Concept explainers

At the end of April, the first month of operations, the following selected data were taken from the financial statements of Shelby Crawford, an attorney:

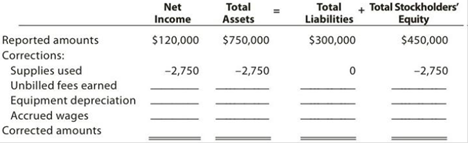

| Net income for April | $120,000 |

| Total assets at April 30 | 750,000 |

| Total liabilities at April 30 | 300,000 |

| Total stockholders’ equity at April30 | 450,000 |

In preparing the financial statements, adjustments for the following data were overlooked:

- Supplies used during April, $2,750.

- Unbilled fees earned at April30, $23,700.

Depreciation of equipment for April, $1,800.- Accrued wages at April 30, $1,400.

Instructions

1.

2. Determine the correct amount of net income for April and the total assets, liabilities, and Stockholders’ equity at April 30. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The adjustment for supplies used is presented as an example.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

Bundle: Financial & Managerial Accounting, Loose-leaf Version, 14th + Working Papers For Warren/reeve/duchac's Corporate Financial Accounting, 14th + ... Financial & Managerial Accounting,

Additional Business Textbook Solutions

Foundations of Financial Management

Financial Accounting, Student Value Edition (5th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Accounting (12th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- I am trying to find the accurate solution to this accounting problem with appropriate explanations.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

- Can you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardCan you demonstrate the accurate steps for solving this financial accounting problem with valid procedures?arrow_forwardAnswer Provide Correct Don't Give Wrong I give Unhelpfularrow_forward

- Sequoia Corporation had a pre-tax accounting income of $68 million during the current year. The company's only temporary difference for the year was warranty expenses accrued for the next year in the amount of $24 million. What would be Sequoia Corporation's taxable income for the year?arrow_forwardRiver stone Enterprises provides the following financial information for the year: . Cash received from customers: $920,000 Cash paid for wages and expenses: $510,000 Depreciation on machinery: $55,000 • • Cash received from the sale of land: $50,000 Gain on the sale of land: $20,000 What is the cash flow from operating activities? a. $430,000 b. $390,000 c. $470,000 d. $400,000 Titan Steelworks has provided the following data for the year: Description Amount Tons of steel produced and sold 250,000 Sales revenue $1,250,000 Variable manufacturing expense $500,000 Fixed manufacturing expense $200,000 Variable selling and administrative expense $100,000 Fixed selling and administrative expense $150,000 $200,000 Net operating income What is the company's unit contribution margin? a. $2.00 per unit b. $3.00 per unit c. $1.60 per unit d. $2.50 per unitarrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage