Concept explainers

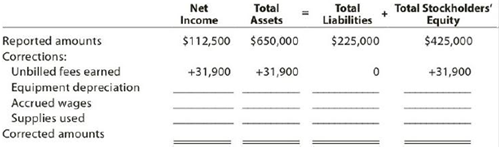

At the end of August, the first month of operations, the following selected data were taken from the financial statements of Tucker jacobs, an attorney:

| Net income for August | $112,500 |

| Total assets at August 31 | 650,000 |

| Total liabilities at August 31 | 225,000 |

| Total stockholders’ equity at August 31 | 425,000 |

In preparing the financial statements, adjustments for the following data were overlooked:

- Unbilled fees earned at August 31, $31,900.

Depreciation of equipment for August, $7,500.- Accrued wages at August 31, $5,200.

- Supplies used during August, $3,000.

Instructions

1.

2. Determine the correct amount of net income for August and the total assets, liabilities, and stockholders’ equity at August 31. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The first adjustment is presented as an example.

Trending nowThis is a popular solution!

Chapter 3 Solutions

CENGAGENOW FOR CORP. FINC

- The matching principle requires:A. Revenues to be recorded when cash is receivedB. Expenses to be recognized when incurred, matched with revenuesC. Assets to be recorded at market valueD. Liabilities to be recorded only when paid i need carrow_forwardThe financial statements of Dobson Company appear below: DOBSON COMPANY Comparative Balance Sheet December 31, Assets Cash Short-term investments Accounts receivable (net). Inventory.... Property, plant and equipment (net). Total assets Liabilities and stockholders' equity Accounts payable.. Short-term notes payable. Bonds payable. Common stock. Retained earnings. Total liabilities and stockholders' equity. Net sales Cost of goods sold Gross profit. Expenses Administrative expenses Selling expenses Interest expense... Total expenses. Income before income taxes Income tax expense. Net income... Additional information: DOBSON COMPANY Income Statement For the Year Ended December 31, 2019 2019 P 35,000 2018 P 40,000 15,000 60,000 50,000 30,000 50,000 70,000 250,000 P400,000 300,000 P500,000 P 10,000 40,000 88,000 P 30,000 90,000 160,000 160,000 145,000 102,000 75,000 P400,000 P500,000 P360,000 198,000 162,000 P59,000 40,000 12,000 111,000 51,000 15,000 P 36,000 a. Cash dividends of P9,000…arrow_forwardThe matching principle requires:A. Revenues to be recorded when cash is receivedB. Expenses to be recognized when incurred, matched with revenuesC. Assets to be recorded at market valueD. Liabilities to be recorded only when paidarrow_forward

- A contra-asset account has what type of balance?A. DebitB. CreditC. ZeroD. Variableneed helparrow_forwardWhich of the following is not a current asset?A. InventoryB. Prepaid InsuranceC. Accounts PayableD. Cashneed helparrow_forwardWhich of the following is not a current asset?A. InventoryB. Prepaid InsuranceC. Accounts PayableD. Casharrow_forward

- Depreciation is recorded in the books to:A. Allocate the cost of an asset over its useful lifeB. Estimate the resale value of assetsC. Track market valueD. Match expenses with liabilities need helparrow_forwardDepreciation is recorded in the books to:A. Allocate the cost of an asset over its useful lifeB. Estimate the resale value of assetsC. Track market valueD. Match expenses with liabilitiesarrow_forwardA contra-asset account has what type of balance?A. DebitB. CreditC. ZeroD. Variablei need helparrow_forward

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning