1.

Set up T-accounts for the general ledger accounts with the unadjusted balances.

1.

Explanation of Solution

T-account: The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

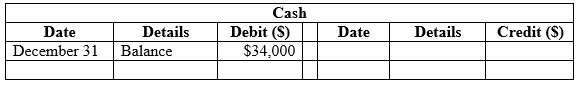

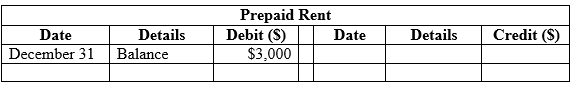

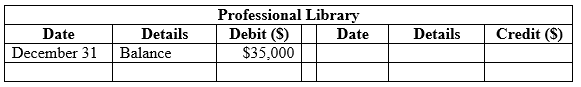

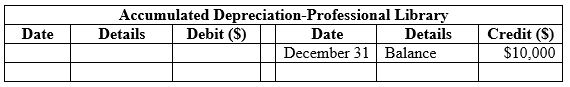

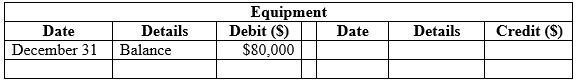

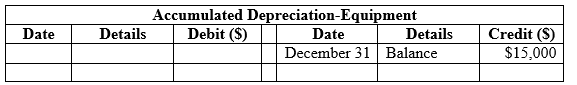

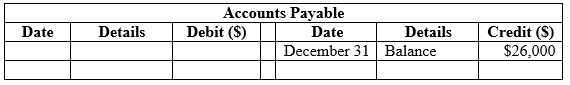

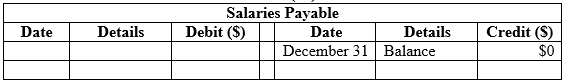

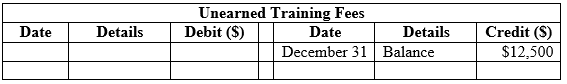

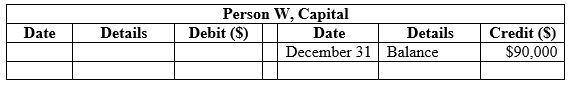

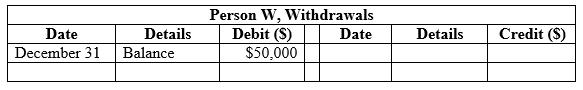

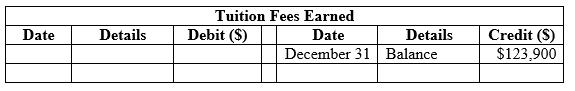

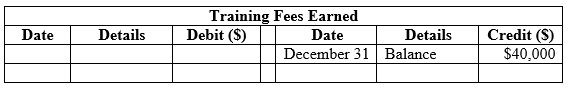

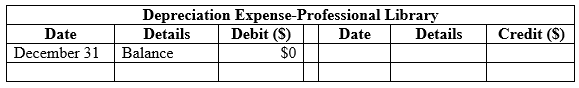

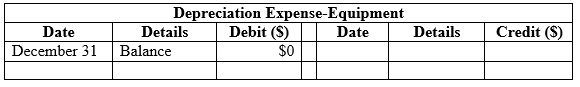

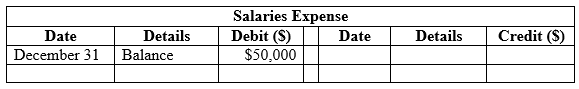

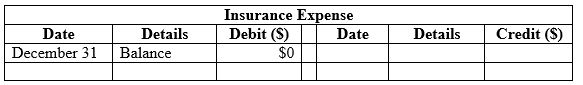

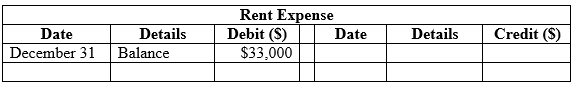

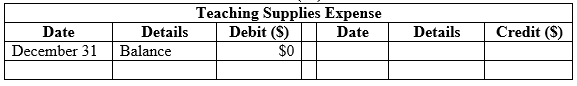

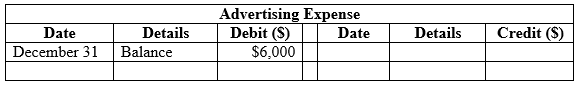

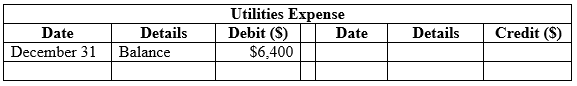

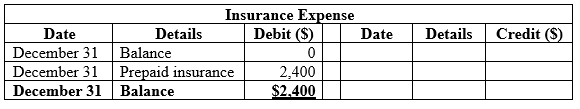

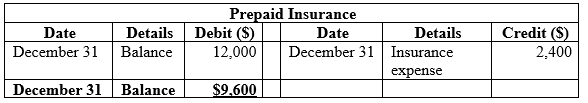

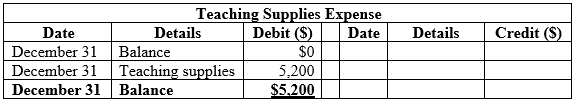

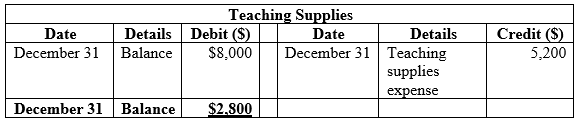

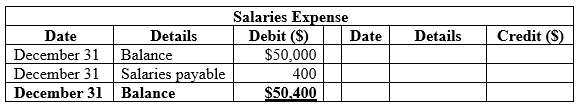

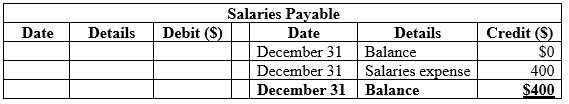

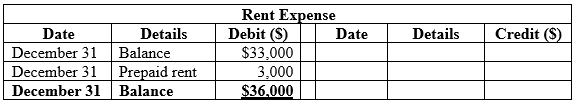

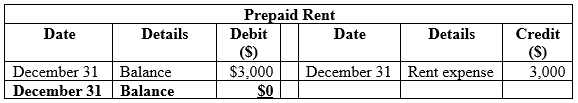

Table (1)

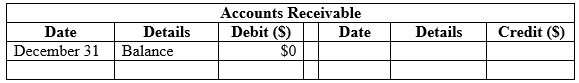

Table (2)

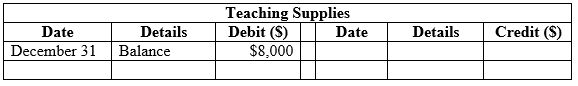

Table (3)

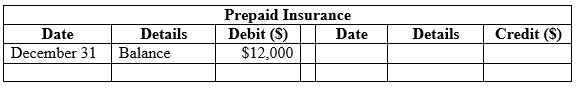

Table (4)

Table (5)

Table (6)

Table (7)

Table (8)

Table (9)

Table (10)

Table (11)

Table (12)

Table (13)

Table (14)

Table (15)

Table (16)

Table (17)

Table (18)

Table (19)

Table (20)

Table (21)

Table (22)

Table (23)

Table (24)

2.

Journalize the

2.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and

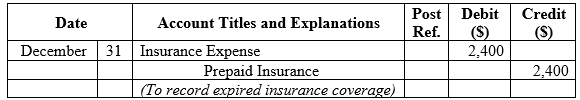

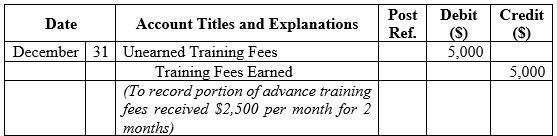

a.

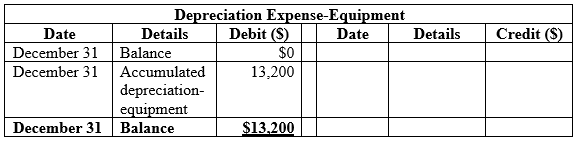

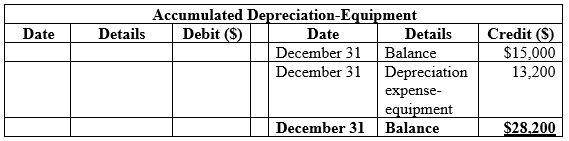

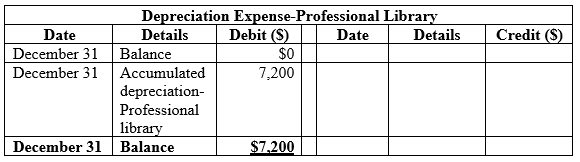

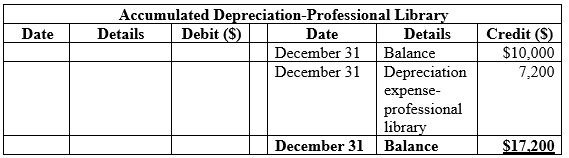

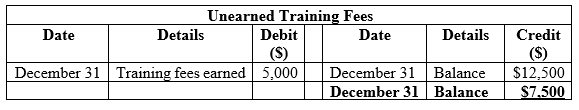

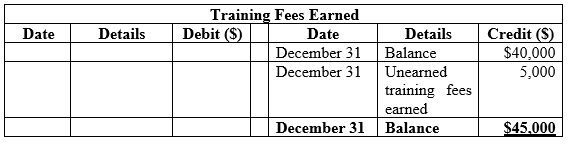

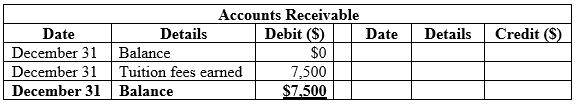

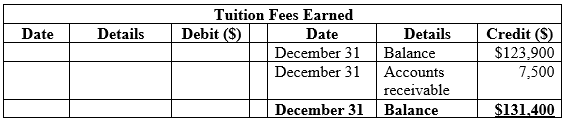

Table (25)

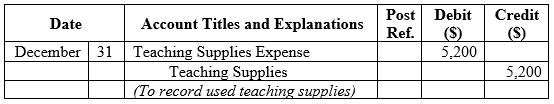

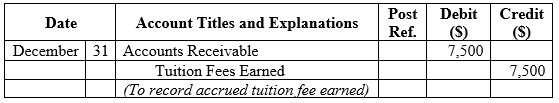

b.

Table (26)

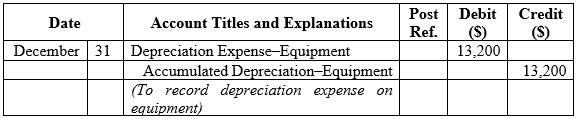

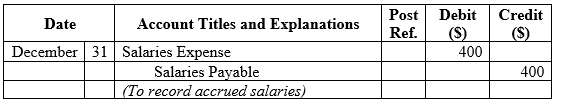

c.

Table (27)

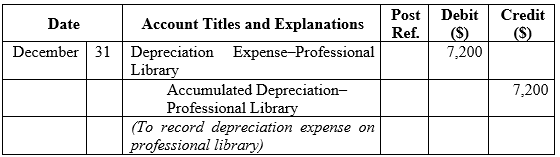

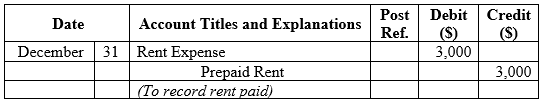

d.

Table (28)

e.

Table (29)

f.

Table (30)

g.

Table (31)

h.

Table (32)

Table (33)

Table (34)

Table (35)

Table (36)

Table (37)

Table (38)

Table (39)

Table (40)

Table (41)

Table (42)

Table (43)

Table (44)

Table (45)

Table (46)

Table (47)

Table (48)

3.

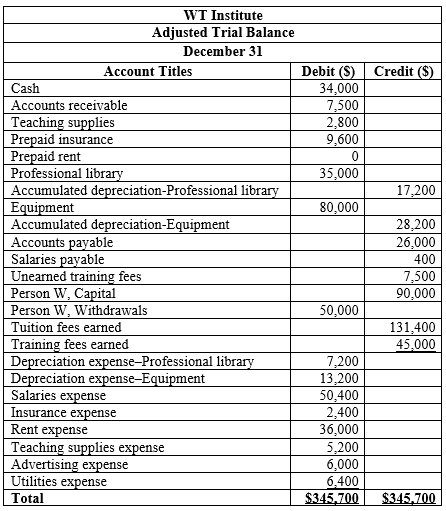

Prepare an adjusted

3.

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is that statement which contains complete list of accounts with their adjusted balances, after all relevant adjustments have been made. This statement is prepared at the end of every financial period.

Table (49)

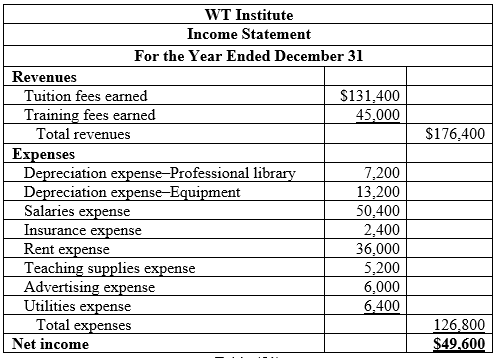

4.

Prepare income statement, owner’s equity and balance sheet of WT Institute for the year ended December 31.

4.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Table (50)

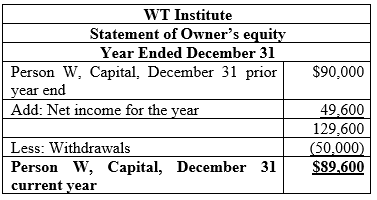

Statement of owner’s equity for WT Institute for the year ended December 31.

Table (51)

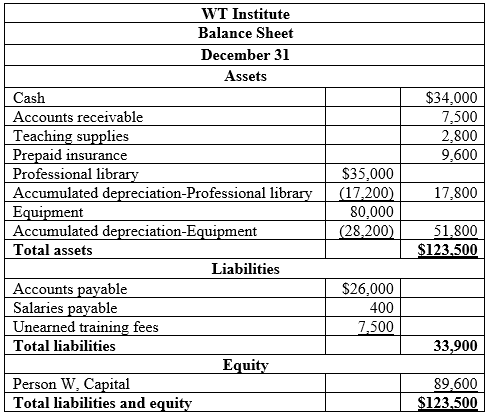

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (stockholders’ equity) over those resources. The resources of the company are assets which include money contributed by stockholders and creditors. Hence, the main elements of the balance sheet are assets, liabilities, and stockholders’ equity.

Note: Refer to income statement for value and computation of net income.

Table (52)

Want to see more full solutions like this?

Chapter 3 Solutions

Principles of Financial Accounting.

- Eckhart Corp. reports that at an activity level of 5,800 machine-hours in a month, its total variable inspection cost is $348,240 and its total fixed inspection cost is $128,500. What would be the total variable inspection cost at an activity level of 6,100 machine-hours in a month? Assume that this level of activity is within the relevant range.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardI need financial accounting question answerarrow_forward

- Wilson Industries manufactures a unique water filtration nozzle. The budgeted indirect total cost of assembling the nozzle is $120,000. The budgeted number of nozzles to be assembled is 40,000. What is the budgeted indirect cost allocation rate for this activity?arrow_forwardGeneral accountingarrow_forwardA retail company purchased new display fixtures for $28,000. Old store equipment was sold for $2,500. A marketable security investment was sold for $45,000. Treasury stock was repurchased for $18,000, and dividends were paid to shareholders in the amount of $30,000. The company issued new bonds resulting in proceeds of $75,000. Calculate the net cash flow from investing activities.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub