Concept explainers

The general ledger of Pipers Plumbing at January 1, 2018, includes the following account balances:

| Accounts | Debits | Credits |

| Cash | $ 4,500 | |

| 9,500 | ||

| Supplies | 3,500 | |

| Equipment | 36,000 | |

| $ 8,000 | ||

| Accounts Payable | 6,000 | |

| Utilities Payable | 7,000 | |

| Deferred Revenue | -0- | |

| Common Stock | 23,000 | |

| 9,500 | ||

| Totals | $53,500 | $53,500 |

The following is a summary of the transactions for the year:

a. January 24 Provide plumbing services for cash, $20,000, and on account, $65,000.

b. March 13 Collect on accounts receivable, $53,000.

c. May 6 Issue shares of common stock in exchange for $11,000 cash.

d. June 30 Pay salaries for the current year, $33,000.

e. September 15 Pay for utilities expenses, $13,000, of which $7,000 represents costs for 2017.

f. November 24 Receive cash in advance from customers, $10,000.

g. December 30 Pay $3,000 cash dividends to stockholders.

Required:

1. Set up the necessary T-accounts and enter the beginning balances from the

2. Record each of the summary transactions listed above.

3. Post the transactions to the accounts.

4. Prepare an unadjusted trial balance.

5. Record

6. Post adjusting entries.

7. Prepare an adjusted trial balance.

8. Prepare an income statement for 2018 and a classified

9. Record closing entries.

10. Post closing entries

11. Prepare a post-closing trial balance.

Requirement – 1

To prepare: The T-accounts and enter the beginning balance from the trial balance.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

The T-accounts of given item in trial balance are as follows:

| Cash | |||

| Jan. 1 | $4,500 | ||

| Bal. | $4,500 | ||

| Equipment | |||

| Jan. 1 | $36,000 | ||

| Bal. | $36,000 | ||

| Common stock | |||

| Jan. 1 | $23,000 | ||

| Bal. | $23,000 | ||

| Utilities payable | |||

| Jan. 1 | $7,000 | ||

| Bal. | $7,000 | ||

| Accounts receivables | |||

| Jan. 1 | $9,500 | ||

| Bal. | $9,500 | ||

| Supplies | |||

| Jan. 1 | $4,000 | ||

| Bal. | $4,000 | ||

| Accounts payable | |||

| Jan. 1 | $6,000 | ||

| Bal. | $6,000 | ||

| Accumulated Depreciation | |||

| Jan. 1 | $8,000 | ||

| Bal. | $8,000 | ||

| Retained earnings | |||

| Jan. 1 | $9,500 | ||

| Bal. | $9,500 | ||

Requirement – 2

To record: The journal entries for given transactions.

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

The journal entries for given transactions of Company P are as follows:

| Date | Account Title and Explanation | Debit($) | Credit($) |

| 2018 | Accounts receivable | 65,000 | |

| January 24 | Cash | 20,000 | |

| Service revenue | 85,000 | ||

| (To record the recognized service revenue on account and cash) | |||

| 2018 | Cash | 53,000 | |

| March, 13 | Accounts receivable | 53,000 | |

| (To record cash collection from customer) | |||

| 2018 | Cash | 11,000 | |

| May, 6 | Common stock | 11,000 | |

| (To record the cash received from issuance of common stock) | |||

| 2018 | Salaries expense | 33,000 | |

| June 30 | Cash | 33,000 | |

| (To record the payment of salaries expense) | |||

| 2018 | Utilities payable | 7,000 | |

| September 15 | Utilities expense | 6,000 | |

| Cash | 13,000 | ||

| (To record the payment of current and post utilities expense) | |||

| 2018 | Cash | 10,000 | |

| November 24 | Deferred revenue | 10,000 | |

| (To record advance cash received from customer) | |||

| 2018 | Dividends | 3,000 | |

| December 30 | Cash | 3,000 | |

| (To record the payment of dividends) | |||

Table (1)

Requirement – 3

To post: The transactions to T-accounts.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increases or decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

T-accounts of above transactions are as follows:

| Cash | |||

| Jan. 1 | $4,500 | Jun. 30 | $33,000 |

| Jan. 24 | $20,000 | Sep. 15 | $13,000 |

| Mar. 23 | $53,000 | Dec. 30 | $3,000 |

| May 6 | $11,000 | ||

| Nov. 24 | $10,000 | ||

| Total | $98,500 | Total | $49,000 |

| Bal. | $49,500 | ||

| Common stock | |||

| Jan. 1 | $23,000 | ||

| May, 6 | $11,000 | ||

| Bal. | $34,000 | ||

| Dividends | |||

| Jan. 1 | $0 | ||

| Dec. 30 | $3,000 | ||

| Bal. | $3,000 | ||

| Accounts receivables | |||

| Jan. 1 | $9,500 | ||

| Jan. 24 | $65,000 | Jun. 30 | $53,000 |

| Total | $74,500 | Total | $53,000 |

| Bal. | $21,500 | ||

| Accumulated Depreciation | |||

| Jan. 1 | $5,000 | ||

| Bal. | $5,000 | ||

| Supplies | |||

| Jan. 1 | $3,500 | ||

| Bal. | $3,500 | ||

| Utilities payable | |||

| Sep. 15 | $7,000 | Jan. 1 | $7,000 |

| Bal. | $0 | ||

| Retained earnings | |||

| Jan. 1 | $9,500 | ||

| Bal. | $9,500 | ||

| Utilities expense | |||

| Jan. 1 | $0 | ||

| Sep. 15 | $6,000 | ||

| Bal. | $6,000 | ||

| Service revenue | |||

| Jan. 1 | $0 | ||

| Jan. 24 | $85,000 | ||

| Bal. | $60,000 | ||

| Deferred revenue | |||

| Jan. 1 | $0 | ||

| Jan. 24 | $10,000 | ||

| Bal. | $100,000 | ||

| Salaries expense | |||

| Jan. 1 | $0 | ||

| Jun. 30 | $33,000 | ||

| Bal. | $33,000 | ||

Requirement – 4

To prepare: The unadjusted trial balance of Company P.

Explanation of Solution

Unadjusted trial balance:

The unadjusted trial balance is the summary of all the ledger accounts before making adjusting journal entries at the end of the period.

| Company P | ||

| Unadjusted Trial Balance | ||

| December 31, 2018 | ||

| Accounts | Debit | Credit |

| Cash | 49,500 | |

| Accounts Receivable | 21,500 | |

| Supplies | 3,500 | |

| Equipment | 36,000 | |

| Accumulated depreciation | 8,000 | |

| Accounts payable | 6,000 | |

| Utilities payable | 0 | |

| Deferred revenue | 10,000 | |

| Common stock | 34,000 | |

| Retained earnings | 9,500 | |

| Dividends | 3,000 | |

| Service revenue | 85,000 | |

| Salaries expense | 33,000 | |

| Utilities expense | 6,000 | |

| Depreciation expense | 0 | |

| Supplies expense | 0 | |

| Totals | $152,500 | $152,500 |

Table (2)

Therefore, the total of debit, and credit columns of unadjusted trial balance is $152,500 and agree.

Requirement – 5

To record: The given adjusting entries of Company P.

Explanation of Solution

Adjusting entries:

Adjusting entries refers to the entries that are made at the end of an accounting period in accordance with revenue recognition principle, and expenses recognition principle. The purpose of adjusting entries is to adjust the revenue, and the expenses during the period in which they actually occurs.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Adjusting entries of Company P are as follows:

Depreciation expense:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| December 31, 2018 | Depreciation Expense | 8,000 | ||

| Accumulated Depreciation | 8,000 | |||

| (To record the amount of depreciation for the year) |

Table (4)

Following is the rule of debit and credit of above transaction:

- Depreciation expense is an expense, and it decreased the value of stockholder’s equity. Therefore, it is debited.

- Accumulated depreciation is a contra-asset account. There is a decrease in assets, therefore it is credited.

Office supplies expense:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| December 31, 2018 | Supplies expense | 4,400 | ||

| Supplies | 2,400 | |||

| (To record the supplies expense incurred at the end of the accounting year) |

Table (5)

Following is the rule of debit and credit of above transaction:

- Supplies expense is an expense, and it decreased the value of stockholder’s equity. Therefore, it is debited.

- Supplies are an asset account. There is a decrease in assets, therefore it is credited.

Deferred revenue:

| Date | Accounts title and explanation | Post Ref. | Debit ($) | Credit ($) |

| December 31, 2018 | Deferred revenue | 7,000 | ||

| Service revenue | 7,000 | |||

| (To record the service revenue recognized at the end of the accounting year) |

Table (4)

Following is the rules of debit and credit of above transaction:

- Deferred revenue is a liability account. There is a decrease in liability, therefore it is debited.

- Service revenue is revenue, and it increased the value of stockholder’s equity. Therefore, it is credited

Requirement – 6

To post: The adjusting entries to appropriate T-accounts.

Explanation of Solution

| Depreciation expense | |||

| Jan. 1 | $0 | ||

| Dec. 31 | $8,000 | ||

| Bal. | $8,000 | ||

| Accumulated Depreciation | |||

| Jan. 1 | $8,000 | ||

| Dec. 31 | $8,000 | ||

| Bal. | $16,000 | ||

| Supplies | |||

| Jan. 1 | $3,500 | Dec. 31 | $2,400 |

| Bal. | $1,100 | ||

| Supplies expense | |||

| Jan. 1 | $0 | ||

| Dec. 31 | $2,400 | ||

| Bal. | $2,400 | ||

| Service revenue | |||

| Jan. 1 | $0 | ||

| Jan. 24 | $85,000 | ||

| Dec. 31 | $7,000 | ||

| Bal. | $92,000 | ||

| Deferred revenue | |||

| Jan. 1 | $0 | ||

| Dec. 31 | $7,000 | Jan. 24 | $10,000 |

| Bal. | $3,000 | ||

Requirement – 7

To prepare: The adjusted trial balance of Company P.

Explanation of Solution

Adjusted trial balance:

Adjusted trial balance is a summary of all the ledger accounts, and it contains the balances of all the accounts after the adjustment entries are journalized, and posted.

Adjusted trial balance of Company P is as follows:

| Company P | ||

| Adjusted Trial Balance | ||

| December 31, 2018 | ||

| Accounts | Debit | Credit |

| Cash | 49,500 | |

| Accounts Receivable | 21,500 | |

| Supplies | 3,500 | |

| Equipment | 36,000 | |

| Accumulated depreciation | 16,000 | |

| Accounts payable | 6,000 | |

| Utilities payable | 0 | |

| Deferred revenue | 3,000 | |

| Common stock | 34,000 | |

| Retained earnings | 9,500 | |

| Dividends | 3,000 | |

| Service revenue | 92,000 | |

| Salaries expense | 33,000 | |

| Utilities expense | 6,000 | |

| Depreciation expense | 8,000 | |

| Supplies expense | 2,400 | |

| Totals | $160,500 | $160,500 |

Table (6)

Therefore, the total of debit, and credit columns of adjusted trial balance is $160,500 and agree.

Requirement – 8

To prepare: An income statement for 2018 and classified balance sheet as on December 31, 2018.

Explanation of Solution

Income statement:

This is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Classified balance sheet:

This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

Income statement:

Income statement of Company P is as follows:

| Company P | ||

| Income statement | ||

| For the year ended December 31, 2018 | ||

| $ | $ | |

| Service revenue (A) | 92,000 | |

| Expenses: | ||

| Salaries expense | 33,000 | |

| Utilities expense | 6,000 | |

| Depreciation expense | 2,400 | |

| Supplies expense | 8,000 | |

| Total expense (B) | 49,400 | |

| Net income

| 42,600 | |

Table (7)

Therefore, the net income of Company P is $42,600.

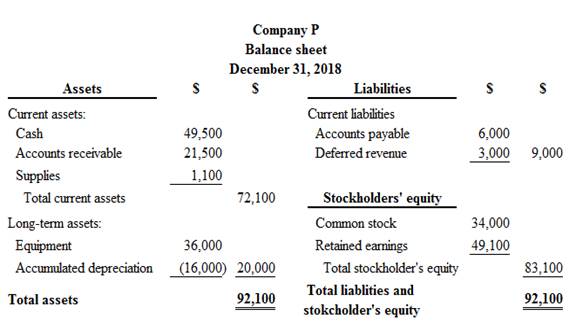

Classified balance sheet:

Classified balance sheet of Company P is as follows:

Figure (1)

Figure (1)

Therefore, the total assets of Company P are $92,100, and the total liabilities and stockholders’ equity are $92,100.

Working note:

Calculation of ending balance retained earnings

Requirement – 9

To record: The necessary closing entries of Company P.

Explanation of Solution

Closing entries:

Closing entries are those journal entries, which are passed to transfer the final balances of temporary accounts, (all revenues account, all expenses account and dividend) to the retained earnings. Closing entries produce a zero balance in each temporary account.

Closing entries of Company P is as follows:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| 2018 | Service revenue | 92,000 | ||

| December 31 | Retained earnings | 92,000 | ||

| (To close all revenue account) | ||||

| 2018 | Retained earnings | 49,400 | ||

| December 31 | Salaries expense | 33,000 | ||

| Utilities expense | 6,000 | |||

| Depreciation expense | 8,000 | |||

| Supplies expense | 2,400 | |||

| (To close all the expenses account) | ||||

| 2018 | Retained earnings | 3,000 | ||

| December 31 | Dividends | 3,000 | ||

| (To close the dividends account) | ||||

Table (8)

Requirement – 10

To post: The closing entries to the T-accounts.

Explanation of Solution

| Service revenue | |||

| Jan. 1 | $0 | ||

| Jan. 24 | $85,000 | ||

| Dec. 31 | $92,000 | Dec. 31 | $7,000 |

| Bal. | $0 | ||

| Supplies expense | |||

| Jan. 1 | $0 | ||

| Dec. 31 | $2,400 | Dec. 31 | $2,400 |

| Bal. | $0 | ||

| Depreciation expense | |||

| Jan. 1 | $0 | ||

| Dec. 31 | $8,000 | Dec. 31 | $8,000 |

| Bal. | $0 | ||

| Utilities expense | |||

| Jan. 1 | $0 | ||

| Sep. 15 | $6,000 | Dec. 31 | $6,000 |

| Bal. | $0 | ||

| Salaries expense | |||

| Jan. 1 | $0 | ||

| Jun. 30 | $33,000 | Dec. 31 | $33,000 |

| Bal. | $0 | ||

| Retained earnings | |||

| Dec. 31 | $49,400 | Jan. 1 | $9,500 |

| Dec. 31 | $3,000 | Dec. 31 | $92,00 |

| Bal. | $49,100 | ||

Requirement – 11

To prepare: A post-closing trial balance of Company P.

Explanation of Solution

Post-closing trial balance:

The post-closing trial balance is a summary of all ledger accounts, and it shows the debit and the credit balances after the closing entries are journalized and posted. The post-closing trial balance contains only permanent (balance sheet) accounts, and the debit and the credit balances of permanent accounts should agree.

Post-closing trial balance of Company P is as follows:

| Company P | ||

| Adjusted Trial Balance | ||

| December 31, 2018 | ||

| Accounts | Debit | Credit |

| Cash | 49,500 | |

| Accounts Receivable | 21,500 | |

| Supplies | 3,500 | |

| Equipment | 36,000 | |

| Accumulated depreciation | 16,000 | |

| Accounts payable | 6,000 | |

| Utilities payable | 0 | |

| Deferred revenue | 3,000 | |

| Common stock | 34,000 | |

| Retained earnings | 49,100 | |

| Total | $108,100 | $108,100 |

Table (9)

Therefore, the total of debit, and credit columns of post-closing trial balance is $108,100 and agree.

Want to see more full solutions like this?

Chapter 3 Solutions

Financial Accounting

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning