Concept explainers

CVP Analysis—Sensitivity Analysis (spreadsheet recommended)

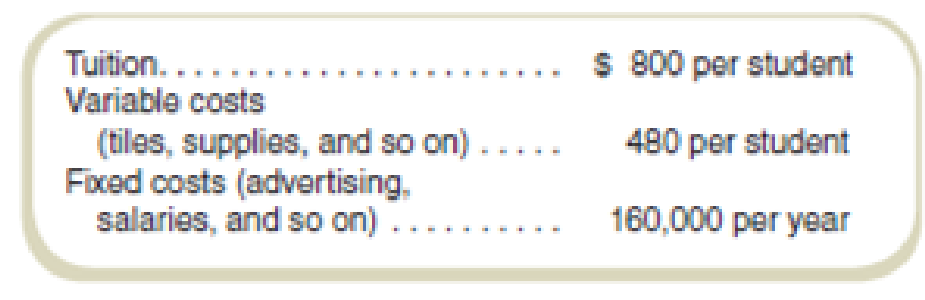

Alameda Tile sells products to many people remodeling their homes and thinks that it could profitably offer courses on tile installation, which might also increase the demand for its products. The basic installation course has the following (tentative) price and cost characteristics:

Required

- a. What enrollment will enable Alameda Tile to break even?

- b. How many students will enable Alameda Tile to make an operating profit of $80,000 for the year?

- c. Assume that the projected enrollment for the year is 800 students for each of the following (considered independently):

- 1. What will be the operating profit (for 800 students)?

- 2. What would be the operating profit if the tuition per student (that is, sales price) decreased by 10 percent? Increased by 20 percent?

- 3. What would be the operating profit if variable costs per student decreased by 10 percent? Increased by 20 percent?

- 4. Suppose that fixed costs for the year are 10 percent lower than projected, whereas variable costs per student are 10 percent higher than projected. What would be the operating profit for the year?

a.

Calculate the enrolment required to break-even for Company A.

Answer to Problem 53P

Company A requires 500 enrolments to break-even.

Explanation of Solution

Breakeven point (BEP): The breakeven point or BEP is that level of output at which the total revenue is equal to the total cost. The BEP means there are no operating income and no operating losses. The management keeps an eye on the breakeven point in order to avoid the operating losses in order to avoid losses.

Contribution margin: The excess of sales price over the variable expenses is referred to as the contribution margin. It is computed by deducting the variable expenses from the sales revenue.

Compute the break-even point:

Thus, Company A requires 500 enrolments to break-even.

Working note 1:

Compute the contribution margin:

b.

Calculate the enrolment required to make the operating profit of $80,000 for the year.

Answer to Problem 53P

Company A requires 750 enrolments to make the operating profit of $80,000 for the year.

Explanation of Solution

Operating profit: The operating profit is the excess of total revenues over total expenses after adjusting for depreciation and taxes.

Compute the enrolments required to make the operating profit of $80,000 for the year:

Thus, Company A requires 750 enrolments to make the operating profit of $80,000 for the year.

c.

- 1. Calculate the operating profit of 800 students.

- 2. Calculate the operating profit when tuition fee per students decreases by 10%. Increases by 20%.

- 3. Calculate the operating profit when the variable cost per students decreases by 10%. Increases by 20%.

- 4. Calculate the operating profit when fixed cost decreases by 10% and variable cost increases by 10%.

Answer to Problem 53P

- 1. Operating profit for selling 800 units is $96,000.

- 2. Operating profit will be $32,000 if the tuition fee per student decreases by 10%.

Operating profit will be $224,000 if tuition fee per student increases by 20%.

- 3. Operating profit will be $134,400 if the variable cost per student decreases by 10%.

Operating profit will be $19,200 if the variable cost per student increases by 20%.

- 4. Operating profit will be $73,600 if fixed costs for the year are 10 per cent lower than projected, whereas variable costs per student are 10 per cent higher than projected.

Explanation of Solution

Target volume: the level of sales which need to be achieved during a particular period of time is termed as target volume.

Target profit: the amount of profit which needs to be achieved during a particular period of time on a particular level of sales is termed as target profit.

1.

Compute the operating profit for 800 units:

Thus, operating profit for selling 800 units is $96,000.

2.

(I)

Calculate the operating profit when tuition fee per students decreases by 10%.

Thus, operating profit will be 32,000 if tuition fee per student decreases by 10%.

Working note 2:

Revised sales price:

(II)

Calculate the operating profit when tuition fee per students increases by 20%:

Thus, operating profit will be 224,000 if tuition fee per student increases by 20%.

Working note 3:

Revised sales price:

3.

(I)

Calculate the operating profit when variable per students decreases by 10%.

Thus, operating profit will be 134,400 if the variable cost per student decreases by 10%.

Working note 4:

Revised variable cost:

(II)

Calculate the operating profit when the variable cost per students increases by 20%:

Thus, operating profit will be $19,200 if the variable cost per student increases by 20%.

Working note 5:

Revised variable price:

4.

Compute the operating profit if fixed costs for the year are 10 per cent lower than projected, whereas variable costs per student are 10 per cent higher than projected:

Thus, operating profit will be $73,600 if fixed costs for the year are 10 per cent lower than projected, whereas variable costs per student are 10 per cent higher than projected.

Working note 6:

Compute the revised variable cost:

Working note 7:

Compute the revised fixed cost:

Want to see more full solutions like this?

Chapter 3 Solutions

FUNDAMENTALS OF COST ACCOUNTING

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardHow can I solve this financial accounting problem using the appropriate financial process?arrow_forwardCan you demonstrate the accurate steps for solving this financial accounting problem with valid procedures?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning  Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning