SURVEY OF ACCOUNT.(LL)-W/ACCESS>CUSTOM<

5th Edition

ISBN: 9781260222326

Author: Edmonds

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 3, Problem 3E

Exercise 3-3 Effect of inventory transactions on financial statements: Perpetual system

Dan Watson started a small merchandising business in 2018. The business experienced the following events during its first year of operation. Assume that Watson uses the perpetual inventory system.

1. Acquired $30,000 cash from the issue of common stock.

2. Purchased inventory for $18,000 cash.

3. Sold inventory costing $15,000 for $32,000 cash.

Required

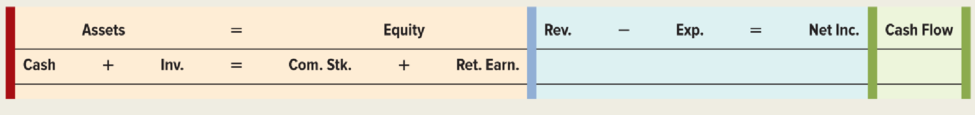

a. Record the events in a statements model like the one shown here.

b. Prepare an income statement for 2018 (use the multistep format).

c. What is the amount of total assets at the end of the period?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Using the results of the Top 5 Customers by Accounts Receivable Amount Due and the Top 5

Customers by Outstanding Sales Order Amount visualization, what conclusion can be made

regarding the outstanding sales orders?

a. The high value of outstanding accounts receivable for Sanders Corp may be directly

related to their high value of outstanding sales orders.

b. The high value of outstanding accounts receivable for Williams Corp may be directly

related to their high value of outstanding sales orders.

c. The high value of outstanding sales orders for Roberts Corp has caused them not to pay a

large value of invoices.

d. Evans Corp has a high value of outstanding accounts receivable and outstanding sales

orders.

Based on the dashboard, what recommendations would you give to improve the overall sales

and revenue of Borders USA?

Is there any additional information would you like to have to provide useful

recommendations?

What are your interpretations of AR Aging and Sales Order Aging dashboards?

1. Using the Sales vs Revenue by Quarter in 2022 visualization, what trends are being shown

between sales and revenue?

a. Sales was variable for each quarter, but revenue decreased every quarter.

b. Sales decreased every quarter, but revenue was variable for each quarter.

c. Revenue was higher than sales for each quarter.

d. Revenue was lower than sales for only the first two quarters.

Chapter 3 Solutions

SURVEY OF ACCOUNT.(LL)-W/ACCESS>CUSTOM<

Ch. 3 - 1. Define merchandise inventory. What types of...Ch. 3 - 2. What is the difference between a product cost...Ch. 3 - 3. How is the cost of goods available for sale...Ch. 3 - 4. What portion of cost of goods available for...Ch. 3 - 5. When are period costs expensed? When are...Ch. 3 - 6. If PetCo had net sales of 600,000, goods...Ch. 3 - Prob. 7QCh. 3 - 8. What are the effects of the following types of...Ch. 3 - 9. Northern Merchandising Company sold inventory...Ch. 3 - 10. If goods are shipped FOB shipping point, which...

Ch. 3 - 11. Define transportation-in. Is it a product or a...Ch. 3 - Prob. 12QCh. 3 - Prob. 13QCh. 3 - 14. Dyer Department Store purchased goods with the...Ch. 3 - 15. Eastern Discount Stores incurred a 5,000 cash...Ch. 3 - 16. What is the purpose of giving credit terms to...Ch. 3 - Prob. 17QCh. 3 - 18. Ball Co. purchased inventory with a list price...Ch. 3 - 22. Explain the difference between purchase...Ch. 3 - Prob. 20QCh. 3 - Prob. 21QCh. 3 - 25. What is the advantage of using common size...Ch. 3 - 27. What is the purpose of preparing a schedule of...Ch. 3 - 28. Explain how the periodic inventory system...Ch. 3 - Prob. 25QCh. 3 - Exercise 3-1 Determining the cost of financing...Ch. 3 - Exercise 3-2 Comparing a merchandising company...Ch. 3 - Exercise 3-3 Effect of inventory transactions on...Ch. 3 - Exercise 3-4 Effect of inventory transactions on...Ch. 3 - Exercise 3-5 Recording inventory transactions in a...Ch. 3 - Exercise 4-6A Understanding the freight terms FOB...Ch. 3 - Exercise 3-7 Effect of purchase returns and...Ch. 3 - Exercise 3-8 Accounting for product costs:...Ch. 3 - Effect of product cost and period cost: Horizontal...Ch. 3 - Cash Discounts and Purchase Returns On April 6,...Ch. 3 - Exercise 4-9A Determining the effect of inventory...Ch. 3 - Inventory financing costs Bill Norman comes to you...Ch. 3 - Effect of shrinkage: Perpetual system Ho Designs...Ch. 3 - Comparing gross margin and gain on sale of land...Ch. 3 - Single-step and multistep income statements The...Ch. 3 - Prob. 16ECh. 3 - Effect of cash discounts on financial statements:...Ch. 3 - Using common size statements and ratios to make...Ch. 3 - Prob. 19ECh. 3 - Determining cost of goods sold: Periodic system...Ch. 3 - Identifying product and period costs Required...Ch. 3 - Problem 4-23A Identifying freight costs Required...Ch. 3 - Effect of purchase returns and allowances and...Ch. 3 - Preparing a schedule of cost of goods sold and...Ch. 3 - Prob. 25PCh. 3 - Comprehensive cycle problem: Perpetual system At...Ch. 3 - Prob. 27PCh. 3 - Comprehensive cycle problem: Periodic system...Ch. 3 - Prob. 1ATCCh. 3 - ATC 3-2 Group Exercise Multistep income statement...Ch. 3 - Prob. 3ATCCh. 3 - Prob. 4ATC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with this financial accounting problem using accurate calculation methods.arrow_forwardCan you provide the valid approach to solving this financial accounting question with suitable standards?arrow_forwardPlease explain the accurate process for solving this financial accounting question with proper principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY