Concept explainers

At the end of April, the first month of operations, the following selected data were taken from the financial statements of Shelby Crawford, an attorney:

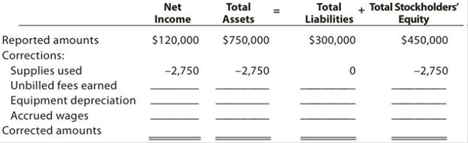

| Net income for April | $120,000 |

| Total assets at April 30 | 750,000 |

| Total liabilities at April 30 | 300,000 |

| Total stockholders’ equity at April30 | 450,000 |

In preparing the financial statements, adjustments for the following data were overlooked:

- Supplies used during April, $2,750.

- Unbilled fees earned at April30, $23,700.

Depreciation of equipment for April, $1,800.- Accrued wages at April 30, $1,400.

Instructions

1.

2. Determine the correct amount of net income for April and the total assets, liabilities, and Stockholders’ equity at April 30. In addition to indicating the corrected amounts, indicate the effect of each omitted adjustment by setting up and completing a columnar table similar to the following. The adjustment for supplies used is presented as an example.

Trending nowThis is a popular solution!

Chapter 3 Solutions

Corporate Financial Accounting

- I need assistance with this financial accounting problem using valid financial procedures.arrow_forwardDirect labour cost variance: Northstar Manufacturing produces metal components. It takes 3 hours of direct labor to produce a component. Northstar's standard labor cost is $15 per hour. During August, Northstar produced 8,000 components and used 25,200 hours of direct labor at a total cost of $365,400. What is Northstar's labor rate variance for August?arrow_forwardHow much was Kaiser's net salesarrow_forward

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardThe company had net sales of $63,000 and ending accounts receivable of $7,200 for the current period. Its days' sales uncollected equals how many days? (Round your answer to nearest number) Solve thisarrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- I am looking for help with this general accounting question using proper accounting standards.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forward

- I am looking for help with this general accounting question using proper accounting standards.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,