Concept explainers

Question:

SERIAL PROBLEM

Business Solutions

P1 P2 P3 P4 PS P6

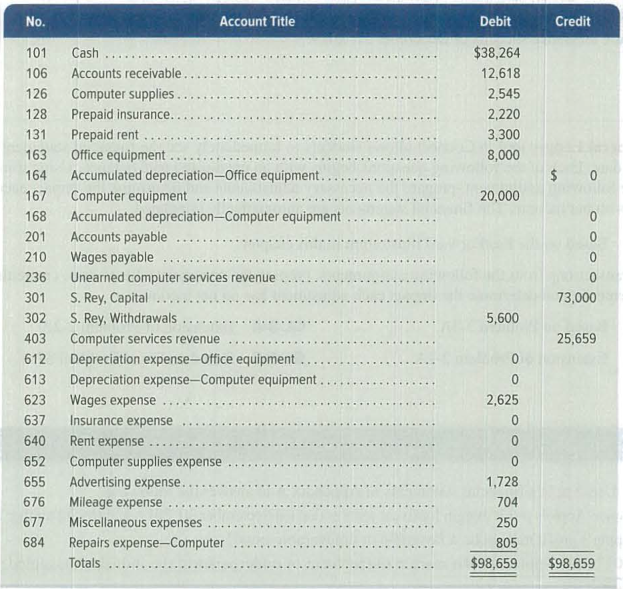

SP 3 After the success of the company's first two months, Santana Rey continues to operate Business Solutions. (Transactions for the first two months are described in the Chapter 2 serial problem.) The November 30,2019, unadjusted

Business Solutions had the following transactions and events in December 2019.

Dec. 2 Paid $1,025 cash to Hillside Mall for Business Solutions's share of mall advertising costs.

3 Paid $500 cash for minor repairs to the company's computer.

4 Received $3,950 cash from Alex's Engineering Co. for the receivable from November.

10 Paid cash to Lyn Addie for six days of work at the rate of $125 per day.

14 Notified by Alex's Engineering Co. that Business Solutions's bid of $7,000 on a proposed project has been accepted. Alex's paid a $1,500 cash advance to Business Solutions.

15 Purchased $1,100 of computer supplies on credit from Harris Office Products.

16 Sent a reminder to Gomez Co. to pay the fee for services recorded on November 8.

20 Completed a project for Liu Corporation and received $5,625 cash.

22-26 Took the week off for the holidays.

28 Received $3,000 cash from Gomez Co. on its receivable.

29 Reimbursed S. Rey for business automobile mileage (600 miles at $0.32 per mile).

31 S. Rey withdrew $1,500 cash from the company for personal use.

The following additional facts are collected for use in making

a. The December 31 inventory count of computer supplies shows $580 still available.

b. Three months have expired since the 12-month insurance premium was paid in advance.

c. As of December 31, Lyn Addie has not been paid for four days of work at $125 per day.

d. The computer system, acquired on October 1, is expected to have a four-year life with no salvage value.

e. The office equipment, acquired on October 1, is expected to have a five-year life with no salvage value.

f. Three of the four months' prepaid rent have expired.

Required

1. Prepare

2. Prepare adjusting entries to reflect a through Post those entries to the accounts in the ledger.

3. Prepare an adjusted trial balance as of December 31, 2019.

4. Prepare an income statement for the three months ended December 31, 2019.

5. Prepare a statement of owner's equity for the three months ended December 3 1, 2019.

6. Prepare a

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Principles of Financial Accounting.

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardHow do milestone payments affect contract revenue recognition? a) Accrue when milestone achieved b) Recognize at contract completion c) Record when cash received d) Spread evenly over contract. MCQarrow_forwardWhat is the interest expense for December 31 ?arrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning - Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning