Concept explainers

Real World Case 3–7

• LO3–2 through LO3–4, LO3–8

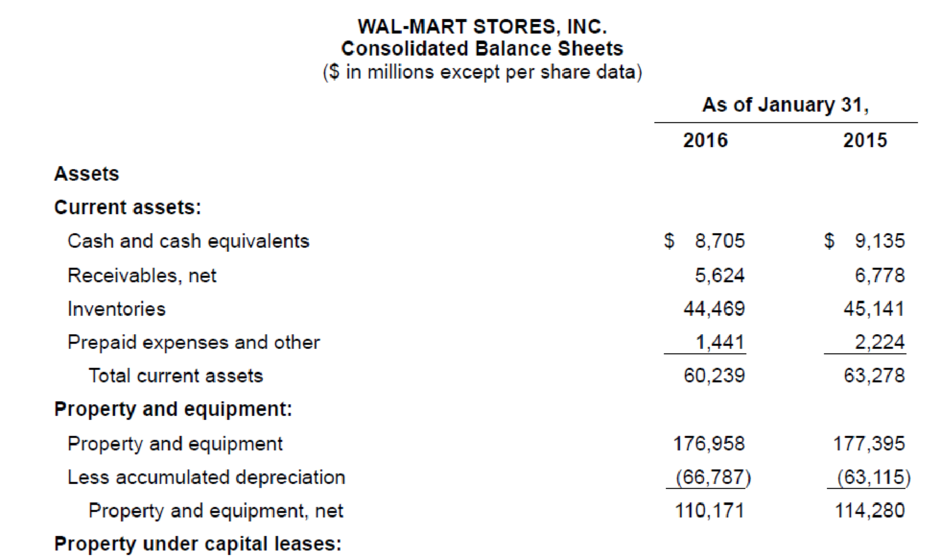

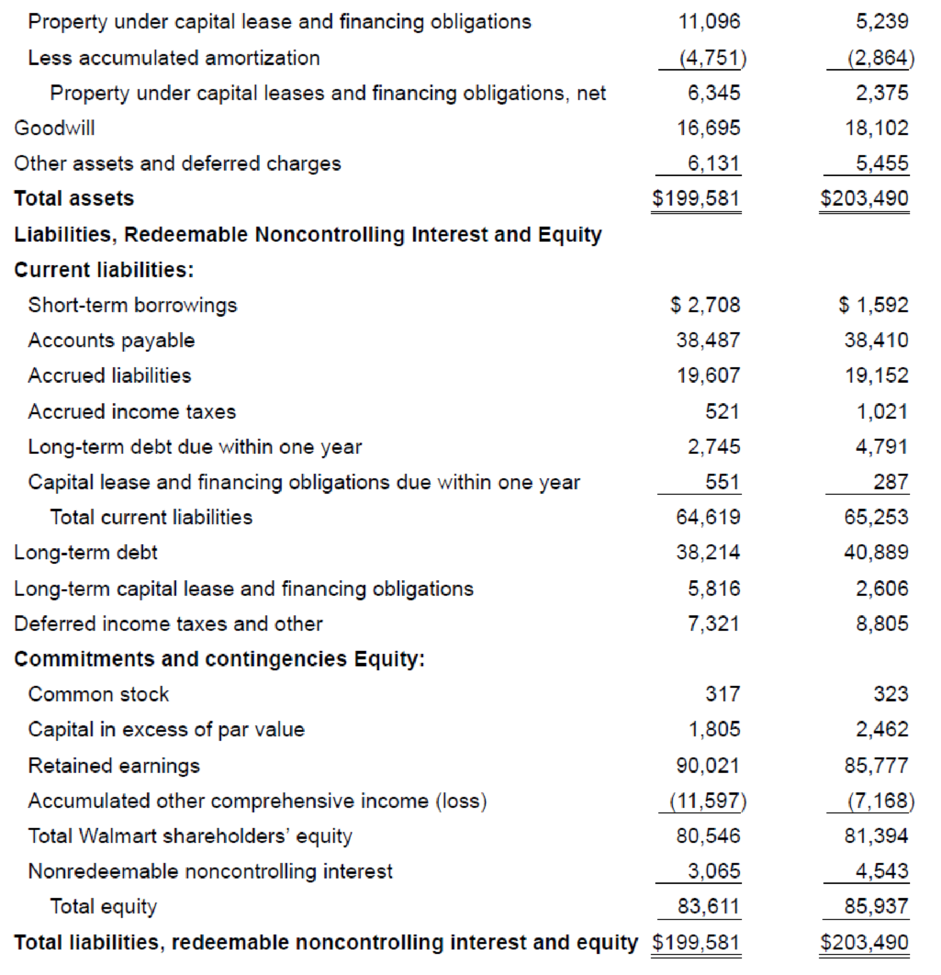

The balance sheet and disclosure of significant accounting policies taken from the 2016 annual report of Wal-Mart Stores, Inc., appear below. Use this information to answer the following questions:

Real World Financials

1. What are the asset classifications contained in Walmart’s balance sheet?

2. What amounts did Walmart report for the following items for 2016:

a. Total assets

b. Current assets

c. Current liabilities

d. Total equity

e.

f. Inventories

3. What is Walmart’s largest current asset? What is its largest current liability?

4. Compute Walmart’s

5. Identify the following items:

a. The company’s

b. The definition of cash equivalents

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

WAL-MART STORES, INC.

1 Summary of Significant Accounting Policies (in part)

Cash and Cash Equivalents

The Company considers investments with a maturity of three months or less when purchased to be cash equivalents.

Inventories

The Company values inventories at the lower of cost or market as determined primarily by the retail method of accounting, using the last-in, first-out (“LIFO”) method for substantially all of the Walmart U.S. segment’s merchandise inventories. Inventories for the Walmart International operations are primarily valued by the retail method of accounting, using the first-in, first-out (“FIFO”) method. At January 31, 2016 and 2015, our inventories valued at LIFO approximate those inventories as if they were valued at FIFO.

Revenue Recognition

The Company recognizes sales revenue net of sales taxes and estimated sales returns at the time it sells merchandise to the customer. Customer purchases of shopping cards are not recognized as revenue until the card is redeemed and the customer purchases merchandise by using the shopping card. The Company also recognizes revenue from service transactions at the time the service is performed. Generally, revenue from services is classified as a component of net sales on our consolidated statements of income.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

- What is the normal balance of Accounts Payable?A. DebitB. CreditC. ZeroD. VariesNeedarrow_forwardGeneral Accounting Question Solutionarrow_forwardWhat is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expenses correctarrow_forward

- Need Help of this Financial Accountingarrow_forwardWhat is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesneed helparrow_forwardWhat is the effect of writing off an uncollectible account under the allowance method?A. Increases net incomeB. No effect on total assetsC. Decreases revenueD. Increases expensesarrow_forward

- The purpose of the trial balance is to:A. Prepare for auditB. Ensure all transactions are postedC. Check that total debits equal total creditsD. Detect all errors correct answerarrow_forwardPlease Make Perfect Answer For this Financial Accountingarrow_forwardThe purpose of the trial balance is to:A. Prepare for auditB. Ensure all transactions are postedC. Check that total debits equal total creditsD. Detect all errors correct solutarrow_forward

- The purpose of the trial balance is to:A. Prepare for auditB. Ensure all transactions are postedC. Check that total debits equal total creditsD. Detect all errors need helparrow_forwardAccounting Question Solutionarrow_forwardHello Tutor Please I want Answer of this General Accounting Questionarrow_forward

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningBusiness/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning

Accounting Information SystemsFinanceISBN:9781337552127Author:Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan HillPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning