ECh. 3 - Refer to the data for Derby Phones in Exercise...Ch. 3 - Refer to the data for Warner Clothing in Exercise...Ch. 3 - CVP with Income Taxes Hunter Sons sells a single...Ch. 3 - CVP with Income Taxes Hammerhead Charters runs...Ch. 3 - Prob. 44ECh. 3 - Prob. 45ECh. 3 - Prob. 46ECh. 3 - Prob. 47ECh. 3 - CVP Analysis and Price Changes Argentina Partners...Ch. 3 - Prob. 49PCh. 3 - CVP AnalysisMissing Data Breed Products has...Ch. 3 - Prob. 51PCh. 3 - Prob. 52PCh. 3 - CVP AnalysisSensitivity Analysis (spreadsheet...Ch. 3 - Prob. 54PCh. 3 - Prob. 55PCh. 3 - Extensions of the CVP ModelSemifixed (Step) Costs...Ch. 3 - Prob. 57PCh. 3 - Extensions of the CVP ModelTaxes Odd Wallow Drinks...Ch. 3 - Prob. 59PCh. 3 - Prob. 60PCh. 3 - Extensions of the CVP ModelTaxes Toys 4 Us sells...Ch. 3 - Extensions of the CVP AnalysisTaxes Eagle Company...Ch. 3 - Extensions of the CVP ModelMultiple Products...Ch. 3 - Extensions of the CVP ModelMultiple Products...Ch. 3 - Prob. 65PCh. 3 - Prob. 66PCh. 3 - Prob. 67PCh. 3 - Prob. 68PCh. 3 - Extensions of the CVP ModelMultiple Products and...Ch. 3 - Extensions of the CVP ModelTaxes With Graduated...Ch. 3 - Prob. 71PCh. 3 - Financial Modeling Three entrepreneurs were...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ivanhoe Equipment Company sells computers for $1,620 each and also gives each customer a 2-year warranty that requires the company to perform periodic services and to replace defective parts. In 2025, the company sold 860 computers on account. Based on experience, the company has estimated the total 2-year warranty costs as $40 for parts and $60 for labor per unit. (Assume sales all occur at December 31, 2025.) In 2026, Ivanhoe incurred actual warranty costs relative to 2025 computer sales of $13,200 for parts and $19,800 for labor. Record the entries to reflect the above transactions (accrual method) for 2025 and 2026. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Date Account Titles and Explanation 2025 2026 2025 Cash Sales Revenue (To record sale of computers) Warranty Expense Warranty…arrow_forwardGeneral Accounting Question Solution Please Solvearrow_forwardPlease Solve this one with Financial Accounting method. Get Solution in timearrow_forward

- Hello Tutor I need Answer of this Financial Accounting Question Solution with Detailed Answerarrow_forwardAccountingarrow_forwardThe following errors took place in journalizing and posting transactions:a. The payment of $3,125 from a customer on account was recorded as a debit to Cash and a credit toAccounts Payable.b. Advertising expense of $1,500 paid for the current month was recorded as a debit to MiscellaneousExpense and a credit to Advertising Expense.c. The purchase of supplies of $2,690 on the account was recorded as a debit to Office Equipment anda credit to Supplies.d. The receipt of $3,750 for services rendered was recorded as a debit to Accounts Receivable and acredit to Fees Earned.Required:Prepare journal entries to correct the errors.Each error correction carries equal marks.arrow_forward

- Required:a) Journalize the following transactions using the direct write-off method of accounting foruncollectible receivables:Aug. 7. Received $175 from Roosevelt McLair and wrote off the remainder owed of $400 asuncollectible.Nov. 23. Reinstated the account of Roosevelt McLair and received $400 cash in full payment.b) Journalize the following transactions using the allowance method of accounting for uncollectiblereceivables:Feb. 12. Received $750 from Manning Wingard and wrote off the remainder owed of $2,000 asuncollectible.June 30. Reinstated the account of Manning Wingard and received $2,000 cash in full payment.Each journal carries equal marksarrow_forwardIf someone tracks, tallys and totals a current liabilities for an accounting period, and then seeks to apply this value in a calculation to assess our liquidity, what’s the difference between the current ratio and the “acid-test” (or “quick”) ratio? Does the difference between these two metrics even matter?arrow_forwardDear tutor. I mistakenly submitted blurr image please comment i will write values. please dont Solve with incorrect values otherwise unhelpful.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

How to Estimate Project Costs: A Method for Cost Estimation; Author: Online PM Courses - Mike Clayton;https://www.youtube.com/watch?v=YQ2Wi3Jh3X0;License: Standard Youtube License