Concept explainers

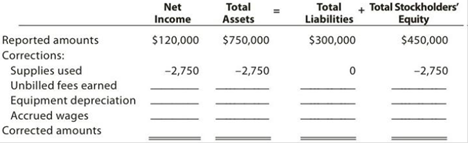

At the end of April, the first month of operations, the following selected data were taken from the financial statements of Shelby Crawford, an attorney:

| Net income for April | $120,000 |

| Total assets at April 30 | 750,000 |

| Total liabilities at April 30 | 300,000 |

| Total stockholders’ equity at April30 | 450,000 |

In preparing the financial statements, adjustments for the following data were overlooked:

- Supplies used during April, $2,750.

- Unbilled fees earned at April30, $23,700.

Depreciation of equipment for April, $1,800.- Accrued wages at April 30, $1,400.

Instructions

1.

2. Determine the correct amount of net income for April and the total assets, liabilities, and Stockholders’ equity at April 30. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The adjustment for supplies used is presented as an example.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

CengageNOWv2, 2 terms Printed Access Card for Warren?s Financial & Managerial Accounting, 13th, 13th Edition

Additional Business Textbook Solutions

Foundations of Financial Management

Financial Accounting, Student Value Edition (5th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Accounting (12th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- Please provide the correct answer with financial accounting questionarrow_forwardHi expert please given correct answer with accounting questionarrow_forwardThe income summary account is used:A. To record net cash flowB. Only by service businessesC. During the closing processD. To adjust retained earnings directlyarrow_forward

- Hello tutor please provide correct answer general accounting question with correct solution do fastarrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this Financial accounting problem with accurate principles.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,