Concept explainers

1 and 2

Prepare the T- account and enter the transaction into their respective accounts for calculating the ending balance.

1 and 2

Explanation of Solution

Prepare the T-accounts:

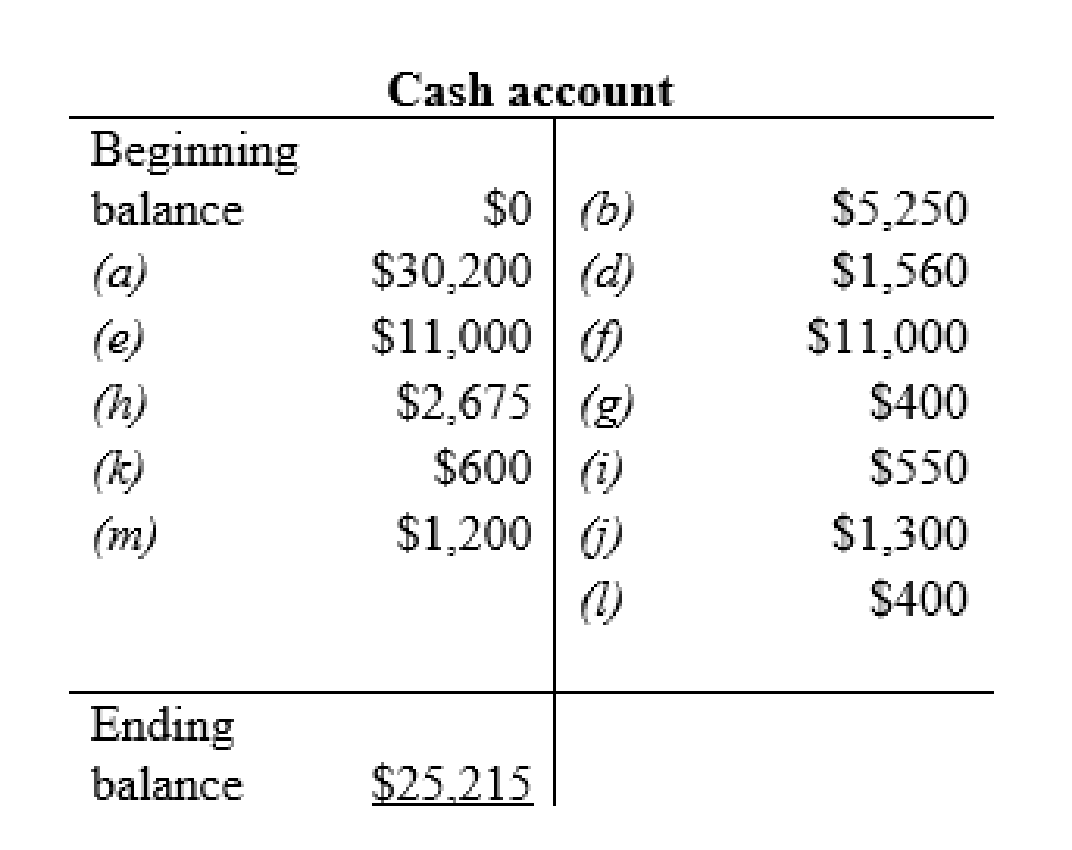

Cash account:

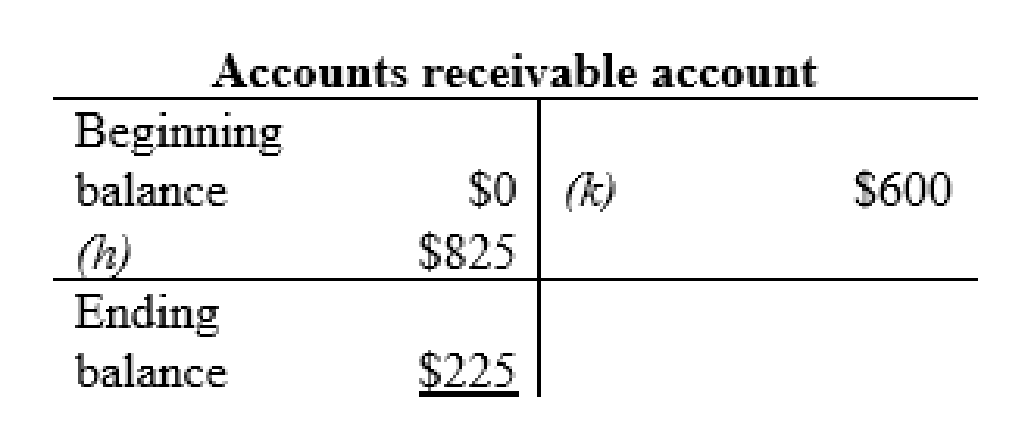

Accounts receivable account:

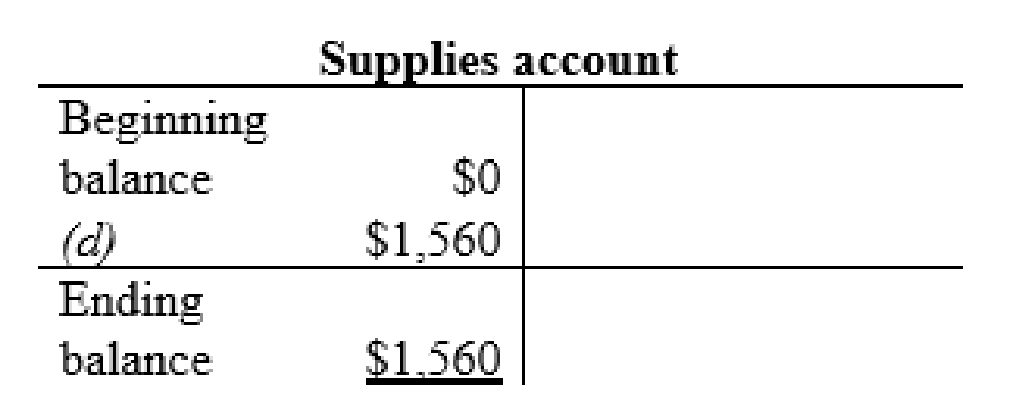

Supplies account:

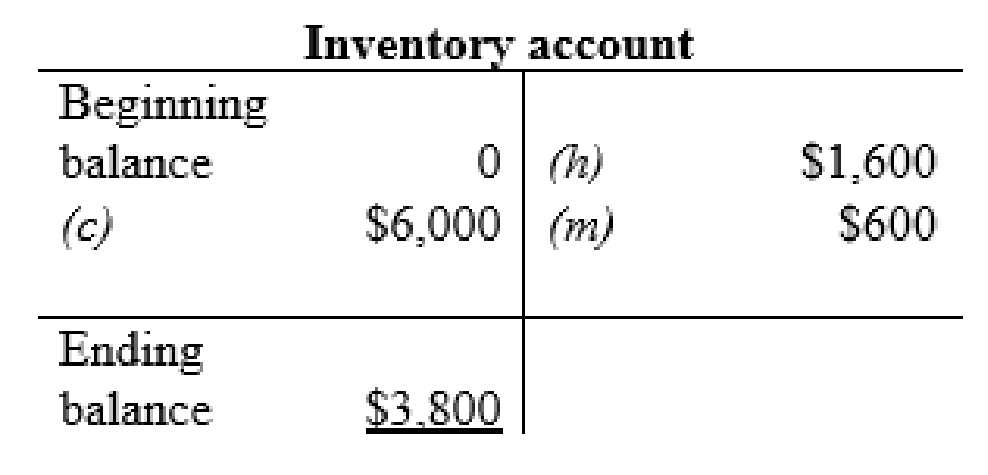

Inventory account:

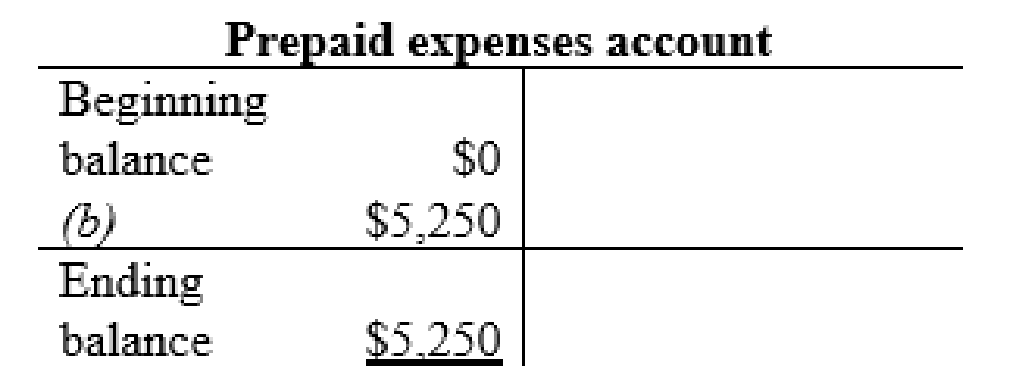

Prepaid expenses account:

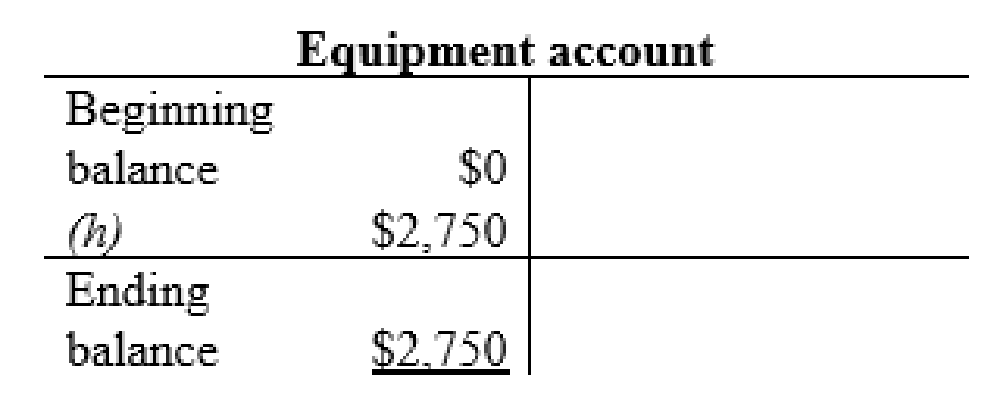

Equipment account:

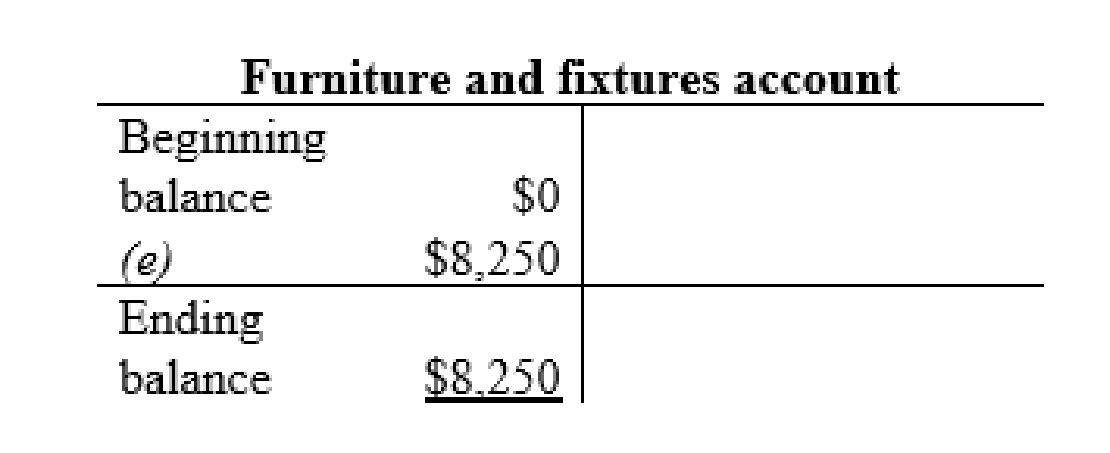

Furniture and fixtures account:

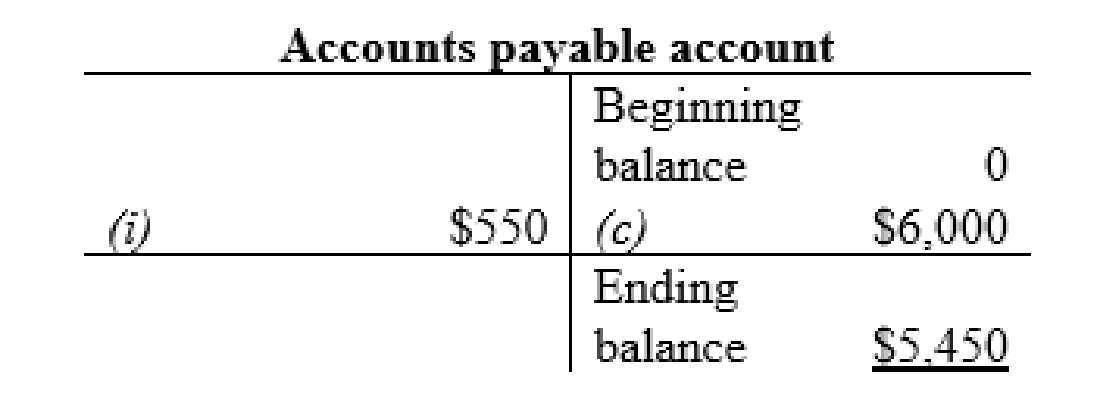

Accounts payable account:

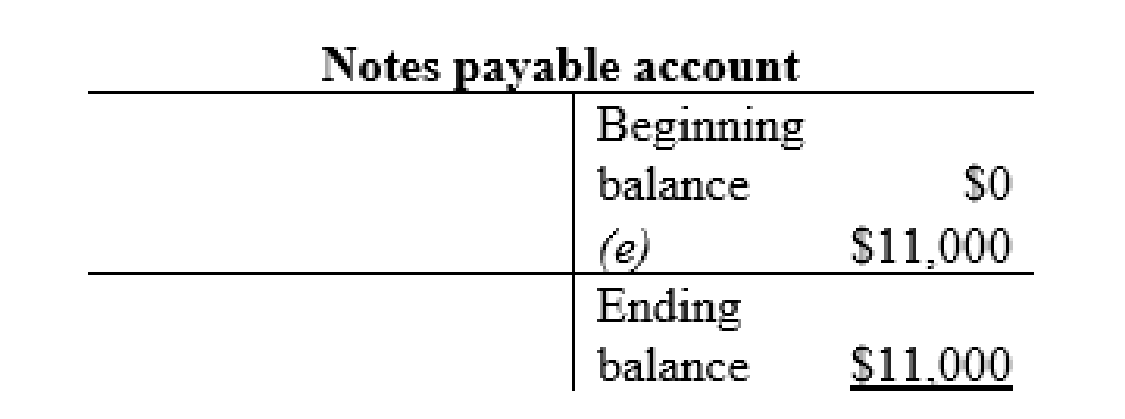

Notes payable account:

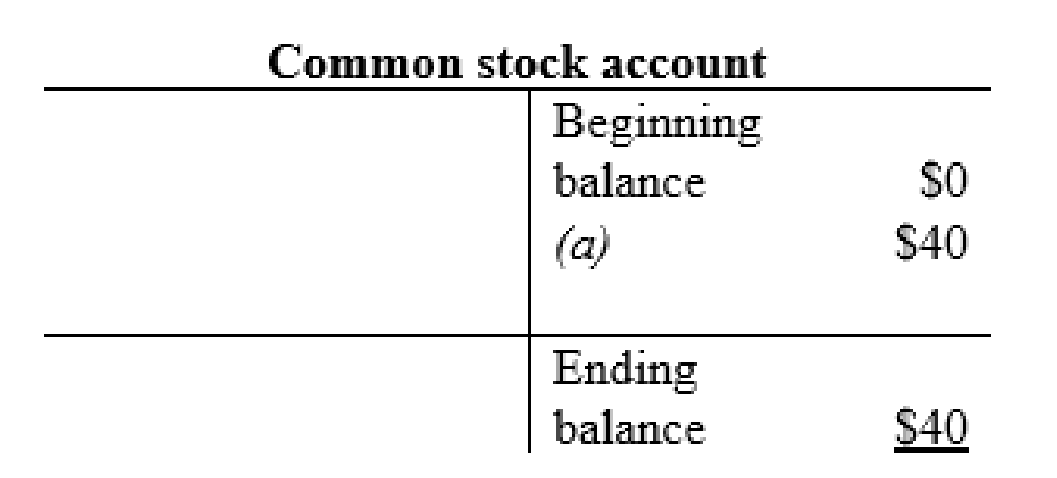

Common stock account:

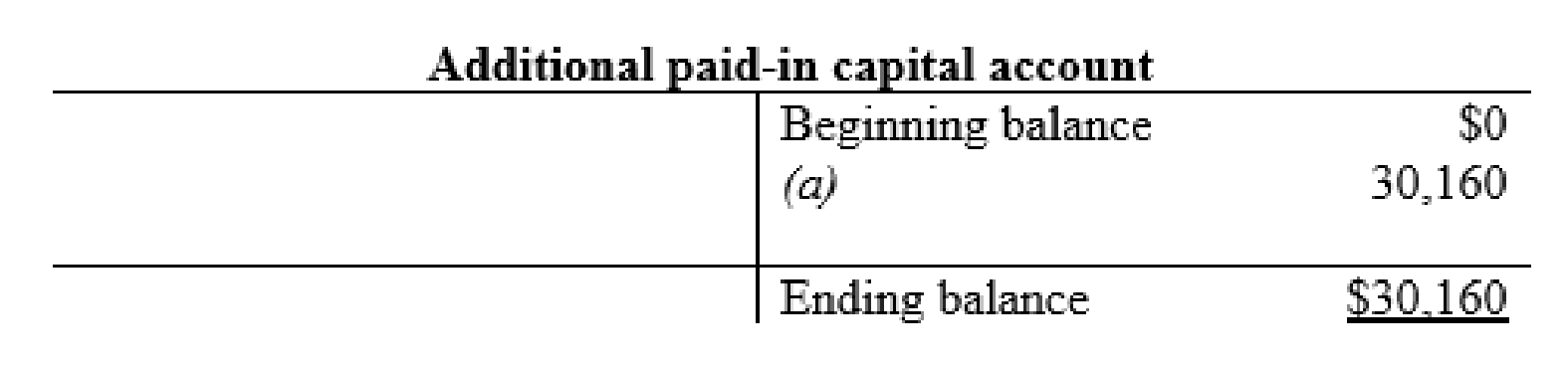

Additional paid-in capital account:

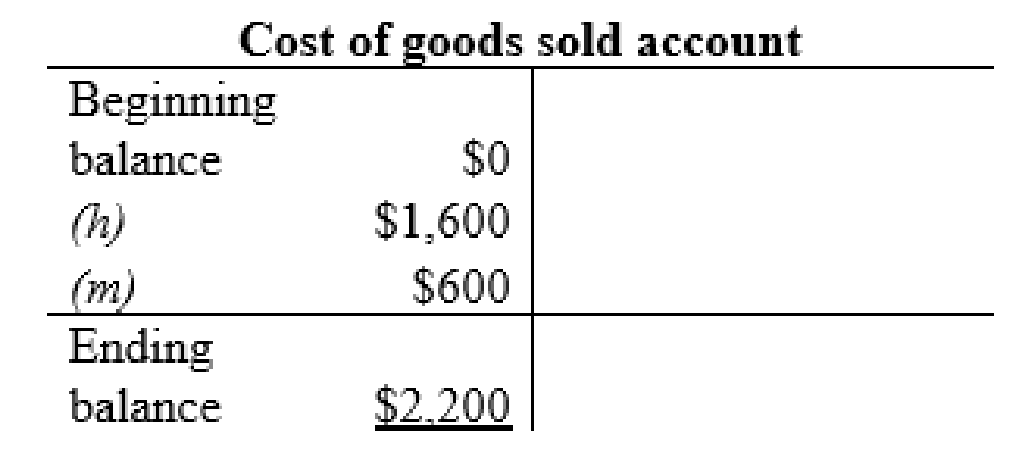

Cost of goods sold account:

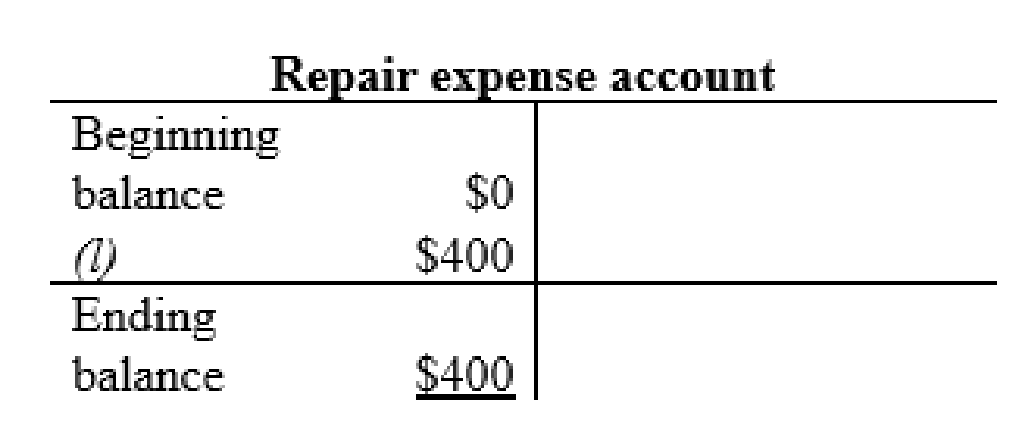

Repair expense account:

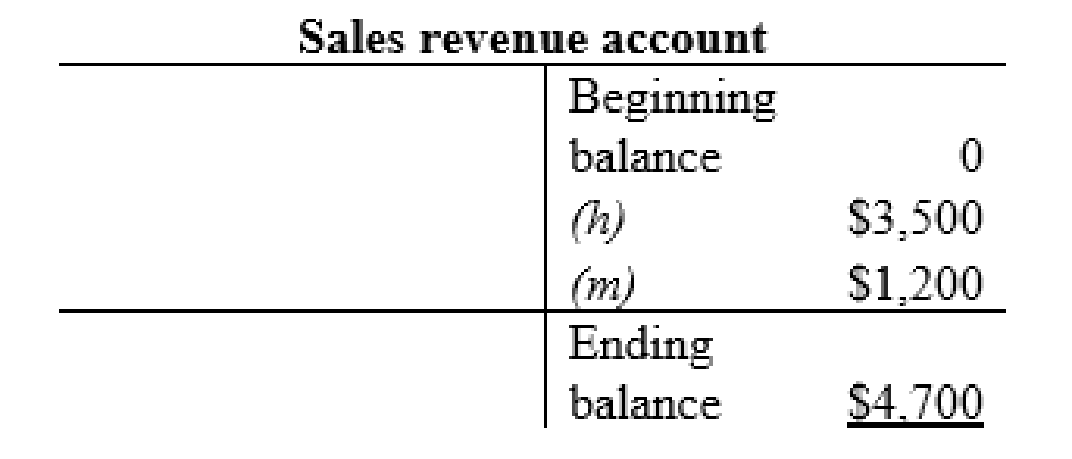

Sales revenue account:

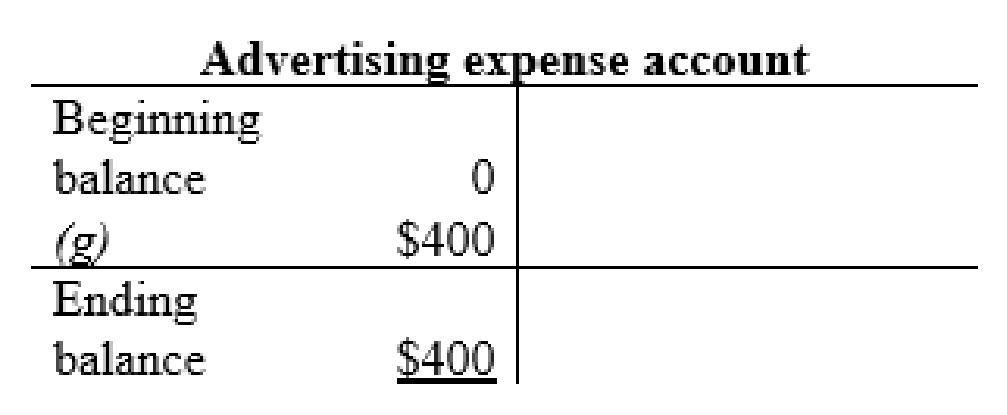

Advertising expense account:

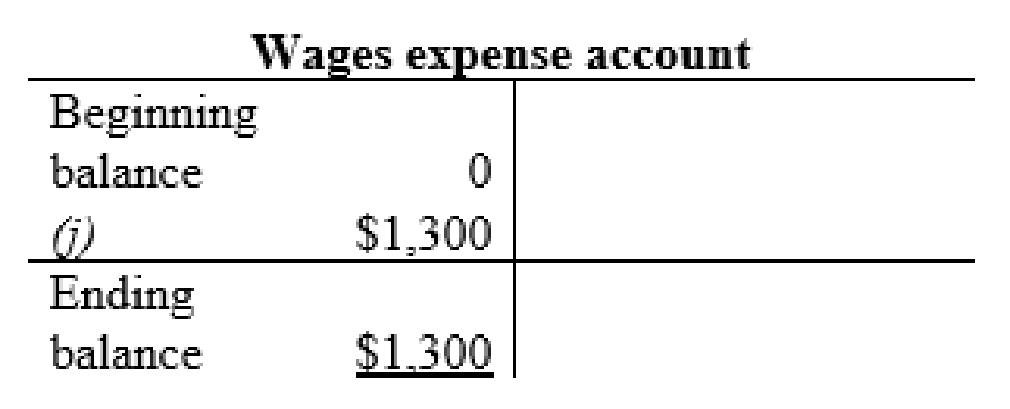

Wages expense account:

Thus, the t-accounts are prepared and the ending balances are calculated.

3.

Prepare an unadjusted income statement for the month February.

3.

Explanation of Solution

Prepare an unadjusted income statement:

| Company KS | ||

| Income statement (unadjusted) | ||

| For the month ended 28th February | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues: | ||

| Sales revenue (1) | 4,700 | |

| Total revenues (A) | 4,700 | |

| Expenses: | ||

| Cost of goods sold (2) | 2,200 | |

| Advertising expense | 400 | |

| Wage expense | 1,300 | |

| Repair expense | 400 | |

| Total expenses (B) | 4,300 | |

| Net Income | $400 | |

Table (1)

Working note (1):

Calculate the total sales revenue:

Working note (2):

Calculate the total cost of goods sold:

Hence, the net income of Company KS is $400.

4.

Write a memo to Person K regarding the results of operations during the first month of the business.

4.

Explanation of Solution

MEMO

From

XYZ

To

Person K

Company KS

28th February,

Subject: Results of operations during the first month of the business.

After the evaluation of effects of the transactions of Company KS, one can conclude that the company has earned a profit of $400. But these are based upon unadjusted amounts. There are several expenses such as rent, supplies,

Regards,

XYZ

5.

Compute the net profit margin ratio for each year and explain the reason for promoting the manager.

5.

Explanation of Solution

Compute the net profit margin ratio:

Net profit margin ratio for 2021:

Hence, the net profit margin ratio for the year 2021 is 0.235.

Net profit margin ratio for 2020:

Hence, the net profit margin ratio for the year 2020 is 0.133.

Net profit margin ratio for 2019:

Hence, the net profit margin ratio for the year 2019 is 0.080.

- By evaluating the net profit margin ratio, it is clear that the profit level of the Company has increased.

- This states that the company is very efficient in generating the revenue from the sales and controlling the expenses.

- Based on this the reasons, the company should promote its manager to the next level.

Want to see more full solutions like this?

Chapter 3 Solutions

FINANCIAL ACCOUNTING (LL)

- Hamlin Corp. produces ceramic figurines. It takes 2.5 hours of direct labor to produce a single figurine. Hamlin's standard labor cost is $18 per hour. During September, Hamlin produced 12,600 units and used 32,500 hours of direct labor at a total cost of $568,750. What is Hamlin's labor efficiency variance for September?arrow_forwardWhat is Hamlin's labor efficiency variance for September?arrow_forwardHow does disaggregation analysis enhance revenue recognition? a) Revenue recognition needs no breakdown b) Combined treatment works better c) Separates complex contracts into distinct performance obligations d) Single entries capture all elements MCQarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education